As Expected, Western Digital to Separate Into 2 Public Companies

One on HDD retaining Western Digital name, other one unnamed on flash

This is a Press Release edited by StorageNewsletter.com on November 2, 2023 at 2:02 pmWestern Digital Corp. announced its board of directors has unanimously approved a plan to separate its HDD and flash businesses.

Creating 2 independent, public companies with market-specific, strategic focus, the separation will better position each franchise to execute innovative technology and product development, capitalize on unique growth opportunities, extend respective leadership positions, and operate more efficiently with distinct capital structures.

The transaction also provides strategic optionality for both businesses. The separation is intended to be structured in a tax-free manner and is targeted for 2CH24.

“Our HDD and flash businesses are both well positioned to capitalize on the data storage industry’s significant market dynamics, and as separate companies, each will have the strategic focus and resources to pursue opportunities in their respective markets. Importantly, separating these franchises will unlock significant value for Western Digital shareholders, allowing them to participate in the upside of two industry leaders with distinct growth and investment profiles,” said David Goeckeler, CEO. “We have already laid important groundwork by building market-leading portfolios and enhancing the operational efficiency of each business, including the creation of separate flash and HDD product business units and separating operational capabilites over the past several years. Additionally, we now have strong product, operational, and financial leadership in place to execute this plan successfully. Each business is in a solid position to succeed on its own, and the actions we are announcing today will further enable each company to drive long-term success in the years to come.“

In completing its strategic review after fully evaluating a comprehensive range of alternatives, Western Digital has determined that to realize its full value, spinning off its flash business is the best, executable alternative at this time. To that end, it believes the current timing for implementing a stand-alone separation strategy is advantageous in its efforts to create shareholder value as industry conditions improve.

“During our strategic review process, we thoroughly evaluated strategic transactions that could be value-accretive to Western Digital. However, given current constraints, it has become clearer to the board in recent weeks, that delivering a stand-alone separation is the right next step in the evolution of Western Digital and puts the company in the best position to unlock value for our shareholders,” Goeckeler added. “We are now emerging from a historic cyclical downturn in storage where all the changes made in the past several years are evident in how well each business performed relative to peers. Moving forward, as we progress through FY24, we see an improving market environment in both businesses, and we will remain open to strategic opportunities that unlock further value in both our HDD and flash investments and assets.”

The final determination to separate will be subject to board approval, the execution of definitive documentation, receipt of opinions or rulings as to the tax-free nature of the transaction, and satisfaction of customary conditions, including effectiveness of appropriate filings with the U.S. SEC, the completion of audited financials, and the availability of financing.

The board of directors engaged Qatalyst Partners, Lazard and J.P. Morgan as financial advisors and Skadden, Arps, Slate, Meagher & Flom LLP as legal counsel during the strategic review process.

Comments

The official reason of the separation, "(to) better position each franchise to execute innovative technology and product development, capitalize on unique growth opportunities, extend respective leadership positions, and operate more efficiently with distinct capital structures", is not convincing.

What the other reasons could be for this move pushed more than a year ago by activist investor Elliott Management?

Maybe, following this separation, the total value of the shares of the 2 companies will be higher for the benefit of the shareholders.

The new public firm concentrated on HDD only, a business going down and with much less future than flash, will be easier to sell. But to whom? We see only 2 buyers, Seagate and Toshiba, the other only HDD manufacturers. But there is no interest for them for this deal because, if WD stops its HDD business, its customers will have no choice but to buy disk drives from the 2 other competitors that will avoid to pay for an acquisition.

The unnamed other public company - we propose WDFlash or WDF - on flash only is the result of the excellent but expansive acquisition of SanDisk announced in October 2015 and finalized on May 12, 2016 for $19 billion, an operation missed by Seagate.

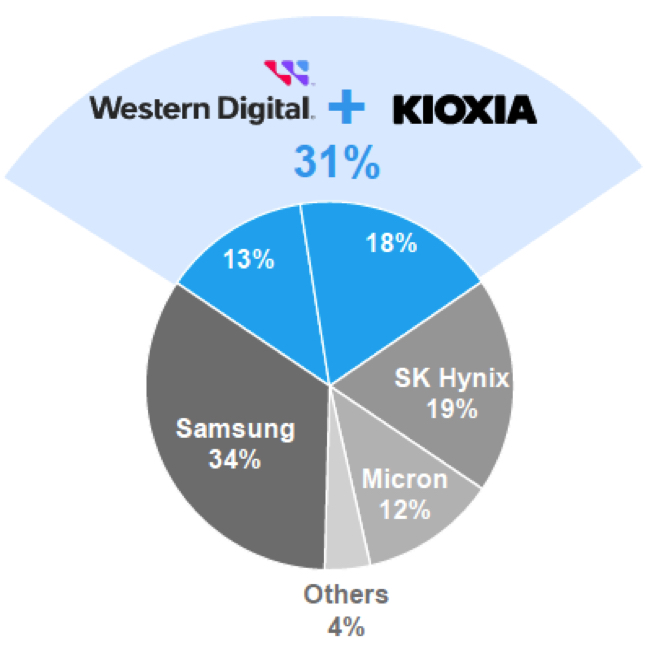

WW CY22 NAND market ($59 billion) (1)

(1) Source: Yole Intelligence NAND market monitor 3Q23 (September 2023)

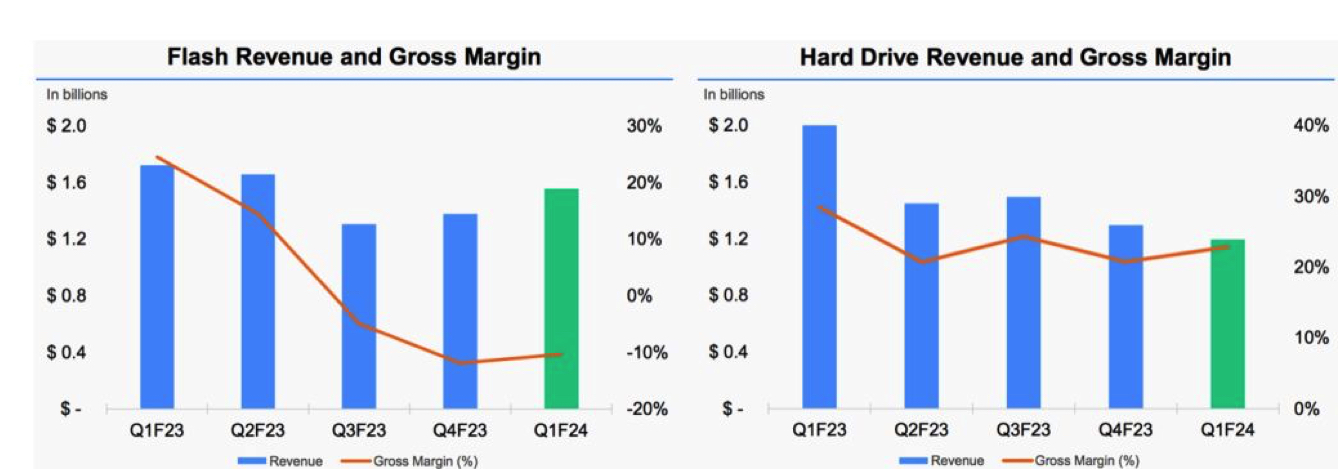

WD flash and HDD metrics

Here are revenues of WD's HDD and flash business from 4FQ21 to 1FQ24:

| in $ million | 4FQ21 | 1FQ22 | 2FQ22 | 3FQ22 | 4FQ22 | 1FQ23 | 2FQ23 | 3FQ23 | 4FQ23 | 1FQ24 | 4FQ23/1FQ24 growth |

| HDDs |

2,501 | 2,561 | 2,213 | 2,138 | 2,128 | 2,014 | 1,657 | 1,496 | 1,295 |

1,194 |

-8% |

| Flash |

2,419 | 2,490 | 2,620 | 2,243 | 2,400 | 1,722 | 1,450 | 1,307 | 1,377 | 1,556 |

13% |

There was no one word on the flash venture being owned at 49.9% by WD and 50.1% by Kioxia, producing over 30% of the world's bits, but it will probably be included in WDF.

The long-rumored WD-Kioxia merger is not going to happen due to a vote of non-support from SK Hynix and other financial issues (with Bain and others).

Seagate, also involved in HDD and SSD, is not going to separate this two business as flash is a very small activity: "Systems, SSD and others" represent only $159 million.

Read also:

Creating Two Independent Public Companies (from page 2)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter