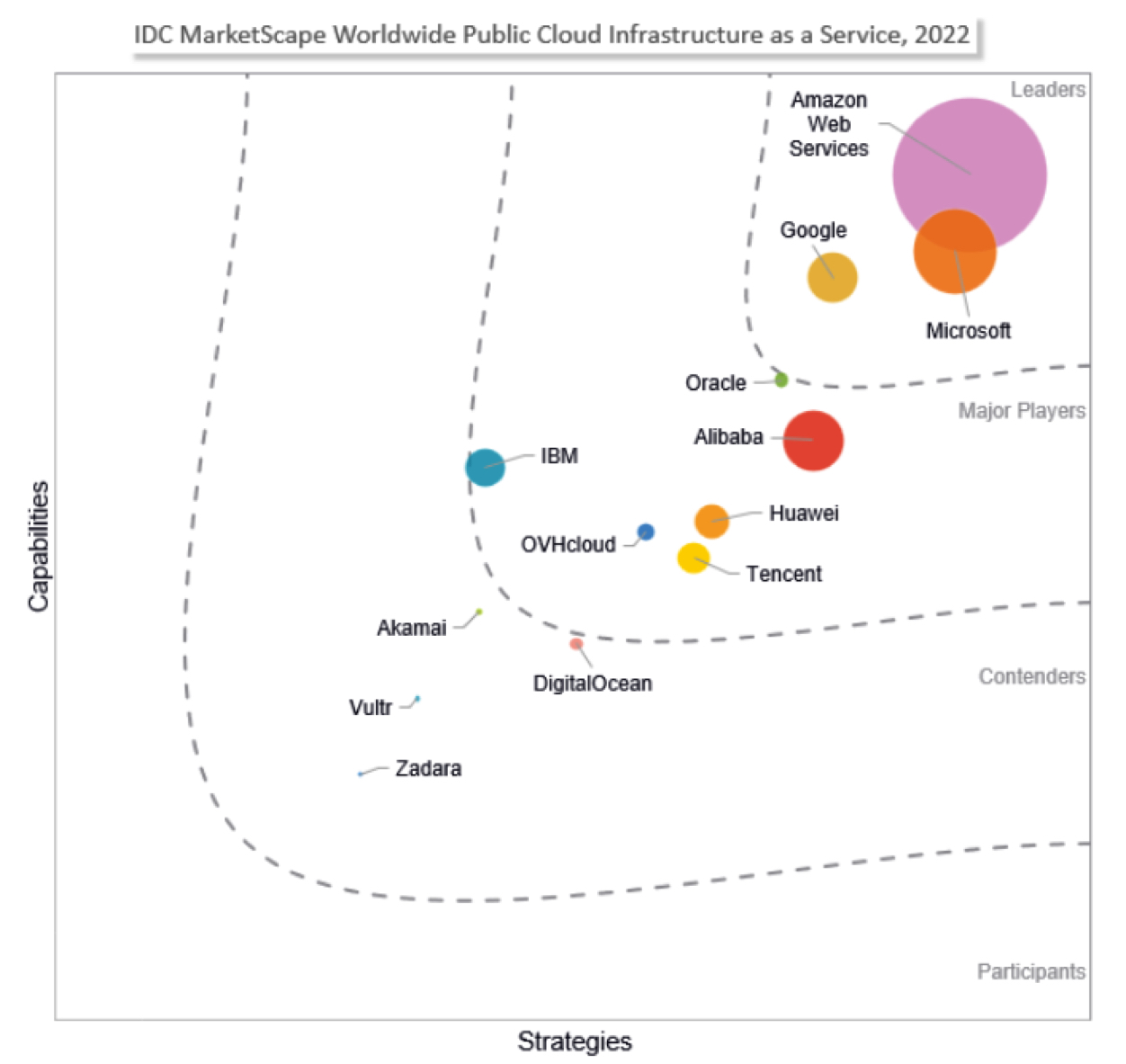

WW Public Cloud Infrastructure as-a-Service 2022

Leaders AWS, Google and Microsoft

This is a Press Release edited by StorageNewsletter.com on November 29, 2022 at 2:01 pmThis market report, published on November 2022 by OVHcloud SAS, was written by IDC Corp.‘s analysts Dave McCarthy, Chris Kanaracus, Rachel Liu and Jasdeep Singh.

IDC MarketScape Worldwide Public Cloud Infrastructure as a Service Vendor Assessment

IDC opinion

Public cloud IaaS continues to see rapid growth as companies WW move workloads to the cloud and create new cloud-native applications. Public cloud IaaS spending rose 35.6% in 2021 to $91.3 billion, driven not only by customer preferences for the cloud but compelled by the onset of the Covid-19 pandemic. Even as the deadly disease is coming under control, thanks to the widespread availability of vaccines and natural immunity, the analyst firm does not expect companies to pull back their use of public cloud IaaS. In fact, it estimates show that spending on public cloud IaaS will overtake the total spent on traditional infrastructure and private cloud in the next several years.

Since the publication of previous IDC MarketScape for public cloud IaaS in 2020 (see IDC MarketScape: Worldwide Public Cloud Infrastructure as a Service 2020 Vendor Assessment, IDC #US46795720, September 2020), the segment has undergone an evolution, thanks to the continuing maturity of hyperscale platforms, the arrival of new players, and a continued rollout of new regions and zones across the world.

There is also a stronger understanding of cloud computing as an operating model for IT, and not something pegged to where infrastructure is located. Public cloud IaaS providers have aggressively expanded their footprints to on premises and edge locations, giving customers the benefits of cloud – scalability, elasticity, and consumption-based pricing – along with advantages such as security and latency associated with the latter 2 options. Moreover, public cloud IaaS providers are becoming increasingly cognizant of the rising interest in sovereign clouds and are adjusting their plans accordingly.

In the 2 years since last IDC MarketScape for public cloud IaaS, customers have a better, richer array of options, thanks to strategic decisions taken by vendors to gain competitive advantage.

The following are some examples of this dynamic in action:

Innovative partnerships exist between software vendors known primarily for their on-premises options and public cloud IaaS providers with the services in many cases delivered natively by the cloud provider. This reflects competitive battle lines being redrawn or even erased, as traditional providers and public cloud IaaS leaders find that deep cooperation is good for customers and thus good for business.

- The movement of once single-focus cloud providers into adjacent areas, such as adding compute to storage, provides new alternatives for IaaS.

- The arrival of managed 5G network services allows customers to set up 5G networks directly from cloud provider consoles.

- While cloud computing has long been dominated by x86 infrastructure, this is changing today with the availability of ARM-based instances as well as custom silicon. Using ARM may require some rewriting of applications, but it offers compelling advantages around cost performance ratios. It is expected rapid expansion and uptake of ARM in the public cloud IaaS market in coming years.

- The move by major ISVs to decommission their own datacenters and shift operations to public cloud is also a major trend. The trend caters to customers that want their SaaS applications and data running close by for privacy and regulatory reasons. This too is a reflection of the sovereign cloud trend.

- Multicloud continues to grow as a preferred customer deployment model (along with hybrid cloud) for reasons such as service selection and vendor management. While customers report multicloud can be difficult and costly to manage, providers are making new steps toward interoperability that can ease this pain and help customers innovate, moving beyond API compatibility and into areas such as dedicated interconnects.

IDC Marketspace vendor inclusion criteria

This IDC MarketScape is an evaluation of global public cloud IaaS providers. IDC’s Worldwide Semiannual Public Cloud Services Tracker covers more than 30 global and regional cloud providers with IaaS. However, many of these companies are focused on specific regions or have not reached a material revenue scale. This MarketScape focuses on providers that have reached a certain threshold of revenue and have a presence in all global regions.

IDC uses the following inclusion criteria for service providers included in this MarketScape:

- The service provider offered IaaS compute and storage services for at least 2 years as of the end of 2021.

- The service provider generated over $100 million in IaaS business in 2021.

- The service provider has active operations in all 3 global regions: Americas, EMEA and AsiaPac.

IDC opted to exclude service providers with public cloud services that were either no longer a strategic business focus or were in the process of undergoing a major transformation since the evaluation would not be an accurate reflection of the service.

Advice for technology buyers

Despite the continuing strong growth in public cloud IaaS revenue, many workloads remain on premises and may stay that way forever due to latency, privacy, and security reasons. Other workloads, such as older, stable bespoke applications, may run fine on traditional infrastructure, making a lift and shift to public cloud unnecessary or undesired.

Public cloud IaaS buyers should, if they have not already, begin viewing cloud computing as an overall operating model spanning a continuum from hyperscale datacenters to edge locations to private datacenters and colocation provider facilities. Advances in infrastructure software such as Kubernetes and VMware, along with vendor willingness to make other functional investments, mean the cloud experience is increasingly similar across all these locations.

The options can be overwhelming, but customers should view the landscape for its advantages and not be afflicted by the paradox of choice. It is critical to determine a workload’s placement not just by cost but also by factors such as service adjacency, the provider’s broader ecosystem, and the provider’s commitment to interoperability and open standards.

It will be the case for many customers that they spend the same or more with a given public IaaS provider over time, but on services that don’t fit into the public IaaS category, as with dedicated cloud IaaS offerings such as AWS Outposts.

Securing and managing public cloud environments continues to be challenging for many customers. Seek providers that offer the best capabilities out of the box, as well as those that have a strong story to tell beyond monitoring and into system observability, a discipline and technology that becomes more critical in multicloud and hybrid cloud environments.

Ultimately, now is a time of fresh opportunity for public cloud IaaS buyers, from both a commercial and innovation standpoint. New and rising players in the public cloud IaaS game are eager for business and offering favorable terms and incentives. The growing maturity around interoperability and partnerships among providers is also good for customers. And as discussed previously, we are in an era where the cloud can be everywhere.

Vendor profile: OVHcloud

It is positioned in the Major Players category in the 2022 IDC MarketScape for WW public cloud infrastructure as a service.

With roots dating to 1999 as a hosted server provider, France-based OVHcloud entered the public cloud IaaS market in 2011. As of 2016, it had a presence in the United States and since then has continued expanding to other geographies. It now has 33 datacenters, primarily in Europe and North America, but is expanding its footprint in Asia.

It offers several flavors of IaaS including OVHcloud Bare Metal Cloud, a hosted private cloud service based on VMware, and OVH Public Cloud. In addition, the company provides website hosting services. Its compute offerings support AMD and Intel-based VMs. Storage options include block, file, and object. It partners with NetApp for an ONTAP-based file storage service managed by OVHcloud and with Veeam for backup. Archiving service tiers and NAS capabilities are also available.

In recent years, OVHcloud has made investments in building out software services higher up the stack in areas such as AI/ML, databases, and container orchestration. It has also continued to court partners focused on commercial and open source software to build its ecosystem. it has also pursued targeted acquisitions to accelerate the deployment of in-house PaaS solutions, including OpenIO and Exten (storage), BuyDRM (security), and ForePaaS (data platform).

Strengths

It has attractive and transparent pricing (e.g., it does not bill for API calls). It also has valuable service adjacency given it also offers dedicated private servers, web hosting, and hosted private clouds. This helps make it a one-stop shop for companies still early in their journey to the public cloud, as they can start the transition with OVHcloud using older deployment models and then maintain the same commercial relationship if and when they decide to move those workloads. OVHcloud’s roots as a European service provider also puts the company in the catbird seat for conversations about sovereign cloud and data residency, and indeed, it has baked these factors into its development approach for years. It has also made sustainability a strong focus for many years.

Challenges

It has the basics and more covered in terms of public cloud IaaS, but lags behind when one looks further up the software stack. Partnerships can help here, but IDC data shows that public cloud customers value native platform services highly for many workloads. The firm also lacks awareness in major markets such as North America and will require heavy additional investment to raise its profile there.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter