History 2003: Third Consecutive Year of Decline for WW Tape Drive Market

By 10.8% in 2002 from 2001 on units and 18.3% on factory revenue

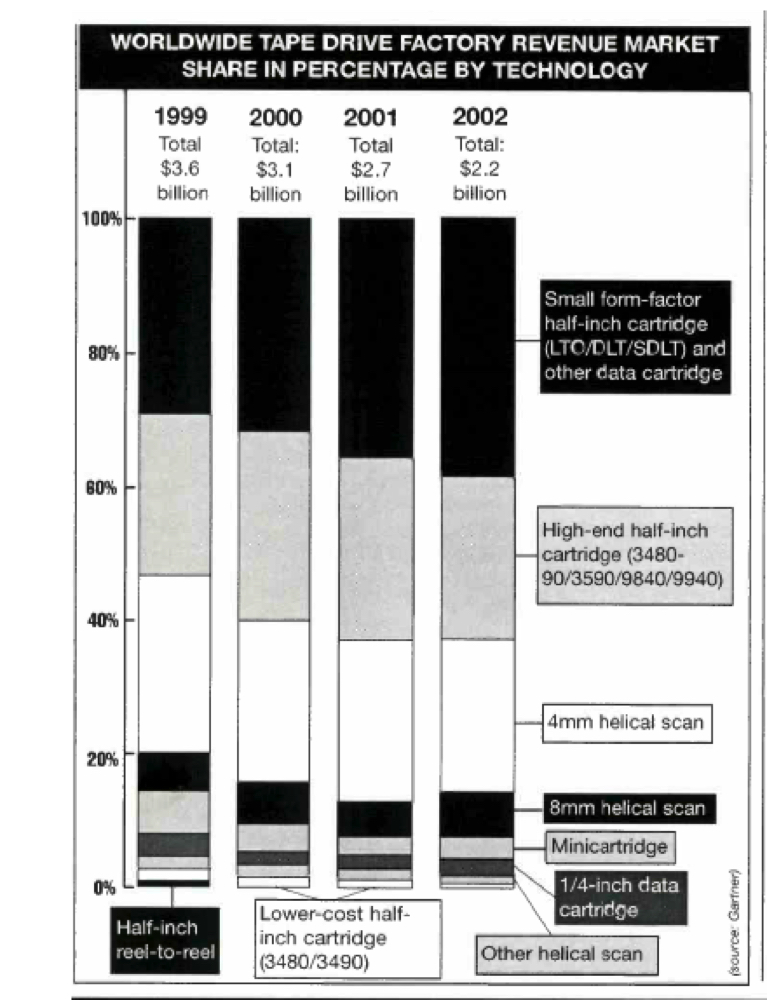

By Jean Jacques Maleval | November 29, 2023 at 2:00 pmThe total market for tape drives in 2002 declined for the 3rd consecutive year, according to a study from Gartner.

It declined by 10.8% from 2001 on a unit basis and 18.3% on a factory revenue basis. Unit shipments for all tape drives in 2002 were 2.229 million drives with factory revenue of $2.178 billion.

The 8mm helical scan tape drive segment was the only one of Gartner Dataquest’s tape segments to show unit and revenue growth in 2002.

4mm helical scan DDS drives represented 47.8% of the total 2002 units, down slightly from 50% in 2001.

The small form factor half-inch cartridge drive segment’s share of units increased slightly from 2001 to 24% of the total drive shipments in 2002.

The rankings of the leading vendors in unit shipments for 2002 remained nearly constant with the rankings in 2001. The top 5 vendors for unit shipments were, in order, Seagate RSS (now Certance), HP, Sony, Quantum and Tandberg Data. The top 5 revenue-producing vendors were HP, IBM, Quantum, StorageTek and Sony.

Vendor rankings for each of the segments – minicartridge, 4mm helical scan and 8mm helical scan drives – in 2002 were nearly identical with 2001.

In the minicartridge segment, Seagate remained in ≠1 position over OnStream, but both companies had a decline in shipments.

This article is an abstract of news published on issue 185 on June 2003 from the former paper version of Computer Data Storage Newsletter.

This article is an abstract of news published on issue 185 on June 2003 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter