Next Gen Memory Market Projected to Reach $25 Billion by 2029

From $7 billion in 2024, CAGR of 29%

This is a Press Release edited by StorageNewsletter.com on March 29, 2024 at 2:04 pmPublished by ResearchAndMarkets.com on February 2024, here is a market report Next Generation Memory – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2019- 2029 (120 pages, $4,275).

The market size is estimated at $6.96 billion in 2024, and is expected to reach $24.76 billion by 2029, growing at a CAGR of 28.90% during the forecast period (2024-2029).

Key Highlights

- Emerging technologies like AI, ML, the IoT, big data, etc., have a growing need for memory devices with high bandwidth, high scalability, and low power consumption. This, along with the growing need for enterprise storage, is one of the most important things driving the growth of the studied market.

- The rapid growth of data has increased the need for better memory and storage in the workplace. Older memory systems have been unable to keep up with the growing amount of data, the need for more bandwidth, and the speed of newer systems.

- With the demand for universal memory devices increasing, most of the new memory technologies aim to become universal memory devices to replace one of the members of the hierarchy with better technology. The high-end laptops use solid-state flash chips instead of huge mechanical hard disks and use the cloud for backup rather than tape drives. Recently, Intel announced Optane, which uses 3D XPoint technology and is close to universal memory. This is primarily a flash drive with non-volatile memory fast enough to function as RAM.

- The emerging non-volatile memory technologies, such as MRAM, STT-RAM, FRAM, phase-change memory (PCM), and ReRAM, combine the speed of SRAM, the density of DRAM, and the non-volatility of flash memory. Hence, these are possible additions to future memory technologies. Furthermore, implementing next-gen infotainment systems and ADAS would combine DRAM memory technologies with significantly higher performance and low power consumption capabilities.

- Furthermore, the increasing demand for enterprise storage applications is driving the market. The end-user industries, such as BFSI, invest heavily in IoT technologies and reap significant financial rewards. For instance, embedded MRAM is a promising technology for applications such as IoT. Also, other next-gen memories, such as 3D Xpoint, offer multiple times faster transfer speeds than the current SSDs.

- Considering the growing demand, vendors operating in the market continuously focus on launching new products to target emerging application areas. For instance, recently, Samsung Electronics announced the launch of their next gen of memory chips that promise to double the speed and offer the most extensive capacity yet. The company introduced these next-gen chips to target the growing demand across data centers and AI applications.

- However, the lack of stability under extreme environmental conditions is restricting the market. Despite recent technological advancements, these memory devices are significantly impacted by harsh environmental conditions in terms of durability and reliability. For instance, the more thermal stress a memory device is exposed to, the greater the risk of damaging it, which challenges a market to grow.

- The global outbreak of Covid-19 had a notable impact on the growth of the studied market. However, in post pandemic scenario, the supply chain disruption improved, growth in investment in new IT infrastructures, growth in the adoption of digital technologies which positively impacted demand, such factors are expected to create growth opportunities for the studied market.

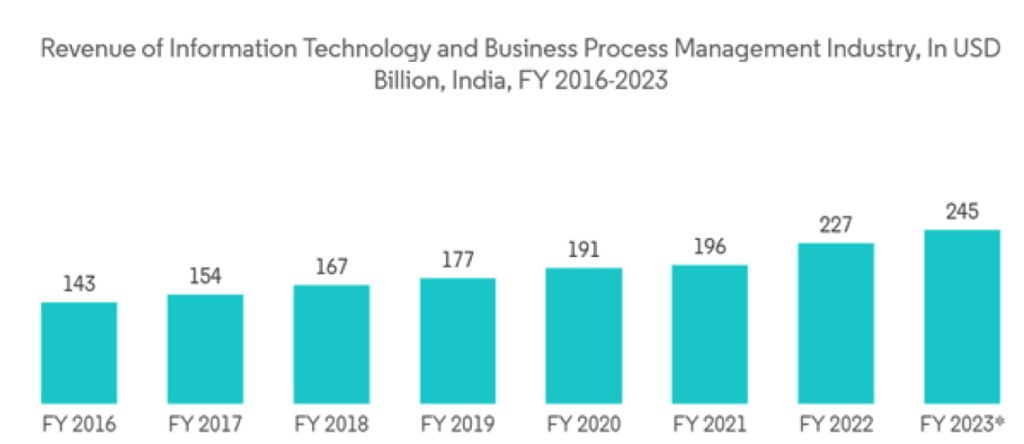

- With the growing size of enterprises, many IT firms have embraced enterprise storage technologies. Such adoption has driven the demand for next-gen storage to handle organizations’ computing power. According to the IBEF, India’s IT and BPM industries are expected to grow from $6.96 billion in 1H21 to $19.93 billion in 2025.

- Also, according to NASSCOM India and MeitY India, the total revenue generated by the IT and BPM industry in India reached a significant amount of $227 billion in 2022 and is likely to reach $245 billion in 2023. The general upward trend observed during this period can primarily be attributed to the substantial influx of outsourcing from foreign companies.

- While many client devices use solid-state storage technologies nowadays, hundreds of millions still use HDDs across virtually all data centers worldwide. With the help of HAMR technology, HDDs should be able to store a lot more data in the coming years.

- Though HDD media is still a top seller in the storage industry, the adoption of flash and SSDs has risen fast over the last several years. Because of the rapid growth of data, significant media investments are being made in this sector. Vendors regularly launch new products to keep this technology relevant and ready for emerging applications. For instance, in October 2022, Western Digital expanded its NVMe SSD portfolio by launching a new SSD drive. This new SSD targets the hardcore gaming segment.

- Furthermore, the growing demand for data centers to support the storage needs of the IT industry is creating growth opportunities for the market under consideration. Even though North America has the most data centers, investments in data centers are also being driven by growing demand in other places. This is creating growth opportunities in other places as well.

- The region is shifting from individual devices and system storage to the core cloud and network edge. According to a survey by Intel Security, the number of companies adopting hybrid cloud services alone has risen by 3x the previous level. Cloud providers have been making the cloud more secure and giving organizations better, more reliable systems, which can be very helpful.

Selection of companies mentioned in this report includes:

- Intel Corporation

- Toshiba Corporation

- Fujitsu Ltd

- Honeywell International Inc.

- Micron Technologies Inc.

- IBM Corporation

- Sony Corporation

- Samsung Electronics Co. Ltd

- Crossbar Inc.

- Cypress Semiconductor Corporation

- Avalanche Technologies Inc.

- Adesto Technologies

- Everspin Technologies Inc

- SK Hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter