Backblaze: Fiscal 4Q23 Financial Results

Backblaze: Fiscal 4Q23 Financial Results

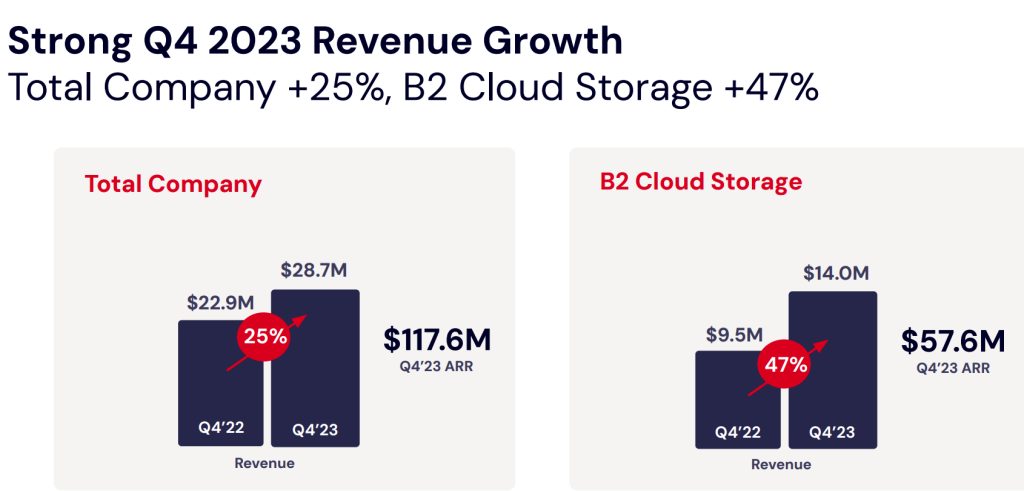

Revenue of $28.7 million up 25% Y/Y, with net loss as usual since inception

This is a Press Release edited by StorageNewsletter.com on February 19, 2024 at 2:02 pm| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 22.9 | 28.7 | 85.2 | 102.0 |

| Growth | 25% | 20% | ||

| Net income (loss) | (14.5) | (10.8) | (51.4) | (58.9) |

Backblaze, Inc. announced results for its fourth quarter and year ended December 31, 2023.

“Backblaze capped off a strong finish to the year with our B2 Cloud Storage revenue growing 47% in 4Q23 and delivered adjusted EBITDA profitability for the 1st time as a public company,” said Gleb Budman, CEO. “We exited 2023 with accelerated revenue growth and dramatically improved profitability and cash usage metrics. I’m excited for the coming year as Backblaze continues to move up in the mid-market and help customers who are poorly served by legacy solutions to break free with our differentiated cloud services.“

4FQ23 Financial Highlights:

- Revenue of $28.7 million, an increase of 25% Y/Y.

- B2 Cloud Storage revenue was $14.0 million, an increase of 47% Y/Y.

- Computer Backup revenue was $14.7 million, an increase of 10% Y/Y.

- Gross profit of $15.2 million, or 53% of revenue, compared to $11.7 million or 51% of revenue, in 4FQ22.

- Adjusted gross profit of $22.1 million, or 77% of revenue, compared to $17.3 million or 75% of revenue in 4FQ22.

- Net loss was $11.4 million compared to a net loss of $14.5 million in 4FQ22.

- Net loss per share was $0.30 compared to a net loss per share of $0.44 in 4FQ22.

- Adjusted EBITDA was $1.6 million, or 6% of revenue, compared to $(2.5) million or (11)% of revenue in 4FQ22.

- Non-GAAP net loss of $5.6 million compared to non-GAAP net loss of $9.0 million in 2022.

- Non-GAAP net loss per share of $0.15 compared to a non-GAAP net loss per share of $0.27 in 2022.

- Cash, short-term investments and restricted cash, non-current totaled $33.4 million as of December 31, 2023.

FY23 Financial Highlights:

- Revenue of $102.0 million, an increase of 20% Y/Y.

- B2 Cloud Storage revenue was $46.4 million, an increase of 40% Y/Y.

- Computer Backup revenue was $55.6 million, an increase of 7% Y/Y.

- Gross profit of $50.0 million, or 49% of revenue, compared to $43.9 million or 52% of revenue, in FY22.

- Adjusted gross profit of $76.2 million, or 75% of revenue, compared to $64.6 million or 76% of revenue in FY22.

- Net loss was $58.9 million compared to $51.4 million in FY22.

- Net loss per share was $1.63 compared to $1.62 in FY22.

- Adjusted EBITDA was $(3.9) million, or (4)% of revenue, compared to $(9.4) million and (11)% of revenue in FY22.

- Non-GAAP net loss of $30.6 million compared to non-GAAP net loss of $32.8 million in FY22.

- Non-GAAP net loss per share of $0.85 compared to a non-GAAP net loss per share of $1.04 in 2022.

4FQ23 Operational Highlights:

- ARR was $117.6 million, an increase of 28% Y/Y.

- B2 Cloud Storage ARR was $57.6 million, an increase of 49% Y/Y.

- Computer Backup ARR was $60.0 million, an increase of 12% Y/Y.

- Net revenue retention (NRR) rate was 109% compared to 113% in 4FQ22.

- B2 Cloud Storage NRR was 122% compared to 122% in 4FQ22.

- Computer Backup NRR was 100% compared to 108% in 4FQ22.

- Gross customer retention rate was 91% in 4FQ23 and 4FQ22.

- B2 Cloud Storage gross customer retention rate was 90% in 4FQ23 and 4FQ22.

- Computer Backup gross customer retention rate was 91% compared to 90% in 4FQ22.

- Number of customers was 511,942 vs. 506,456 in 4FQ22.

- B2 Cloud Storage number of customers was 97,842 vs. 86,874 in 4FQ22.

- Computer Backup number of customers was 431,745 vs. 436,080 in 4FQ22.

- Total Annual Average Revenue Per Customer (ARPU) was $228 vs. $181 in 4FQ22.

- B2 Cloud Storage ARPU was $577 vs. $437 in 4FQ22.

- Computer Backup ARPU was $140 vs. $124 in 4FQ22.

Recent Business Highlights

- Completed Price Increase With Added Product Features: Customer retention remains strong at 91% with enhanced customer value from free egress and bundling of Extended Version History

- Reduced Cash Usage: 4FQ23 cash usage declined over 70% from 3FQ23 to $2.4 million

- Delivered Adjusted EBITDA Profitability: Exceeded guidance by 3% driven by continued cost savings and strong revenue performance

- Launched Powered by Backblaze: Allows partners to incorporate B2 Cloud Storage into their products and offerings in a manner invisible to end users, opening new distribution channels for product

- Launched Backblaze Computer Backup With Enterprise Control: New administrative control feature set caters to larger companies with greater compliance and security needs

- Deepened the Leadership Bench: Hired chief product officer David Ngo who brings 25+ years in data management industry experience to further accelerate innovation

1FQ24 Outlook

- Revenue between $29.6 million to $30.0 million.

- Adjusted EBITDA margin between 4% to 6%.

- Basic shares outstanding of 39.5 to 40.5 million shares.

FY24 Outlook:

- Revenue between $126.0 million to $128.0 million.

- Adjusted EBITDA margin between 8% to 10%.

Comments

4FQ23 revenue totaled $28.7 million, an increase of 25% Y/Y and 13% Q/Q, on top of guidance (between $27.9 million to $28.7 million).

B2 cloud storage revenue was $14 million, reflecting 47% growth. Computer backup revenue totaled $14.7 million, reflecting 10% growth.

Total company net revenue retention was 109% with B2 cloud storage at 122% and computer backup at 100%, which have all improved over 3FQ23.

Working down the P&L adjusted gross margin increased about 300 basis points sequentially to 77%, which was primarily due to the price increase across products and to a lesser extent the higher utilization of prior data center expansions.

For 1FQ24, the company expects revenue to be in the range of $29.6 million to $30 million and adjusted EBITDA margin between 4% and 6%, reflecting continued strong performance in a quarter, which is typically a high quarter for expenses due to payroll taxes and other compensation related expenses.

For FY24, revenue guidance is expected to be between $126 million to $128 million with the midpoint reflecting 25% Y/Y growth.

| (in $ million) | Revenue | Y/Y growth | Net income (loss) |

| FY19 | 40.7 | NA | (1.0) |

| FY20 | 53.8 | 32% | (6.6) |

| FY21 |

67.5 | 25% | (21.6) |

| 1FQ22 | 19.5 | 27% | (12.5) |

| 2FQ22 | 20.7 | 28% | (11.6) |

| 3FQ22 | 22.1 | 27% | (12.8) |

| 4FQ22 | 22.9 | 23% | (14.8) |

| FY22 |

85.2 |

26% |

(51.7) |

| 1FQ23 | 23.4 | 20% | (17.1) |

| 2FQ23 | 24.6 | 19% | (14.3) |

| 3FQ23 | 25.3 | 15% | (16.1) |

| 4FQ23 | 28.7 | 25% | (10.8) |

| FY23 | 102.0 | 20% | (58.9) |

| 1FQ24 (estim.) | 29.6-30.0 | 26%-28% | NA |

| FY24 (estim.) |

126-128 |

24%-25% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter