Global DRAM Revenue for 3Q22 Drops 29% Q/Q Due to Falling Shipments and Prices

Unprecedented since 2008 financial crisis

This is a Press Release edited by StorageNewsletter.com on November 22, 2022 at 2:03 pm This market report, published on November 16, 2022, was written by Ellie Wang, analyst, TrendForce Corp.

This market report, published on November 16, 2022, was written by Ellie Wang, analyst, TrendForce Corp.

Due to Falling Shipments and Prices, Global DRAM Revenue for 3Q22 Showed Q/Q Drop of Almost 30%

Unprecedented Since 2008 Financial Crisis

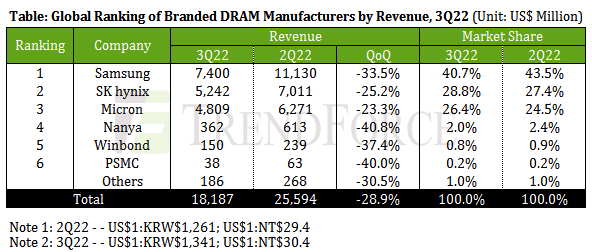

TrendForce reports that for 3Q22, the revenue of the whole DRAM industry dropped by 28.9% Q/Q to $18.19 billion.

This decline is the second largest to the one that the industry experienced in 2008, when the global economy was rocked by a major financial crisis. Regarding the state of the DRAM market in 3Q22, the Q/Q decline in contract prices widened to the range of 10~15% as the demand for consumer electronics continued to shrink. Server DRAM shipments, which had been on a relatively stable trend compared with shipments of other types of DRAM products, also slowed down noticeably from the previous quarter as buyers began adjusting their inventory levels.

Turning to individual DRAM suppliers’ performances in 3Q22, the top 3 suppliers (i.e., Samsung, SK hynix, and Micron) all exhibited a Q/Q drop in revenue.

Samsung posted $7.40 billion and a Q/Q drop of 33.5%, which was the largest among the top three.

SK hynix’s revenue fell by 25.2% Q/Q to around $5.24 billion.

As for Micron, revenue came to around $4.81 billion. Since the company marks its fiscal quarters differently, its DRAM ASP showed a Q/Q decline that was smaller than the ones suffered by the 2 Korean suppliers.

And as a result of this, its Q/Q revenue decline was also the smallest among the top 3. The top 3 are still maintaining a relatively high operating margin at this moment. Nevertheless, the inventory correction period that has started this year will last through 1H23, so they will experience a continuing squeeze on profit.

On the topic of suppliers’ capacity expansion plans, Samsung has gradually slowed down the transfer of its legacy wafer processing capacity from DRAM to CMOS image sensors due to the recent fall in demand for camera modules. Next year, Samsung will raise its DRAM production capacity as its new fab P3L enters operation. However, seeing that inventory reduction is not progressing at the originally anticipated pace, it will decelerate its technology migration to limit its output growth.

Looking at SK hynix, it will also rein in its output growth next year by putting some brake on its technology migration.

Moving to Micron, it has pushed back the schedule for mass production with its 1beta nm process. This deferment has to do with the higher difficulty level for the development of this technology and the general demand slump. Its output growth in 2023 is forecasted to be the smallest among the top 3. Furthermore, TrendForce is not ruling out the possibility of Micron making more tangible production cuts in response to the rapidly shrinking profit margin.

With regard to Taiwan-based DRAM suppliers, Nanya suffered the largest Q/Q revenue drop among the top 6 suppliers in 3Q22, reaching as much as 40.8%. Its result was attributed to the sizable share of consumer DRAM in its product mix as well as the sizable share of customers from Mainland China in its client base. Moving into this fourth quarter, the firm has already scaled back wafer input but maintains the pace of its migration to the 1A nm. However, this technology will still be at the customer sample stage in 2023 as Nanya’s clients hold a cautious demand outlook and are thus not keen on adopting the more advanced process. Therefore, the 1A nm process is not expected to make a noticeable contribution to Nanya’s output until 2024.

Turning to PSMC, its revenue fell by around 40.0% Q/Q for 3Q22 owing to the plummeting consumer DRAM prices. Its DRAM revenue that is presented here mainly pertains to the sales of its branded DRAM products that are manufactured in-house and excludes its DRAM foundry service. However, if DRAM foundry service is included in the calculation, then the Q/Q decline was 22.9%.

Lastly, looking at Winbond, its 3Q22 revenue still showed a significant Q/Q decline of 37.4% even with a fairly conservative pricing strategy. This has to do with the considerable contraction of its shipments. The firm already lowered the capacity utilization rate of its fab in Taichung, Taiwan, in 3Q22. As for the setup of its new fab in Kaohsiung, Taiwan, the schedule for entering the mass production phase has been pushed back slightly due to the unfavorable market situation. The Kaohsiung fab will initially manufacture DRAM using the 25S nm process. This is expected to be followed by the deployment of the supplier’s 20nm process in 2H23.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter