20th Version of StorPool Storage

Adds NVMe/TCP, StorPool on AWS, and NFS File Storage.

This is a Press Release edited by StorageNewsletter.com on August 23, 2022 at 2:02 pmStorPool Storage announced its 20th major version of StorPool Storage, the primary storage platform for large-scale cloud infrastructure running diverse, mission-critical workloads.

This is a milestone in the evolution of StorPool, with the addition of several new capabilities that future-proof the leading storage software and increase its potential applications.

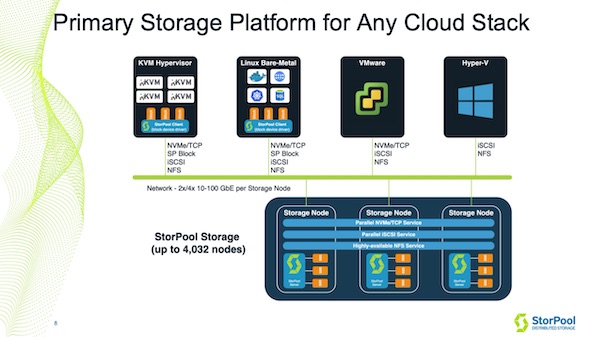

StorPool Storage is designed for workloads that demand reliability and low latency. It enables deploying high-performance, linearly-scalable primary storage systems on commodity hardware to serve large-scale clouds’ data storage and data management needs. With StorPool, businesses streamline their IT operations by connecting a single storage system to all their cloud platforms while benefiting from our utterly hands-off approach to storage infrastructure. The StorPool team architects, deploys, tunes, monitors, and maintains each storage system so that end-users experience fast and reliable services while our customers’ tech teams dedicate their time to the projects that aim to grow their business.

StorPool Storage v20 offers new capabilities:

NVMe/TCP Support

It now supports NVMe/TCP (NVMe-oF, TCP transport) – the next-gen block storage protocol that leverages TCP/IP, the most common set of communication protocols extensively used in datacenters with standard Ethernet networking and controllers.

With NVMe/TCP, customers get high-performance, low-latency access to standalone NVMe SSD-based StorPool storage systems, using the standard NVMe/TCP initiators available in VMware vSphere, Linux-based hypervisors, container nodes, and bare-metal hosts.

The StorPool NVMe/TCP implementation is software-only and does not require specialized hardware to deliver the fast throughput and fast response times required by modern workloads. NVMe/TCP targets are highly available – in the event of a node failure, StorPool fails over the targets on the failed storage node to a running node in the cluster.

StorPool on AWS

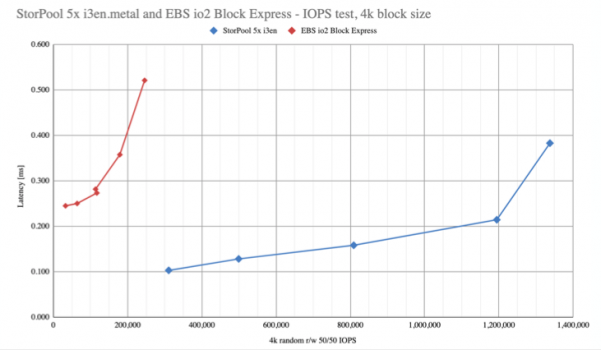

Using StorPool on AWS achieves low latency and high IO/s, delivered to single-instance workloads such as large transactional databases, monolithic SaaS applications, and heavily loaded e-commerce websites. StorPool Storage can now be deployed on sets of 3 or more i3en.metal instances in AWS. The solution delivers fast 1.3 million+ balanced random read/write IO/s to EC2 r5n and other compatible compute instances (m5n, c6i, r6i, etc.). The company frees customers from per-instance storage limitations and can deliver this level of performance to any compatible instance type with sufficient network bandwidth. It achieves these numbers while utilizing less than a 5th of client CPU resources for storage operations, leaving more than 80% for the user application(s) and database(s).

Customers using AWS get the same white-glove service provided to on-premises customers, so they have peace of mind that their application’s foundation is running optimally in the cloud. StorPool’s expert team designs, deploys, tunes, monitors, and maintains each StorPool storage system on AWS. The complete StorPool Storage solution enables anyone to easily and economically deploy heavy enterprise applications to AWS, which was previously not achievable at the cost/performance ratio offered by StorPool.

More technical details about the StorPool on AWS solution

NFS File Storage on StorPool

The vendor is also introducing support for running highly-available NFS Servers inside StorPool storage clusters for specific use cases. NFS services delivered with StorPool are for throughput-intensive file workloads shared among internal and external end-users (video rendering, video editing, heavily-loaded web applications). They can also address moderate-load use cases (configuration files, scripts, images, email hosting) and support cloud platform operations (secondary storage for Apache CloudStack, NFS storage for OpenStack Glance). NFS file storage on StorPool is not suitable for IO/s-intensive file workloads like virtual disks for VMs.

Deploying NFS Servers on StorPool storage nodes leverages the ability of StorPool Storage to run hyper-converged with other workloads and the low resource consumption of StorPool software components. Running in VMs backed by StorPool volumes and managed by the StorPool operations team, NFS Servers can have multiple file shares. The cumulative provisioned storage of all shares exposed from each NFS Server can be up to 50TB. The firm ensures the high availability of each NFS service with the proven resilience of the StorPool block storage layer – NFS service data is distributed across all nodes in the cluster, and it maintains data and service integrity in case of hardware failures.

“With each iteration of StorPool Storage, we build more ways for users to maximize the value and productivity of their data,” said Boyan Ivanov, CEO. “These upgrades offer substantial advantages to customers dealing with large data volumes and high-performance applications, especially in complex hybrid and multi-cloud environments.”

“High performance access to data is essential wherever applications live,” said Scott Sinclair, ESG practice Director. “Adding NVMe/TCP support, StorPool on AWS and NFS file storage to an already robust storage platform enables StorPool to better help their customers achieve a high level of productivity with their primary workloads.”

StorPool storage systems are for storing and managing data of demanding primary workloads such as databases, web servers, virtual desktops, real-time analytics solutions, and other mission-critical software. In addition to the new capabilities, in 2022 alone, the company has added or improved many features for data protection, availability, and integration with popular cloud infrastructure tools.

Comments

This v20 release represents a significant news from one of the pure block SDS players of the industry.

They really belong to the small group of players who transform a rack of independent [storage] servers into a large storage pool exposed here as a block device. This is SDS, a different dimension from storage virtualization beyond DataCore SANsymphony or FalconStor NSS to name 2 famous products. Among similar block SDS we can list Lightbits Labs, ScaleIO, acquired by EMC in 2013 for $200 million, Excelero, acquired by Nvidia in 2022 for "a penny", Datera who disappeared, Seanodes same destiny for a symbolic price, OpenvStorage, ioFabric or Coho Data all hitting a wall. We also have to add players who developed similar approaches but sell their product as an appliance, it was the case of SolidFire, acquired by NetApp in 2015 for $870 million, E8 Storage, acquired by AWS in 2019 for a small amount, and of course Lefthand Networks, one of the pioneers, acquired by HP - at that time - in 2008 for $360 million. We can mention vSAN, StorMagic or FlashGrid here, and also Kubernetes storage oriented exposing block like DataCore Bolt, coming from their MayaData acquisition, Diamanti, Robin.io, acquired by Rakuten in 2022, Ondat (formerly StorageOS), Longhorn, etc. Several of these facts could illustrate some potential difficulties for the company but it is not the case as StorPool is profitable without the need to raise money. This choice also is the wish to control their destiny.

The firm has 50 people adding more in the coming months. The team targets global 2,000 accounts with a sweet spot between 100TB to a few petabytes.

And the list of SDS could be even be larger if we aggregate file and object SDS with at least 20 more names.

The first new feature announced here is paramount as StorPool uses since the inception a Linux client or a iSCSI stack to be connected and integrated to operating environments. Adding NVMe/TCP is key to be considered for high-end projects and it follows the current market wave with NVMe-oF and TCP. Clearly the team has made an obvious choice with TCP and software implementation. It also avoids agent-based model that had some difficulties to be adopted on the market, we remember Excelero or E8 for that and we know how it ended. It offers the capability to StorPool to be consumed by bare-metal servers, VMware vSphere, Linux-based hypervisors or containers environments.

The second announcement could be considered as a surprise but clearly validates the SDS model they develop. We understand that the original demand came from AWS wishing to improve their block device. The solution is a reference architecture today without any marketplace presence so far. The performance demonstrated are pretty impressive both in terms of IO/s and latency with comparison with EBS io2 even if details on io2 are not given. In summary, the test shows a gain of 5x the EBS performance with latency reduced by 50% at the same time, producing a factor of 10.

The third item is even more a surprise as the company developed and preached a block SDS model since the beginning. But the market, we mean users wishing to consolidate use cases on the platform, and reality forced them to add a file layer on top of their block device. They starts with NFS but they didn't mentioned what they choose or develop, only that it is an open source NFS engine, so it could be Ganesha used by several vendors. It operates like a gateway on top of their distributed block device, each NFS engine offers 50TB and users can multiply these engines in an active/passive mode to provide high availability. This implementation is of course less mature than the approach they develop on the block side, the real core expertise of StorPool. We can expect after this file iteration that SMB will arrive based on a Samba implementation.

With these 3 significant features, the vendor strengthens its market position and clearly appear now a unified storage solution for any cloud and any operating environment, what we use to classify as a U3 - Universal, Unified and Ubiquitous - model.

We expect the company to add in a near future erasure coding, SMB probably next year and marketplace presence for AWS then other cloud providers, but the company continues to be attractive both for end-users and partners but obviously for an acquisition. May be raising a new round can boost a bit the valuation before starting to discuss as at the end of the day it's a just a question of price. We'll see how competition will react to these announcements.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter