GigaOm Radar for Primary Storage for Large Enterprises

Leaders analyzed NetApp, Pure Storage, Infinidat; and challengers IBM, Dell, Hitachi Vantara, HPE, Fujitsu, and StorPool

This is a Press Release edited by StorageNewsletter.com on February 5, 2024 at 2:02 pmPublished on January 26, 2024, this market report was written by:

![]() Max Mortillaro, an independent industry analyst with a focus on storage, multi-cloud and hybrid cloud, data management, and data protection, and

Max Mortillaro, an independent industry analyst with a focus on storage, multi-cloud and hybrid cloud, data management, and data protection, and

Arjan Timmerman, an independent industry analyst and consultant with a focus on helping enterprises on their road to the cloud (multi/hybrid and on-prem), data management, storage, data protection, network, and security.

Arjan Timmerman, an independent industry analyst and consultant with a focus on helping enterprises on their road to the cloud (multi/hybrid and on-prem), data management, storage, data protection, network, and security.

GigaOm Radar for Primary Storage for Large Enterprisesv4.0

1. Executive Summary

Primary storage systems for large enterprises have adapted quickly to new needs and business requirements, with data now accessed from both on-premises and cloud applications. We’re in a transition phase, moving from storage systems designed to be deployed in data centers to hybrid and multicloud solutions, with similar functionalities provided on physical or virtual appliances, as well as through managed services.

The concepts of primary storage, data, and workloads have radically changed over the past few years. Mission- and business-critical functions in enterprise organizations used to be concentrated in a few monolithic applications based on traditional relational databases. In that scenario, block storage was often synonymous with primary storage, and performance, availability, and resiliency were prioritized, usually at the expense of flexibility, ease of use, and low cost.

Now, after the virtualization wave and the exponential growth of microservices and container-based applications, organizations are shifting their focus to AI-based analytics, self-driven storage, improved automation, and deeper Kubernetes integration. In addition, the prevalence of cyberthreats such as ransomware attacks require organizations to implement a multilayered defense strategy that encompasses secure storage. To prevent downtime and data loss, protecting data assets at the source (in production and on primary storage systems) becomes a key aspect of any security strategy.

Furthermore, the thirst for performance is still strong, which means support for new storage types – including emerging CXL-compatible persistent memory types and NVMe transport protocols – are now being looked at with more interest.

Moreover, organizations have not lost their appetite for cost optimization. When it comes to TCO and flexibility, the emergence of STaaS means that cloud consumption models are increasingly being sought.

When it comes to modern storage, and block storage in particular, flash memory and high-speed Ethernet networks have commoditized performance and reduced costs, allowing more freedom in system design. FC remains a core component in many storage infrastructures for legacy reasons only. At the same time, enterprises are working to align storage with broader infrastructure strategies, which address issues such as:

- Better infrastructure agility for speeding up response to business needs.

- Improved data mobility and integration with the cloud.

- Support for a larger number of concurrent applications and workloads on a single system.

- Simplified infrastructure.

- Automation and orchestration to speed up and scale operations.

- Drastic reduction of TCO along with a significant increase in the capacity per sysadmin under management.

- Better overall energy efficiency enabling achievement of environmental, social, and corporate governance (ESG) objectives and reduction of energy bills, especially when operating at scale.

These efforts have contributed to the increasing number of solutions as startups and established vendors move to address these needs. Traditional high-end and midrange storage arrays have been joined by software-defined and specialized solutions, all aimed at serving similar market segments but differentiated by the focus they place on the various points described above. A one-size-fits-all primary storage solution doesn’t exist.

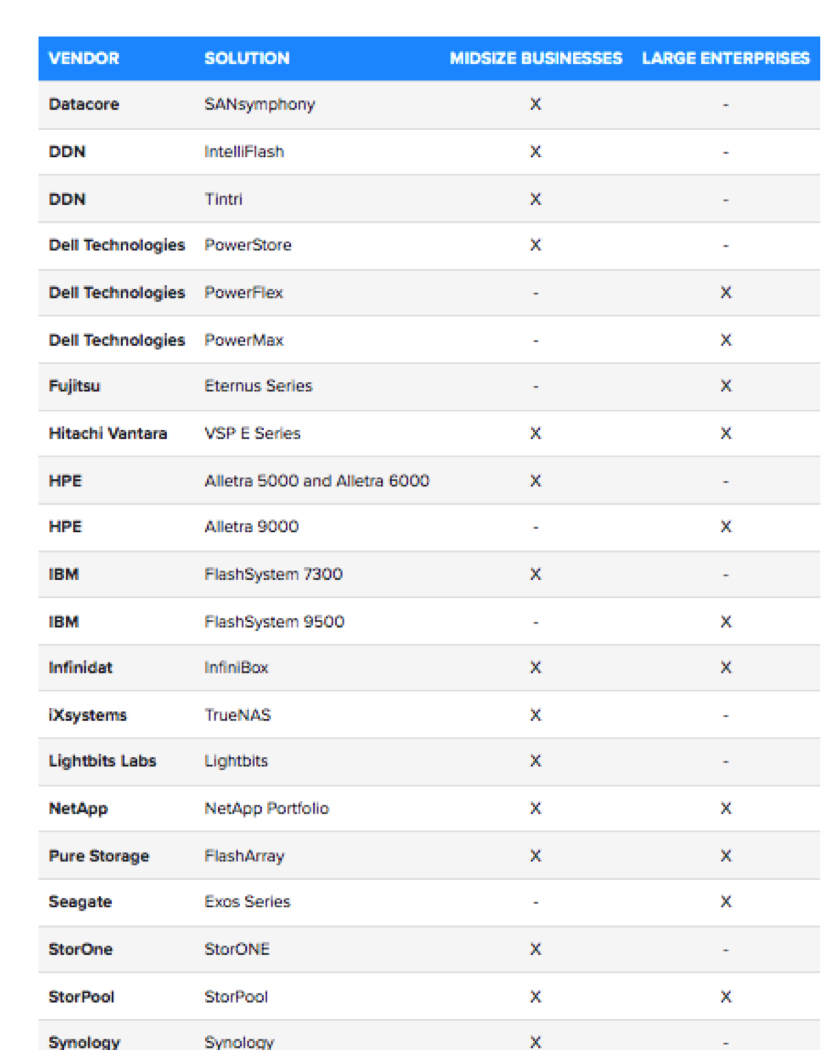

For this evaluation, we have 2 Radar reports: one on primary storage for large enterprises and the other on primary storage for midsize businesses.

Table 1 shows the vendors and primary storage systems covered in each report.

Table 1. Primary Storage Solutions for Midsize and Large Enterprises

This is our 4th year evaluating the primary storage space in the context of our Key Criteria and Radar reports. This report builds on our previous analysis and considers how the market has evolved over the last year.

This report examines 11 of the top primary storage solutions for large enterprises in the market and compares offerings vs. the capabilities (table stakes, key features, and emerging features) and non-functional requirements (business criteria) outlined in the companion Key Criteria report. Together, these reports provide an overview of the category and its underlying technology, identify leading primary storage offerings, and help decision-makers evaluate these solutions so they can make a more informed investment decision.

2. Market Categories and Deployment Types

To help prospective customers find the best fit for their use case and business requirements, we assess how well primary storage solutions are designed to serve specific target markets and deployment models (see Table 2).

For this report, we recognize the following market segments:

- Large enterprises: Here, offerings are evaluated on their ability to support large and business-critical projects. Optimal solutions in this category have a strong focus on flexibility, performance, data services, and features that improve security and data protection. Scalability is another big differentiator, as is the ability to deploy the same service in different environments.

- Specialized: Optimal solutions are designed for specific workloads and use cases, such as MSPs, big data analytics, and HPC.

In addition, we recognize the following deployment models:

- Hardware appliance: These solutions are provided as a self-contained physical device with all the components necessary to deliver primary storage capabilities. The device is fully supported by the vendor, and other than managing the platform, the customer needs only to apply hot fixes or patches. This deployment model delivers simplicity at the expense of flexibility.

- SDS: These solutions are meant to be deployed on commodity servers on-premises or in the cloud, allowing organizations to build hybrid or multicloud storage infrastructures. This option provides more flexibility in terms of deployment, cost, and hardware choice, but it can be more complex to deploy and manage.

Table 2. Vendor Positioning: Target Market and Deployment Model

Table 2 components are evaluated in a binary yes/no manner and do not factor into a vendor’s designation as a Leader, Challenger, or Entrant on the Radar chart (Figure 1).

“Target market” reflects which use cases each solution is recommended for, not simply whether it can be used by that group. For example, if it’s possible for an SMB to use a solution but doing so would be cost-prohibitive, that solution would be rated “no” for that market segment.

3. Decision Criteria Comparison

All solutions included in this Radar report meet the following table stakes – capabilities widely adopted and well implemented in the sector:

- Scale-up or scale-out

- Traditional versus software-defined storage

- Integration with upper layers

- Data protection

- Basic data services

- Resiliency and availability

- System analytics

- NVMe

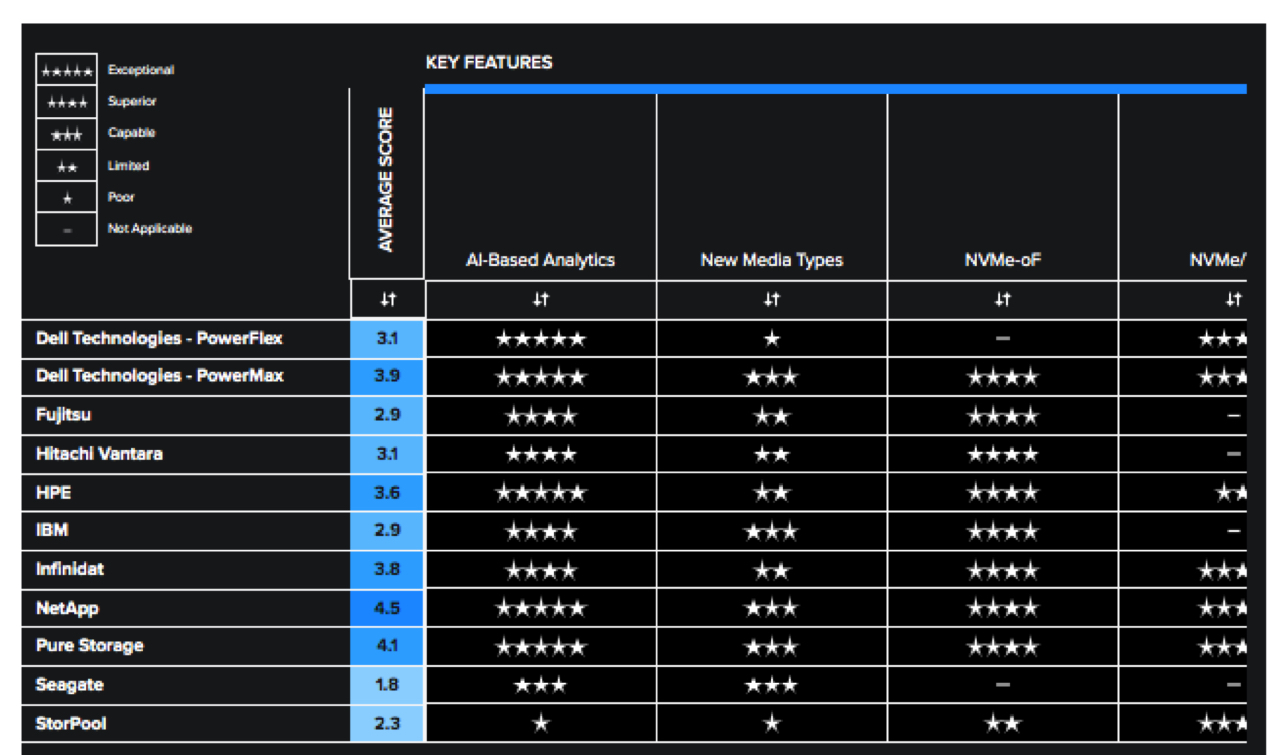

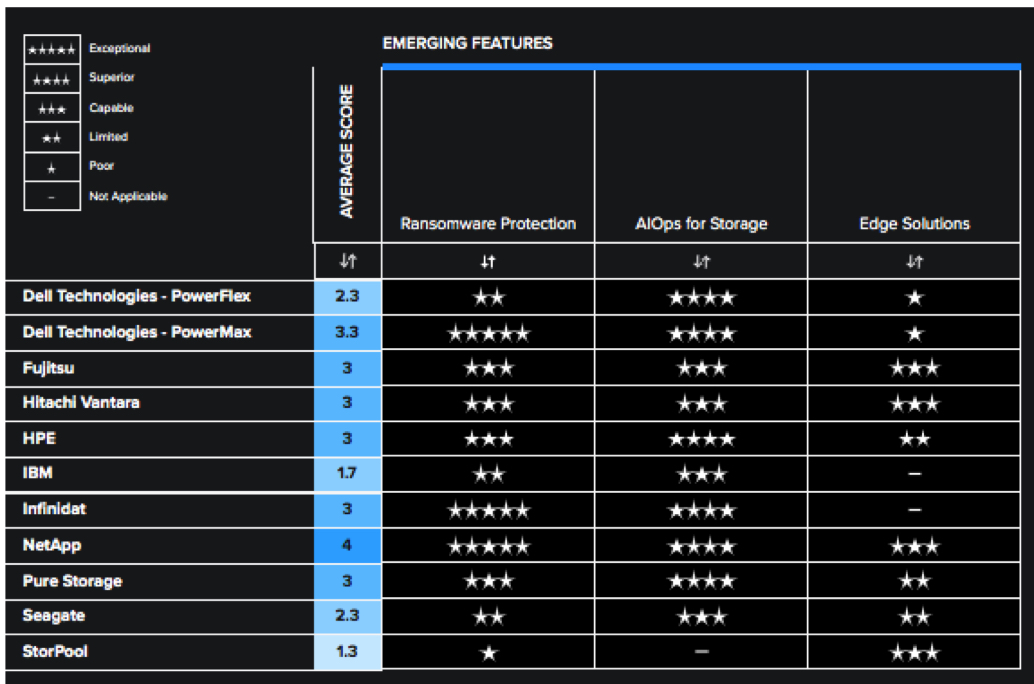

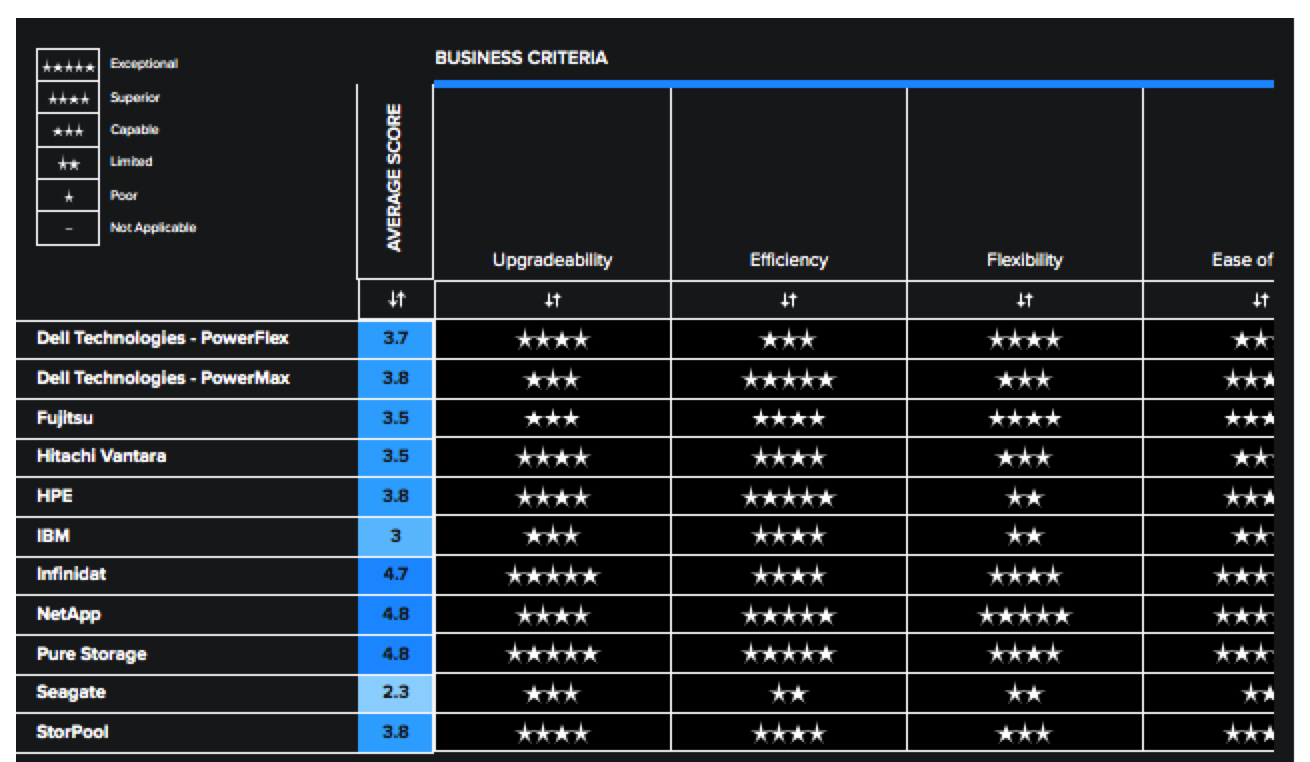

Tables 3, 4, and 5 summarize how each vendor included in this research performs in the areas we consider differentiating and critical in this sector. The objective is to give the reader a snapshot of the technical capabilities of available solutions, define the perimeter of the relevant market space, and gauge the potential impact on the business.

Key features differentiate solutions, outlining the primary criteria to be considered when evaluating a primary storage solution.

Emerging features show how well each vendor is implementing capabilities that are not yet mainstream but are expected to become more widespread and compelling within the next 12 to 18 months.

Business criteria provide insight into the non-functional requirements that factor into a purchase decision and determine a solution’s impact on an organization.

These decision criteria are summarized below. More detailed descriptions can be found in the corresponding report, GigaOm Key Criteria for Evaluating Primary Storage Solutions.

Key Features

- AI-based analytics: The most advanced AI-based analytics is capable of collecting data at a massive scale and can be used to log data from sensors within a storage system, at a rate of up to several million data points per system per day. This data can then be consolidated in large cloud repositories and analyzed using machine learning and other advanced techniques.

- New media types: Finding the right combination of performance and capacity for block storage remains challenging. Hard drives still provide the best $/GB cost ratio, but data access optimization schemes intended to boost their performance in standard enterprise arrays make them overly complex.

- NVMe-oF: It is very beneficial for applications that need absolute performance, including databases, big data analytics, and more generally, all tier-0 applications.

- NVMe/TCP: The next step in the evolution of NVMe is NVMe on TCP/IP. This implementation of the NVMe protocol loses some of the latency benefits of NVMe-oF, but it adds simplicity and flexibility and is able to take advantage of less-expensive Ethernet equipment.

- Cloud integration: Organizations of all sizes are taking advantage of this for modern applications that leverage native services, but they also need to move data to and from their premises to support other applications in a hybrid fashion, integrating block storage with public and private cloud services.

- API and automation tools: Decision-makers should stay abreast of the options offered by storage systems around API compatibility and command line interface (CLI) features. They should seek functional parity among GUIs, CLIs, and APIs.

- Kubernetes integration: Kubernetes is becoming the de facto standard for container application orchestration, and the community has found common ground on how to deal with persistent storage resources in a Kubernetes environment. The CSI spec enables vendors to create plug-ins that allow container orchestrators to operate seamlessly with the resources provided by the storage system.

- STaaS: Some vendors are proposing consumption models that follow cloud economics. Rather than pay up front with Capex funds, customers can instead consume capacity on demand according to a pay-as-you-go model based on recurrent subscription fees that reflect actual consumption.

Table 3. Key Features Comparison

Emerging Features

- Ransomware protection: It is a complex discipline requiring a combination of prevention, proactive detection, and mitigation and recovery techniques. Nevertheless, organizations should not disregard built-in ransomware protection capabilities available on primary storage systems, since they can potentially reduce downtime or even thwart an attack.

- AIOps for storage: Storage vendors have been collecting data for many years now and are using it to train their ML systems. These systems are becoming more autonomous and more directed in their advice, offering steps that are consistent with best practices suggested by the vendors.

- Edge solutions: As primary workloads gradually shift from the data center to the cloud, the edge of the network is becoming more important. Organizations are deploying more small-scale storage solutions at the edge, and those solutions require better fleet management capabilities that can handle zero-touch deployment, central policy-based management, and security and ransomware protection.

Table 4. Emerging Features Comparison

Business Criteria

- Upgradeability: Choosing systems that can last longer without dramatic cost increases after the first few years in production helps keep costs from escalating while avoiding unnecessary data migrations and forklift upgrades.

- Efficiency: Solutions that implement an array of data reduction techniques along with tiering capabilities are best suited to tackle the data growth challenge. Besides capacity and tiering aspects, environmental efficiency is also being considered with greater scrutiny.

- Flexibility: In contrast to past models, in which highly siloed stacks and storage systems served a limited number of applications and workloads, today’s storage systems tend to be shared by a large number of servers, VMs, and applications.

- Ease of use: In many IT organizations, system administrators manage several aspects of the infrastructure. They become generalists without the time or skills to operate complex, difficult-to-use systems. GUIs and dashboards are usually welcomed, especially when supported by predictive analytics systems for troubleshooting and capacity planning.

- Cost per transaction ($/IO/s): Even though most primary block storage systems can perform incredibly well, what this performance actually costs determines the value of the entire system. Instead of comparing prices, organizations should track the price/IO/s metric because it gives a better idea of the trade-offs among different systems when data reduction and other services are enabled.

- Cost of storage ($/GB): The $/GB metric compares systems in terms of the capacity exposed to the clients and, by extension, the efficiency of data reduction mechanisms and, more generally, the way media is utilized. Combining $/GB and $/IO/s metrics can produce a pretty good idea of the overall efficiency of a system and, in particular, of the overall efficiency of its performance and capacity.

Table 5. Business Criteria Comparison

4. GigaOm Radar

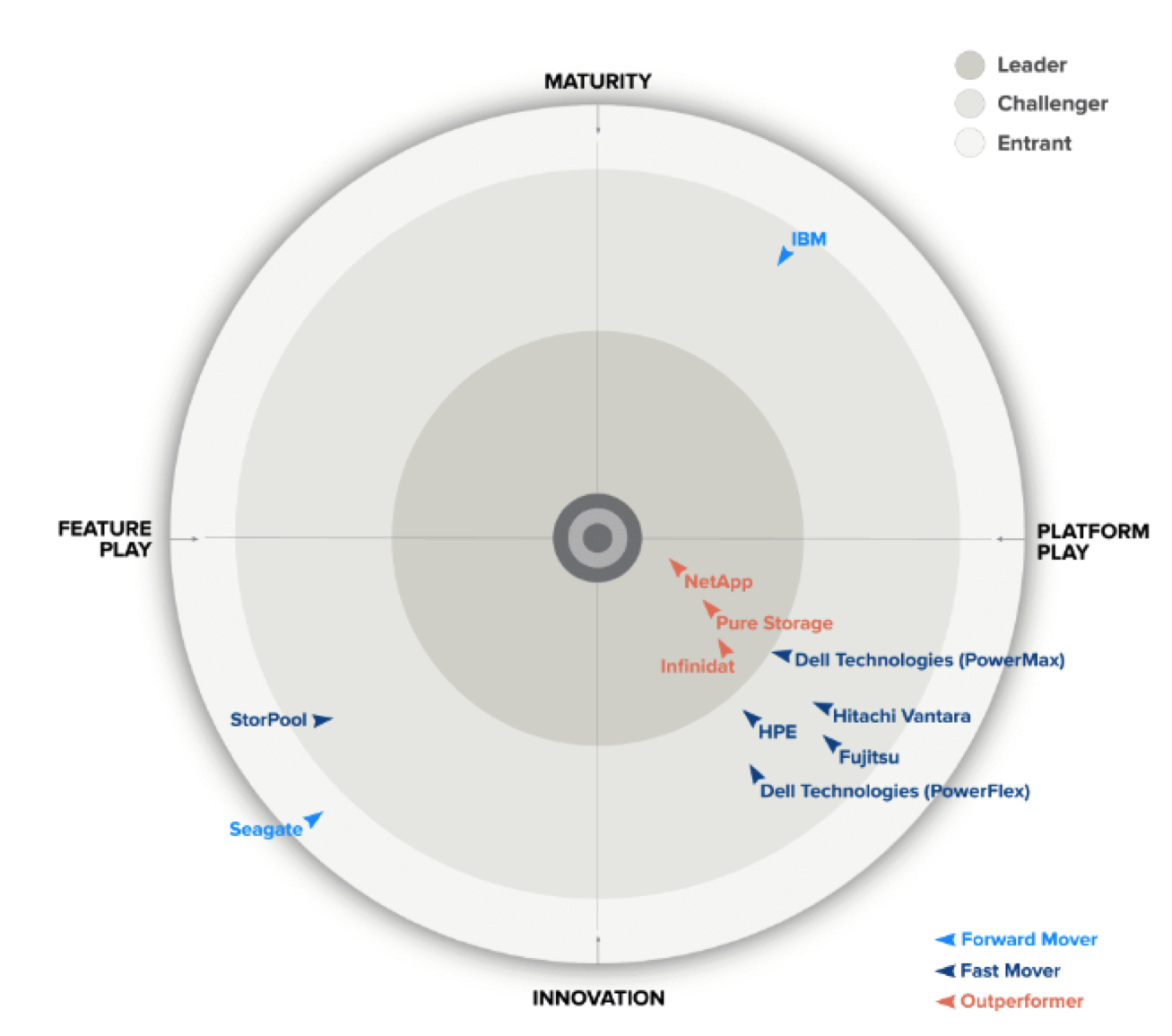

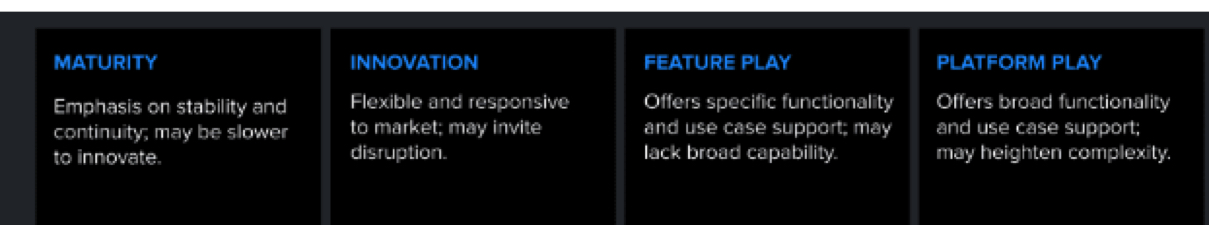

It plots vendor solutions across a series of concentric rings, with those set closer to the center judged to be of higher overall value. The chart characterizes each vendor on 2 axes – balancing Maturity versus Innovation and Feature Play vs. Platform Play – while providing an arrowhead that projects each solution’s evolution over the coming 12 to 18 months.

Figure 1. GigaOm Radar for Primary Storage for Large Enterprises

As you can see in the Radar chart in Figure 1, there’s 1 large cluster of vendors in the Innovation/Platform Play quadrant, 2 vendors in the Innovation/Feature Play quadrant, and 1 vendor in Maturity/Platform Play.

That large cluster in Innovation/Platform Play can be subdivided into 2 groups. The first one includes Infinidat, NetApp, and Pure Storage, all identified as Outperformers. The versatility of these solutions and their pace of execution against strong roadmaps are differentiators for the vendors in this first group compared to the second.

Infinidat focuses on massive capacity and scalability with its InfiniBox rack-scale solution and offers the InfiniBox SSA II all-flash architecture, designed for mission-critical workloads. Moreover, the company made improvements in ransomware protection and cyber resiliency, while making its initial entry into hybrid cloud with InfuzeOS Cloud Edition for AWS, a direct port of their OS into their on-premise products in 2023.

NetApp delivers outstanding capabilities both on-premises and in the cloud (as a first-party offering) with solutions architected around its Ontap OS. The recently launched BlueXP service delivers thorough and seamless data mobility and data management capabilities, providing an unmatched, best-in-class experience. The company launched QLC-based systems (AFF C-Series) in the beginning of 2023.

Pure Storage delivers no-compromise all-flash storage in this segment with FlashArray//XL and FlashArray//X, offering compelling storage capacity and density specifically with //XL series. The company provides best-in-class, Portworx-based Kubernetes support, a proven non-disruptive upgrade architecture, and a broad choice of flexible consumption models, including STaaS options. The portfolio has been expanded to include //E series systems, based on QLC flash and optimized for capacity.

The second group of innovators consists of Fast Movers. The solutions are innovative in their nature, but either the pace of execution is more moderate, or the roadmap less aggressive and disruptive than those in the first group. This group consists of Dell Technologies, Fujitsu, Hitachi Vantara, and HPE:

Dell Technologies offers PowerMax and PowerFlex for large enterprise use cases. This year, the two solutions are covered independently to better highlight their differences. The PowerMax platform combines the robustness of its predecessors with newly introduced appliances that significantly improve capacity, density, performance, and cyber resiliency. It uses a combination of onboard and AIOps-related ML-driven capabilities, and it is able to consume services through a STaaS model. PowerFlex, in contrast, takes a different approach that enables massive scalability.

Fujitsu is a new vendor in this Radar. The company delivers comprehensive enterprise storage capabilities through its Eternus portfolio, which primarily focuses on block storage. In addition, it relies on a partnership with NetApp to fulfill other primary storage requirements.

Hitachi Vantara now supports non-disruptive upgrades on its virtual storage portal (VSP) 5000 series appliances targeting large enterprises. The company is improving its STaaS offering (with support for multitenancy), has closed the gap on Kubernetes integration, and offers multiple management options, as well as ransomware detection and mitigation capabilities.

Focusing primarily on HPE GreenLake, HPE offers its Alletra 9000 appliance for large enterprises, a robust all-NVMe architecture that includes advanced data reduction mechanisms, the excellent HPE InfoSight AI-based analytics platform, and a SaaS intent-based provisioning solution. The company has moved from the Maturity to the Innovation half of the Radar, thanks to the introduction of a modern storage architecture, Alletra Storage MP, that will gradually replace the existing Alletra product line.

The Maturity/Platform Play quadrant of the Radar holds just one vendor: IBM, with its established and proven FlashSystem platform. FlashSystem 9500 appliance is based on the modern Spectrum Virtualize architecture, which offers an NVMe all-flash array delivering block storage support. The solution is backed by IBM’s AI-based analytics suite, which enables performance and scalability for large organizations; the company also offers STaaS options and ransomware protection features.

Finally, on the left side of the Radar, 2 Feature Play solutions are present: Seagate and StorPool:

Seagate is a vendor that’s new in this Radar and classed as an Entrant. The company provides a range of storage appliances branded Exos, which include its own SSD and HDD drives, allowing the solution to perform tight coupling between the storage platform and the storage media.

StorPool is a vendor that’s new to this year’s large enterprise Radar. In previous years, it has been evaluated in the midsize report, but it has demonstrated its ability to serve the large enterprises market as well. It provides a block-based, software-defined primary storage solution with support for NVMe/TCP targeting mission-critical workloads. It can run on AWS and includes an innovative, albeit statistics-based, analytics platform.

It’s also worth noting that Zadara Storage is no longer present in this Radar. The company provides primary storage capabilities to large enterprises, but these are predominantly delivered as-a-service and are an integral part of its on-premises cloud stack. The solution will continue to be rated in GigaOm’s Sonar for STaaS.

In reviewing solutions, it’s important to keep in mind that there are no universal “best” or “worst” offerings; there are aspects of every solution that might make it a better or worse fit for specific customer requirements. Prospective customers should consider their current and future needs when comparing solutions and vendor roadmaps.

5. Solution Insights

Dell Technologies, PowerMax – Large

Formed in 2016, Dell inherits its storage DNA primarily from EMC Corporation (later known as Dell EMC). Although historically the company has had a very heterogeneous portfolio of storage solutions, the founding of Dell Technologies marked a turning point in terms of rationalization.

PowerMax consists of a modular architecture based on node pairs, in which each node pair provides storage, compute, and cache capacity to the PowerMax system, enabling the solution to scale up and scale out. The newest PowerMax systems are based on a new multiple-node NVMe scale-out architecture with Nvidia DPU technology and are designed to deliver high throughput and low latency to performance-oriented workloads and flexible single-drive upgrades.

PowerMax supports NVMe-oF, FC, and iSCSI protocols. PowerMax systems are powered by PowerMaxOS, which includes an embedded hypervisor. The various modules execute as services on top of PowerMaxOS, delivering management, data services, and other mission-critical storage capabilities. The solution also supports SmartFabric Storage Services, a software tool for automating NVMe/TCP infrastructure discovery and configuration.

Data services include advanced hardware-based data reduction through global inline de-dupe and compression backed by Dell’s updated 5:1 data reduction guarantee. Replication is one of the strong capabilities of the PowerMax platform, thanks to the robust and long-established Symmetrix Remote Data Facility (SRDF) feature.

Other data services include ransomware anomaly detection and alerting, cyber recovery vault, multiple-array smart provisioning, multifactor management authentication, end-to-end encryption with data reduction efficiencies, embedded NAS, PowerPath (which enables consistent application availability and performance), and SnapVX space-efficient snapshots that are immutable (secure snapshots that can’t be changed or deleted manually until a user-specified expiration time).

Finally, PowerMax embeds a real-time, ML engine that analyzes host I/O traffic and ensures optimal data placement on NVMe flash drive pools according to each workload’s I/O profile.

Cloud support is available through Cloud Mobility for PowerMax, a feature that runs as a VM on PowerMaxOS. Cloud Mobility allows seamless and transparent data movement between PowerMax systems and object storage, whether cloud-based—Amazon Web Services, Microsoft Azure—or on-premises object stores such as Dell ECS and PowerScale.

The system is managed through Unisphere for PowerMax, a dedicated management interface that supports multiple PowerMax systems and delivers a comprehensive overview of the managed systems with various metrics concerning health, performance, capacity, and compliance. PowerMax also integrates with CloudIQ to benefit from more advanced monitoring and alerting related to health checks, cybersecurity recommendations, performance impact/anomaly/workload contention analysis, capacity forecasting, and more. Additional cyber resiliency capabilities were recently added (October 2023) to PowerMax with cyber intrusion detection and advanced anomaly detection, and a host of security compliance certifications. Power consumption dashboards (which can be enhanced by intelligent power distribution units in 42U racks) and operational efficiency enhancements were also part of this release.

For API and automation support, organizations can either rely on CloudIQ (which provides unified webhook and REST API support across products) or directly use PowerMax APIs.

Kubernetes integration is available through a vVol integration with VMware Tanzu or through Dell’s Container Storage Modules (CSM).

Dell provides STaaS capabilities through its Apex offering, in which clients can order block or file services and define performance tier, base capacity, subscription length, and deployment location (on-premises or in a Dell-provided co-location site), as well as various criteria that will also define the storage platform deployed in the background. Storage is offered as a service, though, so this is less relevant.

Strengths

The compant continues to demonstrate the relevance of its PowerMax solution, thanks to a robust and innovative architecture designed to offer the best reliability for mission-critical workloads. Efficiency improvements and sustained development of the CloudIQ AIOps platform are laudable. The solution has a comprehensive set of data services including ML-driven self remediation and optimization.

Challenges

Compared to other players in the market, cloud integration capabilities remain average.

Purchase Considerations

Organizations continue to trust PowerMax due to its proven heritage (VMAX, Symmetrix) and multicontroller DNA and replication features (SRDF), making it a go-to choice for mission-critical applications. The main aspect to consider with PowerMax is understanding whether its cloud integration capabilities meet the organization’s requirements.

Designed to support mission-critical systems and performance-oriented workloads with strong reliability, PowerMax is capable of covering the vast majority of mainstream on-premises use cases, such as large databases, ERP systems, large virtualization environments, and so on. The solution excels in synchronous replication with SRDF and is often chosen for business-critical, active-active DR use cases.

Radar Chart Overview

The firm has kept the best features of its predecessors while building a modern platform that includes AI-based self-remediation, as well as other AI-based innovations, thus validating PowerMax as a modern and innovative solution. Roadmap and execution speed are good, though not exceptional compared to the Leaders, contributing to PowerMax’s positioning as a Challenger.

Fujitsu, Eternus Series – Large

The Japanese company was founded in 1935, making it the 3rd oldest IT company worldwide after HPE and IBM. It offers a variety of IT-related products, including storage solutions. The company provides the Eternus storage solution to enterprises around the world and has a strong partnership with NetApp.

The Eternus AF delivers flash performance, including seamless management integration with existing disk storage environments, ensuring a great transition of data centers to flash. Thanks to sophisticated inline efficiency technologies, customers benefit from fast response times. Moreover, mirroring and transparent failover ensure nonstop operation and automated quality of service, substantially minimizing administration.

Eternus DX hybrid storage is for hosting data for performance-hungry applications like virtualization, databases, or OLTP, along with unstructured data, online archives, and other data in a single system. These systems allow maximum storage consolidation for structured and unstructured data by balancing speed, capacity, and cost in one system. With its SSD tier, Eternus DX hybrid storage systems deliver “all-flash-like” performance, thus enabling a gradual transition to all-flash, while high-capacity HDDs store unstructured data at the lowest cost. The latest automation technologies enable the management of hybrid configurations (SSDs, SAS, nearline SAS) with minimum manpower.

Eternus AB all-flash Storage and Eternus HB Hybrid Storage are NVMe-ready flexible SAN) storage systems with the performance and efficiency of block storage devices. The modular, RAID-only storage systems are extremely scalable and have software that simplifies configuration and data management. While Eternus AB is exclusively configured with SSDs, Eternus HB has a mix of SSDs and HDDs. Customers can leverage enterprise-class performance for the workloads of core applications and databases such as Microsoft SQL Server, Oracle, SAP, and others.

Eternus Storage Management Software is the unified management system for the Eternus AF/DX family. It ensures that an IT administrator, once trained to operate a specific system, can also manage the other models within the family.

Eternus Family Concept ensures the unified management of all Eternus AF/DX storage systems via the Eternus SF platform. Customers also benefit from easy upgrade options and efficient disaster resilience solutions, such as Eternus Storage Cluster.

Eternus Storage Cluster automatically executes failover in both directions and between different Eternus DX hybrid storage and Eternus AF all-flash models, thus supporting nonstop operations very efficiently.

Strengths

The manufacturer offers a range of storage solutions in the Eternus series that are a good fit in most enterprise environments. With unified management and disaster resilience and storage cluster failover solutions, it provides a flexible and robust storage offering. Furthermore, it offers multiple software solutions to further strengthen the Eternus platform and provide customers with an environment that is scalable, flexible, and easy to administrate.

Challenges

While the Fujitsu storage solution is strong in block storage environments, it seems to rely on partners like NetApp to supply the complete spectrum of storage. Although almost all storage protocols are covered by Eternus storage, the messaging around Fujitsu’s partnership with NetApp tends to dilute the value proposition of Eternus.

While Fujitsu storage is innovative, it still seems to suffer from being part of a vendor’s budget that spans much more than only storage. This will give “true” storage companies in some cases a competitive advantage.

Purchase Considerations

The firm’s solutions can be bought in many different forms for those going the Capex route. The company also offers a strong and extensive STaaS solution that is delivered within the uScale family: it offers storage solutions and several as-a-service options, like IaaS, DaaS, PaaS, and DaaS. This makes the firm quite remarkable in this market.

With the range of storage solutions available in the Eternus series, the use cases are quite varied as well. The company delivers solutions for use cases like databases, virtual environments, containerized environments, hybrid cloud solutions, and unified storage environments. Most verticals can be serviced by Eternus solutions.

Radar Chart Overview

The firm has a comprehensive product range in the Eternus portfolio. Although it proposes unified file and block storage, it does not position its solutions as NAS-only systems–it relies instead on an OEM partnership with NetApp to fill that gap. Eternus systems are capable and noteworthy; the company appears to be investing regularly to broaden its product range, but still there is room for improvement across the multiple areas highlighted above. Significant advancements are needed to move this vendor toward the Leaders circle.

Hitachi Vantara, VSP E Series

For over 60 years, Hitachi Vantara has specialized in data management for mission-critical digital and industrial environments. It develops intelligent data platforms and hybrid cloud infrastructures, and it offers digital consulting expertise as well.

It provides a range of storage solutions for midsize and large organizations. Its products use the same OS and feature set, allowing users to design their infrastructures with a consistent set of characteristics at both the core and edge levels.

The VSP E series is focused on performance, and its scalability is remarkable in performance and capacity. The VSP E590H and E790H can provide up to 10.9PB of capacity; the new E1090H even provides 26PB (and NVMe-oF capability). The latter offers more performance due to additional CPU cores and memory.

Hitachi Ops Center is an ML-powered management platform that simplifies and improves operations for the entire storage stack. This suite consists of several highly integrated components. Hitachi Ops Center Clear Sight provides cloud-based monitoring capabilities. Hitachi Ops Center Analyzer provides real-time observability and anomaly detection, while Hitachi Remote Ops handles infrastructure issue resolution, with up to 90% of problems being automatically resolved. In addition, a new capability called Secure System Updates allows non-disruptive in-place updates without the need to evacuate an array.

The company has closed the gap in Kubernetes integration by adding support for Kubernetes, OpenShift, and Anthos. Hitachi Cloud Connect was added for cloud integration, allowing cloud-adjacent deployments of VSP in Equinix-based co-locations.

The firm offers an interesting STaaS solution called Everflex that allows pay-as-you-go and flexible consumption with guaranteed SLAs/service-level objectives, a fixed-rate card, and integrated analytics. The solution supports scaling up and down, has transparent pricing on a $/GB/month basis, and includes 5 storage service classes with 99.999% or 100% data availability. Recently, multitenancy was added to the STaaS offering and three levels of managed services are available, allowing granular control between the customer and Hitachi.

The company offers an SDS solution called Virtual Storage Software Block (VSS Block). It provides VSS block-ready nodes that allow organizations to scale their SDS system quickly and enable the data plane to be extended from the VSP solutions described above. VSS Blocks run virtualized and integrate with an organization’s core storage platform and existing hypervisor.

Strengths

The firm offers reliable storage solutions with a resilient architecture that guarantees performance. Its STaaS offering, Everflex, provides greater flexibility to customers, allowing them to scale their storage resources without having to manage infrastructure. With the broad range of storage solutions and the soon-to-come VSP One offering, the manufacturer’s solutions are a good fit for almost all business environments.

Challenges

Organizations looking to leverage NVMe flash for critical workloads may face hurdles as NVMe/TCP is unsupported, and NVMe-oF is supported only in the VSP 5000 series and the VSP E1090 series. Cloud integration is also average compared to other market competitors. It’s important to consider performance and integration needs carefully when selecting a solution.

Purchase Considerations

The firm offers various purchase options for its data services and storage. Organizations can follow the normal route of hardware purchase through numerous partners around the globe or consider company’s STaaS offering.

Hitachi Vantara offers a very extended range of hardware solutions, and the use cases for these are very diverse and extend to all verticals. Databases, virtualization, containers, and many others are possible with its VSP platform. With the introduction of VSP One (firm’s offering for One Data Platform announced for early 2024), the possibilities will get even better.

Radar Chart Overview

Hitachi Vantara is a Challenger in the Innovation/Platform Play quadrant. Its rating is lowered by average cloud integration capabilities compared to the Leaders and a lack of support for new media types. In terms of business criteria, flexibility and ease of use are also average, impacting its overall positioning.

HPE, HPE Alletra 9000

A major storage and data center provider, HPE provides storage capabilities in the large enterprise storage segment with its Alletra product line, launched in 2021.

For large enterprises, the vendor offers the Alletra 9000, an all-NVMe array that aims to satisfy the requirements of mission-critical workloads with ultra-low latency and high IO/s, boasting a no-questions-asked 100% data availability guarantee. To ensure system availability, the company leverages its InfoSight infrastructure management and AIOps platform, backed by AI and ML, to predict and prevent service disruptions, enhancing its management and analytics capabilities.

As an all-NVMe architecture, Alletra 9000 supports NVMe-oFC. The solution can be extended with Alletra 2240 storage enclosures, which communicate with the Alletra 9000 through NVMe-oF (RoCE v2) connectivity. It introduces non-disruptive controller upgrades, a new capability, into firm’s storage portfolio. The solution has been improved with additional NVMe drive enclosure node pairs, new data compression efficiency, support for active synchronous replication between 2 data centers, and more.

HPE is moving away from traditional storage management approaches. Besides InfoSight for AIOps, organizations can take advantage of company’s Data Services Cloud Console. This SaaS intent-based provisioning solution enables a cloud-like experience that combines policy-based storage management and a self-service approach to workload provisioning with AI-driven workload placement. Data Services Cloud Console provides a rich and unified set of REST APIs across firm’s products, allows workload movement to and from the cloud, and supports advanced security capabilities.

The manufacturer also supports cloud storage through its Cloud Volumes, a cloud-based platform that allows organizations to provision block volumes on AWS or Azure. Cloud Volumes also offers a backup capability, although it doesn’t support immutable snapshots yet. Finally, the firm also has a good roadmap regarding Kubernetes integration, with dedicated CSI drivers for Alletra systems.

Alletra 9000 systems implement a robust set of cyber-resiliency capabilities that include immutable snapshots, Virtual Lock (a function to prevent deletion of volumes), anomaly detection via InfoSight, and various enhanced immutability features.

The Alletra 9000 platform can be deployed and consumed through GreenLake, company’s STaaS solution, which the firm touts as its primary go-to-market infrastructure delivery solution. This solution appeals to customers with subscription options that range from traditional purchasing models to models that simplify the transition from Capex to Opex.

Note that HPE recently introduced GreenLake for Block Storage built on Alletra Storage MP, which is a new disaggregated/composable storage platform. The solution is available for both midsize and large enterprises; GreenLake understands how hardware components map to specific persona, and helps compose storage according to customer requirements. This is achieved by dynamically configuring compute resources or JBOF blocks, as well as configuring software. GigaOm expects that Alletra Storage MP will replace existing Alletra solutions in the mid-term future.

Strengths

The company occupies an interesting position with a solid all-NVMe platform, but undoubtedly, most of the value it can deliver to large enterprises comes from its heavy investments in various data services platforms such as HPE InfoSight and Data Services Cloud Console. GreenLake is also a strong differentiator, providing organizations with the option to consume every HPE offering as a service. Those 3 elements give a clear picture of where the company is heading: delivery of infrastructure and services through a cloud-like model. The new Alletra Storage MP platform is promising and provides an insight into the future of composable storage. The solution includes an outstanding AI-based analytics engine.

Challenges

Firm’s strategy to act as a trusted, cloud-like provider through GreenLake services intentionally obfuscates its individual offerings to achieve self-service management ease. However, this may confuse potential customers intent on evaluating each solution’s discrete capabilities.

Company’s Cloud Volumes’ capabilities remain limited. Alletra lacks file storage support, however the next-gen Alletra Storage MP platform addresses this challenge.

Purchase Considerations

Alletra 9000 systems provide outstanding analytics capabilities, but they do not provide file protocol support. Organizations considering a unified storage solution may need to consider this when evaluating Alletra systems, or may instead consider switching over to the new Alletra Storage MP platform.

The Alletra 9000 appliances are suited to large environments and mission-critical workloads such as large-scale databases, large-scale container environments, and large-scale virtualization environments.

Radar Chart Overview

Compared to last year, the company flipped over into an almost mirror position from Maturity/Platform Play to Innovation/Platform Play, due mainly to the introduction of Alletra Storage MP, a modern and disruptive approach to storage. It has a respectable roadmap, but innovation pace remains average compared to other competitors. Positioning may improve once Alletra Storage MP starts gaining momentum.

IBM, IBM FlashSystem 9500

One of the oldest storage companies still active, IBM continues to offer relevant storage solutions across multiple market segments, including primary storage. In this space, the company offers FlashSystem, a block storage portfolio that consists of various appliances targeted at midsize and large enterprises.

FlashSystem 9500 is an NVMe AFA that supports 2.5-inch NVMe FlashCore Modules from IBM (with higher densities and self-compression, achieving up to 116TB per single drive), industry standard 2.5-inch NVMe flash drives, and SAS SSDs, with capacities of up to 30.72TB per drive for NVMe SSDs and SAS SSDs. The system also supports storage-class memory, currently achieving up to 4.5PB effective capacity in a 4U footprint. From a connectivity perspective, the FlashSystem 9500 architecture supports iSCSI (iSER – iWARP and RoCE) as well as FC and NVMe-oF.

FlashSystem 9500 is based on Spectrum Virtualize, a storage OS now common to entry-level, mid-range, and high-end IBM storage systems. Supported features include automated tiering, and other resource optimization techniques, such as compression, de-dupe, unmap, and automated thin provisioning, are available to improve capacity consumption and $/GB. Several replication capabilities are included FlashCopy, Metro Mirror (synchronous replication), policy-based asynchronous replication, 3-site replication, and Global Mirror with change volumes. Additionally, a high-availability solution called HyperSwap can be implemented.

Storage Insights predictive analytics suite can monitor both IBM and several 3rd-party systems, helping to establish a complete view of the storage infrastructure from a single interface, and automation can be achieved by taking advantage of the Spectrum Virtualize REST APIs. These APIs are common to all Big Blue’s systems based on Spectrum Virtualize, allowing organizations leveraging multiple IBM storage products based on Spectrum Virtualize to baseline their automation functions.

Integration with the cloud is achieved through cloud tiering features embedded in the systems and virtual instances of Spectrum Virtualize deployed in the public cloud to provide a consistent user experience and set of features across different environments.

Kubernetes clusters can provision block storage dynamically through company’s block storage CSI driver, but functions remain limited.

IBM Storage-as-a-Service allows organizations to consume capacity on demand. For primary storage, the solution is branded IBM Block Storage-as-a-Service and is based on the FlashSystem storage.

Organizations can implement a ransomware protection strategy with FlashSystem through company’s Safeguarded Copy, a technology that provides immutable copies of data on a FlashSystem or SAN volume controller, and on IBM Copy Services Manager, an external automation and scheduling tool.

Strengths

Besides being based on a robust and proven architecture, one of the highlights of the FlashSystem series is the AI-based IBM Storage Insights platform, which provides predictive analytics and proactive support capabilities. The solution also includes laudable data efficiency capabilities and a rich set of replication topologies. In contrast with the previous gen, the new FlashSystem 9500 allows organizations to combine various media types in a single chassis.

Challenges

Although capable in block storage, FlashSystem does not provide unified block and file storage capabilities, limiting its applicability in environments where multiprotocol support is desirable. Kubernetes support is limited. Lack of file support remains a concern.

Purchase Considerations

The primary purchase consideration when evaluating FlashSystem should be around file workload supportability, since the solution does not provide any native file support. Cloud integration is acceptable, but it may require manual configuration to deploy virtual instances of Spectrum Virtualize.

The solution will be relevant for all block-based primary storage workloads including virtualization, databases, and more. Putting the absence of file support aside, there is no particular limitation to be mentioned, and the solution is used across multiple industries.

Radar Chart Overview

The positioning as a Maturity/Platform Play is due to the fact that FlashSystem architecture is mature and proven, with no changes foreseen. There are no plans to support file workloads; the roadmap focuses largely on performance and stability improvements.

Infinidat, InfiniBox

Infinidat was founded in 2011; its corporate HQs are in Herzliya, Israel, with US HQs in Waltham, MA. It focuses on primary storage systems (InfiniBox, InfiniBox SSA II) and data protection systems (InfiniGuard) for large and midsize businesses.

It offers modern, AI-based hybrid storage solutions that optimize data placement and reduce overall TCO. InfiniBox and InfiniBox SSA II leverage their Neural Caching technology optimizing DRAM and flash storage to optimize I/O, and InfiniRAID that optimizes data placement to HDDs and flash storage, thus creating a highly performance optimized data path. The firm has an easy-to-use, AI-driven management system and supports NVMe/TCP and NVMe-oF. Its SDS technology (InfuzeOS) is media-independent and can support other commodity-based media types in the future. In mid 2023, it ported InfuzeOS to AWS, providing a fully functioning version of its on-premises system in the public cloud. InfiniVerse provides infrastructure-wide predictive analytics, monitoring, and reporting on capacity and performance.

The manufacturer delivers essential cyber resilience for storage with InfiniSafe built into its systems. In 2023, InfiniSafe was enhanced with InfiniSafe Cyber Detection, an optional deep scanning and analysis tool for identification of data that may be compromised by malware or ransomware. The firm offers a clever implementation of Kubernetes CSI plug-in and has a complete set of integrations for major OS and virtualization platforms.

In October 2023, it launched SSA Express, an addition to the InfiniBox system. It offers an all-flash functionality for midsize systems of up to 320TB within a traditional hybrid system. This feature caters to smaller workloads requiring all-flash performance and provides the same performance, availability, and ease of use as the traditional InfiniBox SSA, but at a smaller scale. With this feature, the company can consolidate workloads that require other point solutions and prevent small AFA sprawl since many of those arrays can provide consistent performance for only 2 or 2 workloads. This further extends the ROI and TCO because the software powering SSA Express is built into InfuzeOS and provided at no cost via a non-disruptive upgrade.

Strengths

The company has high-end enterprise characteristics and a balanced AI-based architecture that enables users to consolidate a wide range of workloads in a single system and deliver a consistent performance experience. With the STaaS offerings, most midsize businesses are becoming potential customers for firm’s solutions.

Challenges

The lack of support for QLC 3D NAND might become challenging for some customers in the future. The solution is designed for rack scale; although it offers laudable density, large organizations may prefer solutions with a more compact footprint for specific deployment scenarios. To address this demand, the SSA platform now provides partially populated versions that are 60% and 80% of full capacity and can be scaled up to 100% capacity non-disruptively. This helps in the midsize market where fully populated systems of the past may have been too much for customers considering capacity and entry cost in this space.

Although the focus is shifting to more all-flash capabilities on the firm’s system, there is still a gap compared to some of the competition that boasts true all-flash and the use of QLC NAND.

Purchase Considerations

The company has an all-inclusive licensing model that incorporates all core features at no additional cost, including support and a technical advisor who acts as a liaison to the customer’s storage admin and architect teams. The only add-on product sold separately is the InfiniSafe Cyber Detection scanning system. It is sold as a multiple year subscription based on how much data a customer scans versus their total storage footprint. For example, if a customer had a multiple petabyte InfiniBox but planned to scan only 500TB of data, they would subscribe to a 500TB license.

The manufacturer offers 2 STaaS models: Capacity on Demand (COD) and FLX. The COD pricing model is a mix based on the amount of Capex storage upfront and cloud-like operating expansions to add capacity as needed; it is simply licensed and made available. The FLX model is Opex-based with cloud-like, pay-as-you-go consumption—up or down—of storage capacity on a month-to-month basis.

The vendor provides enterprise storage solutions that are reliable, high-performing, and flexible enough to meet the demands of today’s data-intensive digital enterprises. Its portfolio includes robust storage and data protection capabilities that can be easily leveraged to address the biggest data management and protection challenges for private, public, and hybrid cloud architectures. Its solutions support primary storage, cloud storage, BC and DR. The firm backs up its claims regarding its systems with a variety of guarantees for performance, availability and cyber resilience and recovery.

Radar Chart Overview

The company is a Leader in this Radar due to its high scoring on most of the key features and its solid coverage across business criteria. It is innovating at a fast pace and has a core focus on cyber resiliency and AI-based analytics. Compared to the other Leaders, lack of support for QLC NAND and average cloud integrations impact company’s placement on the Radar.

NetApp

Founded in 1992, NetApp is headquartered in San Jose, CA. It’s well known for its file storage solutions; it also made a strategic bet a few years ago to extend its footprint in the public cloud, a key differentiator in this space.

It offers primary storage capabilities across a range of storage solutions for organizations of all sizes. Its most popular primary storage solutions have been the Fabric-Attached Storage (FAS) platform, providing hybrid storage capabilities, and the AFF platform, providing all-flash storage. The vendor continues to deliver a seamless experience across on-premise and public cloud environments with storage systems and services based on the Ontap storage OS that provides multiprotocol data access and BlueXP, a unified control plane that comprises multiple storage and data services.

All entry, mid-range, and high-end systems, including NVMe-based and hybrid models, can count on a series of integrations at the high level common to all storage systems (such as with SnapMirror for data replication), as well as a unified platform for monitoring and analytics (Active IQ). Firm’s AFF A-series products support end-to-end NVMe, encompassing both the back-end NVMe SSDs and front-end NVMe-oF connectivity to host. The company provides both NVMe/FC and NVMe/TCP support, and the solutions help customers modernize their infrastructure with higher performance, lower latency, and simplicity of deployment.

It also offers its ASA systems, which are all-flash, block-only storage systems. Those systems support either TLC or QLC flash or NVMe-oF and NVMe/TCP, and are also running Ontap. Those systems are suitable for SAN-based environments where internal policies mandate storage isolation and dedicated systems to support, for example, ERP systems or mission-critical databases.

The manufacturer uses AIOps to drive down administration costs for its customers through Active IQ, a digital advisor that simplifies the proactive care and optimization of its storage. It also uses AIOps to uncover opportunities to improve the overall health of the storage environment and provide the prescriptive guidance and automated actions to make it happen. The BlueXP platform provides advanced security measures vs. ransomware and suspicious user or file activities when combined with the native security features of Ontap storage.

Cloud integration is best-in-class thanks to BlueXP, the latest evolution of firm’s cloud management capabilities. Ontap technology ensures seamless operations across locations and clouds, simplifies management, and enables data-centric operations. NetApp storage can be consumed as a 1st-party cloud offering on AWS, Azure, and GCP. BlueXP also supports a host of other data services, such as observability, governance, data mobility, tiering, backup and recovery, edge caching, and operational health monitoring.

The company offers Kubernetes support on primary storage through its open-source Astra Trident CSI-compliant dynamic storage orchestrator. Moreover, its Astra Control service enables advanced data protection, disaster recovery, portability, and migration for Kubernetes workloads using the Cloud Volumes platform as a storage provider both within and across public clouds and for Ontap on-premises.

The manufacturer also offers a broad set of STaaS consumption options through its Keystone, providing multiple service levels for unified file and block, block only, and object storage.

Strengths

It offers a comprehensive set of enterprise-grade capabilities that maintain consistency regardless of the deployment model. Its BlueXP offering provides next-level management and orchestration capabilities complemented by a host of SaaS-based data services, simplifying data storage and data management at scale, whichever deployment model is chosen. It’s worth mentioning that Ontap now supports block, file, and object workloads.

Challenges

The company offers a large ecosystem of solutions and services, so perhaps the main challenge some organizations may face is understanding where to start. Using storage building blocks (appliances), customers can become familiar with the ecosystem and its capabilities, gradually gaining a better understanding and building confidence. Cloud native and cloud first customers are increasingly adopting firm’s primary storage services through 1st party cloud offerings, which provides an infrastructure free path to become familiar with NetApp.

Purchase Considerations

In the primary storage space, the only purchase considerations that organizations may have to take into account when evaluating NetApp solutions are related to selecting the solutions that match their workload profiles: ASA systems aside, both AFF and FAS will provide multiprotocol support. As a rule of thumb, all-flash AFF systems will be the most versatile, providing a good balance of performance and capacity (with the QLC-based C-Series). For capacity-oriented use cases or small businesses, FAS systems may be more affordable.

Firm’s portfolio is among the most coherent and comprehensive in the storage industry. All of the systems, even the cloud-based offerings, leverage its Ontap OS, making the solution suitable for virtually any kind of workload or business use case, regardless of the location. The most common AFF and FAS systems deliver unified block, file, and object storage, while ASA systems are suitable for isolated, block-only environments.

Radar Chart Overview

NetApp is positioned as a Leader due to its consistent delivery of the majority of key features, emerging features, and business criteria evaluated in this Radar. The combination of fast-paced innovation (notably in cloud integrations) and the ability to cater to a broad range of workloads and use cases is why it’s positioned in the Innovation/Platform Play quadrant.

Pure Storage, FlashArray

Founded in 2009 and headquartered in Silicon Valley, CA, Pure Storage has focused on flash storage since its inception. The company develops proprietary storage systems (including proprietary flash hardware) and storage architectures that support multigenerational, non-disruptive upgrades.

The FlashArray product line supports unified block and file storage and serves primary storage use cases with 4 products: the FlashArray//X and //XL, which are for business-critical applications and performance-oriented workloads; the FlashArray//C, which targets capacity-oriented workloads with an optimized $/GB price; and FlashArray //E, a capacity-optimized system with a competitive $/GB price point. In addition, organizations can also deploy Cloud Block Store, which brings primary storage and enterprise data services to the cloud.

All major activities, such as capacity expansions, controller upgrades, hardware replacement, and software upgrades, can be performed without incurring downtime or service interruption. This seamlessness is made possible by a highly available architecture in which all modules are hot-swappable, controllers are stateless, and all components are configured either in mirrored mode or in active-active high-availability configuration. In addition, company’s systems embed proprietary DirectFlash NVMe modules that optimize data placement and erasure operations, increasing available capacity and improving media endurance, even with QLC flash.

All FlashArray systems use the same Purity OS. They are unified file and block storage systems that benefit from a common set of data services. Among these, data efficiency mechanisms, such as always-on in-line de-dupe, an improved compression method, and pattern removal, allow FlashArray systems to achieve the effective capacity highlighted above. The entire FlashArray product family supports FC, NVMe-oF (ROCE and FC), SMB, and NFS; NVMe/TCP was added in February 2023.

Pure1 combines AI-based analytics with AIOps and self-driving storage capabilities to manage all Pure’s products, platforms, and services, as well as provide proactive monitoring and AI-driven recommendations. The solution has been expanded recently to include ransomware protection features such as anomaly detection. It also provides compelling container storage support with Portworx, company’s Kubernetes-native storage solution: it provides an edition tailored for use on FlashArray systems.

Strengths

The FlashArray platform provides a comprehensive set of data services and advanced features, including AI-based analytics, AIOps, and Kubernetes support. Organizations can combine FlashArray//X and //C models and define storage policies to optimize data placement and costs across storage tiers. Evergreen//One also provides an excellent STaaS implementation.

Challenges

Pure still lags behind in terms of cloud integrations, with only Cloud Block Store currently offered. The solution unsurprisingly provides block storage in the cloud, but it is not yet providing file services. With a portfolio that now covers all performance and capacity tiers, a policy engine capable of orchestrating data placement across tiers/appliance types would be welcome.

Purchase Considerations

Organizations that require cloud block storage along with on-premises storage (for replication purposes, for example) should assess whether Cloud Block Store can cover the cloud of their choice; the solution is currently available on AWS and Azure. In addition, unified block and file storage is available on-premises but not yet in the cloud.

Pure Storage offers a comprehensive portfolio thanks to the addition of FlashArray //E in June 2023, bringing the $/GB ratio to parity with HDDs in this specific area. The platform is therefore capable of covering a broad spectrum of use cases. Furthermore, all the FlashArray systems use the same OS and share the same set of services, making them for organizations that require primary storage and for those who want to automate storage provisioning and move to a cloud-like consumption model.

Radar Chart Overview

Pure is positioned as a Leader due to its consistent delivery of the majority of key features, emerging features, and business criteria evaluated in this Radar. It’s an innovative company that offers non-disruptive, multigenerational controller upgrades, and it has a comprehensive product portfolio that suits nearly all use cases and workload footprints. This is why it’s positioned in the Innovation/Platform Play quadrant.

Seagate, Exos Series

Founded as Shugart Technology in 1978, Seagate Technologies is a well-known company in the storage industry, in particular as an HDD developer. The company also offers primary storage solutions that are delivered in the Exos series.

It chose to extend its HDD naming convention into the primary storage solutions as well, which is not that strange because all the storage arrays are filled with these HDDs, SSDs, and NVMe drives. It divides the storage solutions into 3 subcategories.

The 1st is the Exos X series, which falls under the Advanced Hybrid RAID Arrays, and is further divided with the Corvault solution. The X series provides the flexibility to start small and expand from there. All Exos X solutions feature self-healing storage technology, Advanced Distributed Autonomic Protection Technology (ADAPT), and Autonomous Drive Regeneration (ADR). The Exos Corvault 4U106 also uses HAMR technology.

The 2nd category is the AP series, which focuses on integrated storage servers, meaning that storage and compute come together in these solutions, which have AMD EPYC CPUs on board. The AP series provides both performance and scalability to the customer, as well as ease of use.

The 3rd and last category is the E series, called expansion and JBODs by the manufacturer. The expansion shells offer more capacity to the Exos X series and provide the ability to expand to a total of 10-disk shelves. The JBODs can be used to add storage to servers that need more capacity.

The engine underpinning Seagate Storage is the Seagate software plus ASIC-based architecture, which provides predictable high performance with a lower materials cost. This is achieved with the VelosCT storage adapters and the ADAPT technology.

Cloud integration can be leveraged through Seagate’s own cloud solution, Lyve Cloud.

Strengths

Firm’s biggest strength is that it uses its own drive technologies to the fullest. The ADAPT and ADR technologies, together with HAMR, provide very effective security and self-healing capabilities to customers, and the VelosCT adapter technology with ASIC architecture provides multiple options for different use cases.

Challenges

Although there’s tight integration with the drive technology, there is room for improvement on multiple points. NVMe integrations exist, but are very limited at the moment, which might prove difficult in environments where high performance is key. Another challenge is the lack of StaaS offerings, cloud integrations, and security features.

Purchase Considerations

Purchase options are limited to traditional settlements. With the option to use Lyve Cloud, there will be more purchase options and in the future, StaaS offerings might be added as well.

The company sees use cases span multiple areas. The solution is suited for backup and recovery needs, big data analytics, video surveillance, and HPC environments.

Radar Chart Overview

Although the firm is an established storage company, it is positioned in the Entrant ring because, while it offers multiple appliance types, the capabilities evaluated are limited compared to most competitors. Furthermore, even though it offers different appliances, the solution still has room for improvement to meet customers’ expectations regarding enterprise-grade storage solutions in terms of data services and adjacent capabilities like AI-based monitoring.

StorPool

It is a privately-owned company based in Bulgaria that specializes in software-defined block storage with a focus on high-performance and business-critical workloads.

It implements a robust and scalable architecture built around a simple network topology, a proprietary network protocol for storage, kernel bypasses, and proprietary drivers for NVMe drives and network adapters (including native hardware acceleration on a very broad range of NIC models). It leverages various media types, including NVMe SSD, making the solution for addressing the most demanding performance requirements. It also offers erasure coding on NVMe SSDs making the solution more cost-efficient and affordable than replication schemes typically used in SDS solutions. QLC-specific flash optimizations are not present by choice: the company supports all storage workloads, regardless of write intensity on regular low cost “read-intensive” 1 DWPD SSD and NVMe drives. The system is built to be highly available at every level – including network connectivity – and maintains its high performance irrespective of utilization rate, whether drives or servers fail, or any rebuilding and rebalancing underway.

Core data services include snapshot and clone capabilities, data tiering, basic data reduction capabilities (with zeroes detection, thin provisioning, and erasure coding), data replication, backups, and DR. The solution embeds storage QoS and throttling to ensure service levels are met and to avoid noisy-neighbor problems, a feature that’s particularly useful for MSPs and multitenant environments. The firm also offers file storage via the NFS protocol for specific workloads, providing NFS shares of up to 50TB each. These are suitable for throughput-intensive file workloads such as video rendering, video editing, and more. They can also address moderate-load use cases (configuration files, scripts, images, and email hosting) but are not suitable for IOPS-intensive file workloads such as virtual disks or VMs.

The solution implements self-healing features that are invisible to the customer and operate at the infrastructure level. The firm provides its Analytics, a cloud-based monitoring system that collects hundreds of metrics per second to deliver deep insights into the performance and availability of customers’ data.

Strengths

It delivers a solid and well-architected, block-based SDS solution that supports multiple storage tiers and can meet the most demanding requirements. The solution is suited to support I/O-intensive workloads and is designed to scale linearly in performance and capacity. Thanks to its tuning capabilities and fully managed service, it can help organizations achieve outstanding $/GB and $/IO/s ratios for high-performance and mission-critical workloads. It has expanded its feature set and is working on a promising roadmap.

Challenges

Even if the company has concerns regarding QLC flash endurance, competitors have architected their solutions to use the media optimally and reduce wear. In the future, inability to optimize the solution for QLC might become problematic. Lack of QLC flash support makes the solution less competitive from a $/GB perspective for predominantly capacity-oriented workloads (such as backup storage); however, the recently implemented erasure coding functionality partially mitigates this downside.

Cloud support exists (in AWS) but requires manual installation and configuration. Improvements are needed in cloud and AI-based analytics.

Purchase Considerations

When evaluating the company, organizations should consider whether they require unified block and file storage or not. The solution supports block and file workloads but has some limitations with file storage. The NFS-based file storage feature is not targeting large scale file deployments, but it is useful when adjacent file storage may be needed in predominantly block-based environments, as an add-on for Kubernetes, CloudStack, and so on. As with every other software-defined storage solution, particular care must be taken to follow the vendor node sizing requirements.

Suited for high-performance and business critical block storage workloads, the solution is capable of addressing a broad set of use cases (including virtual environments) across multiple verticals. In addition to midsize organizations and a growing number of large enterprises, a sizable number of firm’s customers are MSPs that benefit from the solution’s strong multitenancy capabilities.

Radar Chart Overview

StorPool is positioned as a Challenger in the Innovation/Feature Play quadrant. Although capable, its solution is focused on specific use cases and is not meeting all of GigaOm’s key criteria, impacting its scoring and placement. The solution nevertheless has value in its chosen focus area.

6. Analysts’ Outlook

The primary storage market remains a very mature space. Large enterprises still consider architecture and reliability to be the primary decision factors, while midsize organizations focus less on the architecture and more on adjacent capabilities, such as cloud integration. With more data moving to the cloud, and new application deployment models, solutions that integrate hybrid-cloud options are garnering more attention.

Among other key differentiators, large enterprises are seeking comprehensive management capabilities that take advantage of AI and ML. Those solutions should provide predictive analytics capabilities and proactive remediation, and storage should be self-driven to increase the amount of capacity manageable by a single administrator. Combined with other data services, such as immutable snapshots and policy-based automation, AI-based analytics can also help customers build a first line of defense against threats such as ransomware attacks. Organizations also are seeking to replicate the cloud experience with self-service capabilities and policy-based data placement; automation and API integrations play a key role in helping them deliver a seamless experience to their user base.

Another emerging trend is STaaS, and some vendors have already built very compelling offerings that have the potential to transform the way storage is consumed. Both midsize and large organizations are considering STaaS with great interest. It delivers cloud-based, flexible consumption options and offloads the burden of management to the vendors, enabling better allocation of personnel costs toward more productive functions. STaaS was built with large organizations in mind, and the majority of the vendors presented here offer this consumption model. Some are more advanced, while others are still transitioning away from their traditional Capex sales model and still adapting to this tectonic shift.

Last year’s discontinuation of Intel Optane business marked a setback for a limited range of solutions that were leveraging Optane Persistent Memory to improve their solution’s performance. While there has not been a clear replacement yet, several companies are partnering with Kyoxia and are either evaluating or have completed PoC evaluations of Kyoxia FL6 storage-class memory SSDs based on its XL-Flash. It’s also worth noting that other flash manufacturers are considering solutions based on SLC NAND flash as similar alternatives. Those are likely to become more mainstream in the near future.

In some regions of the world, the steep increase in energy costs and the impact of climate change are driving organizations to reevaluate the efficiency of their primary storage solutions from an energy consumption and carbon footprint standpoint, either through voluntary ESG policies or because of skyrocketing utility bills. Ultimately, energy efficiency and sustainability criteria must be balanced with performance requirements and SLAs while also considering long-term sustainability and system lifespan. Vendors have acknowledged this trend and, besides gradually improving their hardware architectures, are also implementing dashboards that monitor energy efficiency, assess the state of the environment, and proactively propose solutions to reduce energy consumption and improve overall storage efficiency.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter