NAND Market: New Hope in Late 2023?

As all NAND suppliers experienced operating losses in 1Q23

This is a Press Release edited by StorageNewsletter.com on July 10, 2023 at 3:01 pm- The year 2023 is anticipated to be a significant year for the NAND market, with suppliers facing a substantial market downturn and increasing financial losses.

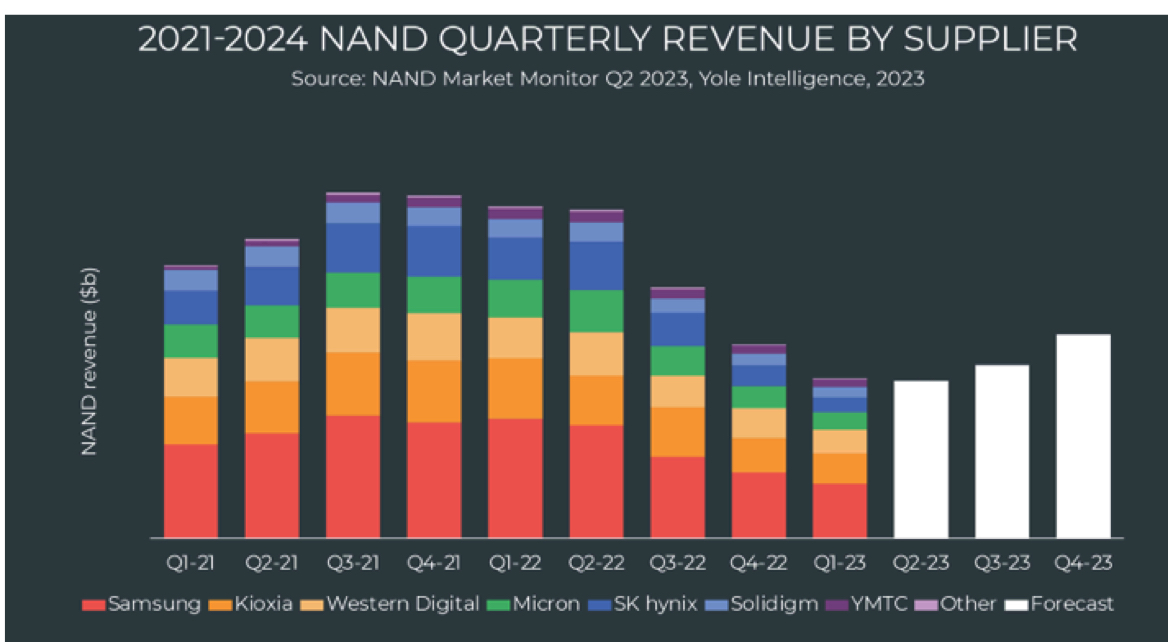

- NAND market conditions remained extremely weak in 1Q23, with soft demand and elevated supplier and OEM inventories resulting in bit shipment declines and falling ASPs.

- All NAND suppliers experienced operating losses in 1Q23, as a result of significant ASP declines and inventory write-downs by multiple suppliers.

- Headwinds related to the global supply chain, inflation, and geopolitical issues will continue to hinder demand in the near-term.

According to Yole Intelligence, part of Yole group, the NAND market has faced numerous challenges in recent years, including a global pandemic, conflicts in Europe, trade tensions with China, and widespread inflation. Additionally, the market has experienced fab outages, supply chain issues, the entry of a new competitor from China, and industry consolidation. These events have reinforced the idea that uncertainty is the only constant in the memory markets.

Looking ahead, the long-term prospects for the NAND market are mixed. The market is influenced by emerging megatrends that drive significant growth in data generation and storage requirements for local, edge, and cloud applications. The demand for NAND is further boosted by the ongoing replacement of HDDs with SSDs based on NAND technology. However, the competitive dynamics in the NAND market are challenging, with several major suppliers, historically low profit margins, and increasing capital requirements.

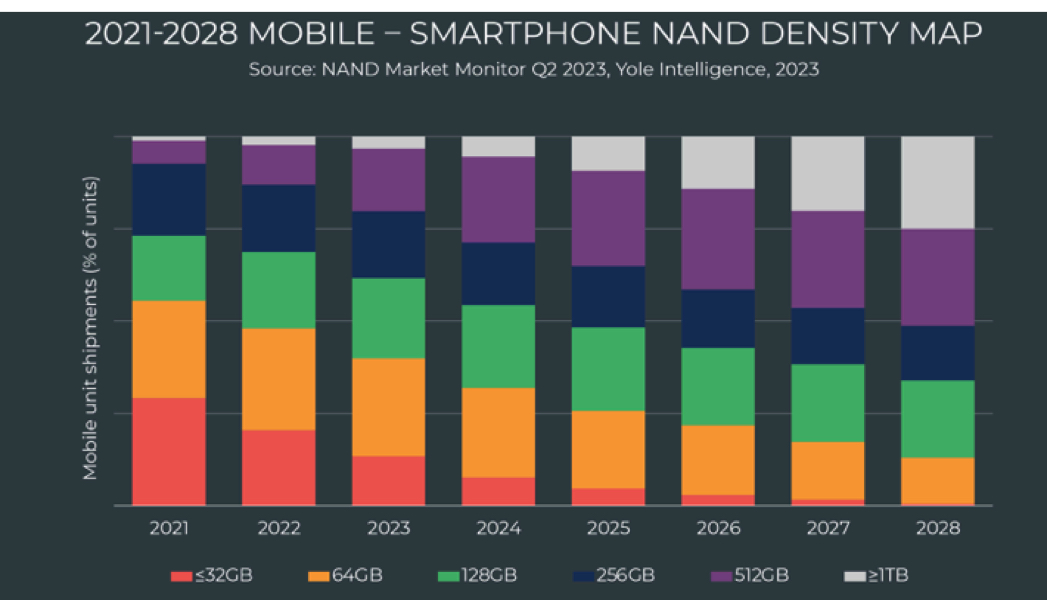

The demand for NAND is driven by various factors, including enterprise SSDs used by hyperscalers and traditional enterprise OEMs, the growing adoption of SSDs in PCs and gaming consoles, and the continuous increase in content storage in smartphones and other mobile devices. These segments will remain the primary drivers of NAND consumption, but emerging trends such as AI and VR adoption, autonomous driving, and the IoT are expected to contribute to future growth.

In terms of key players, Samsung is expanding its manufacturing capacity in Pyeongtaek, South Korea, and Xi’an, China. A Kioxia/Western Digital merger is rumored (in lieu of a Kioxia IPO), while SK hynix has acquired Intel’s NAND/SSD business, which has been renamed Solidigm. Despite its relatively small market size, Micron remains a leader in 3D NAND technology. China’s Yangtze Memory Technologies Co. (YMTC) has made impressive technological progress but faces uncertainties due to recent sanctions imposed by the US.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter