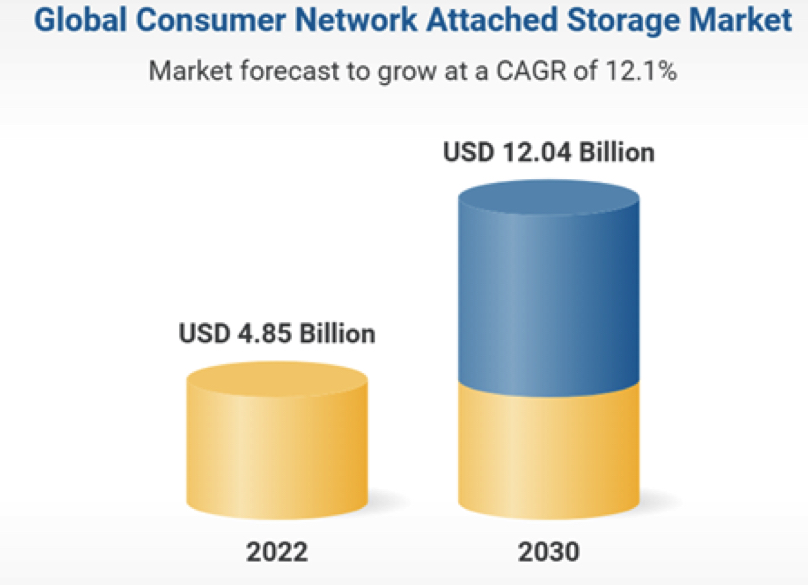

WW Consumer NAS Market to Reach $12 Billion by 2030

Growing at CAGR of 12% from 2023

This is a Press Release edited by StorageNewsletter.com on February 2, 2024 at 2:02 pmThe Global Consumer Network Attached Storage Market Size, Share & Trends Analysis, 2023-2030 report (140 pages) has been added to ResearchAndMarkets.com‘s offering, and published on January 23, 2024.

The global consumer NAS market size is expected to reach $2.04 billion by 2030, growing at a CAGR of 12.1% from 2023 to 2030.

The scalability, cost-effectiveness, and ease of use of these devices are driving the adoption among the end-users. The onset of the Covid-19 pandemic accelerated digital transformation among businesses.

Moreover, the adoption of remote working models and growth in digital media consumption after the onset of the Covid-19 pandemic positively impacted industry growth. Digital media consumption is increasing with the rising number of Internet users WW. Thus, growing digital media consumption is driving the volumes of unstructured data, which is subsequently necessitating new, innovative storage solutions, including consumer NAS solutions. Advances in IoT and growing popularity of social media are among the significant drivers of the increasing volumes of unstructured data. According to a 2022 report by Hootsuite Inc., a social media management platform based in Canada, over 93% of Internet users use social media, and the number of social media users grew by 599 million between October 2020 and October 2022.

Based on the design, the industry is divided into 1-bay, 2-bay, 5-bay, 4-bay, 6-bay, and above 6-bay. The launch of numerous feature-rich 4-bay devices in recent years is making a 4-bay device an attractive option for SMBs. In addition, the acceleration of the work-from-home model, especially after the Covid-19 pandemic, is driving the segment growth. Based on end-users, the industry is further divided into residential and business. Market players are launching new NAS products for SMEs owing to the increasing demand for affordable, scalable, and high-performance storage solutions. Companies are launching new, energy-efficient consumer NAS solutions, which are likely to impact market growth positively. For instance, in June 2023, Synology Inc. announced the launch of DiskStation DS223j, a 2-bay NAS solution.

The solution features various applications and options, such as backup, file syncing and sharing, and video surveillance, for storage & management. With this launch, the company aimed to provide energy-efficient hardware that meets the needs of small businesses and home offices. Key companies use different strategies, such as partnerships and collaborations, expansions, and product developments, to strengthen their market presence and share. In October 2023, TerraMaster announced the launch of F2-212, a 2-bay NAS solution providing storage space of up to 44TB, offering large private cloud storage for small teams and families. With this launch, the company aimed to provide an easy-to-use and secure data management NAS solution for users.

Consumer NAS Market Report Highlights

• The global market growth is attributed to advancements in data-intensive technologies, such as AI and ML, positively impacting the demand for efficient storage solutions

• The 2-bay design segment is projected to register the fastest CAGR from 2023 to 2030

• The standalone segment dominated the market in 2022 with a revenue share of more than 67% and is expected to register a CAGR of 12.5% from 2023 to 2030

• The HDD segment held the largest revenue share in 2022 and is expected to grow at a CAGR of 12.2% from 2023 to 2030

• The 1TB to 20TB segment is projected to grow at the fastest CAGR from 2023 to 2030

• On-premise was the dominant deployment segment in 2022 with a revenue share of more than 51.4% and is projected to register a CAGR of 10.9% from 2023 to 2030

• The business end-user segment held the largest revenue share in 2022 and will expand further at a CAGR of 12% from 2023 to 2030

Market Participants:

- Asustor; Inc.

- D-Link Corporation

- Dell Inc.

- NEC Corporation

- Netgear

- Qnap Systems, Inc.

- Seagate Technology LLC

- Synology, Inc.

- Western Digital Corporation

- Zyxel

- TerraMaster

- Buffalo, Inc.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter