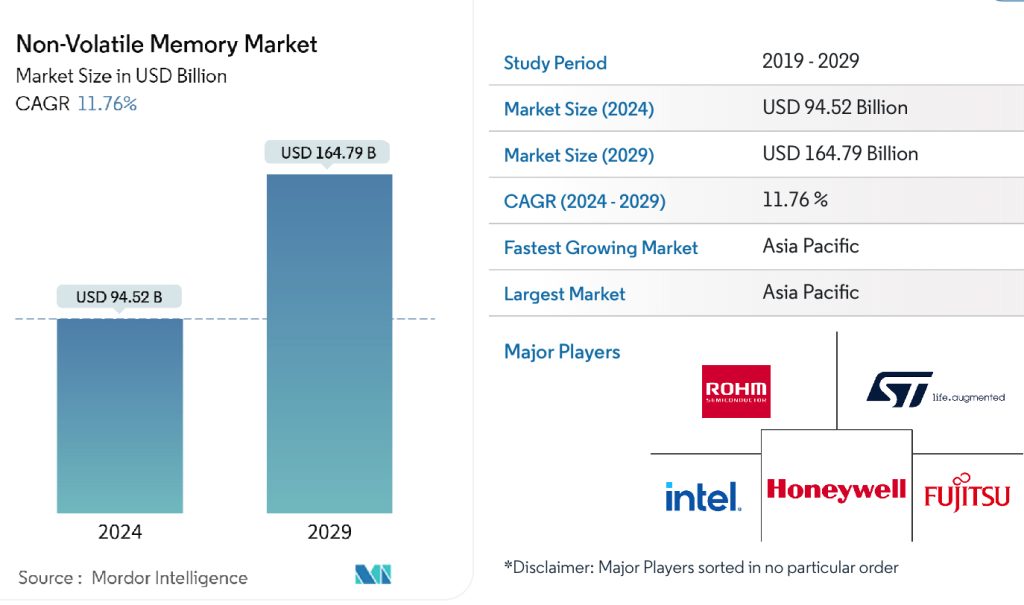

Non-Volatile Memory Market Estimated at $94.5 Billion in 2024

Expected to reach $164.8 billion by 2029, CAGR of 11.8%

This is a Press Release edited by StorageNewsletter.com on April 3, 2024 at 2:02 pmThe report, Non-Volatile Memory Market Size & Share Analysis – Growth Trends & Forecasts (2024-2029) from Mordor Intelligence, covers global non-volatile memory market analysis and it is segmented by type (traditional non-volatile memory – flash memory, EEPROM, SRAM, and EPROM – and next gen non-volatile memory – MRAM, FRAM, ReRAM, 3D-X Point, and Nano RAM -, end-user industry (consumer electronics, retail, IT and telecom, and healthcare), and geography.

Non-Volatile Memory Market

Its size is estimated at $94.52 billion in 2024, and is expected to reach $164.79 billion by 2029, growing at a CAGR of 11.76% during the forecast period (2024-2029). In the last decade, the growth of the portable systems market attracted the interest of the semiconductor industry in non-volatile memory (NVM) technologies for mass storage applications. Demand for greater efficiency, faster memory access, and low-power consumption drive the NVM market growth.

In the flourishing consumer electronics industry, users expect their devices to continually become more powerful, provide new functionality with incredible speed, and store more movies, pictures, and music. While flash enabled substantial innovation during the past few decades, a new gen of memory is required as flash hits technology roadblocks, preventing it from scaling much further.

The adoption of flash memories in consumer electronics due to their low price and power consumption is significant for the market’s growth. NVM is used in smartphones and wearable devices to enable more storage and faster memory access.

The increasing research activities in this space are also driving the market’s growth. For instance, in March 2021, Infineon Technologies LLC announced the launch of 2nd-gen non-volatile Static RAMs that are qualified for QML-Q and high-reliability industrial specs to mainly support non-volatile code storage in harsh environments, including aerospace and industrial applications.

Similarly, in early 2021, Samsung announced the improvement of its MRAM’s MTJ function and advanced its 14nm process to support its flash-type embedded MRAM designed to increase the write speed and density. In addition, the company targets the IC emerging NVM’s application in wearables, microcontrollers, and IoT devices.

However, troubles with NVMs in the market are often caused by the read/write endurance and data retention characteristics. For instance, Phase-change memories and flash memories are examples of NVM’s with limited endurance. These NVM’s have little endurance because after undergoing several writing cycles (RESET cycles for PCM, program/erase cycles for flash memory), the memory cells wear out and can no longer reliably store information.

The Covid-19 outbreak negatively impacted several end-user industries of NVMs, such as the smartphone industry. Spurred demand for server and PC memory for stay-at-home activities, driven by important megatrends like cloud computing, AI, and the IoT, is expected to support the growth of non-volatile memory during the forecast period.

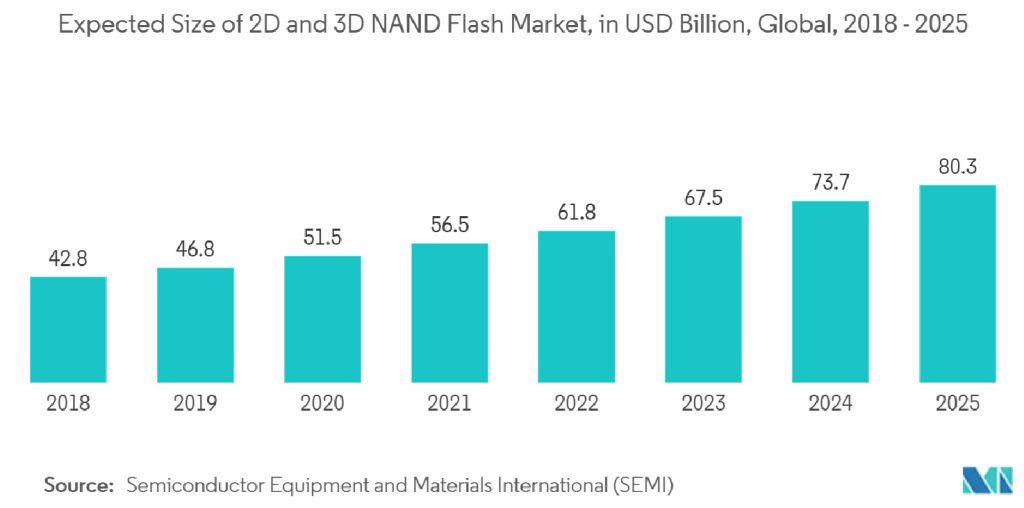

Non-Volatile Memory Market Trends: Flash Memory Expected to Hold a Significant Market Share

The growing demand and penetration of consumer electronics led to device flash memory applications. This memory type finds applications in laptops, GPS, electronic musical instruments, digital cameras, cell phones, and many others. Additionally, it is extensively adopted by data center solution vendors. With exponential growth in the adoption of cloud solutions, the demand for data centers is also surging.

Further, with increasing propensity toward AI/ML applications and IoT devices that require high low latency and high throughput cloud storage, flash storage and enterprise data centers are optimized to train deep neural networks. The growing number and size of data centers are expected to augment demand further.

To cater to the growing demand, vendors operating in the market focus on developing new solutions with better capabilities. For instance, in February 2021, Kioxia Corporation and Western Digital Corp. announced the development of a 6th-generation, 162-layer 3D flash memory technology. This was the company’s highest density and most advanced 3D flash memory technology that utilizes many technology and manufacturing innovations.

Furthermore, NOR Flash memory is also gaining traction due to ultra-low-power needs. For instance, in January 2022, Infineon Technologies announced additional development tools to support its family of SEMPER NOR flash devices. It will further help developers to quickly design safety-critical and inherently secure automotive, industrial, and communication systems.

Similarly, in November 2021, Macronix International Co., Ltd. announced itself as the industry’s first Serial NOR flash memory manufacturer to bring 1.2V devices to mass production. According to the company, the ultra-low-power (ULP), high-speed 120MHz MX25S Serial NOR flash memories are poised to usher in a new generation of products targeted at applications that include IoT, wireless communications technologies, WiFi, and Narrowband IoT systems, hand-held and Bluetooth devices, and consumer applications.

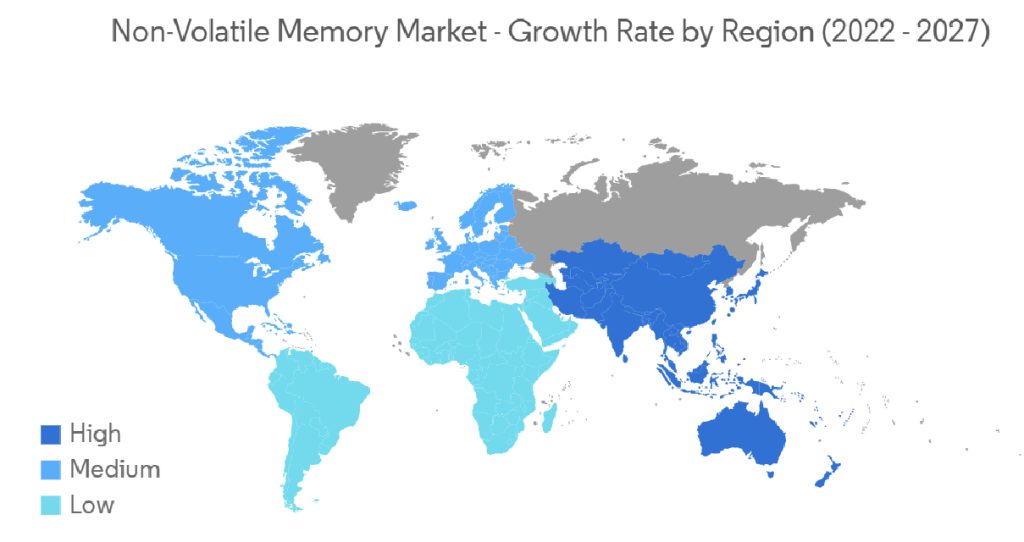

AsiaPac Expected to Account for Significant Market Share

The construction of new infrastructure, including data centers, has been growing across various countries of the AsiaPac region, owing to a surge in demand for online entertainment, telecommuting, and video and voice call services. With the fast development of the digital economy, building large big data centers in countries such as China and India is becoming necessary.

China has emerged as the leading country owing to its aggressive approach to the NAND memory business. For instance, Yangtze Memory Technologies Co. Ltd (YMTC), one of China’s major memory companies, had shipped 64 layers of NAND domestically in low volumes, including SSDs, with 128-layer production in development and shipments in 2021.

Furthermore, start-ups in the region that are engaged in developing technologies related to NVM are receiving several investments. For instance, in April 2021, InnoStar Semiconductor (Shanghai) Co. Ltd raised around $100 million in a pre-series A financing round. The funding round was led by Shanghai Lianhe Investment, and new investors who joined the round included state-backed Atlas Capital and KQ Capital. The company aims to use the investment to produce ReRAM chips and other chips for storage applications.

Companies in the region are utilizing NVM for various industrial applications. In November 2021, Floadia Corporation, a provider of NVM technology, announced the availability of its high-quality eNVM (embedded Non-volatile Memory), with product name ZT, supporting 150°C retention of 10 years, in Shanghai Huahong Grace Semiconductor Manufacturing Corporation 180BCD (Z8) platform.

Furthermore, the region is also witnessing an increase in R&D activities in NVM. In January 2022, Samsung Electronics announced the demonstration of one of the world’s 1st in-memory computing based on MRAM. Such trends are expected to drive the growth of the studied market in the AsiaPac region during the forecast period.

Non-Volatile Memory Market Leaders:

- Rohm co. ltd

- STMicroelectronics NV

- Fujitsu ltd

- Intel Corporation

- Honeywell International Inc.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter