Emerging NVMs Reaffirm Potential

With early adopters such as STMicroelectronics and NXP

This is a Press Release edited by StorageNewsletter.com on June 1, 2023 at 1:02 pm Published on May 25, 2023, this market report was authored by Diego Alfaro, Ph.D., a technology and market analyst working with the semiconductor, memory and computing division as part of the memory team at Yole Intelligence, part of Yole Group, in collaboration with Simone Bertolazzi, Ph.D., and Emilie Jolivet, director, semiconductor, memory and computing at Yole Intelligence.

Published on May 25, 2023, this market report was authored by Diego Alfaro, Ph.D., a technology and market analyst working with the semiconductor, memory and computing division as part of the memory team at Yole Intelligence, part of Yole Group, in collaboration with Simone Bertolazzi, Ph.D., and Emilie Jolivet, director, semiconductor, memory and computing at Yole Intelligence.

With early adopters such as STMicroelectronics and NXP,

emerging NVMs reaffirm their potential

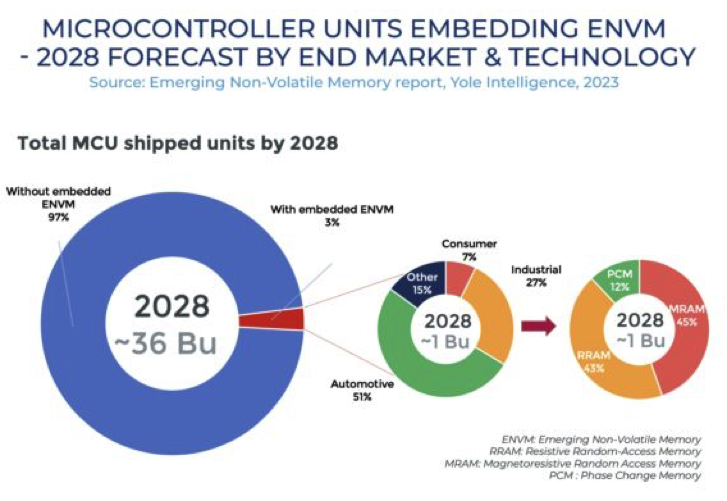

By 2028, Yole Intelligence forecasts that ~3% (~1 billion) of microcontrollers (MCUs) will embed emerging non-volatile memory (ENVM).

By then, the total embedded ENVM market is expected to be worth ~$2.7 billion*.

The latest announcement by NXP and TSMC to deliver the first automotive 16 nm FinFET embedded MRAM confirms the good market dynamics.

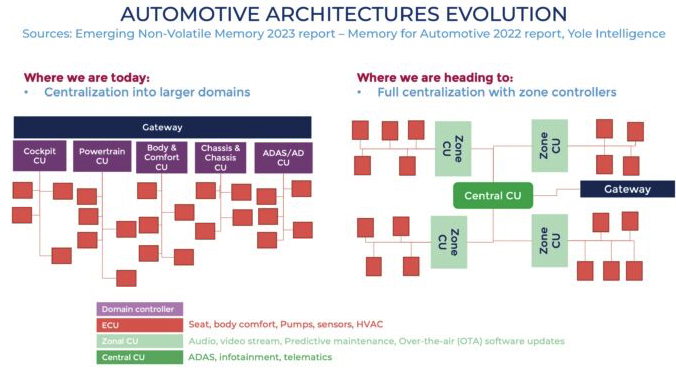

Automotive is one of the fastest-growing end markets in the semiconductor industry. The major technology trends include autonomy, electrification, connectivity, software-defined cars, zonal architectures, as well as enriched cabins with more complex infotainment systems. Semiconductors are essential to enable such trends while meeting stringent security and safety requirements, with microcontrollers and microprocessors driving innovation in embedded NVM.

Yole Intelligence proposes here an overview of NVM technologies and behind that the business opportunities. Alfaro invites us to deep dive into the memories’ technology and get a better understanding of the links between technologies, applications and business opportunities.

Bringing memory resources – either volatile or non-volatile – closer to the computing cores allows for optimizing the trade-off between power consumption and low latency. To do so, one of the main approaches consists of integrating computing macros with memory arrays on the same die (i.e., embedding the memory). In the case of NVM, there is a consensus in the industry that 28/22nm could be the end of embedded flash (eFlash), not because of scalability limitations but because of economic barriers. At 28nm, the number of photomasks required to implement eFlash is of the order of 40, with increasing numbers for smaller nodes, leading the industry to look for alternatives. Therefore, new solutions have been in R&D, known as emerging non-volatile memory (ENVM). Among them, Magneto Resistive Random Access Memory (MRAM), Phase Change Memory (PCM), and Resistive RAM (RRAM) have reached sufficient maturity for production, albeit in small volumes, by some of the leading foundries/IDMs in the industry: TSMC, GlobalFoundries, UMC, Samsung, and STMicroelectronics.

Recently, 2 announcements involving the leading Taiwanese chip manufacturer confirmed the excellent dynamics and prospects for embedded ENVM:

- In November 2022, the first microcontroller product for automotive applications employing embedded RRAM was announced by Infineon. Its AURIX TC4 MCU includes 20MB of non-volatile resistive memory and is manufactured by TSMC on a 28nm process. Though still in the sampling stages, production of the MCU is expected to ramp up in 2024/2025. In March 2023, Continental disclosed that it was developing an innovative modular platform using the AURIX MCU for zonal architectures in forthcoming cars.

- In May 2023, NXP and TSMC disclosed being in the development stage of embedded MRAM IP using 16nm FinFET technology for automotive applications. Sampling of the first products with embedded MRAM is planned for 2025.

The announcements reaffirm TSMC’s leadership in terms of ENVM scaling and maturity. Besides offering RRAM and MRAM in their catalog on technologies below 40nm, TSMC also developed 40nm BCD (Bipolar CMOS-DMOS) for Power Management ICs using embedded RRAM. The technology has been in mass production since 2021.

Another illustration of these trends is the adoption of PCM-type embedded ENVM in automotive MCUs by STMicroelectronics, in sampling since 2018.

ENVM will be key to enabling the ongoing revolutions in the automotive industry. Besides providing an alternative to eFlash for technology nodes below 28nm, they could offer performance improvements for data and firmware storage. For instance, some megabyte of code could be updated in a few seconds compared to eFlash, which takes about 1m,. NXP’s decision to integrate TSMC’s MRAM on a 16nm FinFET process is a milestone in terms of scaling for ENVM. So far, most developments below 22nm have remained at the R&D stage. The announcement reveals a rapid acceleration in the time to market of products conceived in such platforms in the coming years.

Simultaneously, the AURIX TC4 MCU family from Infineon implies a new push for embedded RRAM from foundries and top IDMs. Furthermore, the potential use of Infineon’s products for zonal architectures confirms the high potential market growth since several MCUs could be used per car.

* The embedded emerging NVM market size is evaluated based on assumptions of the average chip area occupied by a given memory technology and its associated cost.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter