Kioxia and WD Elevate Capacity Utilization

Pushing NAND flash supply growth to 11%

This is a Press Release edited by StorageNewsletter.com on March 26, 2024 at 2:02 pm This report, published on March 19, 2024, was written by Bryan Ao, analyst, TrendForce Corp.

This report, published on March 19, 2024, was written by Bryan Ao, analyst, TrendForce Corp.

Kioxia and WD Elevate Capacity Utilization,

Pushing NAND Flash Supply Growth to 10.9%

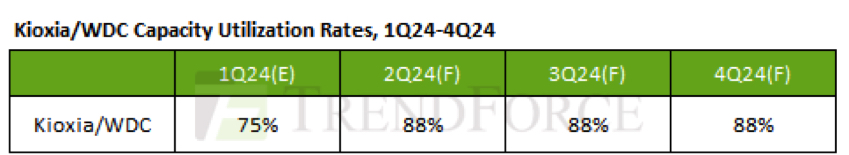

Anticipation of NAND flash price hikes into 2Q24 has motivated certain suppliers to minimize losses and lower costs in hopes of returning to profitability this year. Kioxia and WD led the charge from March, boosting their capacity utilization rates to nearly 90% – a move not widely adopted by their competitors.

This report points out that to meet the demand surge in 2H24, especially given Kioxia and WD’s currently low inventory, the production increase is mainly targeting 112-layer and select 2D products. This strategy is expected not only to secure profitability within the year but also to contribute to a projected 10.9% rise in the annual NAND flash industry supply bit growth rate for 2024.

Kioxia sets sight on 218-layer capacity expansion by 2025 to lead in high-stack technology

Process upgrades have become essential for maintaining cost competitiveness with NAND flash prices on the rise in 2024 and a gradual reduction in suppliers’ stock levels. Samsung and Micron are at the forefront of this effort, with their 200-layer and above product output anticipated to surpass 40% by the year’s end.

Kioxia and WD’s production focus in 2024 remains on 112 layers. Benefiting from Japanese government subsidies, equipment installation to increase 218-layer output is expected to commence in the latter half of the year, with a more aggressive outlook for 218-layer production in 2025. Kioxia’s strategy involves directly advancing to 300-layer and above processes after 218 layers to achieve a more favorable cost structure and regain technological and cost leadership.

NAND flash demand bit growth falls short of expectations as prices increase under pressure in 2H24

It’s been observed that following in the footsteps of Kioxia/WD, NAND flash suppliers are expected to gradually ramp up production in the latter half of this year. However, with inventory levels of PC and smartphone buyers rising in 1Q24, subsequent procurement momentum is expected to decline. Additionally, AI has not notably driven NAND flash capacity upgrades this year, and unless there’s a significant uptick in enterprise SSD purchases, the overall demand for NAND flash may not meet expectations.

Thus, TrendForce predicts that the rate of price increases for NAND flash contracts will decrease to 10–15% starting in 2Q24, before dropping to 0–5% in 3Q24.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter