History 2000: Market Down for High-Performance Tape

But surprising turnaround expected

By Jean Jacques Maleval | December 16, 2022 at 2:00 pmA new study published by Freeman Reports projects a recovery in the performance tape market sector after years of sluggishness as users shift to new tape technologies such as StorageTek’s 9840 and IBM’s Magstar.

“New, small form factor tape technologies such as Ultrium and SuperDLT will meet surprising resistance, despite their apparent price advantage, as they attempt to elbow their way into the high-performance tape market,” said Robert C. Abraham, author of the report, Performance Tape Outlook ($2,495).

SAN implementations of tape, primarily configured in automated tape libraries, will fuel the growth for high-end tape.

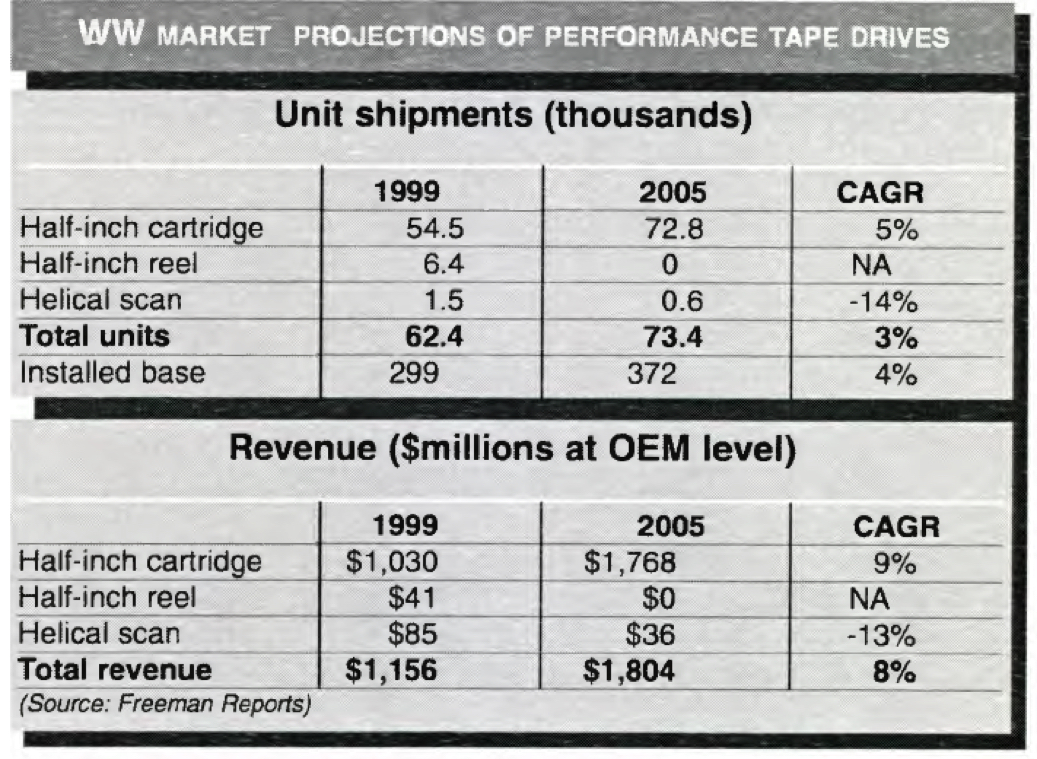

Industry shipments for all classes of high performance tape drives – including half-inch cartridge, half-inch reel, half-inch helical, and 19mm technologies – declined 2% to 62,400 units in 1999 and will decline an additional 13% in 2000 before climbing to 73,400 units in 2005, a 3% CAGR growth from 1999.

Despite the unit shipment declines in 1999 and 2000, combined revenue from these products, measured at an OEM level, rose by 7% to $1.16 billion in 1999 and will increase each subsequent year to $1.8 billion in 2005, equivalent to an 8% annual rate.

“This difference in overall growth rates reflects the decline of low-cost older technology products such as half-inch reel and 18-track half-inch cartridge combined with the growth of very high performance products such as Magstar and 9840,” states the author.

The report shows that the decline in unit shipments of older technology drives is larger than the growth of newer technology drives through 2001.

After that point, the increase in new technology shipments more that offsets the decline in older tape drive shipments.

“Substantial shipments of FC interface drives, the preferred interface for SAN, will be a key factor contributing to the first rise in high performance tape drive shipments since 1996. The growth of SAN provides unprecedented opportunities for secondary storage,” declares Abraham.

Total industry revenue for high performance tape drives moved up in 1999 principally due to a large increase in high-end 9840 drive shipments from StorageTek. The fast access of these drives, combined with virtual storage capability, enable their use in the most demanding applications.

According to Abraham, “These revenue increases accentuate the shift in product mix from lowc apacity drives to higher-capacity network-oriented devices. Excellent growth opportunities exist at the high-end due to the growing need posed by network storage requirements. And despite the expected squeeze on the high performance tape segment from lower-priced, small form factor drives such as Ultrium and SuperDLT, users are not expected to migrate away from these high performance devices.”

This article is an abstract of news published on issue 154 on November 2000 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter