History 2002: Europe Imposes Anti-Dumping Files on Taiwan CD-Rs Imported

Up to 39.5%

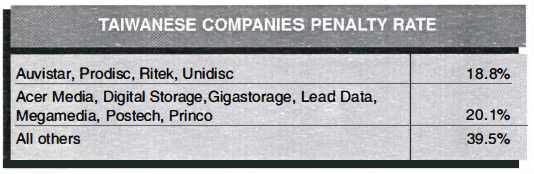

By Jean Jacques Maleval | June 26, 2023 at 2:01 pmEffective December 16, 2001, and for a probationary period of 6 months, the EEC has ruled that all Taiwanese CD-R manufacturers will be subject to an anti-dumpting tax of 39.5% for all exports to Europe.

Only a few companies that cooperated with the European organization’s investigation will enjoy a less severe tax schedule (see table below). Such is the case, for instance, of Ritek, the world’s number one manufacturer, but not of ≠2 CMC Magnetics, which refused to work with the European administration, and which, furthermore, boasts plants in Mexico, Hong-Kong not to mention the recent acquisition of a Mitsubishi facility in Ireland ideally situated to supply Europe.

This particular case dates back to February 2001, when the Committee of European CD-R Manufacturers (CECMA), which gives all appearances of having been created for this specific purpose, filed suit with the EEC vs. Taiwanese rival dumping.

The investigation that followed revealed that in 2000, the Taiwanese market share in Europe had attained nearly 60% of the market, compared to 24% two ears earlier, while at the same time, the percentage of European sales, all member countries combined, fell from 17% to 13%.

At the same time, and in spite of ever-decreasing production costs in Europe, European producers universally lost money in this sector – with 5 enterprises even giving up the business entirely in 2000 – all because of tremendous price drops for which the Taiwanese, when all is said and done, are not necessarily responsible.

In addition to this latest anti-dumping tax, consumers in Europe must factor in the private-use tax, which exists in a number of European countries in order to calculate the sale price of CD-Rs, not forgetting the royalties designated for the Philips/Sony/Taiyo Yuden trio for each media sold.

More than ten years ago, the EEC sought to protect its computer media manufacturers by implementing anti-dumping taxes. These were only partially successful however. Recall what happened with floppy diskettes, where European taxes were imposed on both Asian and US importers. The result: some Asian companies actually set up floppy factories in Europe, with the upshot that there are even fewer European floppy factories on the continent today.

What’s to stop Taiwanese companies from transferring their CD-R production outfits to another country, China for example? This would only lead to another EC investigation, at which point the plant in question would just move elsewhere.

As one major European CD-R buyer put it, “we can count on Asian dynamism enough that they will have sufficient lead time over European institutions.”

What’s more, the EEC hasn’t even laid the groundwork for enforcing the tax. Why deny the fact that the Taiwanese know better than anyone how to make CD-Rs, given the extent of their investment to date?

Isn’t it just a little bit hypocritical to stand by silently while certain European manufacturers source their media from Taiwanese firms, and then at the same time embark on a witch hunt?

Recently, a customer of Primedisc, the German joint venture between Philips and Ritek, complained about receiving CD-Rs he was misled to believe were made in Europe.

By the end of December, and therefore several days after the issuance of the EEC directive, we found CD-Rs at unit prices as low as €.44 in France and €.39 in Germany, even in small quantities: the tax is evidently not being added by everyone.

When custom duties become as high as this, it can only lead to the rise of illegal import channels. In any event, any protection afforded to local industry by assessing duties on imports will only be short-lived, even if Ritek did appear to be looking to eliminate competition by taking advantage of its massive production outfit to slash prices, without, incidentally, taking a loss. Call that dumping if you like, others would simply call it business strategy.

This article is an abstract of news published on issue 168 on January 2002 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter