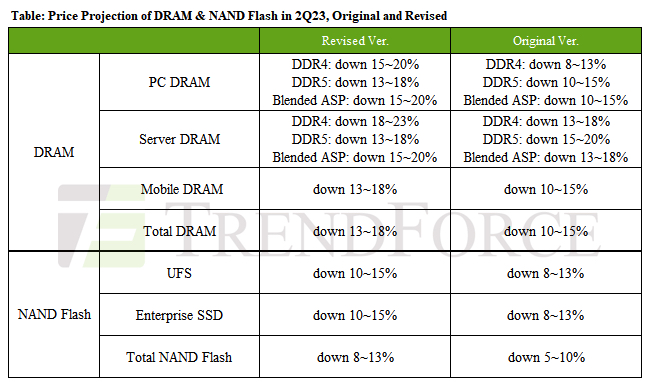

In 2Q23, DRAM Prices to Fall 13~18% in 2Q23, NAND Flash 8~13%

Due to weak server shipments and high inventory levels

This is a Press Release edited by StorageNewsletter.com on May 22, 2023 at 4:48 pmThis market report, published on May 9, 2023, was written by Avril Wu and Bryan Ao, analysts at TrendForce Corp.

DRAM and NAND Flash Prices Expected to Fall Further in 2Q23,

Due to Weak Server Shipments and High Inventory Levels

Research indicates that, as production cuts to DRAM and NAND flash have not kept pace with weakening demand, the ASP of some products is expected to decline further in 2Q23. DRAM prices are projected to fall 13~18%; NAND flash is expected to fall between 8~13%.

The significant drop in DRAM prices was mostly attributed to high inventory levels of DDR4 and LPDDR5 as PC DRAM, server DRAM, and mobile DRAM collectively account for over 85% of DRAM consumption. Meanwhile, the market share for DDR5 remains relatively low.

PC DRAM: Despite suppliers urgently reducing inventory, transaction volume has failed to increase due to the ample supply of DDR4. In contrast, prices for DDR5 are experiencing a far more moderate decline compared to DDR4 thanks to a tighter supply. Overall, the ASP of PC DRAM is expected to decrease by 15~20% in 2Q23.

Server DRAM: Weaker server demand has led to increased DDR4 inventory pressure on suppliers, with quarterly price declines expanding to 18~23%. The supply of DDR5 has been constrained owing to PMIC compatibility issues, narrowing the price decline for server DRAM in 2Q23 to 13~18%. However, given that DDR5’s market share remains low, its impact on price changes is limited, meaning the overall price decline in 2Q23 for server DRAM will remain between 15~20%.

Mobile DRAM: Smartphone brands have finally finished correcting their memory inventories meaning a higher purchasing momentum compared to last year. However, inventory pressure on suppliers continues to remain high, which means they are more willing to offer discounts. Buyers have been merging 3Q23 demand with 2Q23 to increase their bargaining power, causing the ASP decline of mobile DRAM to expand to 13~18% in 2Q23.

NAND flash is primarily affected by enterprise SSD and UFS price drops, and the oversupply situation in the market has yet to be resolved. These two products account for over 50% of total NAND flash consumption.

Enterprise SSD: Server demand continues to be revised downward, exacerbating inventory pressure on manufacturers. Order volume in China has not significantly increased following the lifting of lockdown restrictions. Orders for server ODMs have also struggled to grow due to high inventory levels, leading to the ASP decline of enterprise SSDs in 2Q23 to expand to 10~15%. Demand for enterprise SSDs is expected to grow significantly in 2H23 as new platforms are released and inventory levels continue to fall.

UFS: Smartphone brands have finally finished correcting their memory inventories meaning a higher purchasing momentum compared to last year. However, inventory pressure on suppliers continues to remain high, which means they are more willing to offer discounts. Buyers have been merging 3Q23 demand with 2Q23 to increase their bargaining power, causing the ASP decline of UFS to expand to 10~15% in 2Q23.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter