Compute and Storage Cloud Infrastructure Spending Continued to Grow

As prices soared in 1Q23

This is a Press Release edited by StorageNewsletter.com on July 6, 2023 at 2:02 pmAccording to the International Data Corporation‘s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud deployments, including dedicated and shared IT environments, increased 14.9% Y/Y in 1Q23 to $21.5 billion. Spending on cloud infrastructure continues to outpace the non-cloud segment with the latter declining 0.9% in 1Q23 to $13.8 billion. The cloud infrastructure segment saw unit demand down 11.4%, but ASPs grew 29.7%, driven by inflationary pressure as well as a higher concentration of GPU-accelerated systems being deployed by cloud service providers.

Spending on shared cloud infrastructure reached $15.7 billion in the quarter, increasing 22.5% compared to a year ago. Continuous strong demand for shared cloud infrastructure is expected to surpass non-cloud infrastructure in spending in 2023. The dedicated cloud infrastructure segment declined 1.5% Y/Y in 1Q23 to $5.8 billion. Of the total dedicated cloud infrastructure, 44.5% was deployed on customer premises during the quarter.

For 2023, the analyst firm forecasts cloud infrastructure spending to grow 7.3% compared to 2022 to $96.4 billion – a slight improvement from the prior outlook for the year of 6.9%. Non-cloud infrastructure is expected to decline 6.3% to $60.4 billion. Shared cloud infrastructure is expected to grow 8.4% Y/Y to $68.0 billion for the full year, while spending on dedicated cloud infrastructure is expected to grow 4.8% to $28.4 billion for the full year. The subdued growth forecast reflects the expectation that the market will face significant macroeconomic headwinds and curbed demand with cloud staying positive due to the drive for modernization, Opex focus, and continued growth in digital consumer services demand, while non-cloud contracts as enterprise customers shift towards capital preservation.

“Cloud infrastructure spending remains resilient in the face of macroeconomic challenges,” said Kuba Stolarski, research vice president, IDC’s infrastructure systems, platforms, and technologies group. “However, the segment is grappling with substantial price hikes and Q1 marked the second consecutive quarter of declining system unit demand. Although the overall outlook for the year remains positive, its growth hinges on the expectation that volume will drive it. Prolonged stagnation in demand could pose a significant obstacle to growth for the remainder of this year.”

IDC tracks various categories of service providers and how much compute and storage infrastructure these service providers purchase, including both cloud and non-cloud infrastructure. The service provider category includes cloud service providers, digital service providers, communications service providers, and managed service providers.

In 1Q23, service providers as a group spent $21.5 billion on compute and storage infrastructure, up 14.6% from the prior year. This spending accounted for 60.8% of the total market. Non-service providers (e.g., enterprises, government, etc.) decreased their spending 0.5% Y/Y. It is expected that compute and storage spending by service providers to reach $94.5 billion in 2023, growing at 5.6% Y/Y.

On a geographic basis, Y/Y spending on cloud infrastructure in 1Q23 increased in all regions except Central & Eastern Europe (impacted by the Russia-Ukraine war), China, and Canada. Spending in CEE declined 27.1% Y/Y, while China was down 20.4%, and Canada declined 4.9%. Latin America, USA, the Middle East and Africa, Japan, and AsiaPac (excluding Japan and China) (APeJC) grew the most at 39.2%, 34.3%, 33.5%, 17.1% and 16.4% Y/Y, respectively. Western Europe grew at 7.4% Y/Y.

For 2023, cloud infrastructure spending is expected to grow in all regions except CEE and Canada, with Latin America expected to grow fastest at 16.1%. All other regions (APeJC, Canada, Japan, Latin America, USA, and Western Europe) are expected to post annual growth in the 0-15% range.

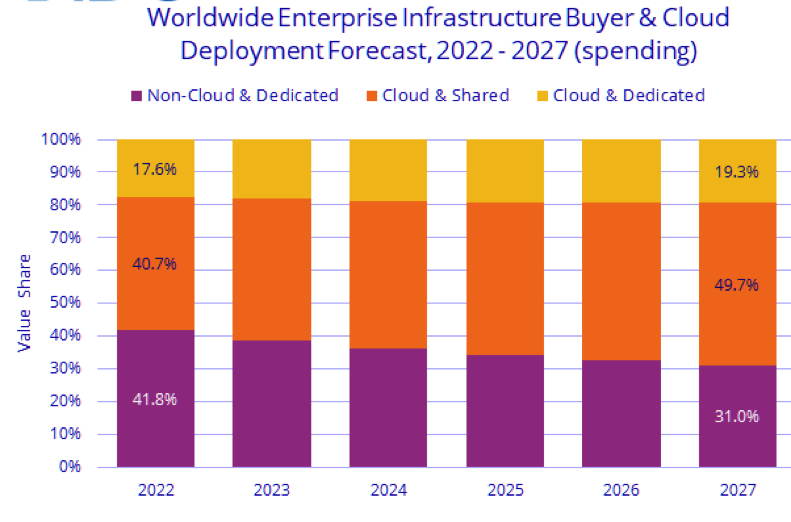

Long term, IDC predicts spending on cloud infrastructure to have a CAGR of 11.2% over the 2022-2027 forecast period, reaching $153.0 billion in 2027 and accounting for 69.0% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 72.0% of the total cloud amount with an 11.9% CAGR and reaching $110.1 billion in 2027. Spending on dedicated cloud infrastructure will grow at a CAGR of 9.6% to $42.9 billion. Spending on non-cloud infrastructure will grow at a 1.3% CAGR, reaching $68.6 billion in 2027. Spending by service providers on compute and storage infrastructure is expected to grow at a 10.6% CAGR, reaching $148.2 billion in 2027.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter