Cloud Storage Cuts Impact Archive and General Storage Demand in 2023

Nearline capacity shipments plunged historic 32% Y/Y with hyperscale capacity purchases falling to 417EB, down from 610EB in 2022.

This is a Press Release edited by StorageNewsletter.com on March 28, 2024 at 2:02 pmPublished on March 22, 2024, this market report was written by analysts of Trendfocus, Inc. in Tape and Archive Storage Service CQ4 ’23 Quarterly Update.

Following 2023 Plunge, Hyperscale Demand to Improve in 2024, Recover in 2025

Cloud storage cuts impact archive and general storage demand in 2023

As reported in Cloud, Hyperscale and Enterprise Storage Service (CHESS) 4CQ23 Quarterly Update and Long-Term Forecast, nearline capacity shipments in 2023 plunged an historic 32% Y/Y with hyperscale capacity purchases falling to just under 417EB, down from nearline 610EB in the prior year.

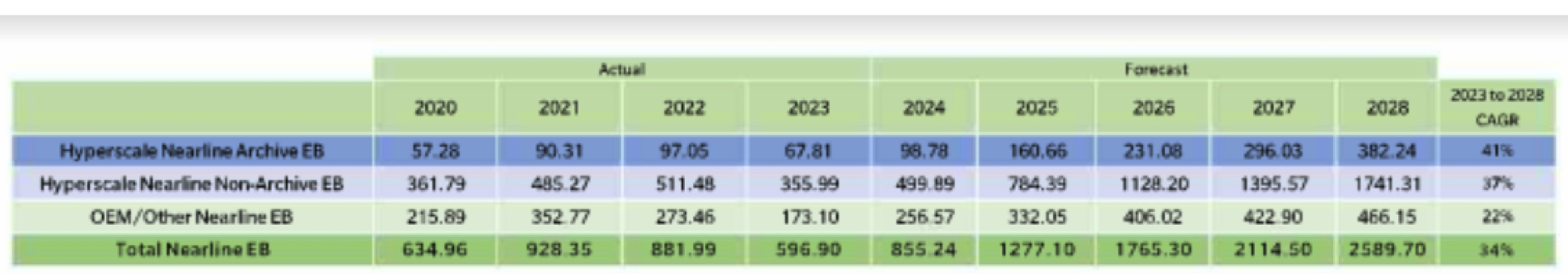

Nearline HDD Capacity by End Market, Use Case

In addition to slowing cloud services demand prolonging the digestion of prior purchases, several large hyperscale companies implemented a series of optimization and efficiency projects to further reduce new purchases in the weak economic environment.

This report updates the hyperscale nearline HDD archive forecast in the context of the latest Long-Term Forecast projections published in February 2024. Analysis of the hyperscale storage purchases and use cases continue to indicate the long-term growing need for archive storage at cloud companies, even if demand remains particularly weak in the current environment.

However, even in the face of significant annual cuts to both hyperscale HDD and flash purchases, cloud tape usage in 2023 managed 6% Y/Y growth in exabytes.

Major global economies, with the exception of China, which continues to suffer through a real estate financial crisis that has hampered economic activity, have demonstrated resiliency even as tight monetary policies were implemented to cool excessive inflation that took hold during the Covid-19 pandemic. As inflation rates have fallen from their highs, countries such as USA have avoided dipping into a recession and recent talk of interest rate cuts coming in 2024 should drive building confidence in commercial spending later this year.

With IT and cloud services spending deferred during the slowdown of the past 2 years, 2025 will likely experience a recovery in commercial and cloud spending as pent-up demand drives sharp storage capacity growth.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter