Report for Storage-as-a-Service

Leaders being HPE, NetApp, Zadara, Pure Storage, Dell and Hitachi Vantara analyzed

This is a Press Release edited by StorageNewsletter.com on October 3, 2023 at 2:02 pm![]() Published on August 30, 2023, this market report was written for GigaOm by Justin Warren, founder and chief analyst of PivotNine Pty Ltd, a boutique consulting firm based in Melbourne, Australia, covering enterprise datacenter, cloud, and information security technologies.

Published on August 30, 2023, this market report was written for GigaOm by Justin Warren, founder and chief analyst of PivotNine Pty Ltd, a boutique consulting firm based in Melbourne, Australia, covering enterprise datacenter, cloud, and information security technologies.

GigaOm Sonar Report for Storage as a Service (STaaS)v3.0

An Exploration of Cutting-Edge Solutions and Technologies

1. Summary

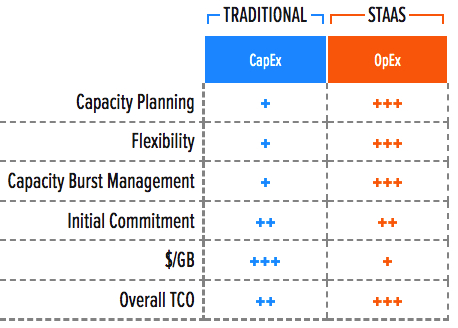

Storage as a service (STaaS) is a subscription-based model for storage that provides customers with a cloud-like experience in terms of flexibility, system management, and provisioning for their on-premises infrastructure. It contrasts with more traditional purchasing models by which customers acquire hardware, software, and services, and manage the infrastructure on their own. Table 1 compares STaaS to more traditional purchasing models.

Table 1. Comparison between Traditional and STaaS Purchasing Models

+++ Exceptional: Outstanding focus and execution

++ Capable: Good but with room for improvement

+ Limited: Lacking in execution and use cases

– Not applicable or absent

Enterprises are now familiar with cloud consumption models, and they are always looking for ways to bring that advantage to on-premises infrastructure. For most enterprises, flexibility is an increasingly important component of their IT strategy.

From a technical perspective, it is now clear that the hybrid cloud is the preferred approach for most organizations, and there is an accompanying need to rationalize and standardize as many processes as possible to enable a seamless experience. In some cases, perhaps because of specific industry regulations, particular infrastructure needs, or simply company policy, IT organizations can’t always adopt a full hybrid-cloud approach. For these organizations, it is more important than ever to use cloud-like options to provide the same level of agility that their competitors enjoy. In this respect, STaaS – or, more generally, on-premises infrastructure as a service (OIaaS) is an option that should be considered more often.

STaaS, or OIaaS, is just one of the many purchasing options now available. Customers can choose to adopt it as their principal IT infrastructure acquisition approach, but most organizations will likely choose a more balanced approach that aligns the purchasing model with specific business needs and use cases.

The STaaS model is also attractive for local service providers and MSPs who can quickly adapt their infrastructure and spending to the number of customers and projects under management.

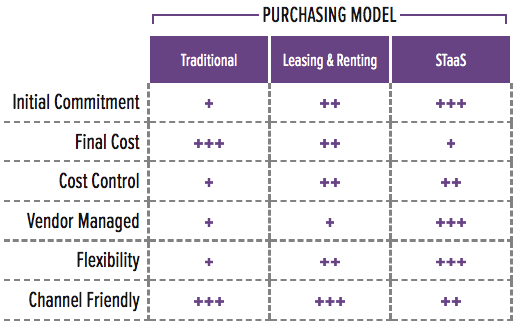

In Table 2, we take a quick look at the differences among the major purchasing approaches. STaaS suits customers seeking maximum flexibility and consumption pricing, and those who are comfortable leaving the majority of infrastructure management decisions to their chosen vendor.

Table 2. Comparison between Traditional, Leasing and Renting, and STaaS Purchasing Models

+++ Exceptional: Outstanding focus and execution

++ Capable: Good but with room for improvement

+ Limited: Lacking in execution and use cases

– Not applicable or absent

How we got here?

Over the past few years, many organizations have tried a cloud-only approach, only to discover that the cloud isn’t going to meet all their needs, especially when the infrastructure is complex and they’re constrained by legacy applications that were designed well before cloud paradigms came along. The upshot is that the vast majority of enterprises are targeting a hybrid approach that can give them the best of both worlds: the flexibility of the cloud and the cost efficiency of bulk on-site purchasing. The public cloud is very flexible but tends to be relatively expensive, while on-premises infrastructure is generally more rigid but has lower and more predictable costs. To meet customers’ needs, cloud providers have introduced a series of on-premises and hybrid cloud solutions to bring their services directly into the customer’s data center.

While the cloud computing industry has been trying to move its offerings onto customer premises, storage vendors have adapted their solutions to make them easier to manage and consume. Financial options like leasing and renting are no longer enough to cover all possible scenarios and tend to be quite rigid when changes need to be made to the infrastructure. For example, although customers can expand the infrastructure and add new hardware to the account, there is no easy way to return unused hardware. Additionally, hardware that has been purchased at various times is often difficult to manage in terms of warranty, services, support, and system lifespan.

Fortunately, the storage industry has come up with a number of improvements. Many vendors improved support plans by adding free hardware updates, which also helped to eliminate end-of-life issues with their hardware and stave off competitive threats. This support was facilitated by the huge amount of data that vendors have collected from systems in the field.

For customers, the benefit of these improvements is clear: they remove a number of complexities in system lifecycle management. With better control over system lifespan, proactive support made possible by analytics, and customers becoming comfortable with vendors taking more control of their storage system, the introduction of STaaS has been a natural evolution of modern storage.

2. Overview

STaaS became commercially viable once several foundational technologies developed to sufficient maturity:

- Hardware: Flash memory is much more predictable, durable, and resilient than HDDs. Modern storage hardware also operates with greater scale and redundancy than in the past, further improving the overall reliability, durability, and resilience of storage systems. Operational management of storage hardware has also been simplified. Keeping systems updated and aligned with the latest technology improves overall reliability, simplifies operations at scale, and makes the entire installed base more predictable.

- Software: Customers have become more familiar with continuous software releases, particularly for security-related patching. They now trust vendors to update systems without major failures, which is vital for storage systems that hold important data. Customers have also become more accustomed to the continuous improvements delivered by regular software updates. Receiving additional value in performance, features, or functionality without extra cost has become relatively commonplace.

- Analytics: Customers have become accustomed to allowing vendors to collect vast amounts of data about their storage systems in operation. Vendors gather detailed information on failure rates, anomalies, capacity growth, performance figures, and so on, and they have, so far, proved to be trustworthy custodians of this sensitive customer data. This data helps both vendors and customers to plan in advance for most maintenance operations, improve system SLAs, and minimize capacity planning issues. The recent introduction of ML techniques has further enhanced the customer experience and simplified system tuning operations.

The combination of modern hardware, software, and data analytics has enabled vendors to de-risk the delivery of STaaS and bring down the costs to a level customers can accept. At the same time, customers are more familiar with service-based delivery of infrastructure and have sufficient faith in vendors that they are willing to entrust their important data to storage delivered as a service.

STaaS is quickly becoming a big differentiator for on-premises storage. It simplifies the purchasing process, and it also makes the infrastructure elastic. Though it is more expensive than traditional options, customers don’t have to pay upfront for infrastructure that will initially go unused.

Critical elements of the STaaS model are:

- Data and analytics: Reliable data and analytics are mandatory for understanding real storage consumption, capacity, and performance trends, workload needs, and so forth. They underpin the financial models that make STaaS pricing work for both vendors and customers, and drive the durability, reliability, and trust customers expect when using STaaS for their important data.

- STaaS management console: The management console offered by vendors along with analytics tools is the main UI for the STaaS service. It should include all significant options from resource provisioning and deallocation to reporting and billing.

- Management services: Depending on the level of service provided by the vendor or selected by the customer, the customer experience may differ. Some vendors offer the hardware as is, with only basic support services, leaving most management operations to the customer. Other vendors push the level of service further and give the customer less control over the physical infrastructure, with an experience that is closer to cloud storage.

Use Cases

As a consumption model, STaaS is best suited to use cases with the following characteristics:

- Cloud-like experience: Organizations of all types want IT to be more aligned with their business needs and cloud consumption models. They want to replicate the benefits of the public cloud while maintaining their on-premises advantages, such as fast resource provisioning and limited commitment in case of sudden expansion or compression of the existing infrastructure. STaaS also allows customers to limit their commitment to a specific vendor or technology.

- Cost control: This consumption model enables IT managers to move their budget from capital expenditures (Capex) to Opex) and reduce financial risk. A cloud-like pay-as-you-go subscription model is simple and limits the initial financial commitment. Technology refreshes and migrations become irrelevant to the customer. With the right reporting and internal chargeback/showback mechanisms, it becomes easier to identify centers of cost per application and/or department. Although the acquisition cost is higher than for traditional models, the TCO could be lower because of all the benefits associated with this model.

- Elastic IT and seasonality: Customers with high business seasonality can take advantage of this model to make their infrastructure more elastic and flexible. They can allocate resources and release them as changing business needs dictate. More generally, any organization can experience a sudden increase in demand. STaaS allows an organization to quickly add more resources to meet that demand. It also allows an organization to react quickly to a sudden drop in demand by reducing its resource consumption and spending almost immediately.

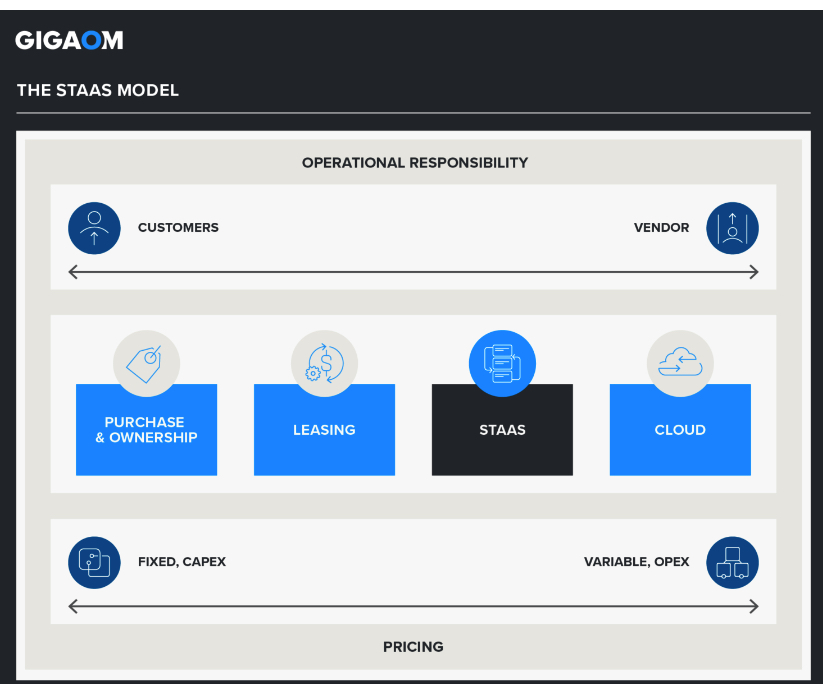

Large organizations often require more than one approach to align with their diverse needs. As Figure 1 shows, STaaS is an approach that sits perfectly between traditional purchasing, renting, or leasing at one extreme and fully elastic cloud at the other.

Figure 1. STaaS Model

3. Considerations for adoption

Before adopting a STaaS consumption model, customers should understand the benefits and limitations of current offerings and how the market is evolving to accommodate new business needs.

The concept of STaaS reduces the impact of the products themselves, which become something of a commodity. In fact, customers don’t choose a specific storage system or configuration but instead select performance, availability, and capacity parameters. In other words, a customer selects a service-level objective (SLO), and it’s the vendor who selects the right model and configures it to match the customer’s request. Capacity planning is also handled by the vendor according to the customer’s resource utilization trends.

The value of the back-end architecture, system scalability, data optimization, and data services is hidden behind the scenes and no longer relevant to the customer. That said: some vendors still prefer to show which storage model is actually delivered and installed at the customer’s site and can provide a certain degree of control over the hardware to advanced customers.

The initial deployment of a STaaS infrastructure requires an investment by the storage vendor in terms of hardware, software, and installation services. In order to justify all of this, the vendor usually requires an initial commitment from the customer in the form of a minimum capacity allocated for a period of time. This could be a limiting factor for organizations with small IT infrastructures.

Generally, the STaaS model is more appropriate for large or medium-sized organizations that already have sizable storage infrastructures in place. Vendors are pushing this model to a wider audience, but limitations imposed by fixed costs and minimum expansion steps make it impractical below a certain threshold. Other types of customers that are very attracted by STaaS are MSPs and local service providers. These customers can benefit from a resource consumption model that is totally aligned with their business models and practices.

This type of solution might be considered an evolution of leasing and rental. It is a more advanced option for customers who may have already tested a similar purchase model but want something that is more of a turnkey solution: flexible with no need to deal with asset management during and after the contracts.

In the end, STaaS is more expensive than a direct purchase, or a lease or rental, but in a large organization, the operational and business benefits can dramatically improve TCO and make this solution economically sound in the medium and long term.

Key characteristics for enterprise adoption

Here, we explore the key characteristics that may influence enterprise adoption of the technology based on attributes or capabilities that may be offered by some vendors but not others. These criteria will be the basis on which organizations decide which solutions to adopt for their particular needs.

These key characteristics are:

- Initial commitment

- Cost transparency

- Expansion

- Ease of use

- Control plane and management layer

- Data plane and protocol support

- Multitenancy

- Ecosystem and integrations

Initial commitment

The initial commitment required by the vendor could be a limiting factor for adoption. Many vendors require a minimum initial capacity commitment for a substantial period (one year in some cases). This may hamper adoption by smaller organizations.

Cost transparency

$/GB and $/IO/s ratios become more important with this model, and it can be challenging to determine the cost implications of some workloads ahead of time. Granularity and transparency in how costs are calculated is of fundamental importance for financial governance. Simpler billing models are also preferred.

Expansion

Most STaaS solutions leave some system resources available for future expansion without requiring physical intervention to install additional hardware to speed up provisioning operations. Customers should evaluate how much of the system is available for expansion and make sure there is an SLA in place to ensure system reserve capacity is expanded in a timely manner.

Ease of use

Vendors are working to integrate STaaS tools with the rest of their management software to ensure they are easy to use. Besides resource provisioning, reporting and billing are the major features. The tools should also provide information about the cost of acquiring additional resources.

Control plane and management layer

The STaaS control plane should support both GUI and REST API access and support all of a vendor’s storage options. It should allow for integration into other systems as part of a cloud operating model, not close off the STaaS as an isolated silo.

Data plane and protocol support

All major protocols for block, file, and object storage access should be supported. Customers have a variety of workloads and require a variety of storage access protocols. Support for the Container Storage Interface (CSI) helps customers use STaaS with containerized applications, which are becoming more common.

Multitenancy

STaaS is getting the attention of MSPs and large organizations that want to separate different customers or business units for reporting and billing purposes. Multitenancy also enables self-service options when appropriate.

Ecosystem and integrations

STaaS should integrate with common customer systems-such as servers, networking, and backup and recovery-without extensive customization. Support for additional software and third-party options should help customers solve their problems by connecting services together via standard interfaces.

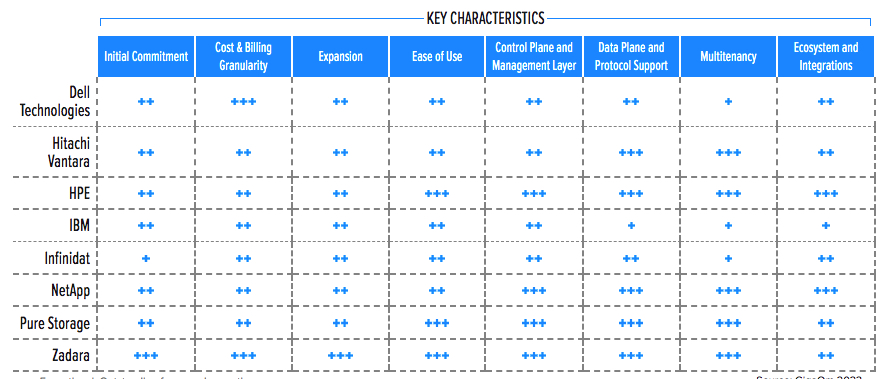

Table 3 shows how well these key characteristics are implemented in each of the solutions assessed in this report.

Table 3. Key Characteristics Affecting Enterprise Adoption

+++ Exceptional: Outstanding focus and execution

++ Capable: Good but with room for improvement

+ Limited: Lacking in execution and use cases

– Not applicable or absent

4. GigaOm Sonar

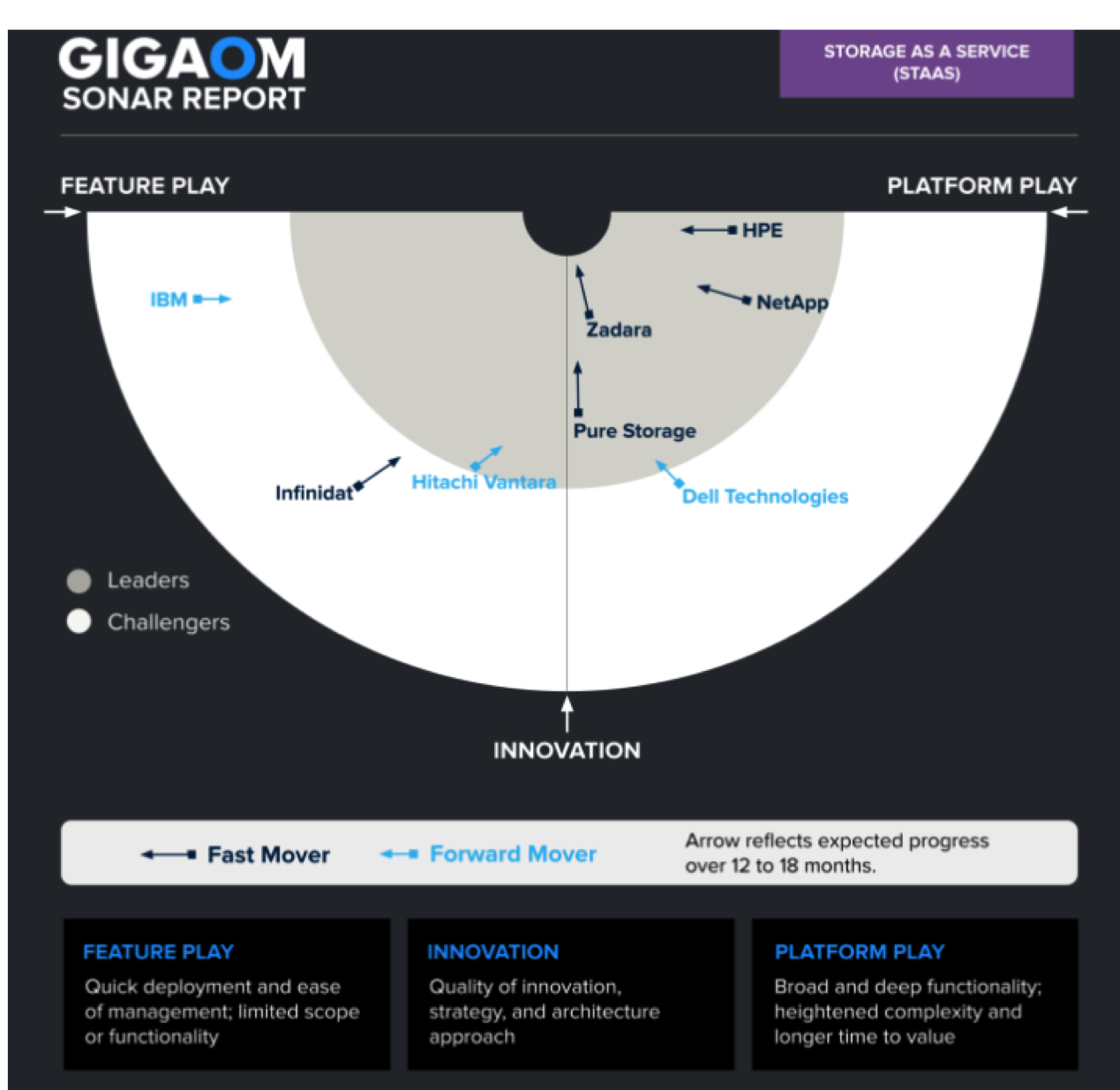

It provides a forward-looking analysis of vendor solutions in a nascent or emerging technology sector. It assesses each vendor on its architecture approach (Innovation) while determining where each solution sits in terms of enabling rapid time to value (Feature Play) vs. delivering a complex and robust solution (Platform Play).

The GigaOm Sonar chart (Figure 2) plots the current position of each solution vs. these 3 criteria across a field of concentric semicircles, with solutions set closer to the center judged to be of higher overall value. The forward-looking progress of vendors is further depicted by arrows that show the expected direction of movement over a period of 12 to 18 months

Figure 2. GigaOm Sonar for STaaS

As you can see in the Sonar chart in Figure 2, Zadara continues to lead the market; however, other players have cottoned on to the value of providing an experience that aligns with that of the public cloud. The market is consolidating around a group of Platform Play offerings from HPE, NetApp, Dell Technologies, and Pure Storage that embrace providing a unified experience across a range of storage and data services. Hitachi Vantara is moving to join this group as it also adds more capabilities and integrations to its STaaS.

Dell Technologies has drifted somewhat, mostly due to the increase in innovation and investment from its competitors. Customer appetite for STaaS is driving substantial investments in vendor offerings, and Dell will need to invest in its STaaS in line with the broader market to remain competitive.

Infinidat has increased its investments and is rapidly gaining on the leaders. IBM seems content to add capabilities at its own pace, and its STaaS offering remains focused on the needs of specific customers.

5. Vendor Insights

Dell Technologies

Its APEX storage Services is its STaaS offering, part of the broader APEX portfolio. The APEX portfolio is an umbrella brand that covers all of Dell’s as-a-service and subscription options, including on-site, public cloud, and custom options.

Block, file, and backup target storage options are available via the APEX console, a self-service portal that enables customers to work in a cloud-like fashion. Resources are requested according to SLOs rather than as products and delivered with a pay-as-you-go experience that includes reporting and billing. Only a subset of the full Dell storage and data protection portfolio is available via APEX STaaS. Customers looking to use systems outside the core APEX STaaS offering can use APEX Flex on Demand subscriptions to obtain a STaaS-like experience.

Customers can select a Dell-managed subscription where the company maintains the infrastructure while customers retain operational control of workloads and applications, or customers can choose to stay responsible for these everyday administrative tasks such as capacity monitoring and resource optimization.

The service aims to provide a fully customizable experience, from the UI to a complete set of APIs for automation. The customer selects the type of storage (block, file, or Backup Target, with object storage support via an S3 interface to file storage), the performance and capacity tier, and the subscription terms and location.

New systems and upgrades are usually delivered in as few as 4 weeks from time of order, and every system is shipped with a minimum 40% buffer capacity to sustain temporary capacity bursts. Unlike several competitors, Dell charges the same rate for both base commitment and on-demand usage; customers won’t be charged a premium for on-demand usage above the base commitment. Initial commitment and subscription terms for customers are aligned with similar offers from competitors, though Dell’s initial commitment for block storage was reduced to 14.7TB raw (down from 50TB). APEX can also provide the service in selected Equinix colocation facilities.

The APEX console is integrated with CloudIQ, which provides cloud-based proactive monitoring and predictive analytics so that customers can reduce risk, plan ahead, and improve productivity. APEX remains a single-tenant solution.

Strengths

Continues to build out a holistic cloud-like experience that encompasses its portfolio of products. The solution is well suited to customers starting to explore the move to consumption-based pricing of infrastructure.

Challenges

The continued lack of multitenancy support will frustrate MSPs and enterprises with a shared service IT model. Customers will need to combine options from the APEX STaaS and APEX Flex on Demand portfolios to access the full range of Dell product lines.

Hitachi Vantara

Its EverFlex STaaS is a productized, self-service offering aimed at midmarket enterprise customers and partners that grew out of the more bespoke EverFlex Infrastructure Services.

Block, file, and object storage are available at a variety of size and performance level guarantees, with a minimum commitment of 50TB for one year. Systems can be deployed in 60 days, both on-site at a customer location or colocated at a partner data center, with a 4-hour service activation.

Once a system is installed, customers can self-serve via the STaaS Cloud Management Console, which runs in the public cloud for global access and agility. Pricing is transparent; a base minimum payment is billed monthly, with excess usage incurring an additional charge.

The cloud management portal offers APIs to enable automation and integration with other products and services. Integrations are available for common enterprise systems such as VMware, Microsoft, Oracle, and Cisco UCS, and automation tools such as Terraform and Ansible. Integration with Hitachi Ops Center and its AI-based analytics tools remain unavailable for STaaS customers.

Hitachi Vantara’s STaaS is multitenant and provides a robust role-based access control (RBAC) mechanism to separate different types of users in the same organization. It includes MSP-style features such as configurable markups and discounts.

Strengths

STaaS is a solid offering well-suited to midmarket enterprises, especially MSPs and those using a shared services IT model. It has excellent multitenancy features.

Challenges

The entry-level commitment is at the higher end, relative to competitors. The number of integrations available is somewhat limited, which may frustrate customers trying to adopt a highly automated cloud operating model, particularly one that embraces hybrid cloud.

HPE

It has altered its GreenLake platform approach to embrace a hybrid/multicloud strategy that sees GreenLake as the common control plane no matter where infrastructure is deployed. This has seen HPE extend its STaaS offerings beyond its traditional on-premises infrastructure to encompass some public cloud options while keeping customers inside the GreenLake experience.

The customer experience remains at the center of the solution, which is now available in a range of geographical locations and to organizations of practically all sizes directly through the IT company or via its partners. However, the updated GreenLake cloud operating model approach does not support all of HPE’s storage options. If customers require something non-standard, GreenLake Flex Solutions provide a way to achieve consumption pricing of a bespoke storage solution.

GreenLake supports management of storage for Amazon Web Services instances, with Azure and SimpliVity planned.

The GreenLake API approach is somewhat bifurcated, as enterprises that have integrated with prior on-site-focused iterations of the API are reluctant to change working systems and the new API is not backward compatible. The new API structure is geared toward new HPE GreenLake customers.

Strengths

The GreenLake approach unifies operations under a single cloud-like model that many enterprises will find appealing, particularly those looking for a cloud-like experience on-site that aligns with that in the public cloud.

Challenges

Object storage support is only available via GreenLake Flex, using Scality object storage. HPE GreenLake’s UI is somewhat biased toward GUIs, which infrastructure-as-code aficionados may find limiting. Support for public cloud options under HPE GreenLake is relatively new and will introduce some backward-compatibility challenges for existing customers.

IBM

Its STaaS offerings are available on its FlashSystem and DS8900F technologies. The service provides customers with multiple configuration options, including protocol type (FC or iSCSI), performance tier, capacity, and availability guarantee. The initial commitment required varies by performance tier but can be as low as 25TB for 1 year at the highest tier of performance storage.

Storage systems are fully managed by Big Blue, and the customer interface is straightforward, allowing quick resource provisioning. The customer experience is consistent between on-site and the public cloud, thanks to firm’s Spectrum Virtualize software, which simplifies data replication and migrations across different environments.

Pricing is transparent and based on usable system capacity at a chosen performance tier. Customers can opt to upgrade to higher performance tiers and larger capacity when needed. Customers can take advantage of data footprint reduction, and pricing for additional capacity will be billed at the same $/GB rate as the committed capacity without penalty.

The service includes standard monitoring tools as well as a dedicated technical account manager who can help to speed up support and advise customers regarding system status and any necessary interventions. Initial subscriptions are available through vendor’s business partners, while the service is delivered directly by the company, including remote system updates and hardware service.

Object storage is available via the Transparent Cloud Tiering proxy feature of the DS8900F, which supports IBM Cloud Object Storage, Amazon S3, RStor, and IBM TS7700 VTLs (when configured as an object storage target). CSI support is also available. Unfortunately, the service continues to lack file storage options.

Strengths

Solution offers a focused option for customers with demanding performance and availability needs. Pricing is transparent and clear.

Challenges

Storage protocol support is limited and heavily weighted toward block storage workloads. The customer interface is not as advanced as that of many competitors, and customers will need to look into Red Hat OpenShift to get a true cloud-like experience.

Infinidat

It provides 3 STaaS options: Elastic Pricing, FLX, and a new InfuzeOS Cloud Edition. The Elastic Pricing option involves a Capex purchase of base capacity with consumption pricing for burst capacity. FLX is fully consumption priced with a minimum commitment of 250TB and additional capacity charged only as it is consumed.

Pricing is straightforward, based on $/GB per month measured on average daily capacity stored in the system, excluding snapshots. There are no penalties if the data reduction ratio changes. Systems are fully managed by the company and regularly updated without service disruptions. The firm also offers a complete system upgrade after 3 years that includes data migration if necessary, though system components can be upgraded seamlessly at any time.

The vendor collects a variety of system status and resource-consumption information, which customers can access via the cloud-based InfiniVerse console to see insights and suggested actions, including advice on capacity requirements. These AIO/s and DevOps tools are also available to partners for integration and process simplification in complex environments.

Company’s InfinIO/s provides integrations with a range of common infrastructure including Brocade, Cisco, VMware, and Oracle, as well as more cloud-like systems such as Kubernetes and OpenStack. APIs are available for those willing to invest in building integrations with automated management systems.

All systems now include InfiniSafe technology as part of InfuzeOS. It provides a range of cyber resilience options, including guaranteed rapid recovery from immutable snapshots within one minute, and a fenced forensic environment for incident response.

The service is for large organizations, though multitenancy features are somewhat lacking, which MSPs may find restrictive.

Strengths

Provides a solid STaaS option for larger organizations looking for large capacity, high performance, resilient storage with SLA-based guarantees.

Challenges

The lack of object storage support will require customers to invest in additional systems and tools to add object capabilities. The firm continues to build out its partner ecosystem, but it’s currently not as robust as some of its competitors.

NetApp

Its STaaS offering, Keystone, provides a subscription approach for both on-site infrastructure and NetApp’s cloud storage services.

The minimum customer commitment is 25TB of capacity for 1 year of high-performance storage, in line with competitors. Contracts for committed capacity can be 1 to 5 years and include options for monthly in arrears or annual upfront payments with volume price breaks and upfront payment discounts. Customers can also reallocate up to 25% of their on-site spend to cloud storage services every quarter.

An additional 20% guaranteed burst capacity is preprovisioned and is only charged for when used, at the same rate as the baseline committed capacity, providing peace of mind. The company delays charging for burst capacity for 60 days after a new installation to allow the baseline capacity to settle. Metering is based on the daily average capacity used, billed monthly.

Management is handled via company’s BlueXP, a cloud-based control plane customers can use to manage a portfolio of STaaS options on-site, in a colocation facility, or in the cloud from a single integrated console. BlueXP provides operational management, reporting, and self-service provisioning capabilities, and can integrate with internal orchestration tools via Keystone APIs.

A sustainability SLA guarantee is available for customers who opt to enable one, with credits provided to customers if the SLA is not met. The storage vendor works with customers to set up the SLA based on the customer needs, aligned to the way sustainability is measured in different locations. Sensor and SmartPDU reporting data can be made available.

The company has a partner-friendly approach to its STaaS, with strong multitenancy capabilities that will be particularly attractive to MSPs. Resource provisioning is based on SLOs-such as performance level, capacity, and protocols-and resources are made available to customers accordingly. Customers don’t actually know which NetApp storage system is used, making the experience similar to public cloud storage.

Strengths

Keystone integrates well with firm’s broader portfolio, and there is strong support for enterprise tools such as ServiceNow and Ansible Tower. The pricing is transparent and clear, with low risk of surprises or bill shock.

Challenges

Keystone is not available in LATAM locations, as the foirm has prioritized the 16 countries in which it does the most business. BlueXP is still relatively new and does not cover all firm’s products yet but is rapidly adding new capabilities.

Pure Storage

Evergreen//One, its storage-as-a-service offering, is part of the broader Evergreen family of offerings. Evergreen//Flex provides a consumption experience with customer asset ownership, while Evergreen//Forever provides a more traditional purchase experience with regular hardware and software upgrades included in the subscription.

Evergreen//One is a subscription offer that includes all Pure hardware options, Portworx software, Pure’s cloud storage services, the flashStack integrated storage and compute system co-delivered with Cisco, and Cloud Block Store (CBS) on AWS and Microsoft Azure. Storage systems can be deployed on-site, in colocation facilities, or on the native public cloud with CBS, depending on the customer’s needs.

The minimum customer commitment is 50TB capacity for one year. Pricing is transparent, with discounts for larger capacity and contract length commitments. The company guarantees fast delivery of additional resources to most countries in the world.

Storage is centrally managed from Pure1, firm’s AI-enabled cloud-based management system. Pure1 provides automated storage upgrades that can be grouped by policy, depending on a customer’s risk appetite. Customers have complete visibility into their storage infrastructure, and Pure’s goal is to enable AI-assisted lifecycle management of assets with full-service commerce. For example, Pure1 will recommend optimizations and upgrades, and existing customers can request quotes for new equipment or subscription expansions directly in Pure1 without needing a sales call.

The company offers 2 tiers of multitenancy support called Tenant and Tenant Spaces, designed to support both MSPs and enterprise customers who support internal customers in a multitenant fashion.

It has recently added an Energy SLA, where customers can receive service credits if energy efficiency SLAs are not met. It will work with customers to define an SLA appropriate to the way sustainability is measured in different locations.

It has also added an optional ransomware recovery SLA. It will supply customers with a clean system to recover to so the existing system can be quarantined for forensic analysis and other incident response activities. It guarantees next business day shipping of clean recovery arrays for North America and Europe or 3 business day shipping for Asia. The SLA includes on-site professional services to assist customers with recovery efforts.

Strengths

Has a well-deserved reputation for the ease of use and simplicity of management that it brings to its STaaS offerings. Multitenancy support is now excellent.

Challenges

Pure Fusion still lacks some of the fleet management features needed by customers with large fleets, but progress on closing this gap has been solid. Service credits for missed SLAs need to be requested by customers rather than being automatically applied.

Zadara

Its zStorage has always been STaaS, with a cloud operating model as a core design principle. This focus on cloud operations shows in the design choices the company has made to make both API-driven operations and GUI-based management easy for customers to use.

Firm’s solution can be accessed via major cloud providers, local MSPs (with more than 250 partners around the world), and on-premises. When adjacent to a hyperscaler, the minimum commitment is just 1h, setting the vendor apart from competitors.

Customers can also configure dedicated virtual private storage arrays (VPSAs) that do not share storage resources with any other customer. For dedicated on-site STaaS, a minimum 6-month contract is required, which is still substantially less than the 12 months required by competitors. Upgrades are transparent to the customer, as the system is fully managed by the vendor and its partners.

Pricing is simple and consistent, based on capacity and throughput usage. Consumption is metered per hour and billed monthly. Storage services include block, file, and object protocols. Data is encrypted at rest and in transit, and customers can provide their own keys via KMIP or manually entered encryption key.

Self-service is core to management of the platform, with robust RBAC and separation of concerns. The solution is fully multitenant, with chargeback capabilities and solid reporting features. Performance can be monitored in real time, and both provisioning portal admins and customers can self-generate billing reports via GUI or API. Both the UI and APIs are well designed and easy to use.

Strengths

Provides a true STaaS offering with a cloud operating model that’s been core to the product since the beginning. It is straightforward and easy to use, with integrated EC2-compatible services.

Challenges

Has seen its greatest success with xSPs and enterprises with shared-services IT that are operationally ready to adopt a cloud operating model. The company is adding integrations, such as with Veeam, and features like policy-driven storage provisioning to make adoption easier for less mature organizations.

6. Near-term roadmap

The industry has quite clearly settled on hybrid and multicloud as the preferred approach; few customers are choosing all one cloud or all on-site. Customers want choice: not too little, not too much.

However, customers have shown a strong preference for the operating model of public cloud and cloud-native software techniques. The specifics of the infrastructure are less important; what customers are looking for are standardized data services they can consume as a service regardless of where the infrastructure is deployed. Customers want to be able to change their minds, moving workloads between on-site and cloud locations depending on the changing business needs of their applications.

Not all STaaS vendors fully embraced this cloud operating model from the outset. Those who changed the financing but not the operations ended up with STaaS that felt familiar but lacked the operational flexibility that public cloud provides. This appealed to more conservative customers, but as the cloud operating model continued to gain traction, these providers have been forced to add more cloud-like options. Customers don’t want to change their applications just because a vendor doesn’t support their preferred operating model in a particular location.

As we predicted last year, vendors are indeed converging on a public cloud storage operational model.

It’s unlikely that one vendor will dominate the market with a specific cloud operating model. While AWS remains the public cloud market leader and many services mimic its interface (the de facto standard S3 object storage interface is a good example), alternatives exist. Instead, vendors are attempting to abstract services with their own unifying control plane to provide customer choice with a consistent interface.

Customers therefore need to move their assessments up a level and look less at the storage specifics and more at the operational approach and control plane capabilities of the vendors. Is the vendor investing sufficiently in building out the interfaces and integrations to enable customer choice? Will the control plane support the infrastructure options you need both now and in the future? Or will you end up stranded on an obsolete approach that the vendor will deprecate as legacy and abandon for greener pastures elsewhere?

Wise customers will look first at their own business drivers and assess their operational approach. Will it support infrastructure that flexes and changes constantly? Is funding allocated by project, or is infrastructure treated as a product maintained with continuous investment and improvement? Alignment of operational models will only increase in importance as the STaaS market matures.

7. Analyst’s take

The cloud isn’t a place; it’s a state of mind. The broad middle of enterprises (not just the early adopters) are starting to come around and embrace cloud options as at least part of their infrastructure choices. Since essentially every customer is demanding it, those vendors that tried to stay entirely on-site are finally adding cloud options into the mix, while those who swung too far toward cloud-only are bringing aspects of the cloud back on site. Public clouds, too, are finally embracing deployment options outside the cloud.

The cloud operating model – and the structure of its API-driven approach – is being taken up everywhere. SaaS, therefore, looks more and more like a public cloud service wherever we find it. It’s not merely a financing option to convert Capex to Opex while the interface to storage remains the same as traditional non-cloud options.

Customers want public cloud interfaces to their data, but they don’t always want their data in the public cloud. The big challenge is deciding which interface that should be. For some customers, unifying everything under a specific opinionated vendor offering makes sense. For others, flexibility and change are more important, but that can come with efficiency sacrifices.

The key is to look at what the data is being used for, both now and what is likely next year and beyond. Options that allow you to change your mind without substantial switching costs are the best hedge vs. uncertainty. This is less about moving the data itself than moving the way the data is accessed, such as doing development in the public cloud while running large, stable datasets on-site. A standard operational approach makes moving workloads around much easier.

All the vendors seem to be coming to the same conclusion: STaaS should look like a public cloud service as much as possible. Those who started closer to this end point have enjoyed a head start, but it is closing rapidly as even the most stubborn laggards decide to join everyone else.

8. Report methodology

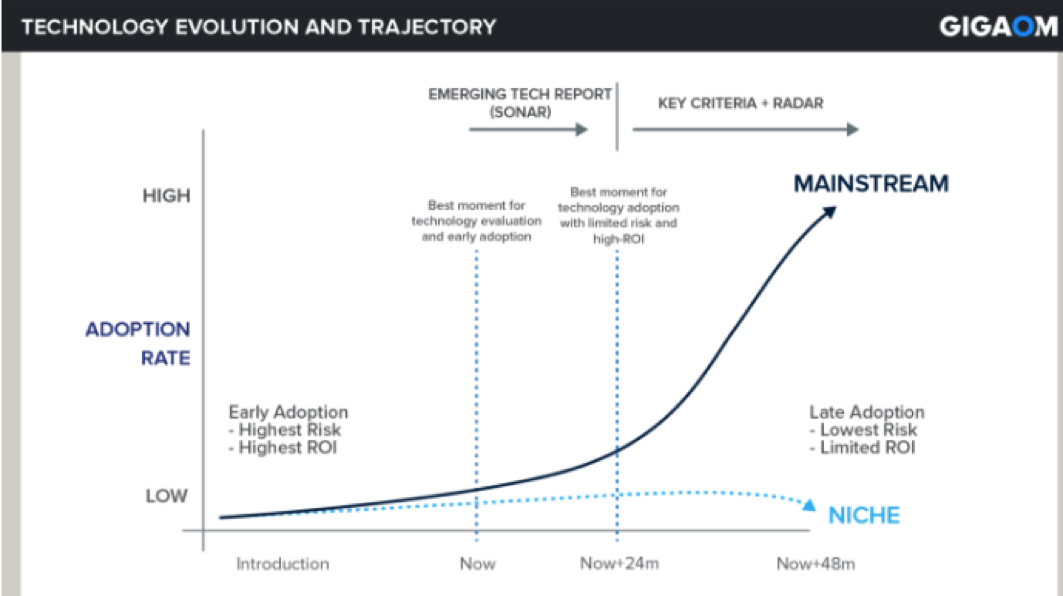

A GigaOm Sonar report analyzes emerging technology trends and sectors, providing decision-makers with the information they need to build forward-looking-and rewarding-IT strategies. Sonar reports provide analysis of the risks posed by the adoption of products that are not yet fully validated by the market or available from established players.

In exploring bleeding edge technology and addressing market segments still lacking clear categorization, Sonar reports aim to eliminate hype, educate on technology, and equip readers with insight that allows them to navigate different product implementations. The analysis highlights core technologies, use cases, and differentiating features, rather than drawing feature comparisons. This approach is taken mostly because the overlap among solutions in nascent technology sectors can be minimal. In fact, product implementations based on the same core technology tend to take unique approaches and focus on narrow use cases.

The Sonar report defines the basic features that users should expect from products that satisfactorily implement an emerging technology, while taking note of characteristics that will have a role in building differentiating value over time.

In this regard, readers will find similarities with the GigaOm Key Criteria and Radar reports. Sonar reports, however, are specifically designed to provide an early assessment of recently introduced technologies and market segments.

The evaluation of the emerging technology is based on:

- Core technology: Table stakes

- Differentiating features: Potential value and key criteria

Over the years, depending on technology maturation and user adoption, a particular emerging technology may either remain niche or evolve to become mainstream (see Figure 3). Sonar reports intercept new technology trends before they become mainstream and provide insight to help readers understand their value for potential early adoption and the highest ROI.

Figure 3. Evolution of Technology

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter