History 2003: WW Removable Flash Storage Market Grew 73% in 2002

Reaching $2.13 billion

By Jean Jacques Maleval | December 14, 2023 at 2:00 pmIntense competition between NAND flash memory suppliers has lowered costs and stimulated consumer adoption of removable solid-state storage.

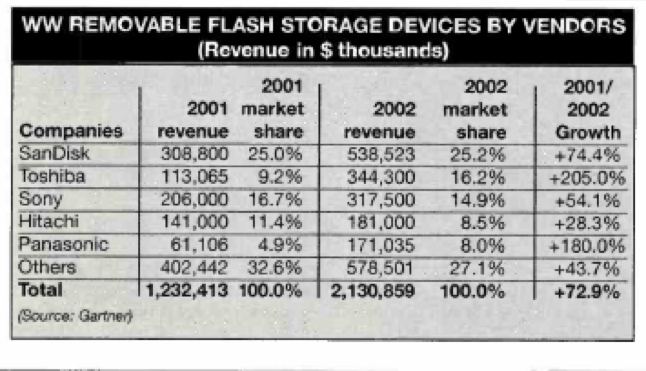

WW removable solid-state storage revenue totaled $2.13 billion in 2002, a 72.9% increase from 2001 revenue of $1.23 billion, according to Gartner, Inc. in a report entitled Removable Solid-State Storage Market Share, 2002 ($6,995).

Removable solid-state storage (RS3) encompasses portable storage devices that use nonvolatile memory and do not contain moving parts. This category primarily consists of, but is not limited to, flash cards and USB flash drives.

“The flash card and USB flash drive market is price point driven, which means that consumers will buy the maximum number of megabytes of storage that their budget will allow, so the market greatly benefited from the reduced costs associated with the adoption of advanced semiconductor device technology,” said Joseph Unsworth, analyst for Gartner’s semiconductor group. “Competition between the main NAND flash memory device suppliers, Samsung and Toshiba, further accelerated cost per bit declines. The lower costs fueled the continued growth of the flash card market. However, the more explosive growth was in the USB flash drive market as this new application was adopted,quickly in the marketplace.”

Flash card vendors dominated the total RS3 market in 2002 because the USB flash drive market is still in its infancy.

SanDisk remained in the top spot with 25% of the market. Its capability to manufacture many different types of flash cards, as well as having its own semiconductor memory fabrication resources available enabled the company to stay ahead of the competition.

Toshiba jumped two spots into the ≠2 position based on its NAND-based flash memory device manufacturing capabilities and utilizing their distributor’s channels to sell their product.

Gartner analysts said that the majority of flash card and USB flash drive vendors enjoyed significant growth as retail prices reached affordable levels for consumers. Flash card revenue increased 66.8% to $1.995 billion in 2002, up from $1.196 billion in 2001.

USB flash drive revenue experienced tremendous growth increasing from $36.3 million in 2001 to $135.6 million in 2002.

CompactFlash was the ≠1 format in the RS3 market. Memory Stick grabbed the ≠2 spot by beating out the SD card which experienced significant growth from the previous year. The SmartMedia card suffered a severe decline in sales, dropping from the 2nd position in 2001 to ≠4 in 2002.

“SmartMedia card’s decline is because, in part, of the arrival of the xD card, which experienced strong growth in 2002 and is notable because it was released only in the fourth quarter of the year,” said Unsworth.

The large population and sustained demand for consumer electronics helped the Americas region capture the largest part of the RS3 market in 2002, with 36% market share. Japan kept pace with 25%, due in part to the large appetite for consumer electronics products.

This article is an abstract of news published on issue 186 on July 2003 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter