History 2002: European Disk Systems Market Declines 14% in 2001

Compaq ≠1

By Jean Jacques Maleval | June 23, 2023 at 2:00 pm By Claus Egge, IDC research analyst, European storage systems (he passed away in 2012)

By Claus Egge, IDC research analyst, European storage systems (he passed away in 2012)

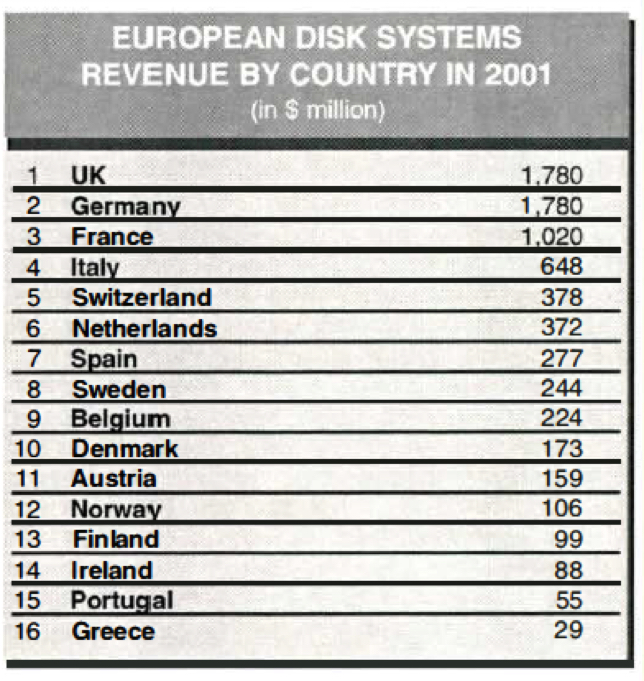

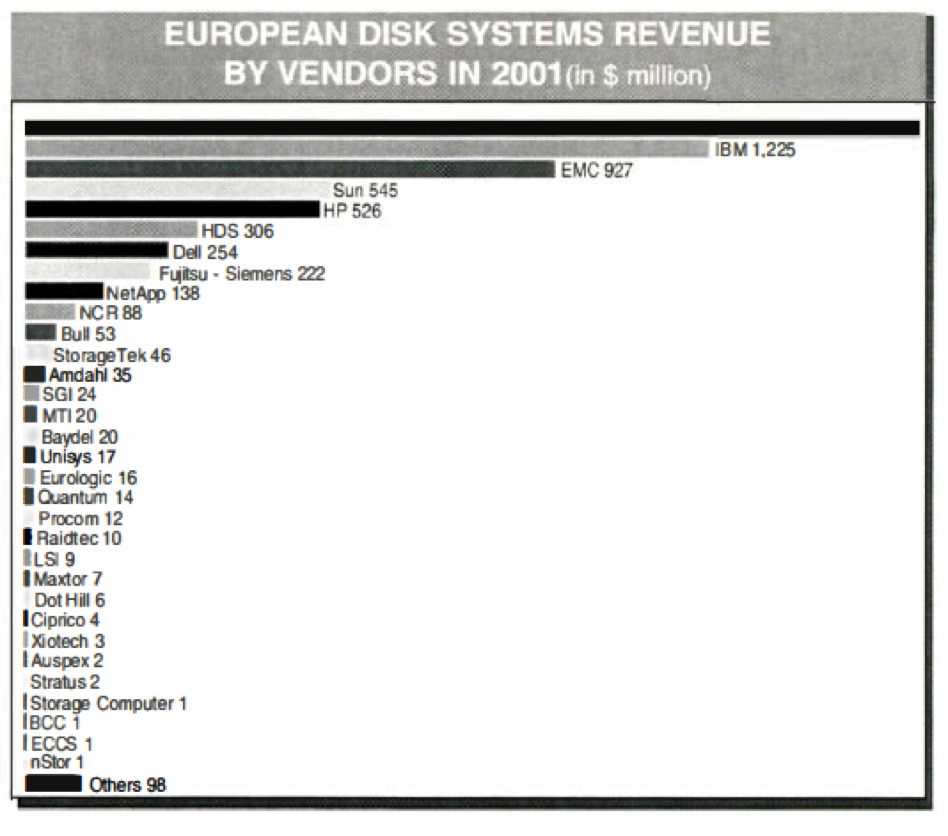

IDC, one of the foremost market research firms for storage subsystems offers not only an overview of the European market, but also a ranking of countries and major players in the field.

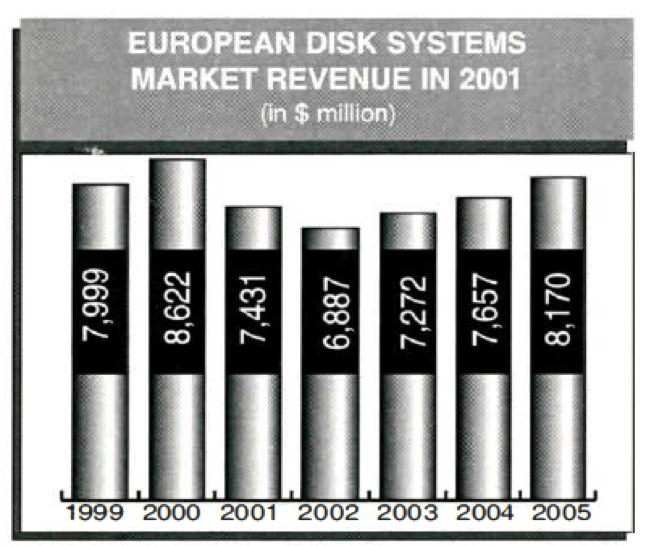

Here are the highlights: While the value of the 2000 European disk systems market was prosperous with almost 8% growth, 2001 went into reverse with a decline which we estimate will be pushing 14%. This perceived instability is more than anything down to the way business demand storage.

On the one hand, the IT departments are increasingly paying attention to the storage elements in their IT infrastructure and the composition of their budgets reflect this. On the other hand, enterprises understand that while they expect to add more sophistication to their storage when the economy is doing well, storage is mainly seen as capacity when economic conditions stagnate.

The result has been that businesses are conservatively investing in storage networking, but capacity utilization becomes a top priority when it is time to cut costs.

Over time, we plan that storage networking (SAN and NAS) will dominate with 68% of all European external storage sales in 2005.

The majority of the value in networked storage will come from SANs, as this is a segment with the most added value, and we forecast the SAN disk systems market to be worth $3,205 million in 2005 while the NAS will account for $1,309 million. This means that SAN will make up 39% of the market and NAS 16%.

This article is an abstract of news published on issue 173 on June 2002 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter