FalconStor: Fiscal 3Q22 Financial Results

FalconStor: Fiscal 3Q22 Financial Results

Sales at only $3 million down 7% Y/Y, slightly profitable

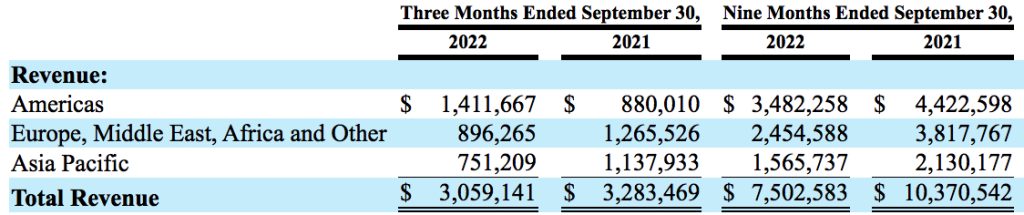

This is a Press Release edited by StorageNewsletter.com on November 11, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 3.283 | 3.059 | 10.371 | 7.503 |

| Growth | -7% | -28% | ||

| Net income (loss) | 0.349 | 0.221 | 0.395 | (1.819) |

FalconStor Software, Inc. announced financial results for its third quarter 2022, which ended on September 30, 2022.

“Our focus on recurring revenue growth through hybrid cloud data protection solutions and increased profitability enabled delivery of quarter-over-quarter revenue and net income growth for the second consecutive quarter,” said Todd Brooks, CEO. “The hybrid cloud reseller relationship we formed with IBM in 2FQ22 continued to expand during the quarter with new customers taking advantage of our joint offerings and existing customers expanding their monthly usage. IBM’s hybrid cloud focus is a key element of its growth strategy, as detailed in IBM’s first, second, and third quarter 2022 earnings announcements. We are excited to help the tens of thousands of IBM customers around the globe to leverage IBM hybrid cloud solutions.”

“Total revenue increased to $3.1 million in 3FQ22 from $2.4 million in 2FQ22, and $2.0 million in 1FQ22. Our aggressive focus on advancing critical hybrid cloud relationships and our efforts to realign to a subscription- and monthly consumption-based recurring revenue model continue to challenge our Y/Y revenue growth as 3FQ22 revenue was $3.1 million, compared to $3.3 million in 3FQ21,” he stated. “Our continued focus on tightly managing operating expenses resulted in delivering $0.2 million in GAAP net income during 3FQ22, compared to a $0.9 million GAAP net loss in 2FQ22. We are excited by the progress we have made and are working hard to continue delivering Q/Q revenue and profitability growth.”

3FQ22 Financial Results

• Annual recurring revenue (trailing 12-month recurring revenue): 4.5% Y/Y growth

• Ending cash: $1.7 million, compared to $1.8 million in 2FQ22, and $3.5 million in 3FQ21

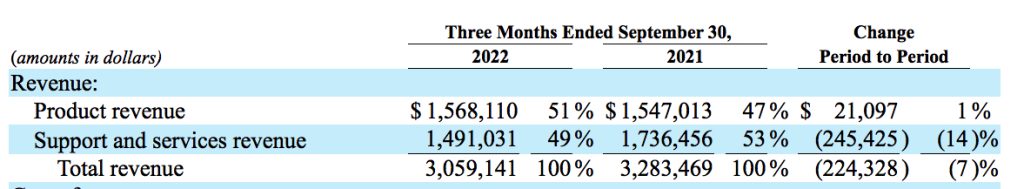

• Total revenue: $3.1 million, compared to $2.4 million in 2FQ22, and $3.3 million in 3FQ21

• Total cost of revenue: $0.4 million, compared to $0.4 million in 2FQ22, and $0.4 million in 3FQ21

• Total operating expenses: $2.3 million, compared to $2.5 million in 2FQ22, and $2.4 million in 3FQ21

• GAAP net income (loss): $0.2 million, compared to $(0.9) million in 2FQ22, and $0.3 million in 3FQ21

FY22 Guidance

- Revenue between $10.0 million and $12.0 million

- Adjusted EBITDA between $-0.5 million to $1.2 million

- %: -5% to 10%

- Net Income between -1.8 million and -0.5 million

- %: -18% to -4%

Comments

The company records revenue of $3.1 million, down 7% Y/Y and up 29% Q/Q, its best quarter for FY22, with tiny net income.

For the nine months ended September 30, 2022 and 2021, product revenue represented 42% and 51% of total revenue, respectively. It represented $3,125,936 for the 9 months ended September 30, 2022 decreased $2,162,811, or 41%, from $5,288,747 in the prior year period. This decrease is due to order delays as well as entering into several large multi-year contracts in the first 9 months of 2021 that did not repeat in 1FH11.

Maintenance and technical support services revenue for the 9 months ended September 30, 2022 decreased $456,857 to $4,369,416, compared to $4,826,273 in the prior year period. These sales result primarily from the purchase of maintenance and support contracts by customers, and the renewal of maintenance and support contracts by existing and new customers after their initial contracts expire. The decrease in maintenance and technical support service revenue from the previous year reflects a decline in new contracts and renewals.

Professional services revenue for the 9 months ended September 30, 2022 decreased to $7,231, compared to $255,522 in the prior year period. It will vary depending on the number of solutions for which customers elect to purchase engineering or professional services to assist with their implementations or other projects. The firm expects professional services revenue to continue to vary from period to period based upon the number of customers who elect to utilize professional services upon purchasing any of firm's solutions.

During 3FQ22, shift to recurring revenue based revenue took a material step forward as the company continued to expand its strategic reseller relationship with IBM to co-market joint solutions consisting of FalconStor's VTL/StorSafe software, IBM Cloud Object Storage, and IBM Power Virtual Servers (PowerVS) for efficient application and data migration from on-premises environments to PowerVS Cloud, and on-going SaaS-based backup and restore within PowerVS Cloud.

GAAP total revenue in 3FQ22 declined 6.8% Y/Y. Given the reduction in GAAP 3FQ22 revenues, the vendor delivered a net income of $221,372, compared to $348,640 in 3FQ21, even though it managed operating costs to $2,296,464 in the quarter compared to $2,391,966 in 3FQ21.

Despite Y/Y GAAP total revenue decline, it believes GAAP total revenue will continue to increase each quarter during 2022. In fact, GAAP total revenue increased to $3,059,141 in 3FQ22 compared to $2,394,335 and $2,049,107 in the second and first quarters of 2022, respectively, and it expect sequential Q/Q GAAP total revenue to continue increasing throughout the balance of 2022.

For FY22, revenue is supposed to be between $10.0 million and $12.0 million - historical lowest yearly revenue -, or down yearly 25% to 30%, as also expected at the end of the former quarter, with net loss between $0.5 million and $1.8 million.

| FY | Revenue in $ million |

Growth |

| 2004 | 28.7 | NA |

| 2005 | 41.0 | 43% |

| 2006 | 55.1 | 34% |

| 2007 | 77.4 | 41% |

| 2008 | 87.0 | 12% |

| 2009 | 89.5 | 3% |

| 2010 | 82.8 | -7% |

| 2011 | 82.9 | 0% |

| 2012 | 75.4 | -9% |

| 2013 | 58.6 | -32% |

| 2014 | 46.3 | -21% |

| 2015 | 48.6 | 5% |

| 2016 | 30.3 | -38% |

| 2017 | 25.2 | -17% |

| 2018 | 17.8 | -29% |

| 2019 | 16.5 | -7% |

| 2020 | 14.8 | -10% |

| 1FQ21 | 3.8 | 20% |

| 2FQ21 | 3.3 | -7% |

| 3FQ21 | 3.3 | -25% |

| 4FQ21 | 3.8 | 4% |

| FY21 | 14.2 | -4% |

| 1FQ22 | 2.0 | -47% |

| 2FQ22 | 2.4 | -27% |

| 3FQ22 | 3.1 | -7% |

| 4FQ22 (estim.) | 2.5-4.5 | -34% - 18% |

| FY22 (estim.) | 10.0 - 12.0 | -30% - -25% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter