DRAM Contract Prices Projected to Increase 13-18% in 1Q24

As price surge continues.

This is a Press Release edited by StorageNewsletter.com on January 11, 2024 at 2:01 pmThis market report was published on January 8, 2024 by TrendForce Corp.

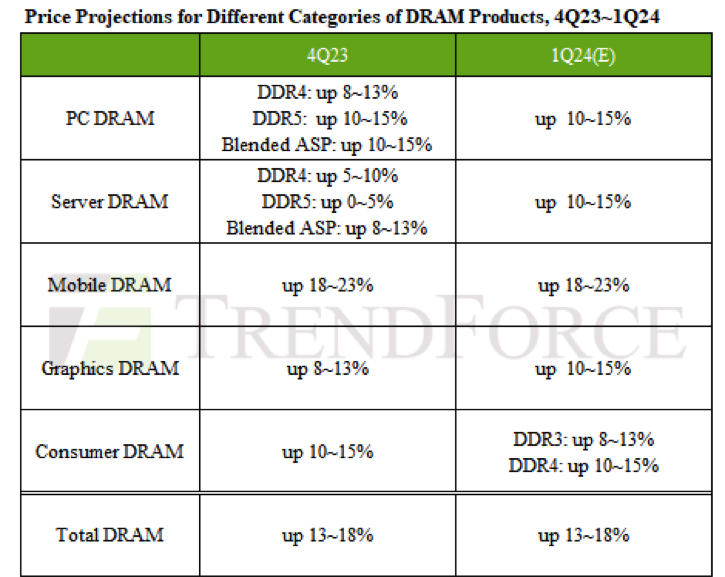

DRAM contract prices are estimated to increase by approximately 13-18% in 1Q24 with mobile DRAM leading the surge. It appears that due to the unclear demand outlook for the entire year of 2024, manufacturers believe that sustained production cuts are necessary to maintain the supply-demand balance in the memory industry.

PC DRAM: The market is buzzing with unfilled DDR5 orders, while savvy buyers brace for a continued surge in DDR4 prices, keeping procurement engines running. This trend, however, is shadowed by a gradual industry pivot toward DDR5, casting uncertainty over the expansion of DDR4 bit procurement volumes. Despite this, both DDR4 and DDR5 prices have yet to hit the target set by manufacturers, and buyers seem ready to ride the wave of price hikes into 1Q24. This sets the stage for an estimated 10-15% in PC DRAM contract prices, with DDR5 poised to take the lead over DDR4 in this pricing rally.

Server DRAM: Buyers were strategically working to deplete DDR4 stocks last year, catapulting DDR5 inventory to an impressive 40% in 4Q23. This figure towers over the 20-25% market penetration rate, signaling that the full throttle of market demand is yet to be unleashed. Meanwhile, manufacturers are strategically constricting DDR4 supply while ramping up DDR5 production to boost their profit margins, setting the scene for a robust 10-15% spike in server DRAM contract prices in 1Q24. As for some manufacturers had previously locked in higher price baselines, resulting in a more moderated 8-13% price hike for a few players in the early months of 2024.

Mobile DRAM: The market narrative is driven by contract prices lingering at historical lows, prompting buyers to build up safe and cost-effective inventories, thereby amplifying their purchasing power. This scenario ensures that mobile DRAM demand remains unabated in 1Q24. In a situation where aggressive buying meets limited supply, market tension that benefits manufacturers in price negotiations is created. However, given the lingering uncertainties in the smartphone market, manufacturers are treading cautiously and not rushing to ramp up production. The complexity and time-intensive nature of semiconductor processes suggest that this supply-demand tension is here to stay for a while, likely leading to a significant 18-23% upswing in mobile DRAM contract prices in 1Q24. This market—largely controlled by a few key players—may even see higher price surges, particularly in scenarios of panic buying by brand-conscious customers.

Graphics DRAM: The continuous upward price trajectory has kept buyers on their toes, fueling a relentless stocking spree. The demand for mainstream GDDR6 16Gb specification remains robust, with the market largely open to embracing price upticks. This sets the anticipation for a 10-15% rise in graphic DRAM contract prices in 1Q24. TrendForce is casting a keen eye on this sector and has noted no imminent signs of price drops. The current momentum in procurement is predominantly driven by early stocking strategies by buyers. Given that graphics DRAM caters to a niche market, it’s crucial to monitor whether the sales energy of end-user electronic products can match this upward pace.

Consumer DRAM: Manufacturers are aggressively raising contract prices, which has prompted buyers to stockpile early. This has greatly improved purchasing momentum. However, the first quarter coincides with the industry’s off-season, and end sales are expected to be weak and lead to increased inventory levels due to buyers’ early stocking strategies. Manufacturers generally believe that in 2024 – with the expanding penetration of HBM and DDR5 each quarter – low-margin DDR4 capacity will be crowded out, thereby leading to shortages. As such, DDR4 contract prices are expected to outpace DDR3 in the first quarter by 10-15%. DDR3 continues to be supplied by Taiwanese manufacturers, and with generally high inventory levels, its contract price increase is estimated at 8-13% for 1Q24.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter