NetApp: Fiscal 2Q24 Financial Results

NetApp: Fiscal 2Q24 Financial Results

Revenue of $1,562 million down 6% Y/Y and up 9% Q/Q, remaining profitable since years

This is a Press Release edited by StorageNewsletter.com on November 30, 2023 at 2:01 pm| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 1,633 | 1,562 | 3,255 | 1,994 |

| Growth | -6% | -8% | ||

| Net income (loss) | 750 | 230 | 964 | 382 |

Highlights in 2FQ24:

• Net revenues of $1.56 billion for 2FQ24

• Introduced substantial innovation including the ASA C-Series, the extension of the company’s Ransomware Recovery Guarantee, and performance and availability guarantees for NetApp Keystone storage as-a-service

• Record GAAP consolidated gross margins of 71%; record non-GAAP consolidated gross margins of 72%

• GAAP operating margins of 20%; record non-GAAP operating margins of 27%

• GAAP net income per share of $1.10; record non-GAAP net income per share of $1.58

• $403 million returned to stockholders in share repurchases and cash dividends in the second quarter

NetApp, Inc. reported financial results for the second quarter of fiscal year 2024, which ended on October 27, 2023.

“We delivered another strong quarter, with revenue above the midpoint of our guidance and all-time highs for gross margins, operating margins, and EPS,” said George Kurian, CEO. “We are at the forefront of the evolution of the storage industry, helping our customers turn disruption into opportunity. Our modern approach to intelligent data infrastructure helps customers operate with seamless flexibility to deploy new applications, unify their data for AI, and simplify data protection in a world of limited IT resources, rapid data growth, and increased cybersecurity threats.“

2FQ24 financial results

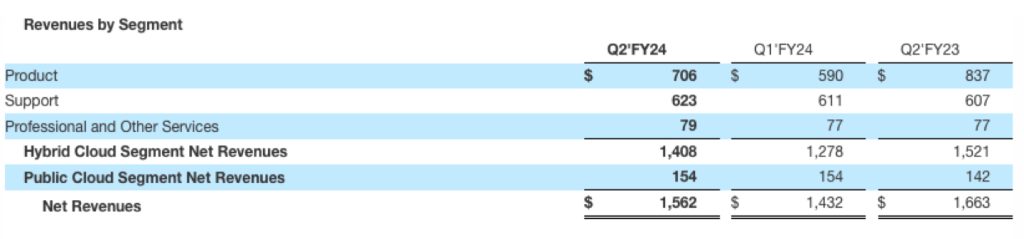

• Net revenues: $1.56 billion, compared to $1.66 billion in 2FQ23, a Y/Y decrease of 6%, or 8% in constant currency.

• Hybrid cloud revenue: $1.41 billion, compared to $1.52 billion in 2FQ23.

• Public cloud revenue: $154 million, compared to $142 million in 2FQ23.

• Billings: $1.45 billion, compared to $1.60 billion in 2FQ23; a Y/Y decrease of 9%, or 11% in constant currency.

• Public cloud annualized revenue run rate (ARR): $609 million, compared to $603 million in 2FQ23, a Y/Y increase of 1%.

• AFA ARR: $3.2 billion, compared to $3.1 billion in 2FQ23, a Y/Y increase of 1%.

• Net income: GAAP net income of $233 million, compared to $750 million in 2FQ23; non-GAAP net income3 of $334 million, compared to $326 million in 2FQ23. The Y/Y fluctuations in GAAP and non-GAAP net income each include a favorable impact of approximately $15 million from foreign currency exchange rate changes.

• Earnings per share: GAAP net income per share of $1.10 compared to $3.41 in 2FQ23; non-GAAP net income per share of $1.58 compared to $1.48 in 2FQ23. The Y/Y fluctuations in GAAP and non-GAAP net income per share each include a favorable impact of approximately $0.07 from foreign currency exchange rate changes.

• Cash, cash equivalents and investments: $2.62 billion at the end of 2FQ24.

• Cash provided by operations: $135 million, compared to $214 million in 2FQ23.

• Share repurchase and dividends: Returned $403 million to stockholders through share repurchases and cash dividends.

Dividend

The next cash dividend of $0.50 per share is to be paid on January 24, 2024, to stockholders of record as of the close of business on January 5, 2024.

Guidance:

- Revenue in 3FQ24 is expected to be in the range of $1.51-$1.67 billion.

- Revenue in FY24 is expected to be down approximately 2% Y/Y.

Comments

George Kurian, CEO, commented: "2FQ24 improved on our solid start to FY24 in what continues to be a challenging macroeconomic environment. We delivered revenue above the midpoint of guidance while our operational discipline yielded company all-time highs for gross margin, operating margin, and EPS."

Shares rose more than 6% in extended-hours trading the day of the announcement, after the data infrastructure company posted results that beat estimates and boosted its full-year forecast.

Looking at the results of the quarter, momentum from new products and the go-to-market changes the company made at the start of the year drove 10% Q/Q growth in hybrid cloud segment revenue to $1.4 billion. AFA business benefited from the growth of the AFF C-Series increasing 14% from 1FQ24 to ARR run rate of $3.2 billion.

2FQ24 billings of $1.5 billion decreased 9% Y/Y, and revenue of $1.6 billion decreased 6% Y/Y, as IT budgets remain constrained in a challenging macro environment.

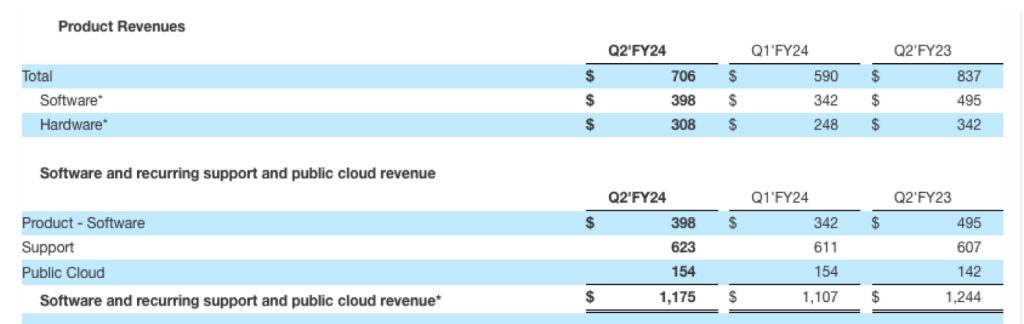

Hybrid cloud revenue of $1.4 billion decreased 7% Y/Y, and product revenue of $706 million decreased 16% Y/Y. As discussed in 1FQ24, 1FH23 and most notably product revenue, benefited from elevated levels of backlog entering FY23. For 2FH24 Y/Y comparisons should be more apples-to-apples.

Support revenue, an attach to install base and indicative of the value of products, grew 3% Y/Y to $623 million.

Public cloud revenue increased 8% Y/Y to $154 million and was flat from 1FQ24 and up 8% Y/Y. This growth was driven by hyperscaler 1rst party and marketplace services, partially offset by continued declines in subscription services. 1st party and marketplace offerings are highly differentiated and are tightly aligned with customers’ buying preferences. These services grew over 30% from 2FQ23. The firm continue to see customer expansion and deepening partnerships, as well as increases in customer count, capacity, revenue and ARR in this part of the portfolio.

The AFF C-Series AFA continues to exceed expectations, delivering new customers and numerous wins over the competition. In 2FQ24, the firm competed vs. an AFA competitor with C-Series to win a $16 million deal at an IaaS company.

It anticipate ARR headwinds of approximately $55 million from exited services and unrenewed subscriptions in 2FH24. Growth in 1st party and marketplace services are expected to partially offset this decline, positioning the manufacturer to enter FY25 with a more focused and much healthier business from which to grow.

It expects the momentum in 2FQ24 to continue through FY24, despite continued softness in the demand environment due to the challenging macro.

The vendor is raising its F24 guidance in still a soft IT spending environment. It now expect FY24 revenue to be down approximately 2% Y/Y. It expects to see continued strength in product and hyper-scaler 1st-party and marketplace services, as it works through minor headwinds from public cloud subscription services. Consolidated gross margins are expected to be approximately 71%.

In 3FQ24, it expects revenue to range between $1.51 billion and $1.67 billion, which at the midpoint implies an increase of 4% Y/Y.

NetApp's financial results since FY16 in $ million

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 |

6,146 | 4% |

1,169 |

| FY20 |

5,412 | -12% |

819 |

| FY21 | 5,744 | 6% | 730 |

| 1Q22 |

1,458 | 12% | 202 |

| 2Q22 |

1,566 | 11% | 292 |

| 3Q22 |

1,614 | 10% | 252 |

| 4Q22 | 1,680 | 8% | 259 |

| FY22 | 6,318 | 10% | 937 |

| 1Q23 |

1,592 | 9% | 214 |

| 2Q23 |

1,663 | 6% | 750 |

| 3Q23 | 1,526 | -5% | 65 |

| 4Q23 | 1,581 | -6% | 334 |

| FY23 |

6,362 | 1% |

1,230 |

| 1FQ24 |

1,432 | -10% | 149 |

| 2Q24 |

1,562 | -6% | 230 |

| 3FQ24 (estim.) |

1,510-1,670 | -1%-9% |

NA |

| FY24 (estim.) | 6,237 |

∼-2% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter