NAND and SSD Markets Struggle in 3Q22

With units and exabytes down Q/Q 14% and 10%, respectively

This is a Press Release edited by StorageNewsletter.com on November 15, 2022 at 2:02 pmThis is an abstract of Trendfocus, Inc.‘s NAND/SSD Information Service, 2CQ22 Quarterly Update, Executive Summary, published on November 8, 2022.

NAND and SSD Markets Struggle in 3CQ22 with Units and Exabytes Down Double-Digits

Data center has now joined every other market segment with declines and softening demand

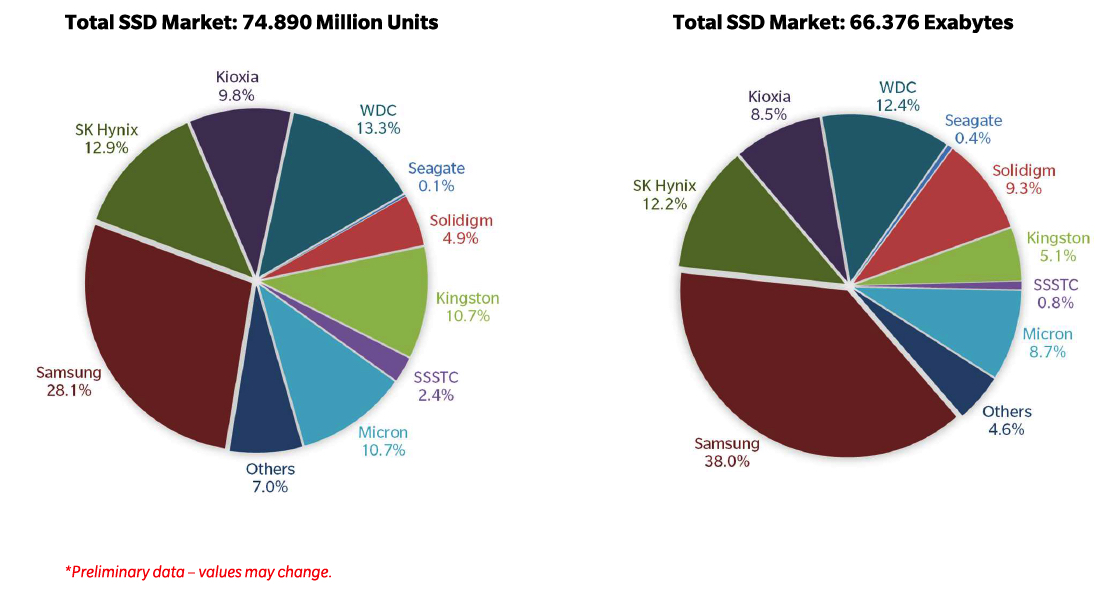

Overall unit shipments dropped 14% Q/Q to 74.89 million, with exabytes following suit, down 10% to 66.38EB shipped.

PC OEM SSD demand, reflected in client module shipments, led the sequential declines, falling 19% and 11% in units and exabytes, respectively, to 50.37 million units and 27.10EB.

Every single enterprise SSD category declined in both units and capacity shipments, shipping a total of just under 15 million units, down 8% Q/Q with an 11% decline in capacity to 34.43EB in the quarter.

SAS SSDs shipped 0.85 million units, declining more than any other enterprise segment at -17% Q/Q, while capacity shipped for the interface plunged 23% to 2.96EB.

The final segment to post a sequential drop in 3CQ22 was enterprise PCIe, which declined 2% in units to 9.22 million SSDs, and fell 9% in capacity shipped to 26.90EB, signaling reduced data center demand after 2 strong quarters of purchases.

Total NAND bit shipments declined 9% from the previous quarter to 146.85EB with all market segments except game consoles posting sequential reductions.

3CQ22 SSD Market Share, by Supplier, Units in Million, Exabytes

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter