NAND Flash Industry Revenue Grows 24.5% in 4Q23

Expected to increase another 20% in 1Q23

This is a Press Release edited by StorageNewsletter.com on March 11, 2024 at 2:02 pm This market report, edited on March 6, 2024, was written by Bryan Ao, research staff member at TrendForce Corp.

This market report, edited on March 6, 2024, was written by Bryan Ao, research staff member at TrendForce Corp.

NAND Flash Industry Revenue Grows 24.5% in 4Q23

Expected to increase another 20% in 1Q23

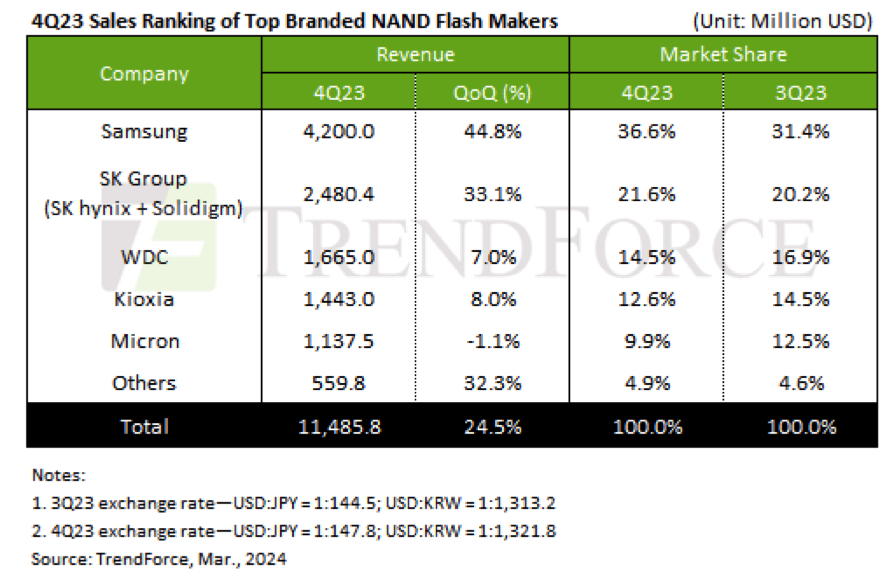

It is reported that a substantial 24.5% Q/Q increase in NAND flash industry revenue, hitting $11.49 billion in 4Q23.

This surge is attributed to a stabilization in end-demand spurred by year-end promotions, along with an expansion in component market orders driven by price chasing, leading to robust bit shipments compared to the same period last year.

Additionally, the corporate sector’s continued positive outlook for 2024 demand—compared to 2023 – and strategic stockpiling have further fueled this growth.

Looking ahead to 1Q24, despite it traditionally being an off-season, the NAND flash industry is expected to see a continued increase in revenue by another 20%. This anticipation is underpinned by significant improvements in supply chain inventory levels and ongoing price rises, with clients ramping up their orders to sidestep potential supply shortages and escalating costs. The ongoing expansion of order sizes is expected to drive NAND flash contract prices up by an average of 25%.

Samsung stole the spotlight in 4Q23, primarily due to substantial growth fueled by a sharp rise in demand across servers, notebooks, and smartphones. Despite not fully meeting customer orders, its bit shipment volume surged by 35% Q/Q, coupled with a 12% increase in ASP, boosting its revenue to $4.2 billion – a significant 44.8% Q/Q growth.

SK Group trailed behind Samsung, enjoying a 33.1% revenue jump to $2.48 billion thanks to significant price recoveries.

Western Digital saw a slight 2% dip in shipment volume but a 10% increase in ASP, leading to a 7% revenue increase to $1.67 billion for its NAND flash division. The retail SSD market witnessed a substantial boost in shipments due to a price rebound, dropping inventory levels to a 4-year low.

Kioxia, boosted by PC and smartphone client orders, reported a modest shipment growth and an 8% revenue increase to $1.44 billion in 4Q23.

Facing the most severe oversupply situation in 2023, the industry saw prices climb nearly 10% in 4Q23.

However, Micron reduced its supply significantly to improve profitability, leading to a more than 10% Q/Q decrease in bit shipments and a 1.1% decrease in revenue to $1.14 billion. Furthermore, it anticipates a 15–20% annual increase in NAND flash demand bit growth for the year, emphasizing the need for ongoing capacity adjustments to achieve a balance between supply and demand for potential profitability in the industry.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter