DRAM Revenue Soaring to $13.5 Billion in 3Q23, 18% Q/Q Growth

Attributed to gradual resurgence in demand

This is a Press Release edited by StorageNewsletter.com on December 8, 2023 at 2:03 pm![]() This market report, published on December 4, 2023, was written by Ellie Wang, analyst at TrendForce Corp.

This market report, published on December 4, 2023, was written by Ellie Wang, analyst at TrendForce Corp.

Contract Prices Bottom Out in Q3,

Reigniting Buyer Momentum and Boosting DRAM Revenue by Nearly 20%

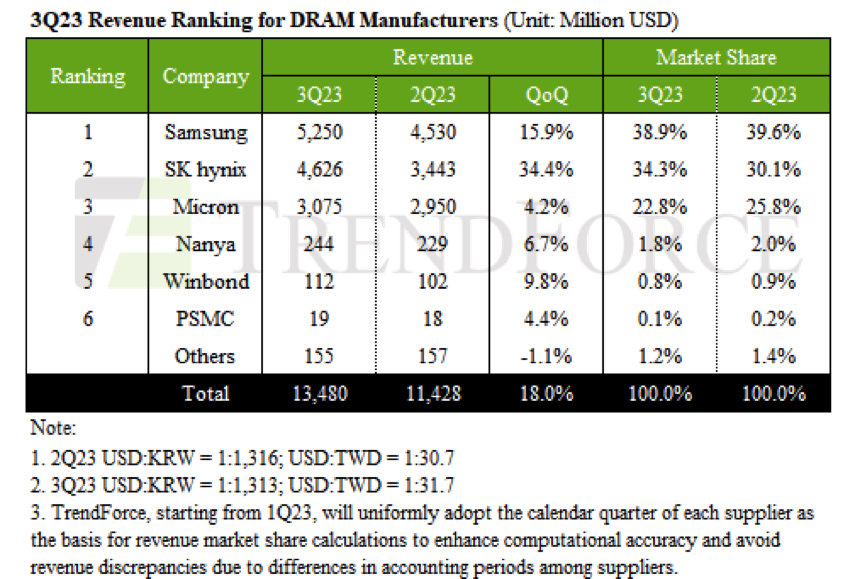

The report reveals a significant leap in the DRAM industry for 3Q23, with total revenue soaring to $13.48 billion – marking 18% QoQ growth.

This surge is attributed to a gradual resurgence in demand, prompting buyers to re-energize their procurement activities.

Looking ahead to 4Q23, while suppliers are firmly set on price hikes, with DRAM contract prices expected to rise by approximately 13–18%, demand recovery will not be as robust as in previous peak seasons. Overall, while there is demand for stockpiling, procurement for the server sector remains tentative due to high inventory levels, suggesting limited growth in DRAM industry shipments for Q4.

Three major manufacturers witnessed Q3 revenue growth.

Samsung’s revenue increased by about 15.9% to $5.25 billion thanks to stable demand for high-capacity products fueled by AI advancements and the rollout of its 1alpha nm DDR5.

SK hynix showcased the most notable growth among manufacturers with a 34.4% increase, reaching $4.626 billion and significantly narrowing its market share gap with Samsung to less than 5%.

Micron’s revenue rose by approximately 4.2% to $3.075 billion – despite a slight drop in ASP – supported by an upswing in demand and shipment volumes.

Samsung expanded its production cuts by the end of 3Q23, mainly targeting DDR4 products with high inventory levels. The cutback is expected to intensify to 30% in 4Q23, reducing overall wafer inputs. Anticipating demand recovery in 2H24, Samsung plans to increase wafer inputs starting 2Q24.

SK hynix benefited from a growth in HBM and DDR5 shipments and is expecting a slight uptick in capacity and wafer inputs by the end of the year, with a steady quarterly rise next year in line with DDR5’s growing market penetration.

Micron, having reduced its production earlier, currently maintains relatively healthy inventory levels. The company has already begun increasing its wafer inputs in 4Q23, primarily focusing on the 1beta nm advanced process. It is estimated that wafer input volume for 2024 will continue to rise modestly, with a key emphasis on transitioning to more advanced manufacturing processes.

In Taiwan, Nanya’s shipments benefited from orders from PC clients and spot market momentum, growing 17–19%. However, subdued demand for its mainstream DDR3 and DDR4 products, along with declining prices, restricted its revenue growth, culminating in a modest $244 million.

Winbond’s aggressive pricing strategy aimed at expanding its DDR3 business and digesting new capacity from its KH factory led to shipment growth, boosting its 3Q23 revenue to $112 million.

PSMC primarily calculates its revenue from consumer DRAM products it manufactures, excluding DRAM foundry services. Benefiting from the rise in spot prices, there was a slight increase in demand, which led to a 4.4% quarterly increase in DRAM revenue. However, when including revenue from DRAM foundry services, there was a 5.5% decrease this quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter