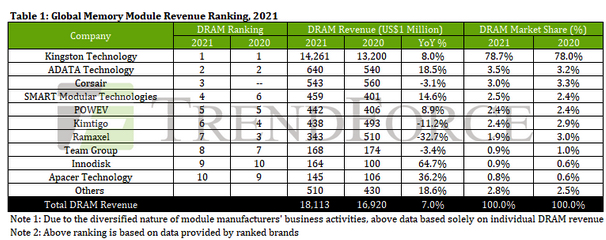

DRAM Module Revenue Grew 7% Y/Y at $18.1 Billion in 2021

On ascendant 2021 DRAM pricing, and leader being Kingston with 79% of market

This is a Press Release edited by StorageNewsletter.com on September 23, 2022 at 2:02 pmSpurred by pandemic-induced lifestyle changes in the past two years, demand for distance education grew and sales of electronic products boomed, driving the growth of DRAM module shipments.

According to TrendForce Corp.‘s statistics, overall 2021 sales in the global DRAM module market reached S$18.1 billion, with an annual growth rate of approximately 7%. Due to different business strategies employed by each module house, revenue distribution among module houses varied.

The world’s top 5 memory module houses accounted for 90% of total sales in 2021. The top 10 also includes 97% of global module market turnover.

Kingston accounts for nearly 80% of the market and it is hard to buck the trend of the rich getting richer. In terms of business strategy, Kingston actively introduced IT and provides a highly customized production model, leading to continuous growth in shipment scale and driving its revenue growth by 8.0%, ranking ≠1.

ADATA largely ships consumer products. In 2021, revenue benefited from demand generated by the stay-at-home economy, spurring significant growth in both shipments and per unit sales pricing. The company aggressively optimized costs and increased gross profit, pushing revenue growth to 18.5%, ranking ≠2.

Corsair comes ≠3 with solid revenue performance. However, the company specializes in the e-sports market. In 2H21, shipments slowed slightly hindered by a GPU shortage and revenue declined marginally by 3.1% as a result.

The products of another US company, SMART Module, have pervaded the industrial computer field in recent years with their main source of revenue being Europe and the United States. After lockdowns were lifted, demand in Europe and the United States recovered significantly, driving SMART Module’s revenue growth by 14.6% and taking the company from ≠6 ranking in 2020 to ≠4.

Module Demand in China relatively weak due to spread of pandemic

The order of Chinese module houses has changed slightly in this ranking while POWEV remains ≠6. In addition to a complete product portfolio, the company also aggressively explores offline channels, and is the first to launch DDR5 modules, all of which have contributed to revenue to a certain extent.

Kimtigo ≠6 in terms of 2021 revenue, primarily due to the pandemic in China, weak customer demand, and declining unit sales prices causing poor revenue performance.

Ramaxel was affected by weak purchasing momentum in China and supply chain shortages, its shipment figures falling compared with 2020, moving the company into ≠7.

The revenue of Team Group dropped slightly by 3.4% in 2021, primarily due to a disappointing Chia Coin cryptocurrency market causing a decline in the shipment of related products. However, it has been active in the industrial computer market in recent years, which is expected to stabilize future revenue growth performance.

Innodisk makes great strides in developing AIoT smart applications, ranking first in growth. It ranked ≠9, and not only sells industrial computer products, but is also actively developing the AIoT market. Its applications encompass networking and smart cities. These sectors contributed greatly to revenue in 2021, delivering a growth rate as high as 64.7%, the highest among the top 10 ranks.

Apacer, ranked ≠10, has focused on the high-unit price industrial computer market in recent years, accounting for 70% of its revenue. In 2021, it benefit from the recovery of demand to stimulate an increase in per unit sales price, driving revenue growth by 36.2%, and its development in the industrial computer field cannot be underestimated.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter