History 2000: Qualstar, Discreet but Efficient Tape Library Manufacturer

Started in 1984 by president and CEO Bill Gervais.

By Jean Jacques Maleval | October 7, 2022 at 2:00 pmUntil now, tape library manufacturer Qualstar has always been fairly understated about its activities, eking out only the barest information about anything other than its products.

However, since the company has just filed for an IPO, which could in turn allow it to raise some $50 million, it has been forced to reveal its inner workings.

In fact, Qualstar is a relatively old storage company, started in 1984 by its current president and CEO Bill Gervais, 57, a former co-founder and engineering manager at Micropolis, subsequently president of Northridge Design Associates. He himself holds a 32.8% stake in the company, which started by manufacturing 9-track reel-to-reel tape drives for PC and workstations designed for backup as well as data transfer between mainframes and PCs.

In fact, Qualstar is a relatively old storage company, started in 1984 by its current president and CEO Bill Gervais, 57, a former co-founder and engineering manager at Micropolis, subsequently president of Northridge Design Associates. He himself holds a 32.8% stake in the company, which started by manufacturing 9-track reel-to-reel tape drives for PC and workstations designed for backup as well as data transfer between mainframes and PCs.

This particular activity has gradually diminished with the progressive decline of reel-to-reel devices, even if Overland Data’s exit from the market allowed Qualstar to increase sales in 2CQ99.

“Nine track is the longest running tape format for data recording in the history of the world,” said Gervais in Storage Inc., 4Q99.

The firm also sold 18- and 36-track cartridge drives, but ceased this activity in June 1999.

To compensate, the firm embarked intelligently into cartridge libraries in 1995, following the designs of the current VP engineering, Dick Nelson, 56, also a co-founder of the company, and its second largest shareholder, with a 23.6% stake.

The first automation solutions were designed for Exabyte and its 8mm cartridges, although the latter company’s subsequent entry into the robotics sector, not surprisingly, led to some friction between the 2 firms.

Today, Qualstar’s libraries support nearly all tape cartridge formats (except for 3480 and 9840): 8mm by Exabyte, Ecrix and Sony (AIT libraries represented a third of the company’s total sales for FY99), DLT by Quantum and Benchmark, LTO (with IBM drives), and even QIC, which is very rare.

These devices, moreover, have an excellent reputation: “I’ve never had a single problem with any of their products,” asserted Guy Le Bougeand, president of Datex, which sells the systems in France.

Qualstar’s discretion can be explained largely by the fact that it doesn’t sell directly to the end user, but exclusively to integrators, VARS and OEMs, which generally add their own brand names. And of course, this type of clientele doesn’t much like when the source of their products is revealed.

The firm’s largest customer is a US integrator, Loronix Information Systems, which accounted for 23.4% of the company’s revenues during the 6 months ended in 1999. It markets digital video recording management and identification systems.

There is also Tandberg, for its QIC SLR32, SLR50, SLR100 cartridges, but that’s been put in some doubt now that the Norwegian firm has just acquired a very good library manufacturer of its own, Breece Hill.

Nonetheless, there are plenty of others left: BCC Technologies, Compaq, Data General/EMC, Rorke Data, etc.

For the marketing, everything goes through Bob Covey, 52, once with ATG/Cygnet and Micropolis.

Until now, the library maker has scarcely ever left hardware or gotten involved in subsystems or software management. But its libraries are supported by some of the best names, such as CA, HP, Legato, Tivoli and Veritas.

This could all change, though, based on the $1.1 million that Qualstar has invested in Chaparral Network Storage to incorporate routers into its products, in order to provide FC connectivity.

The company has no direct foreign presence, but there are currently plans underway to open a German subsidiary, since at the moment, the non-US market represents no more than 22% of sales for the last 6 months of its last published fiscal exercise.

Despite its years in the industry, Qualstar is not a huge company, with only 81 employees, including 52 in manufacturing, housed in a single 28,000-square-foot facility in Canoga Park, CA.

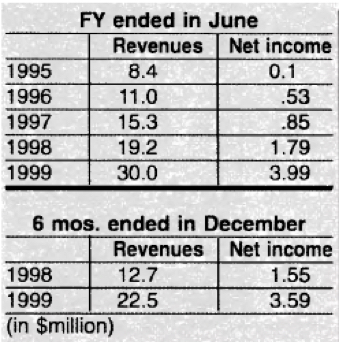

But its financial results for the last half dozen or so years are remarkable, on a par with a much larger operation. Since 1996, revenues have grown at an annual compound growth rate of 31%, while net income has risen 75%, despite significant competition from the likes of Adic, ATL/Quanturn, Breece Hill, EB, Overland, SpectraLogic and StorageTek.

An IPO was imaginable sooner, perhaps, but the firm’s management no doubt preferred to wait until the company had beefed up a bit. The success of the operation, after all, will depend less on Qualstar itself, and far more on the mood of the investment community – Wall Street is never quick to put money into storage hardware that doesn’t have an excellent reputation at the moment.

Two new libraries

Qualstar this quarter will start to deliver a pair of new high-capacity additions to its TLS-6000 line for DLT cartridges. The 68120 comes with up to 8 DLT7000/8000 or Benchmark DLT1 drives and up to 120 cartridges, with a price beginning at $64,400. The 68124 can handle as many drives and up to 240 media, starting at $82,400. FC interface is available as an option. As for the other five TLS-6000 libraries, they come with automatic alignment, bar code support, positive- pressure filtered air and leadscrew mechanisms.

This article is an abstract of news published on issue 146 on March 2000 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter