History 2003: WW Storage Software Market Shows Buoyancy in 2Q03

Grew 7.3% Q/Q, reaching $1.6 billion in 2Q03 compared to 1Q03.

By Jean Jacques Maleval | January 26, 2024 at 2:00 pmAccording to IDC’s WW Quarterly Storage Software Tracker, the WW storage software market grew 7.3% sequentially, reaching $1.6 billion in 2Q03, compared to 1Q03.

The storage replication software market had the largest sequential gain, growing 8.5% in 2003.

Growth in the backup and archive software market, which is the largest segment in the storage software market, was consistent with the overall market at 7.3% sequential growth.

The SRM market grew less than the overall market with 6.1 % sequential growth.

“Each segment of the storage software market grew over the first quarter results,” said Bill North, IDC’s research director for storage software. “The markets for both storage replication software and backup and archive software are being accelerated by renewed customer emphasis on data protection and DR, as well as recent record retention and retrieval regulations. Meanwhile, the SRM market faces continued budget priority pressures, which accounts for its more modest gains.”

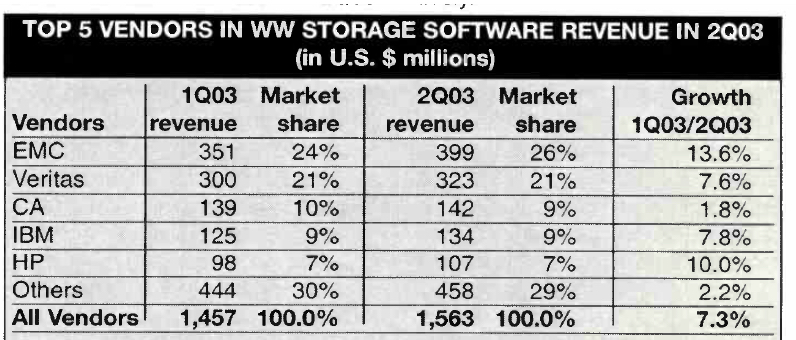

Since the 4Q02, the rank order among the top 5 storage software vendors has remained unchanged. EMC maintains its lead in 2Q03 with a 26% revenue share, gaining nearly 1.5 point since 1Q03. Veritas maintained the 2nd position, slightly outpacing the overall market. Computer Associates and IBM tied for the 4th position, while HP followed in the 5th position. EMC and HP were the only 2 vendors among the top 5 to post double-digit sequential revenue growth, 13.6% and 10.0% respectively.

Top 5 vendors in WW storage software market

This article is an abstract of news published on issue 189 on October 2003 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter