History 2003: McData Goes Shopping

Acquiring start-ups Sanera Systems and Nishan Systems, along with participations in Aarohi Communications

By Jean Jacques Maleval | January 9, 2024 at 2:00 pmWith $300 million in cash, and another $150 million recently borrowed, and after the statements by president and CEO John Kelley, we’ve been wondering when switch and director company McData would make a move to expand its product line.

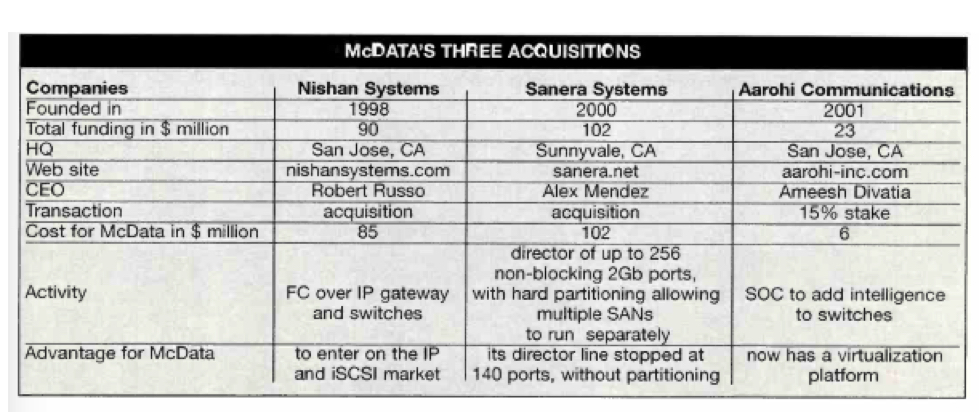

And it has, laying down nearly $200 million for the acquisition of 2 Californian start-ups, Sanera Systems in Sunnyvale and Nishan Systems in San Jose, along with participations in Aarohi Communications, also in San Jose, all companies with which it has worked more or less directly in the past.

Quite a spree, when you consider that since its founding, the company has only one other acquisition to its name, software company SANavigator in 2001 for a mere $30 million.

Sanera, founded in 2000, having raised to date approximately $102 million in financial rounds, was acquired by McData for nearly the same amount. Its star product is the DS10000, a director of up to 256 non-blocking 2Gb or 10Gb FC ports, with hard partitioning (not zoning) to allow multiple SANs to run completely separately. McData, which until now offered up to 140 ports, will be better equipped to face its competitors, Cisco which offered a 224-port director and CNT/lnrange with 256 ports. McData had been developing a similar product, but ultimately preferred to acquire Sanera in order to accelerate its entry in the market. The latter company is still at the warm-up stage, and had yet to sell any products.

Nishan systems, founded in 1998, is a pioneer in FC over IP gateways and had begun to amass some revenue, $3 to $4 million per quarter, with some 100 installations under its belt. Its IPS line includes 2 IP storage switches with up to 16 ports, supporting iSCSI, iFCP, and e-Port for trunking to both IP backbones and FC fabrics. IP storage switches are crucial for SAN interconnection as well as replication over long distances, a technology McData lacked, and that it will now be able to add to its offer in the form of blades with its directors, with better chances now for poaching in CNT’s terrain. Note, incidentally, that since last January, McData’s SANavigator software has supported Nishan products.

The relationship between Aarohi and McData is nothing new, but the latter has now formalized matters with the injection of $6 million in the former, roughly a 15% stake that includes a seat on the 5-member board. Aarohi’s product, FabricStream, is a SoC processor that adds intelligence to switches and directors. McData’s ongoing intelligent platform plans are based on this piece of hardware, for which to date only one company, the start-up Incipient, had developed software. This technology was all that McData needed to venture into virtualization.

All 3 investments complement McData’s offerings perfectly, providing it with the largest product range in the switch market, from 4 to 256 ports, a feat only Cisco and CNT had previously come close to achieving.

It also improves McData’s odds in an eventual face-off with Cisco and Brocade in intelligent directors and against CNT for remote replication.

At the same time, however, these are not investments that will generate substantial revenue in the short term. It will take time to integrate the recent arrivals.

Even so, we expect other acquisitions by McData in the near term, specifically in storage software, particularly since the company is far from running out of cash.

The company’s main problem these days is that it is still far too dependent on 2 OEMs, IBM and above all EMC, which together account for nearly 80% of its total revenue, somewhat limiting its ability to venture too far into storage management for fear of appearing to become a competitor.

The SAN interconnectivity segment continues to undergo a major period of consolidation: Sun and Pirus, Brocade with Rhapsody, Cisco with Andiamo, CNT and Inrange, and now McData with Nishan and Sanera.

We haven’t seen the end of it either, since there are still a few start-ups ripe for the picking, including MaXXan Systems, Sandial Systems, LightSand/SANcastle and Maranti Networks.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter