Commvault: Fiscal 2Q24 Financial Results

Commvault: Fiscal 2Q24 Financial Results

Company growing and more profitable

This is a Press Release edited by StorageNewsletter.com on November 1, 2023 at 2:02 pm| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 188.1 | 201.0 | 386.0 | 399.1 |

| Growth | 7% | 3% | ||

| Net income (loss) | 4.5 | 13.0 | 8.0 | 25.6 |

Commvault Systems, Inc. announced its financial results for the fiscal second quarter ended September 30, 2023.

“Our Q2 total revenue growth accelerated, driven by our hyper-growth SaaS platform, and we delivered robust operating margin leverage,” said Sanjay Mirchandani, president and CEO. “Next week, at Commvault SHIFT, we’ll unveil our cyber resilience platform, combining our leading data protection capabilities with comprehensive new security and AI-powered innovations that are critical for customers in an era of escalating cyber-attacks.“

2FQ24 highlights

• Total revenues were $201.0 million, up 7% Y/Y

• Total ARR grew to $711 million, up 18% Y/Y

• Subscription revenue was $97.8 million, up 25% Y/Y

• Subscription ARR grew to $530 million, up 32% Y/Y

• Income from operations (EBIT) was $17.6 million, an operating margin of 8.8%

• Non-GAAP EBIT was $42.0 million, an operating margin of 20.9%

• Operating cash flow of $40.3 million, with free cash flow of $40.1 million

• Second quarter share repurchases were $31.3 million, or approximately 442,000 shares of common stock

Financial outlook for 3FQ24

• Total revenues between $206 million and $210 million

• Subscription revenuebetween $106 million and $110 million

• Non-GAAP operating margin approximately 21%

Financial outlook for FY24

• Total revenues between $812 million and $822 million

• Total ARR to grow 14% Y/Y

• Subscription revenue between $408 million and $418 million

• Non-GAAP operating margin to grow between 50 to 100 basis points Y/Y

• Free cash flow approximately $170 million

Comments

Quarterly revenue, at $201 million, is above expectations of $195 million to $199 million expected at the end of 1FQ24, corresponding to a growth of 7% Y/Y and 1% Q/Q, driven by acceleration across key KPIs during the quarter.

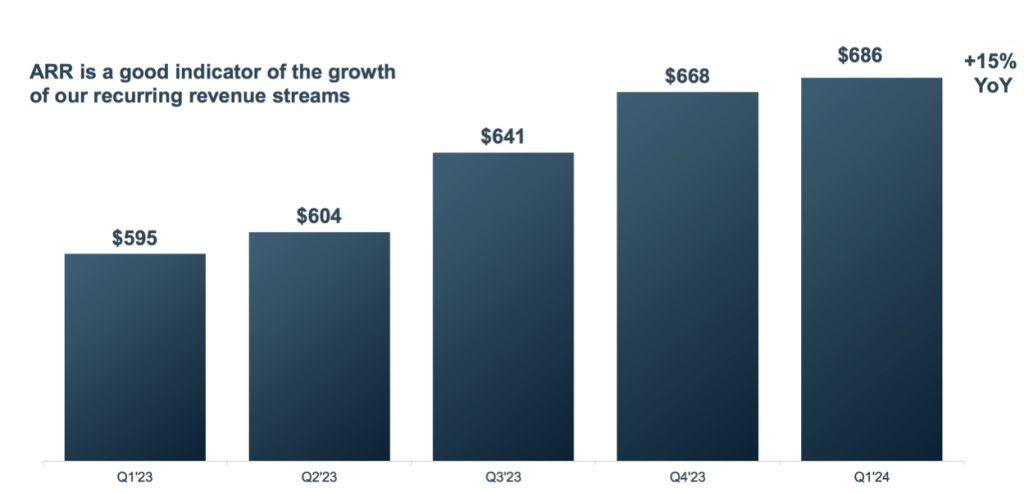

Total ARR in $ million

Total ARR, the metric used to measure underlying growth accelerated 18% Y/Y to $711 million. Subscription ARR grew 32% year-over-year to $530 million and is now nearly 75% of total ARR.

SaaS momentum accelerated with Metallic ARR, up 77% Y/Y to $131 million. Metallic-SaaS net dollar retention rebounded to 130%.

Revenue growth was led by subscription revenue of $98 million, an increase of 25% Y/Y. The company saw double-digit growth in term software licenses combined with an accelerating contribution of SaaS revenue, which was up over 80% Y/Y. Subscription revenue is now approaching 50% of total revenue compared to 42% one year ago.

SaaS ARR finished the quarter at $131 million, an increase of 77% Y/Y. SaaS net dollar retention rate for 3FQ24 accelerated to 130% vs. 118% reported last quarter.

2FQ24 perpetual license revenues were $14 million.

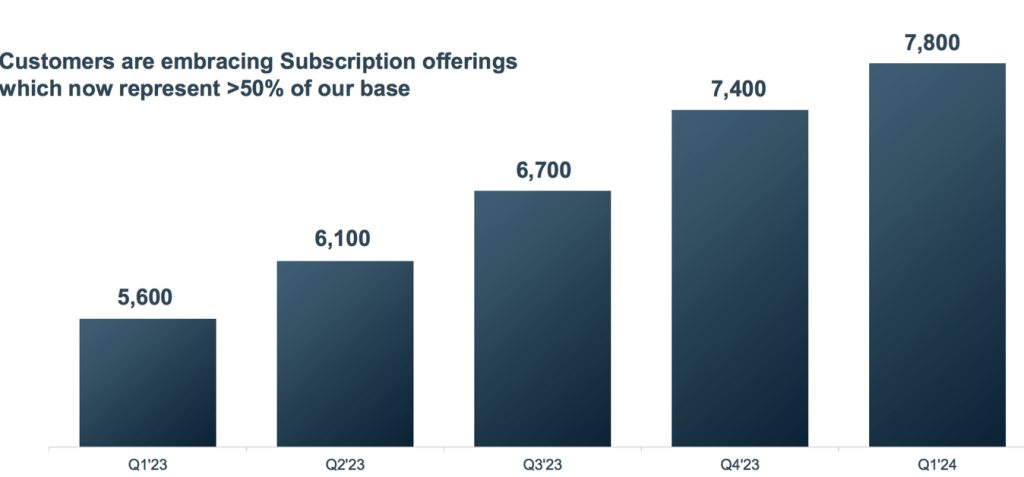

Subscription customer growth

2FQ24 customer support revenue was $77 million, which includes support for both term-based and perpetual software licenses.

Year-to-date, customer support revenue from perpetual licenses represents 55% of total customer support, with the balance coming from term software licenses. This compares to approximately 60% in FY23 and 70% in FY22. At this trajectory, the firm expects customer support revenue from term-based software licenses to become the majority of its customer support revenue next fiscal year.

Commvault ended the quarter with no debt and $283 million in cash, of which $93 million within USA.

It ended the quarter with a headcount of 2,900 employees, reflecting a 1% decline Y/Y.

Outlook for 3FQ24

For 3FQ24, expected subscription revenue, which includes both the software portion of term-based licenses and SaaS will be $106 million to $110 million. This represents 24% Y/Y growth at the midpoint.

Total revenue is expected to be $206 million to $210 million (or up 6% to 8%) with year-over-year growth of 7% at the midpoint. At these revenue levels, we expect Q3 consolidated gross margins to be approximately 82.5% and EBIT margins of approximately 21%.

Outlook for FY24

Revenue is estimated to be between $812 and $822 million or up 3% to 5%, above former estimation last quarter of between $805 and $815 million or up 3% to 4%

Total ARR will grow 14% Y/Y, which reflects a 100 basis point increase over prior guidance.

The firm now expects subscription ARR, which includes term-based licenses and SaaS to increase 24% Y/Y. From a revenue perspective, it now expects subscription revenue to be in the range of $408 million to $418 million growing 19% Y/Y at the midpoint. At these levels, subscription revenue will exceed over 50% of total revenue.

Revenue and net income (loss) in $ million

| Fiscal Period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| FY18 | 699.4 | 8% | (61.9) |

| FY19 | 711.1 | 2% |

3.6 |

| FY20 |

670.9 |

-6% |

(5.6) |

| FY21 | 723.5 | 8% | (31.0) |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 | 198.0 | 8% | 3.5 |

| 2FQ23 | 188.1 | 6% | 4.5 |

| 3FQ23 | 195.1 | -4% | (0.3) |

| 4FQ23 | 203.5 | -1% |

(43.5) |

| FY23 | 784.6 | 2% |

(35.8) |

| 1FQ24 | 198.2 | -3% |

12.6 |

| 2FQ24 | 201.0 | 7% |

13.0 |

| 3FQ24 (estim.) | 206-210 | 6%-8% |

NA |

| FY24 (estim.) | 812-822 | 3%-5% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter