DataCore Enhanced Swarm Software-Only Solution Optimized for Media Workflows

Archive solution offers fast metadata search and seamless public cloud integration.

This is a Press Release edited by StorageNewsletter.com on September 12, 2022 at 2:03 pmDataCore Software Corp. announced the latest version of Swarm object storage solution for M&E applications, including content archiving, preservation, distribution, sports, broadcast, production studios, and e-sports.

Swarm offers enhancements for on-site and public cloud environments, including hybrid cloud enablement, improved performance for video streaming, and fast metadata search capabilities.

“DataCore is committed to ensuring that our Swarm archive solutions address the ever-evolving needs of the media and entertainment industry,” said Abhijit Dey, chief product officer. “The latest version of Swarm enables media companies to securely access, distribute, and archive data faster and more efficiently to keep pace with the massive amount of on-demand content being consumed today.”

Swarm ensures that growing media asset libraries are continuously protected and instantly accessible. Online migration eliminates time-consuming and costly refresh cycles, reducing TCO and ensuring maximum uptime. The newest version of Swarm optimizes operational and workflow efficiencies for private, public, and hybrid cloud data storage. Using it, media companies can rapidly move content in and out of public clouds, bringing increased flexibility, scalability, and cost savings to their workflows.

Swarm’s unparalleled capabilities empower video-driven organizations to support private streaming, provide longtail video on demand, and centralize long-term video archives. Offering up to 100% faster metadata search and partial file restore, Swarm allows media companies to quickly search for assets, customize metadata, and manage billions of objects across multiple sites.

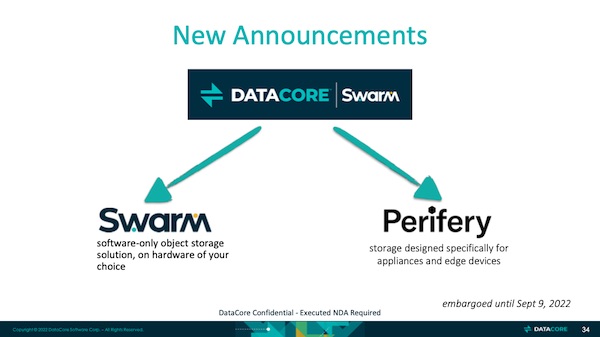

This enhanced version of Swarm is offered as a software-only solution. The same features are available in appliance form as Perifery, DataCore’s new next-gen object storage platform designed for appliances and edge devices.

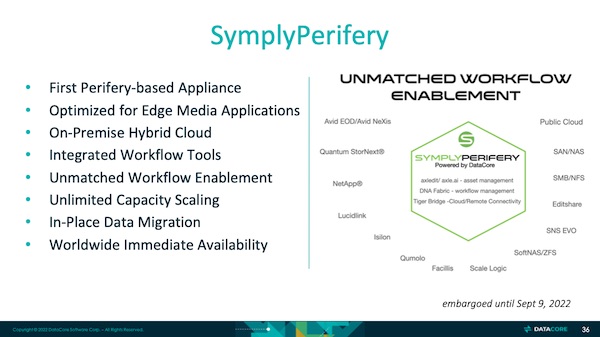

Perifery is built into Symply’s newly released appliance, SymplyPerifery, optimized for M&E organizations.

DataCore demonstrates Swarm and its new SymplyPerifery appliance at IBC2022, September 9-12 in Amsterdam, The Netherlands.

Comments

This represents a significant announcement for DataCore addressing the edge computing challenge for some verticals use cases at least to start.

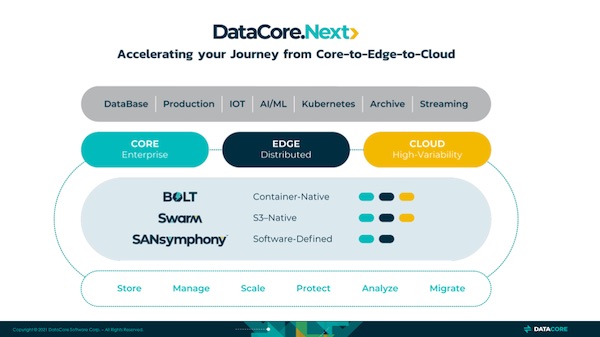

First Dave Zabrowski, CEO of the company for soon 5 years, has shared, in Paris, France, for the IT Press Tour then at IBC in Amsterdam, an updated strategy for the next 3 years, it's called DataCore NEXT.

This new direction integrates the core to edge to cloud layer supported by the 3 product lines. This new model is more simple than the previous one that listed many product features and technical functions, this time we see IT domains above any flavor of Core-Edge-Cloud delivered via Bolt, Swarm and/or SANsymphony for several high-end functions.

We immediately realize that SANsymphony, at least today, doesn't target the cloud, we mean run in the cloud, nothing new here but it's worth to mention that some other SDS on the planet are already available on one of the top 3 cloud service providers. We don't see file storage answer either on this image even if the company has a reseller/OEM agreement with Hammerspace as vFilO but it's not listed the reason being probably that DataCore doesn't own it.

The new segment addressed by the company is now the edge clearly an obvious large opportunity and already a red ocean. It represents also a way for on-premises vendors to limit the erosion of sales in the data center as more and more workloads are swallowed by the cloud. For now, the company chooses 2 vertical - healthcare and M&E.

It has released a new Swarm version and extended the product to fit at the edge for specific use cases. As such the team has packaged Swarm under a new flavor named Perifery to be deployed specifically at the edge but also ready for appliance delivery model. This is interesting as other vendors are doing the reverse proposing their solution as just software to be deployed in any circumstances, on-premises or in cloud.

The firm even goes further with a partnership with Symply, a hardware company dedicated to M&E, with a tailored appliance named SymplyPerifery. This solution promoted during the IBC022 show is delivered with a set of partners like axledit, StorageDNA or Tiger Technology for its Bridge product.

Symply will sell a dedicated appliance to the market instead of DataCore's software coupled with some commodity hardware like any integrator can do. The nature of this market requires such model and for more generic use cases, the company pushes the software model with the classic Swarm flavor. Thus, Symply can address directly with a ready to use solution the media archiving segment. To accelerate this market penetration, the firm has recruited Alex Grossman as VP product management and product marketing for this activity. Surprisingly it made a recent announcement about his arrival but Grossman LinkedIn page mentioned May for his new position. He is a recognized specialist in the domain, he has collaborated with Symply being its founder, and Quantum and Active Storage.

The object storage segment has a whole is a paradox, we recognize that the technology is needed promoting some exclusive characteristics. More and more solutions exist, S3 is everywhere, we wrote 3 years ago an article titled Object storage is dead, S3 eats everything. S3 on top of NAS just as a new interface is ubiquitous. In fact users don't really care, they need and ask for a S3 path or target and they don't pay attention to the design. Purist can always react to this but it does the job for many use cases. What applications consume is an interface not an internal design or architecture. Beyond that it is also the result of a standard, here a de-facto one, but clearly a massive one. As an effect, the object storage segment is clearly saturated with more than 20 players, of any size, pure players exist, how many probably 4 or 5 no more, but many more with more comprehensive solutions. This situation explains why some pure players have clearly difficulties to exist, every day is a battle. And this surviving mode for some of them is reinforced by open source and a few key names we have in mind that shake market positions.

To conclude, we must cover that aspect. DataCore's board, Insight Venture Partners and Zabrowski have understood market moves and have decided to acquire Caringo in 2021 and later MayaData to build a larger storage software ISV and grow its market footprint. Caringo, as pioneer of the object storage wave founded in 2005, had real difficulties to take off despite a respected and recognized technology.

Cleversafe founder Chris Gladwin understood this very and exited that market in 2015 when IBM acquired the company for a price never seen in the domain, $1.3 billion. At that time the company was 10 years old.

Now the question arises for DataCore as we all realize that Zabrowski didn't join the company to stay CEO for 10 years and potentially retire, Insight's goal is different. DataCore being one of the last independent gem on the storage planet, an exit path is something feasible with a "bigger body". We think that the destiny of DataCore is not an IPO but rather to land at a bigger company and it is much more a reality today with a real portfolio than it was with SANsymphony alone.

Who could be the candidates for DataCore? HPE is an obvious name, completely naked on the object storage side, Bold could be aggregated into Ezmeral and SANsymphony added to the block storage line as the SDS flavor in addition to Alletra and Nimble. This acquisition makes sense, DataCore has already 10,000 customers and a strong channel. Also Zabrowski knows very well HPE having worked a very long time there and sold Cloud Cruiser in 2017.

Outside of HPE, who else? IBM? OpenText? In terms of transaction amount, we estimate that the deal should reach the $1.2-1.5 billion range fueled by SANsymphony, Swarm, Bolt, a huge installed base and its channel. Or an alternative path could appear with a private equity firm. We'll see but I won't be surprised to read such move in the next 18 months.

We record an interview with Dave Zabrowski in Paris a few days ago, available here.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter