N-able: Fiscal 3Q22 Financial Results

N-able: Fiscal 3Q22 Financial Results

Sales up 6% Y/Y with tiny net income

This is a Press Release edited by StorageNewsletter.com on November 11, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 88.4 | 93.5 | 257.0 | 276.0 |

| Growth | 6% | 7% | ||

| Net income (loss) | 1.9 | 0.3 | (1.9) | 9.7 |

N-able, Inc. reported results for its third quarter ended September 30, 2022.

“We are proud of our 3FQ22 results, which came in above the high end of our outlook for both revenue and profit. Just after the end of the third quarter we hosted many of our partners at our Empower conference with the theme ‘Own the Cloud’. Across the board we received validation that our strategy is on track and that we are helping our partners drive successful, recession-resilient businesses,” said president and CEO John Pagliuca. “Our offerings in RMM, data protection, and security are leaders in the market, and we are committed to innovating on the cutting edge as MSPs become even more mission-critical to SMEs globally. We are focused on helping our partners manage everything, secure everything, and accelerate their growth, and my fellow N-ablites are driven to fulfill this mission every day.”

“The revenue growth and adjusted EBITDA we delivered in the third quarter reflect our efforts to focus on particular categories of partners, including MSP aggregators and emerging-growth MSPs, with particularly strong growth in our security and data protection offerings,” added EVP and CFO Tim O’Brien. “We demonstrated strong cost management in the quarter while continuing to focus investment on growth and strategic initiatives. We plan to continue to prioritize our growth-oriented investments while maintaining cost discipline across other aspects of the business.”

3FQ22 highlights:

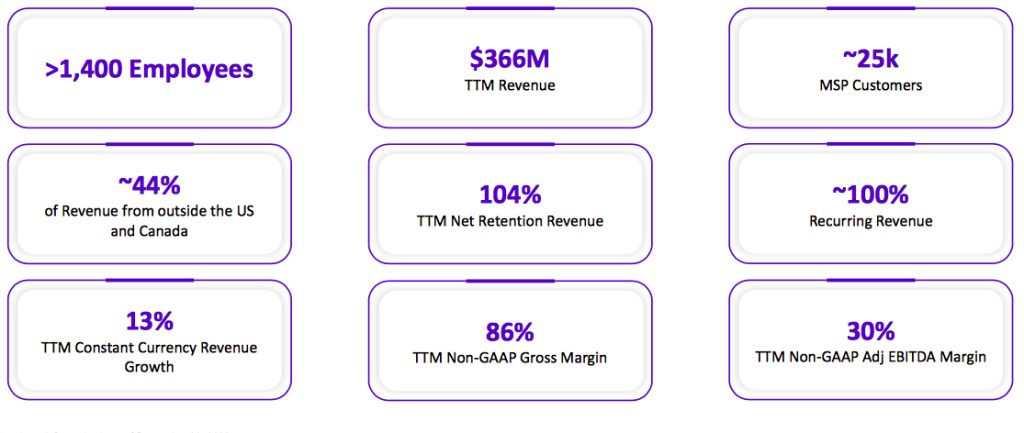

• Total revenue of $93.5 million, representing 6% Y/Y growth, or 13% Y/Y growth on a constant currency basis.

• Subscription revenue of $91.2 million, representing approximately 6% Y/Y growth, or approximately 13% Y/Y growth on a constant currency basis.

• GAAP gross margin of 83.9% and non-GAAP gross margin of 84.8%.

• GAAP net income of $0.3 million, or $0.00 per diluted share, and non-GAAP net income of $12.3 million, or $0.07 per diluted share.

• Adjusted EBITDA of $28.8 million, representing an adjusted EBITDA margin of 30.9%.

Balance Sheet

At September 30, 2022, total cash and cash equivalents were $87.7 million and total debt was $337.5 million.

Outlook for 4FQ22

• Total revenue in the range of $93.3 to $93.8 million, representing 5% Y/Y growth, or 11% to 12% growth on a constant currency basis.

• Adjusted EBITDA in the range of $27.5 to $28.0 million, representing 30% of total revenue.

Outlook for FY22

• Total revenue in the range of $369.3 to $369.8 million, representing 7% Y/Y growth, or 12% to 13% Y/Y growth on a constant currency basis.

• Adjusted EBITDA in the range of $111.0 to $111.5 million, representing 30% of total revenue.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter