History 2001: Which Is ≠1, Compaq or EMC?

Contradictory press releases

By Jean Jacques Maleval | May 4, 2023 at 2:00 pmOn the same day, November 14, we were treated to 2 contradictory press releases: “Compaq StorageWorks overtakes EMC to become undisputed leader in disk storage,” read the headline of – you guessed it – Compaq’s announcement; while EMC sang a different tune, “EMC to finish 2001 as world’s #1 provider of extemal storage for 5th consecutive year, IDC reports.”

A week later, Big Blue entered the fray: “IBM has made undisputed gains vs. its competitors in the storage market.”

Just a few days later, a 4th player got involved: “IDC WW storage lists Xiotech one of the fastest growing external disk storage system vendors.”

How can it be that all 4 companies refer to the same IDC study, 2001 disk storage systems forecast and analysis? Who do you believe? Digging a little deeper, paradoxically, you have to believe all 4.

In fact, everything depends on how you say it, which part you take and consequently how you position yourself.

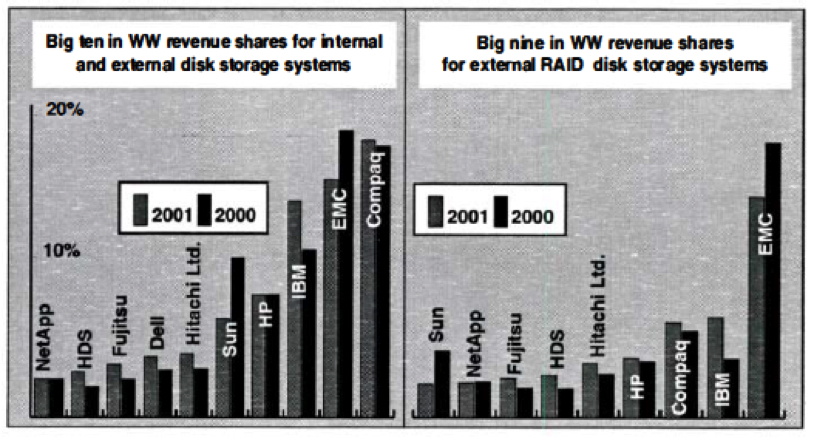

The IDC study was eagerly anticipated among storage subsystem competitors. Indisputably, in the research firm’s forecasts, Compaq does garner 1st place in the category for internal and disk storage subsystems combined, with $4.4 billion or 18.2% of the market, ahead of EMC.

The latter clearly lost ground, compared to its previous share, which fell from 18.8% to 15.6%. But the 2 companies don’t actually play on a level field, since EMC sells only external systems. If we include all storage revenues, that is to say, tape drives and automation products as well, Compaq would be even further ahead of EMC, which has no presence in the latter markets either.

Nevertheless, it’s far from certain that Compaq is the world leader in overall storage, since Seagate Technology reaped more than $6 billion for its fiscal year ended June 2001.

When IDC, however, counts only 2001 revenues for storage systems based on external RAIDs, EMC, even though it loses 6 points compared to 2000, remains incontestably the leader, with $3.8 billion or 25.3% of the WW market.

In this light, Compaq drops to ≠3 (11.0%) behind IBM (11.6%), which picked up 4.8% over last year, percentage increase that blows the other major industry players out of the water, in terms of pure market gain. It’s beginning to be clear how everyone wins.

To make the case for its own impressive growth, Xiotech, meanwhile, relies (without citing them) on IDC figures that show Xiotech’s sales multiplied by a factor of more than 5 from 1999 to 2000, even if the company is only ranked 18 in terms of revenue for external RAID subsystems.

Other data worth noting in the same market study:

- The HP-Compaq merger, which will combine $2.7 billion in external RAID revenues for 2001, will not unseat EMC as the leader in this category, but will nonetheless pave the way for clear leadership (26.3%) for combined sales of internal and external disk subsystems;

- The big winner in the external RAID market for 2000-2001 was IBM (+44.6%), while the main losers were EMC (-32.6%) and Sun (-58.0%).

- The market for disk storage subsystems grew annually by 10.4% in 2000, but is expected to cede 18.2% of its ground in 2001, for a total worth of $25 billion.

- Network Appliance’s share in the NAS market fell by 45% to 32.5%, due in particular to EMC’s entry on the scene, which resulted in WW revenue growth for the latter of 14%.

It’s worth noting that in all this spin rivalry, IDC’s figures themselves are not in dispute – no one doubts that the market research company covers the WW storage market better than anyone, although rival Trendfocus (limited to HDD hardware) is nothing to be sneezed at.

We have only one beef: if IDC really wants to ensure its continued credibility, it really needs to safeguard vs. companies hijacking its statistics at will, each claiming the ≠1 slot at something, ultimately at IDC’s expense. We’re not challenging the veracity of the individual claims, but rather the wisdom of IDC offering something for everyone.

Let’s face it, IDC gave these 4 companies invaluably good press, yet if only on the basis of this one moderately critical article (hey, we’re normally content just to reprint a neutral summary of most IDC reports), none of them returned the favor frankly, with 4 different takes each manipulating the same data 4 different ways, suggesting, however unwittingly, a certain complacency on IDC’s part at having its research spun as loosely as desired.

While analysts surely have an interest in selling good news, no one can put a price on credibility, and all good news must credibly be offset by the bad. The number of press releases citing IDC analysts may arguably be good PR for the research firm, but given how many of these end up hawking new products, it becomes difficult to separate IDC from the hype. And that can’t be good.

This article is an abstract of news published on issue 167 on December 2001 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter