Veeco: Fiscal 2Q23 Financial Results

Veeco: Fiscal 2Q23 Financial Results

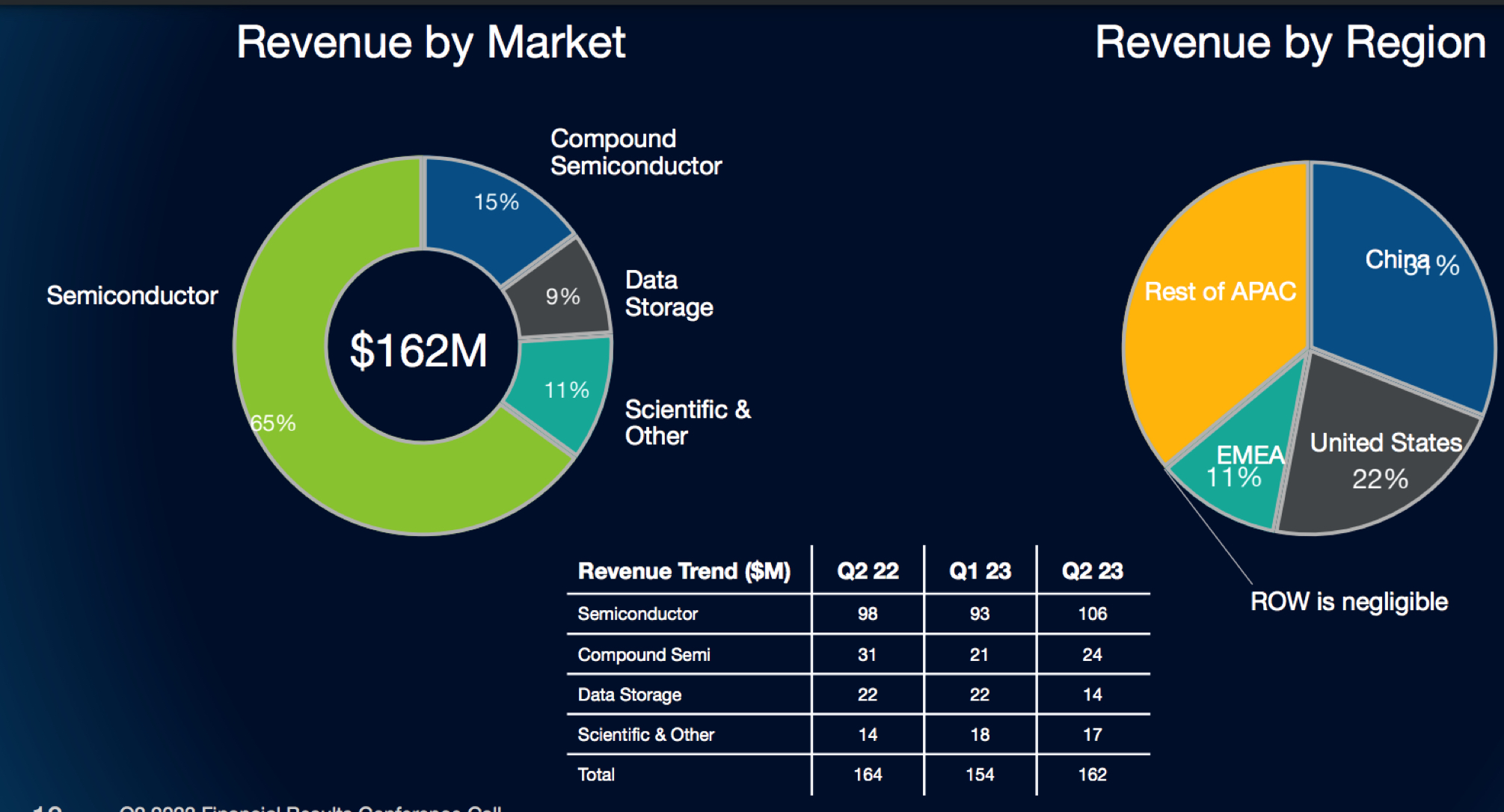

$13.9 million sales for storage, down 35% Q/Q and Y/Y

This is a Press Release edited by StorageNewsletter.com on August 15, 2023 at 2:02 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 164.0 | 161.6 | 320.4 | 315.1 |

| Growth | -1% | -2% | ||

| Net income (loss) | 9.7 | (85.3) | 23.0 | (76.6) |

2FQ23 Highlights:

- Revenue of $161.6 million, compared with $164.0 million in the same period last year

- GAAP net loss of $85.3 million, or $1.61 loss per diluted share, included a $97.1 million loss related to debt refinancing, compared with net income of $9.7 million, or $0.18 earnings per diluted share in the same period last year

- Non-GAAP net income of $20.6 million, or $0.36 per diluted share, compared with $20.0 million, or $0.35 per diluted share in the same period last year

Veeco Instruments Inc. announced financial results for its second quarter ended June 30, 2023.

“Veeco had another solid quarter with strong top and bottom-line non-GAAP results driven by record semiconductor revenue,” commented Bill Miller, Ph.D., CEO. “We continue to execute our Laser Annealing growth strategy in advanced node logic and memory by winning new customers and applications.”

“Veeco is uniquely positioned with differentiated technologies in secular growth markets. Looking ahead, we expect opportunities for our technologies to grow as customers continue to adopt our products for their most advanced node devices used for high-performance computing and artificial intelligence,” he added.

The following guidance is provided for 3FQ23:

- Revenue in the range of $155 million to $175 million

- GAAP diluted earnings per share in the range of $0.16 to $0.27

- Non-GAAP diluted earnings per share in the range of $0.30 to $0.40

Comments

Storage business totaled 9% of revenue, a decline from the prior quarter. The company offers ion beam equipment, with customers using its products to manufacture thin-film magnetic heads for HDDs.

Unfortunately, the HDD industry experienced contraction in exabyte shipments in 2022 and 2023, with uncertainty as to the timing of a recovery. However, recent analyst and industry forecasts predict nearline HDD exabyte shipments to grow at an approximate 20% to 25% CAGR over the coming years. Despite current industry challenges, the firm continues to expect revenue growth in 2023 based on the ship dates of orders in its backlog.

So it is expecting that, in 3FQ23, storage to be up, could be in the $30 million range.

Historical revenue for storage (in $ million)

| Period | Revenue |

| FY19 | 84.1 |

| FY20 | 123.3 |

| FY21 | 168.8 |

| 1FQ22 | 21.6 |

| 2FQ22 | 21.5 |

| 3FQ22 | 27.7 |

| 4FQ22 | 16.7 |

| FY22 |

87.5 |

| 1FQ23 | 21.5 |

| 1FQ23 | 13.9 |

| 3FQ23 (estim.) | ∼30 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter