History 2003: WW Disk Storage Systems Shows Buoyancy in 1Q03

Driven by open SANs

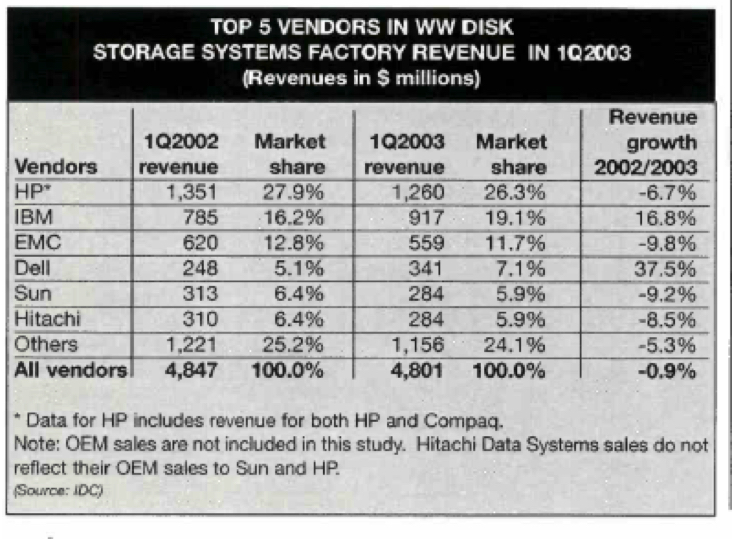

By Jean Jacques Maleval | December 4, 2023 at 2:01 pmWW disk storage systems factory revenue was $4.8 billion in 1Q03, down 1% compared with 1Q02, according to IDC’s Worldwide Disk Storage Systems Quarterly Tracker.

This slight Y/Y decline was less than the 8% yearly decline that was shown in 4Q02, indicating a continued trend toward stabilization in overall market spending.

The overall market was buoyed by strong sales in the open SAN market, which grew nearly 14% Y/Y in terms of factory revenues.

Meanwhile, overall storage capacity continues to outpace revenue, growing nearly 49% Y/Y to 175.6PB shipped during 1Q03.

“First quarter results continue to illustrate increased customer adoption of network storage systems (NAS and open SAN),” said Charlotte Rancourt, research director of IDC’s disk storage systems program. “Network storage for the first time represents more than half (53% revenue share) of the total external disk storage systems market, up 5 points from a year ago. The traditional DAS systems represents 42% of total external disk storage revenue in the first quarter, down from 46% a year ago.“

In 1Q03, HP led the total disk storage system market, with 26.3% revenue share, followed by IBM and EMC with 19.1% and 11.7% revenue share, respectively. Dell and IBM posted the strongest Y/Y growth during among the top 5 vendors, with 37.5% and 16.8% respectively.

In the total external disk storage system market, revenue decreased 2.7% Y/Y in 1Q03. HP maintained its ≠1 position with 19.5% revenue share. EMC was ≠2 with 17.4% revenue share. EMC and HP switch positions in the total external RAID market, where EMC led the market with 19.2% revenue share and HP followed closely with 18% revenue share.

EMC continues to maintain its leadership in the total network storage market (NAS combined with open SAN) with 26.3% revenue share. In the open SAN market, HP led with 27.9% revenue share followed by EMC with 24.5% share.

In the NAS market, NetApp maintained its ≠1 position with 37.3% share followed behind by EMC with 33.7% share.

“Once again, SAN attached arrays accounted for an increasing portion of the storage systems market in the first quarter,” said Eric Sheppard, senior analyst of IDC’s disk storage system program. “This growth can be attributed to the strong end-user demand for solutions that enable efficient use of storage resources.”

This article is an abstract of news published on issue 186 on July 2003 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter