Persistent Storage Solutions for Kubernetes-Based Applications

Selected and analyzed: Linbit, NetApp, Infinidat, IBM, HPE, Dell and Pure Storage

This is a Press Release edited by StorageNewsletter.com on August 7, 2023 at 2:02 pm This market report, published on July 18, 2023, was written for Gigaom by Joep Piscaer, technologist with team building and tech marketing skills, and background as a CTO, cloud architect, infrastructure engineer and DevOps culture coach having built many engineering and architect teams and culture, founder of TLA Tech, a tech marketing firm focusing on cloud-native having blogs at https://www.tla-tech.io/joeppiscaer/.

This market report, published on July 18, 2023, was written for Gigaom by Joep Piscaer, technologist with team building and tech marketing skills, and background as a CTO, cloud architect, infrastructure engineer and DevOps culture coach having built many engineering and architect teams and culture, founder of TLA Tech, a tech marketing firm focusing on cloud-native having blogs at https://www.tla-tech.io/joeppiscaer/.

GigaOm Radar for Enterprise Kubernetes Storagev4.0

Persistent Storage Solutions for Kubernetes-Based Applications

1. Summary

The adoption of cloud-native, container-based architectures and application modernization continues to fuel demand for persistent storage on Kubernetes platforms. Organizations understand that the benefits of cloud-native workloads in terms of performance, scalability, and portability are key enablers of achieving business goals.

Many enterprises already run cloud-native workloads and realize the advantages of more agile and flexible architectures, including application portability that enables frictionless workload movement from the data center to the cloud, and even across clouds. This provides greater flexibility and responsiveness to business requirements than using legacy technologies.

Storage solutions for Kubernetes environments have evolved since our last report, especially in the realm of migration and mobility, as well as in maturing enterprise features for security, advanced data services, and an enhanced developer experience.

A common pattern in adopting persistent storage solutions for Kubernetes is the reuse of existing enterprise storage solutions. This is considered a safe bet for the first couple of deployments, but these systems weren’t architected with the ephemeral nature of containers in mind. Often, older arrays can’t cope with the sheer number of backend operations required by Kubernetes at scale. However, vendors are quickly removing bottlenecks from their architectures to support containers at scale and stretching their product portfolio to include cloud storage services for multicloud use cases.

Compared to other types of storage systems, enterprise storage is highly scalable and secure, aiming to satisfy even the strictest requirements. Often, these systems are operated by trained storage administrators. However, this scenario has been slowly shifting to a self-service on-demand model, with developers requiring more direct access to storage operations to deploy and manage storage for their applications. This is a major boon for enterprise IT organizations looking for the smartest way to evolve their processes and align them with the latest business and technology requirements.

Organizations can now consider more factors than ever before, including financial and business issues, when choosing where their applications and data should run-and they want the freedom to decide where that should be. The public cloud is known for its flexibility and agility, but on-premises infrastructure is still better in terms of efficiency, cost, and reliability. With widespread adoption across cloud, edge, and on-premises, Kubernetes is instrumental in executing the vision of portable, flexible, and agile hybrid cloud strategies, making applications and their data portable and cloud-agnostic-for the most part. It needs the right integration with infrastructure layers-such as storage-to complement its still maturing native support for stateful storage.

It remains a significant task to select and implement a Kubernetes storage solution for persistent data that makes the most of Kubernetes’s application mobility and data portability capabilities.

With Kubernetes now supporting business-critical applications and services, requirements become more stringent. Scalability, performance, resilience, security, and other non-functional requirements are the order of the day, and Kubernetes needs to do it all to ensure a consistent level of throughput without service disruptions. These requirements drive the demand for enterprise stateful data services, solid security controls, mature multitenant performance management-like QoS and bandwidth throttling-and thorough alerting, reporting, and monitoring.

Lastly, enterprises do not want to be locked into any single vendor’s ecosystem as they reap the benefits of Kubernetes’s portable and agnostic promise, and they’re looking for a storage solution that works with feature parity across on-premises and cloud infrastructures.

This GigaOm Radar for enterprise Kubernetes storage will focus on general-purpose enterprise storage systems that include support for Kubernetes-based container environments in addition to supporting virtualization, bare metal, and other use cases. These general-purpose enterprise storage systems allow organizations to leverage existing deployed storage platforms to deliver persistent storage capabilities to Kubernetes without having to architect new solutions. These solutions are mostly suited to customers who are already running these storage arrays and are looking to add Kubernetes support for mixed-workload environments or large data centers with a sizable investment in storage infrastructure.

This is our 4th year evaluating the Kubernetes storage space in the context of our Key Criteria and Radar reports.

All solutions included in this Radar report meet the following table stakes-capabilities widely adopted and well implemented in the sector:

- CSI compatibility

- Snapshot functionality

- Operational and data security

- Cloud and platform support

This GigaOm Radar report highlights key enterprise Kubernetes storage vendors and equips IT decision-makers with the information needed to select the best fit for their business and use case requirements. In the corresponding GigaOm report Key Criteria for Evaluating Kubernetes Storage Solutions, we describe in more detail the capabilities and metrics that are used to evaluate vendors in this market.

2. Market Categories and Deployment Types

In this report, we’re evaluating enterprise storage, referring to traditional storage systems with support for Kubernetes-based workloads. These can be highly available controller- or appliance-based systems, software-defined architectures, or hyperconverged servers. A defining characteristic of these systems is that they support more than just Kubernetes and were not specifically designed to support Kubernetes. Support was added as Kubernetes gained popularity.

The preexisting architecture of these systems results in broader diversity in the ways they interact and integrate with Kubernetes, ranging from basic container storage interface (CSI) functionality to a wide array of integration points that make the storage system container-aware for provisioning and deprovisioning purposes.

While enterprise storage is generally resilient, highly available, and performant, it was not designed with Kubernetes constructs or the ephemeral nature of containers in mind. Though this may have initially created performance bottlenecks or problems with the operational overhead of the continuously changing metadata of containers, we expect no enterprise storage array with support for Kubernetes to suffer from these problems in 2023.

That said: we see that enterprise storage vendors are lagging slightly compared to their Kubernetes-native storage competition in terms of how quickly they support new features and standards as well as the general depth of support for them.

Keep in mind also that scaling of enterprise storage generally works very differently than scaling of Kubernetes-based applications. The misalignment between these two approaches may cause artificial or temporary bottlenecks as usage grows, causing operational overhead and complexities.

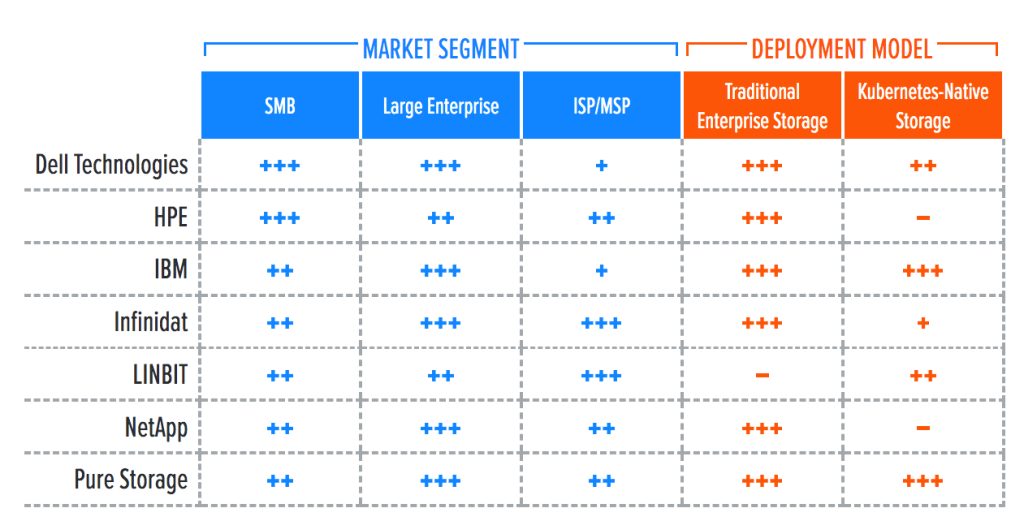

To better understand the market and vendor positioning (Table 1), we assess how well solutions for enterprise storage with Kubernetes support are positioned to serve specific market segments and deployment models.

For this report, we recognize the following market segments:

- SMB: In this category, we assess solutions on their ability to meet the needs of organizations ranging from small businesses to medium-sized companies. Also assessed are departmental use cases in large enterprises where ease of use and deployment are more important than extensive management functionality, data mobility, and feature set.

- Large enterprise: Here, offerings are assessed on their ability to support large and business-critical projects. Optimal solutions in this category have a strong focus on flexibility, performance, data services, and features to improve security and data protection. Scalability is another big differentiator, as is the ability to deploy the same service in heterogeneous environments, including on-premises and cloud. Finally, developer experience is weighed in this category because large enterprises often need self-service capabilities for their development teams.

- Independent service provider/MSP (ISP/MSP): In this category, solutions that are suitable for ISPs and MSPs are assessed. These should include additional security and multitenancy capabilities and the ability to throttle performance per tenant.

In addition, we recognize 2 deployment models for solutions in this report:

- Traditional enterprise storage: These are controller-based physical hardware arrays, often with hardware optimizations to reduce power consumption, physical space, and increase performance. These solutions serve block, file, and sometimes object storage.

- Kubernetes-native storage: These are hyperconverged, software-only architectures that run as container-based applications. They leverage the Kubernetes scheduler and other capabilities to serve up block (or file) storage to containers running on the same or another Kubernetes cluster, and utilize each compute node’s storage capabilities.

Key to a successful deployment is a solution’s ability to go where the data goes. In other words, it’s important to determine whether the storage solution can be deployed on-premises, in the cloud, at the edge, and at smaller ISPs. Such flexibility takes the solution’s architecture into account and indicates whether it can be deployed easily across the variety of environments organizations have to cope with.

Table 1. Vendor Positioning

+++ Exceptional: Outstanding focus and execution

++ Capable: Good but with room for improvement

+ Limited: Lacking in execution and use cases

– Not applicable or absent

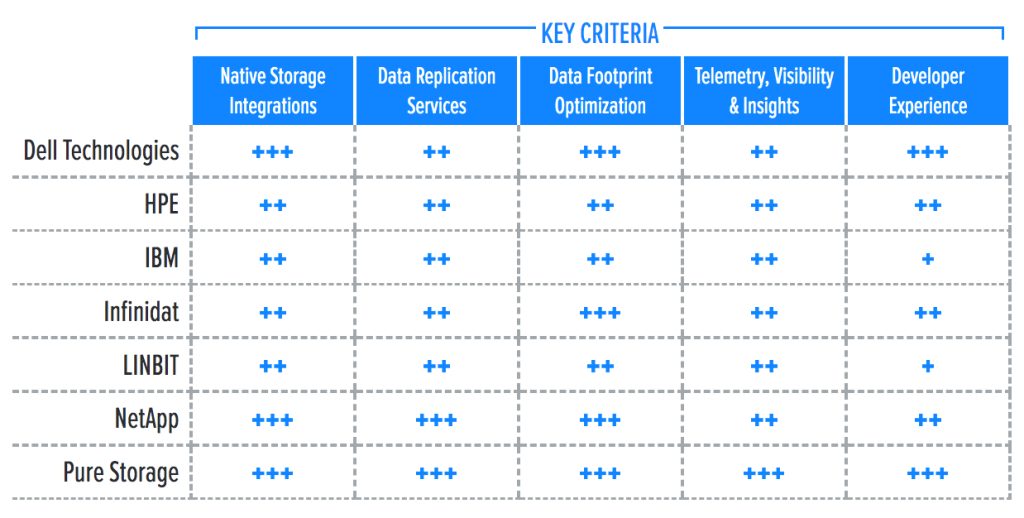

3. Key Criteria Comparison

Building on the findings from the GigaOm report Key Criteria for Evaluating Kubernetes Storage Solutions, Table 2 summarizes how each vendor included in this research performs in the areas we consider differentiating and critical in this sector. Table 3 follows this summary with insight into each product’s evaluation metrics-the top-line characteristics that define the impact each will have on the organization.

The objective is to give the reader a snapshot of the technical capabilities of available solutions, define the perimeter of the market landscape, and gauge the potential impact on the business.

Table 2. Key Criteria Comparison

+++ Exceptional: Outstanding focus and execution

++ Capable: Good but with room for improvement

+ Limited: Lacking in execution and use cases

– Not applicable or absent

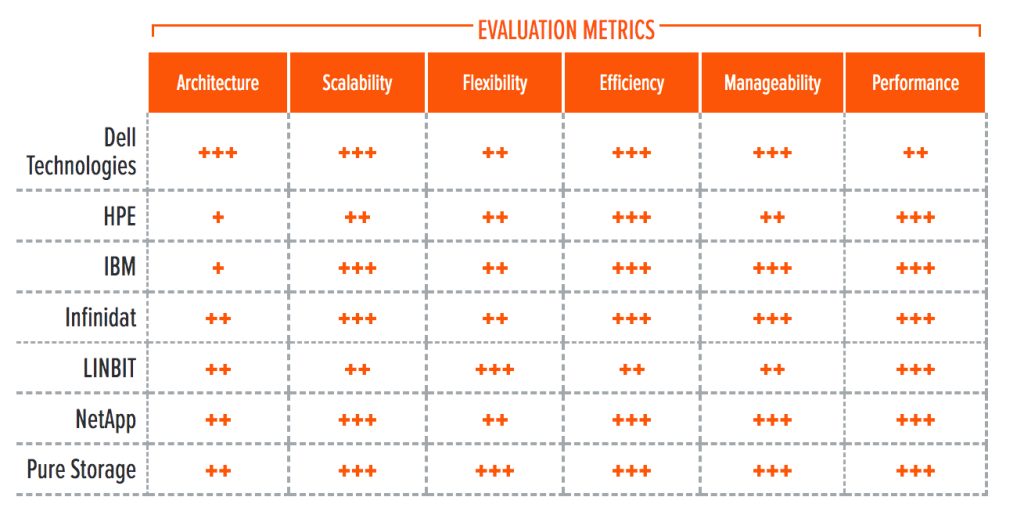

Table 3. Evaluation Metrics Comparison

+++ Exceptional: Outstanding focus and execution

++ Capable: Good but with room for improvement

+ Limited: Lacking in execution and use cases

– Not applicable or absent

By combining the information provided in the tables above, the reader can develop a clear understanding of the technical solutions available in the market.

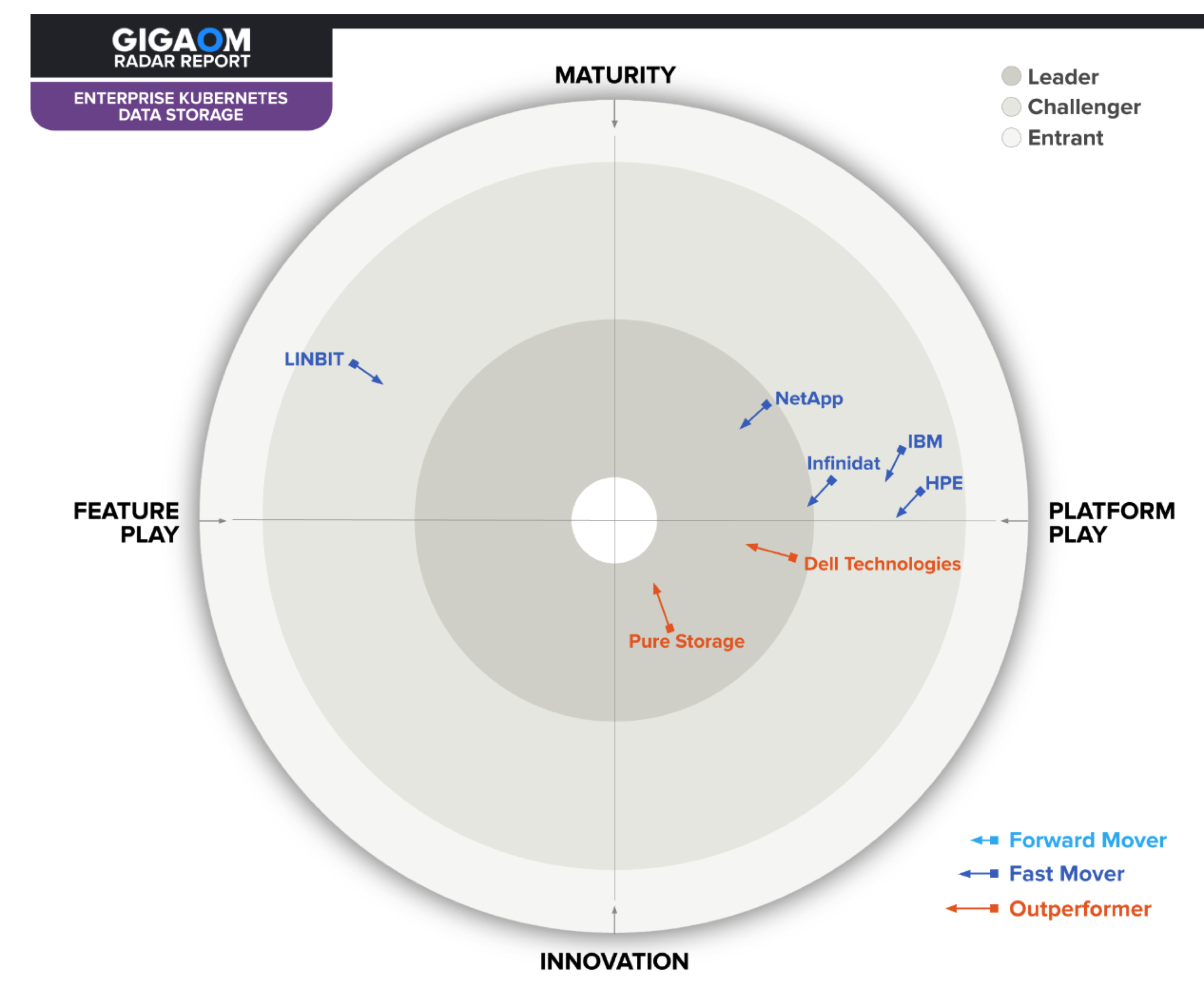

4. GigaOm Radar

This report synthesizes the analysis of key criteria and their impact on evaluation metrics to inform the GigaOm Radar graphic in Figure 1. The resulting chart is a forward-looking perspective on all the vendors in this report based on their products’ technical capabilities and feature sets.

The GigaOm Radar plots vendor solutions across a series of concentric rings, with those set closer to the center judged to be of higher overall value. The chart characterizes each vendor on two axes-balancing Maturity vs. Innovation and Feature Play vs. Platform Play-while providing an arrow that projects each solution’s evolution over the coming 12 to 18 months.

Figure 1. GigaOm Radar for Enterprise Kubernetes Storage

As you can see in Figure 1, Kubernetes storage solutions for the enterprise reflect a broad spectrum of solutions and various levels of development and maturity. Vendors in this Radar cater to a wide range of existing use cases, as these are systems that are already deployed into customer environments, serving bare metal, virtualization, and other use cases. Kubernetes support is a clear add-on, both from the customer use case perspective and the solution vendor’s point of view.

These are solutions that do more than just Kubernetes. For use cases specific to Kubernetes environments, sister report GigaOm Radar for Cloud-Native Kubernetes Storage dives into storage solutions suitable for new projects and greenfield deployments, with solutions aligning much closer to Kubernetes’s capabilities.

The bottom-right sector highlights the Innovation Leaders in enterprise Kubernetes storage. These category leaders, Dell Technologies and Pure Storage, have strong enterprise approaches, advanced data services, and well-executed developer experiences. Their high-quality, well-featured solutions cater to a wide range of use cases, with strong integration of Kubernetes into their storage platforms. They are bridging the old and new with plug-ins to add native support for Kubernetes to existing storage architectures.

On the top-right are 4 vendors that have mature storage solutions, but their integration of Kubernetes into their platforms is still developing. IBM, Infinidat, and HPE are amid a profound transformation initiative, replatforming, or launching a new product. NetApp has recently discontinued their exploration of a new storage architecture (with Astra Data Store) and has decided to move back to its Ontap core.

5. Vendor Insights

Dell Technologies

Its Container Storage Modules (CSM) lets customers use traditional storage arrays as multitenant, feature-rich enterprise storage for modern apps running on Kubernetes. This gives Dell customers a full set of data management features for Kubernetes infrastructure with replication, multitenancy, resiliency, and observability, delivering a great Kubernetes experience backed by enterprise storage.

Dell offers a rich Kubernetes storage portfolio optimized for many types of workloads, with an extensive list of enterprise features, supporting cloud, on-premises, and hybrid storage deployment models across its portfolio with CSI drivers for PowerFlex, PowerMax, PowerScale, PowerStore, and Unity. Dell PowerProtect Data Manager supports in-cloud backup protection on Amazon Web Services (AWS), Microsoft Azure and Google Cloud, helping to bridge the gap between on-premises Kubernetes environments and using the cloud for snapshots and backup. Support for application-consistent snapshots is a recent addition. Dell supports volume group snapshots, enabling consistent snapshots for more complex applications.

Dell’s CSM portfolio enables custom extensions for enterprise capabilities such as authorization, resiliency, snapshot replication and application mobility, encryption, and observability. These are all managed by a single operator. Its newly announced APEX Navigator for Kubernetes provides a multicloud, multicluster policy-based management pane to deploy and manage CSMs across many environments.

One of the CSMs enables mature monitoring, alerting, and analytics, as well as Grafana and Prometheus integration. This gives admins essential performance and capacity storage information that can be used to troubleshoot more complex application performance issues.

Dell’s recent focus on KubeVirt is notable, making Kubernetes the scheduler for not just containers but VMs as well, creating simpler and more integrated migration scenarios between VMs and containers.

Although Dell is clearly offering its customers a good set of features with the various CSMs, a cloud-native, Kubernetes-based storage solution is missing, which reduces the scope of use cases for where and how to deploy Dell-based storage for Kubernetes-clusters.

Strengths: Dell’s container storage modules are industry-leading extensions to the CSI, enabling advanced data services for Kubernetes-based environments backed by Dell storage. The effort and urgency that Dell is putting into adding capabilities to its portfolio is significant.

Challenges: Some features require additional products. The growing number of CSMs increases architectural complexity. A cloud-native storage option is missing from its portfolio, making Kubernetes-based edge deployments less compelling.

HPE

It adds Kubernetes support via its CSI drivers for Alletra, Nimble, Primera, and 3PAR, which run on vanilla upstream Kubernetes, Red Hat OpenShift, and HPE Ezmeral Runtime Enterprise. Notably, it also supports Amazon EKS Anywhere for on-premises and edge-like deployments. It has Helm charts and an operator for deployment.

Data protection is handled by the partner ecosystem (including Kasten and Commvault), and organizations can integrate their own data protection solution with the HPE Kubernetes storage of their choice.

Data optimization capabilities can be accessed by leveraging the underlying storage features, such as de-dupe and compression, outside of the CSI integration. Data footprint optimization features are present in the underlying storage systems but not exposed through CSI or additional plug-ins for self-service consumption.

The solution supports multitenancy features such as QoS, by which users can limit both IO/s and capacity usage, while it also supports encryption.

As the CSI spec gradually matures features and capabilities, HPE keeps a close watch on differentiating features in its primary storage family of products that could be suitable for implementing in CSI and Kubernetes.

While the CSI drivers are functional, the level of integration of Kubernetes into the storage portfolio is not remarkable, missing the mark on fully integrating storage functionality such as replication and data footprint optimization into the Kubernetes environment. This makes HPE less suitable for direct interaction with developer audiences because they will not be able to manage and operate storage for Kubernetes in a self-service manner and will still have to rely on storage admin teams for some of the interaction with storage systems. Similarly, telemetry and monitoring integration into Kubernetes environments is unremarkable and requires third-party tools.

Key features for large-scale fleet management are missing, and it is not yet possible to get full visibility of the storage resources consumed by a Kubernetes application through standard analytics tools.

Strengths: Offers Kubernetes storage capabilities throughout its storage product range, making it simple for organizations to operationalize Kubernetes deployments regardless of their size or the nature of their infrastructures.

Challenges: The absence of a Kubernetes-centric management plane across the entire product range creates unnecessary operational overhead and increases complexity.

IBM

It supports Kubernetes through its open-source CSI driver, available for IBM enterprise storage platforms, OpenShift, and vanilla Kubernetes clusters. In addition to a block storage CSI driver, it also supports IBM Spectrum Scale file-based storage through a second plug-in. It enables Kubernetes support for a broad range of IBM storage solutions, including block and file systems, as well as hardware and software-only deployments. However, there are some limitations in place for DS8000-based systems, and snapshot limitations resulting from its alpha status in the CSI spec.

The CSI driver supports the IBM DS8000 family, FlashSystem 5xxx, 7xxx and 9xxx, the Spectrum Virtualize family, and the SAN Volume Controller. This enables Kubernetes support for a broad range of IBM storage solutions, including block and file systems as well as hardware and software-only deployments in on-premises and cloud environments.

While the CSI driver is clearly a stop-gap solution for adding Kubernetes support to existing enterprise storage solutions, it’s a crucial step in the right direction for those running these systems to extend their relevance beyond traditional virtualization and bare-metal use cases. Moreover, IBM Storage Fusion can be layered on top of enterprise IBM storage to enable additional cloud-native use cases and architectures while leveraging investments in existing storage.

The underlying storage systems provide various advanced data services, like replication, de-dupe, and more, but there are no mature data portability or migration features to move to Kubernetes-based workloads, and there is no support for KubeVirt. IBM does not integrate all of its storage functionality into Kubernetes environments, requiring developers to work with storage teams to unlock this functionality.

Notably, the developer experience for IBM’s existing storage portfolio is lagging behind the competition, as its Kuberentes support is bolted-on and not (yet) integrated entirely. For a richer experience, IBM customers should look for IBM’s cloud-native solution, IBM Storage Fusion, which unlocks support for OpenShift.

Strengths: CSI driver unlocks Kubernetes support for its portfolio of enterprise storage solutions, enabling organizations to expand use cases beyond bare metal and virtualization.

Challenges: The lack of migration capabilities and lackluster developer experience make the CSI driver a stop-gap solution for existing customers. New customers should look at IBM’s cloud-native Storage Fusion or alternatives instead.

Infinidat

It focuses on high-performance, large-scale storage arrays and has recently introduced a software-only deployment option for public clouds. It offers a general-purpose mixed workload InfiniBox array, a platform for consistent performance and low latency: InfiniBox SSA, and an InfiniGuard data protection and secondary storage platform. To meet customers’ growing demands for Kubernetes support, the firm created a CSI-compliant driver, adding native support for Kubernetes objects and operations. The CSI driver is operator-based, making it easier to do lifecycle management.

Company’s scalable snapshots have been recently enhanced with immutability and air-gapping features for ransomware protection, and other core InfiniBox technologies, such as active/active synchronous and three-site replication options, are built around those snapshot capabilities. Various backup software platforms, including Kasten and Trilio, integrate with InfiniBox snapshots to provide application consistency and archiving options, as well as public cloud options. Infinidat also supports snapshot scheduling with its own software.

Multisystem management is done in the InfiniVerse SaaS service, which also boasts extensive performance monitoring. All metrics data is accessible through APIs, which can then be used with open-source tools like Prometheus and Grafana, as well as standard data center products such as ServiceNow.

The vendor’s architecture is designed for multipetabyte scale. The data plane gives customers low latency and bulk bandwidth and IO/s, and the control plane provides APIs that are non-blocking and scalable. The InfiniBox CSI driver leverages the same APIs as other user interfaces.

Firm’s customers typically require high resiliency and long infrastructure lifecycles, as well as the ability to mix workloads on the same systems-not just Kubernetes. This is seen in the company’s current support for Kubernetes as well as on its roadmap; neither of which feel bleeding-edge. Kubernetes is just one integration, and the company focuses on a wide spectrum, including VMware, OpenStack, and OpenShift.

The company checks the basic Kubernetes boxes and has solid CSI support, but it relies heavily on its partners for functionality like application-consistent snapshots and in-depth monitoring, which forces customers to invest in other tooling to provide a streamlined Kubernetes environment to their users.

Strengths: Has mature integrations with Kubernetes and its ecosystem, including backup solutions. Its roadmap for Kubernetes-related enhancements aligns well with its target audience.

Challenges: The offering is lacking in areas like application-aware snapshots and in-depth monitoring, which require third-party solutions.

LINBIT

It is the company behind DRBD, an open-source distributed and replicated storage system. LINBIT SDS is the company’s commercial offering, leveraging DRBD, LINSTOR, and other open-source technologies to create a software-defined distributed storage system focused on cloud-native applications, but that is also available for other orchestration platforms like OpenStack, CloudStack, OpenNebula, oVirt, Proxmox VE, and XCP-ng.

The storage solution is highly focused on performance optimization, minimizing the compute and memory footprint. Its direct integration into Linux with a kernel module reduces latency and resource consumption. It includes asynchronous and synchronous data replication, snapshotting, delta shipping (to other clusters or remote S3 buckets), and data reduction.

The solution’s architecture makes volumes accessible on every cluster node, and its integration with Kubernetes means it can change the R/W node for each volume depending on pod (re)scheduling. It is topology-aware and actively co-locates data with container workloads. LINBIT SDS is deployed as a collection of microservices. A controller manages the cluster configuration and resources. The satellite manages the creation, modification, and deletion of storage resources on each node. The storage layer is implemented as a kernel driver, several userspace management applications, and some shell scripts. Its support for ARM and other processor architectures is interesting for certain edge deployments.

LINBIT SDS scales to hundreds of cluster nodes and has a specific mode of operation using NVDIMMs for additional performance. It has native integration with Red Hat’s OpenShift but also runs on vanilla Kubernetes. Its operator-based deployment option automates most of the lifecycle management of the solution.

To cater to customer demand, LINBIT SDS supports both self-managed solutions on-premises and in the cloud (deployed to cloud VM instances and utilizing local or remote cloud block resources) or cloud-hosted Kubernetes clusters (like AKS and EKS).

Since our last report, the LINBIT SDS GUI has matured and is now on par with CLI and API interfaces.

Strengths: LINBIT SDS is a highly performant, flexible solution based on open source technologies and is eminently suitable for tech-savvy customers that need the performance and flexibility and those that need multitenancy, like service providers or big private cloud environments.

Challenges: The solution has a slightly higher-than-average learning curve due to its flexibility and open source nature.

NetApp

It delivers Kubernetes storage and data management services for its portfolio of enterprise storage solutions through Astra, a data management solution with its main feature set that focuses on application-aware data protection and mobility for container-based workloads, including snapshots and clones, backup and restore, and DR.

In conjunction with Astra Trident, an open-source, CSI-compliant dynamic storage orchestrator, Astra Control enables customers to consume and manage their storage resources across NetApp storage platforms. It integrates firm’s Ontap enterprise and native cloud storage offerings (including FSx, ANF, and CVS).

A key capability of Astra is its support for SnapMirror, which enables native storage migration between Ontap on-premises and in the cloud, allowing organizations to migrate to cloud-native architectures seamlessly. The ability to run Ontap in the cloud through various software-only offerings unlocks SnapMirror as an enabler of cloud migration scenarios.

Multitenancy is supported, with RBAC support and access granularity at the application level. At-rest encryption is supported with customer-provided and managed keys.

The company provides monitoring tools for the storage administrator via its Cloud Insights product, offering full stack observability for Kubernetes and the underlying data. Ransomware protection features are built into Ontap, not Astra.

Firm’s portfolio of storage products and services natively supports functionality like inline de-dupe, compression, and compaction. However, not all functionality is exposed through CSI or other plug-ins, necessitating the intervention of storage teams to enable these capabilities for developers. Astra Trident leverages storage efficiency functionality natively, supported by vendor’s storage portfolio and data movers.

Astra Control is a fully managed (SaaS) application-aware data management service that manages, protects, and moves Kubernetes workloads both in public clouds and on-premises. Optionally, Astra Control can be deployed as a self-hosted service.

Strengths: Has integrated Kubernetes into its portfolio of enterprise and cloud storage products with Astra, making it a great solution for those looking to run Kubernetes workloads on NetApp storage for its rich set of Ontap data services.

Challenges: With the recent discontinuation of Astra Data Store, Astra now relies exclusively on Ontap core, limiting its otherwise capable Kubernetes feature set to users of ONTAP on-premises and in the cloud. Its Astra capabilities progressed only marginally compared to last year’s report.

Pure Storage

It uses its cloud-native storage solution, Portworx, to unlock Kubernetes support for its enterprise storage products (FlashArray and FlashBlade), using its Essentials edition, and has sunsetted any direct CSI integrations of its enterprise portfolio.

Portworx PX-Store aggregates and pools storage capacity and a series of advanced data management components. It is a modern, distributed, container-optimized storage solution with elastic scaling, storage-aware class-of-service, multiple-writer shared volumes, local snapshot capabilities, and multiple failover options (node-aware, rack-aware, availability zone-aware). Local synchronous replication for data center HA is also supported.

Stateful snapshot capabilities are available, as is the ability to perform Cloudsnap backups to cloud storage. Auto-scaling groups are available and support AWS, Azure, and Google Cloud Platform (GCP). Encryption is available at the cluster level when customers bring their own key management system. Optionally, PX-DR and PX-Backup add additional data protection features.

The integration of Portworx on Pure controller-based architectures enhances data efficiency because users benefit from the data reduction capabilities offered by the storage arrays, which are superior to those offered by the standalone Portworx solution.

Portworx is managed through PX-Central and integrates with Pure Pure1, which consumes telemetry data from Portworx and delivers best-in-class app-centric analytics and, eventually, recommendations.

Although Portworx Essentials may feel limited compared to the standalone Portworx product, it allows organizations to seamlessly deploy cloud-native workloads on a proven Kubernetes storage solution. As their needs grow, they can effortlessly migrate those workloads to the full Portworx solution if they decide to adopt it.

Similarly, company’s recent focus on KubeVirt is notable, making Kubernetes the scheduler for not just containers but VMs as well, creating simpler and more integrated migration scenarios between VMs and containers.

Strengths: Portworx Essentials allows existing Pure customers to get acquainted with the Portworx experience without re-architecting their storage. The solution delivers a consistent experience that customers can reuse if they adopt the full Portworx product. The product offers excellent data efficiency and management with good monitoring capabilities.

Challenges: The solution offers limited data management and security features, although that’s understandable because of overlap with the potential full Portworx implementation and Pure’s focus on Portworx as a separate, mature product line.

6. Analyst’s Take

The products covered in this report are storage solutions with an existing installed base, for which adding Kubernetes support is a crucial lifeline to extending the investments in these platforms beyond bare metal and virtualization. While organizations using these solutions require Kubernetes support, it’s neither greenfield nor exclusive; and these solutions must continue to support bare metal and virtualization and existing environments.

For these solutions, integrating Kubernetes into their systems through CSI is a logical step, but CSI support is no longer a differentiator in the enterprise storage space. Vendors are clearly looking to bridge the gap between enterprise storage and cloud-native use cases with additional solutions, functionality, and capabilities, each associated with their own strengths and drawbacks.

Relative differences among vendors in this year’s report continue to diminish, indicating a slowdown in innovation as companies instead invest in cloud-native persistent storage solutions for Kubernetes.

However, switching storage platforms is non-trivial, requiring significant investments in new storage technologies, migration efforts, and associated application replatforming, all of which require time. The solutions discussed in this report are helpful tools that let customers start or accelerate these replatforming efforts, and most offer adequate support for Kubernetes, including data portability, data protection, and other advanced data services to make this shift happen.

However, migration support from these legacy architectures into more modular, cloud-native systems is surprisingly absent; these capabilities seem to be the exception, not the rule, for solutions in this report.

The Leaders circle (Figure 1) includes 2 companies – Dell and Pure – that are able to overcome hurdles in CSI and deliver a mature set of features to Kubernetes-based environments.

That does not mean that those solutions offer the only or even the best approach to delivering persistent storage to Kubernetes environments; our sister report GigaOm Radar for Cloud-Native Kubernetes storage dives into storage solutions suitable for new projects and greenfield deployments, with solutions aligning much closer to Kubernetes’s capabilities.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter