Veeco: Fiscal 3Q22 Financial Results

Veeco: Fiscal 3Q22 Financial Results

Storage represents $27.7 million or 16% of total revenue.

This is a Press Release edited by StorageNewsletter.com on December 26, 2022 at 2:01 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 150.2 | 171.9 | 430.3 | 492.3 |

| Growth | 14% | 14% | ||

| Net income (loss) | 9.0 | 15.0 | 17.8 | 38.0 |

3FQ22 Highlights:

- Revenues of $171.9 million, compared with $150.2 million in the same period last year

- GAAP net income of $15.0 million, or $0.27 per diluted share, compared with $9.0 million, or $0.17 per diluted share in the same period last year

- Non-GAAP net income of $26.0 million, or $0.45 per diluted share, compared with $20.5 million, or $0.40 per diluted share in the same period last year

Veeco Instruments Inc. announced financial results for its third quarter ended September 30, 2022.

“With significant contributions from our laser annealing product line, as well as systems for advanced packaging and EUV mask blank production, we achieved another record revenue quarter in our semiconductor business which drove robust year-on-year revenue growth for the company,” commented Bill Miller, CEO. “Despite the challenging current macro environment, we continue to invest in executing our growth strategy, are well positioned with attractive technologies and we are optimistic about expanding our served available market.“

Outlook

- Revenue is expected in the range of $150 million to $170 million

- GAAP diluted earnings per share are expected in the range of $0.05 to $0.23

- Non-GAAP diluted earnings per share are expected in the range of $0.24 to $0.40

Comments

Among its multiple businesses, it is involved in storage with ion-beam etch and deposition processes for thin-film magnetic heads for high-density HDDs, referred as "data storage" by the company.

This activity represents $27.7 million or 16% of total revenue compared to $21.5 million in 2FQ22 and $39.3 million in 3FQ21.

Historical Revenue for Data Storage (in $ million)

| Period | Revenue |

| 1FQ19 | 19.6 |

| 2FQ19 | 22.7 |

| 3FQ19 | 24.1 |

| 3FQ19 | 17.6 |

| FY19 | 84.1 |

| 1FQ20 | 38.9 |

| 2FQ20 | 28.3 |

| 3FQ20 | 36.9 |

| 4FQ20 | 19.2 |

| FY20 | 123.3 |

| 1FQ21 | 41.0 |

| 2FQ21 | 52.0 |

| 3FQ21 | 39.3 |

| 4FQ21 | 36.5 |

| FY21 | 168.8 |

| 1FQ22 | 21.6 |

| 2FQ22 | 21.5 |

| 3FQ22 | 27.7 |

| FY22 (estim.) | ∼120.6 |

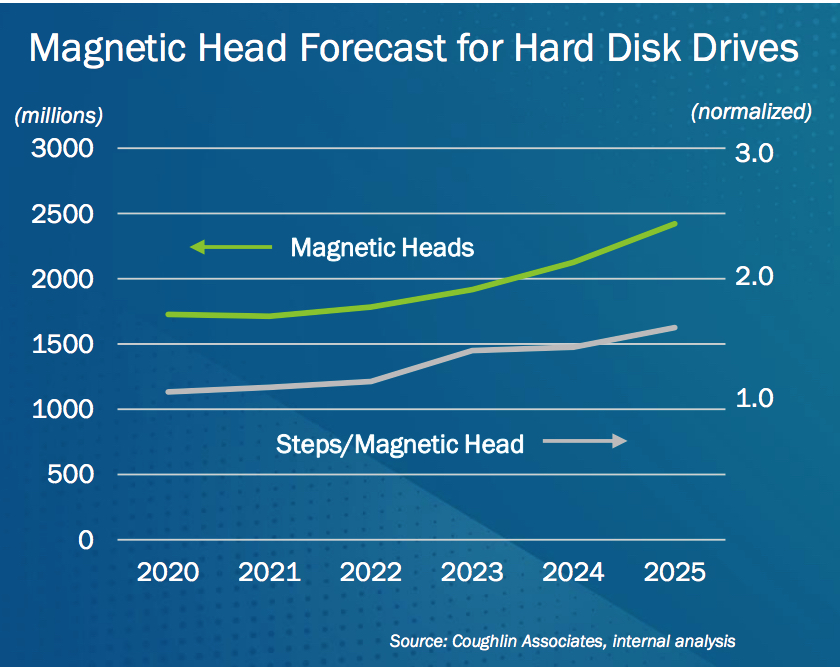

Outlook for data storage market

- Revenue decreasing ~45% in 2022.

- Expecting market to recover in 2023 on sound fundamentals and order activity

- End market storage growth ~30% CAGR

- Manufacturers projected to continue increase in heads per drive and number of process steps per head

- Combination of increased head demand and complexity expected to drive equipment sales over next several years

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter