WW Enterprise SSD Revenue Falling by Nearly Half

Following slump in volume and price

This is a Press Release edited by StorageNewsletter.com on June 16, 2023 at 2:03 pmThis market report, published on June 1, 2023, was written by Bryan Ao, analyst at TrendForce Corp.

Slump in Both Volume and Price Leads to Global Enterprise SSD Revenue Falling by Nearly Half

An amalgamation of off-season effects and high inflation caused a slump in purchasing enthusiasm in markets like North American server ODM and China. This led to a surge in 1Q23 inventory levels for enterprise SSD suppliers, contrary to the anticipated reduction.

The situation was not remedied by a decrease in production either, forcing suppliers to resort to price cuts to boost shipment volumes. Additionally, the strain from high inflation eroded purchasing momentum in these markets, instigating a simultaneous dip in both volume and price for enterprise SSDs.

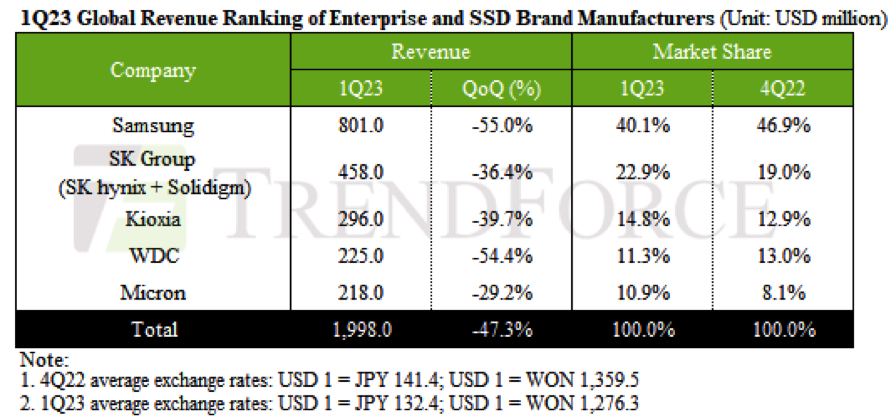

This resulted in a significant 47.3% decline in 1Q23 revenue, reducing it to $1.998 billion. However, after the 1Q23 inventory liquidation, there’s been a projected slight uptick in purchasing demand for server ODM orders in 2Q23. Consequently, enterprise SSD suppliers’ revenue is anticipated to revert to a growth trajectory in the second quarter.

Kioxia rose to 3rd place in 1Q23 despite its enterprise SSD revenue dropping 39.7% to approximately $296 million. Its long-term trajectory will be influenced by the potential completion of its merger with WDC. This merger could reshape future R&D strategies for enterprise SSD products. WDC may shift its focus toward the development of client SSDs if further opportunities for integration arise. Concurrently, Kioxia could channel more resources into enhancing customer verification processes. This strategic reallocation of resources could bolster the shipment volume of enterprise SSDs, promoting growth in the sector.

Samsung has been expanding its market footprint through aggressive pricing since 4Q22. However, significant revisions in server shipment targets for 2023 led to a contraction in 1Q23 demand for enterprise SSD orders, particularly from North American clients. Consequently, Samsung’s 1Q23 enterprise SSD revenue fell to $801 million, marking a Q/Q decline of 55%. Its 2Q23 revenue could experience a further dip as North American clients continue to make ongoing inventory adjustments, but a potential recovery is anticipated for the second half of the year. Notably, Samsung holds a competitive edge in technology with the launch of a 128-L PCIe 5.0 product. As the penetration rate of Arm-based server platforms escalates and the demand for AI servers is projected to surge, Samsung’s market leadership hinges on aligning its product development to meet the transmission speed requirements of these burgeoning platforms.

SK Group (SK hynix & Solidigm) also felt the impact of the general market slowdown, reporting 1Q23 enterprise SSD revenue of $458 million – a Q/Q decrease of 36.4%. A resurgence in demand is anticipated as China’s overall inventory liquidation strategy and total procurement volume gradually stabilize. This could result in SK Group’s 2Q23 enterprise SSD revenue growth rate and market share outperforming the average.

WDC, battered by order cuts and a price war, has seen its enterprise SSD shipments curtailed, leading to a 1Q23 revenue of $225 million – a staggering Q/Q drop of 50%. Furthermore, its current R&D pace for enterprise SSDs has lagged behind competitors with a notable decline in NAND flash profits this year, leading to the company opting to trim capital investment. This strategy may ultimately heighten competitive pressure on its enterprise SSDs. As itss primary North American clients increasingly shift to in-house manufacturing, the growth rate of enterprise SSD revenue could decelerate. However, this slowdown could be mitigated if WDC successfully obtains approval for its PCIe SSD solutions from a wider range of clients.

Micron experienced a downturn in 1Q23 due to a slump in server ODM demand, with its revenue falling to $218 million – a Q/Q decrease of 29.2%. Despite being the first supplier to introduce a 176-L PCIe 4.0 product, the launch was hindered by slower-than-expected verification progress and tepid market demand, which led to delayed shipment of the new products. Micron’s constraints in the Chinese market, which impact the shipment volumes of enterprise SSDs, necessitate an expansion of collaborations with clients in other regions. In particular, the progress of verification with North American clients will be crucial and will largely dictate its revenue performance.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter