Semi Report: Global Semiconductor Capacity Projected to Reach Record High 30 Million Wafers/Month in 2024

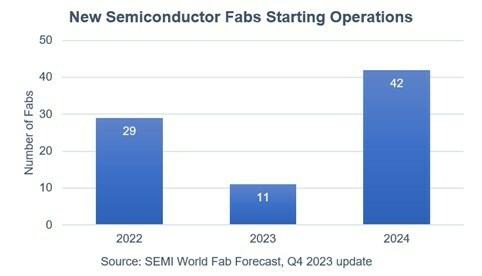

82 new volume fabs, including 11 projects in 2023 and 42 projects in 2024 spanning wafer sizes ranging from 300 to 100mm

This is a Press Release edited by StorageNewsletter.com on January 8, 2024 at 2:01 pmGlobal semiconductor capacity is expected to increase 6.4% in 2024 to top the 30 million (*) wafers/month (wpm) mark for the 1st time after rising 5.5% to 29.6wpm in 2023, Semi announced in its latest quarterly World Fab Forecast report.

![]()

The 2024 growth will be driven by capacity increases in leading-edge logic and foundry, applications including generative AI and HPC, and the recovery in end-demand for chips. The capacity expansion slowed in 2023 due to softening semiconductor market demand and the resulting inventory correction.

“Resurgent market demand and increased government incentives worldwide are powering an upsurge in fab investments in key chipmaking regions and the projected 6.4% rise in global capacity for 2024,” said Ajit Manocha, president and CEO, Semi. “The heightened global attention on the strategic importance of semiconductor manufacturing to national and economic security is a key catalyst of these trends.”

Covering 2022 to 2024, the World Fab Forecast report shows that the global semiconductor industry plans to begin operation of 82 new volume fabs, including 11 projects in 2023 and 42 projects in 2024 spanning wafer sizes ranging from 300 to 100mm.

China leads semiconductor industry expansion

Boosted by government funding and other incentives, China is expected to increase its share of global semiconductor production. Chinese chip manufacturers are forecast to start operations of 18 projects in 2024, with 12% Y/Y capacity growth to 7.6 million wpm in 2023 and 13% Y/Y capacity growth to 8.6 million wpm in 2024.

Taiwan is projected to remain the 2nd-largest region in semiconductor capacity, increasing capacity 5.6% to 5.4 million wpm in 2023 and posting 4.2% growth to 5.7 million wpm in 2024. The region is poised to begin operations of 5 fabs in 2024.

Korea ranks 3rd in chip capacity at 4.9 million wpm in 2023 and 5.1 million wpm in 2024, a 5.4% increase as 1 fab comes online.

Japan is expected to place 4th at 4.6 million wpm in 2023 and 4.7 million wpm in 2024, a capacity increase of 2% as it starts operations of 4 fabs in 2024.

The World Fab Forecast shows the Americas increasing chip capacity by 6% Y/Y to 3.1 million wpm with 6 new fabs in 2024.

Europe and Mideast is projected to up capacity 3.6% to 2.7 million wpm in 2024 as it launches operations of 4 new fabs.

Southeast Asia is poised to increase capacity 4% to 1.7 million wpm in 2024 with the start of 4 new fab projects.

Foundry segment continues strong capacity growth

Foundry suppliers are forecast to rank as the top semiconductor equipment buyers, increasing capacity to 9.3 million wpm in 2023 and a record 10.2 million wpm in 2024.

The memory segment slowed expansion of capacity in 2023 due to weak demand in consumer electronics including PCs and smartphones. The DRAM segment is expected to increase capacity 2% to 3.8 million wpm in 2023 and 5% to 4 million wpm in 2024. Installed capacity for 3D NAND is projected to remain flat at 3.6 million in 2023 and rise 2% to 3.7 million wpm next year.

In the discrete and analog segments, vehicle electrification remains the key driver of capacity expansion. Discrete capacity is forecast to grow 10% to 4.1 million wpm in 2023 and 7% to 4.4 million wpm in 2024, while analog capacity is projected to grow 11% to 2.1 million wpm in 2023 and 10% to 2.4 million wpm in 2024.

The latest update of the World Fab Forecast report, published in December, lists 1,500 facilities and lines globally, including 177 volume facilities and lines with various probabilities expected to start operation in 2023 or later.

(*) 200mm equivalent

Resource :

Download a sample of the World Fab Forecast report. (registration required)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter