Backblaze: Fiscal 2FQ22 Financial Results

Backblaze: Fiscal 2FQ22 Financial Results

Always growing and in red

This is a Press Release edited by StorageNewsletter.com on August 12, 2022 at 2:02 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 16.2 | 20.7 | 31.5 | 40.2 |

| Growth | 28% | 28% | ||

| Net income (loss) | (2.4) | (11.6) | (6.1) | (24.1) |

Backblaze, Inc. announced results for its second quarter ended June 30, 2022.

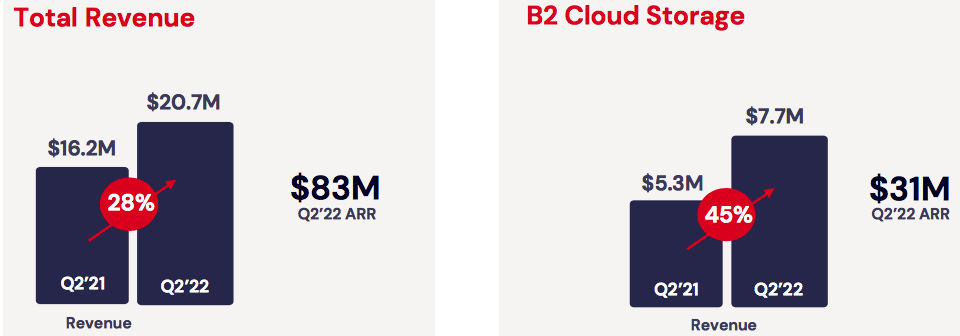

“Our 28% revenue growth in 2FQ22 not only outpaced what we achieved last year in the same period, it also highlights the strength of our recurring revenue model and that data grows through varying economic conditions,” said Gleb Budman. “In addition, in 2FQ22, the amount of data added by B2 Cloud Storage customers was greater than for any other quarter in company history, we added a customer with our largest purchase order ever, and in July we hired an experienced CMO Kevin Gavin to help continue driving our growth.”

2FQ2 Financial Highlights:

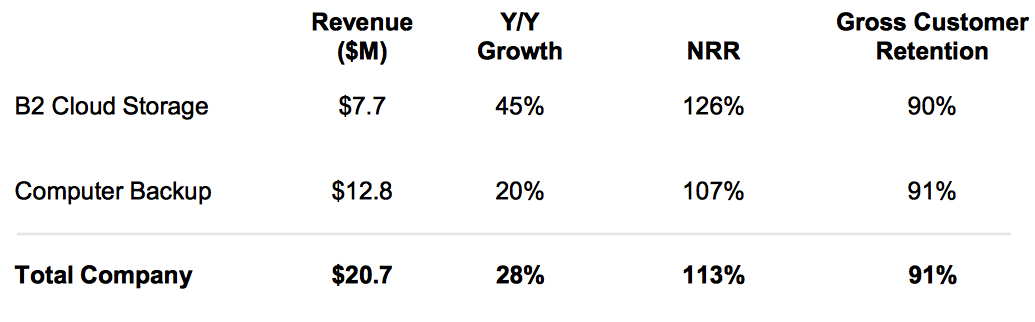

- Revenue of $20.7 million, an increase of 28% Y/Y.

- B2 Cloud Storage revenue was $7.7 million, an increase of 45% Y/Y.

- Computer Backup revenue was $12.8 million, an increase of 20% Y/Y.

- Gross profit of $11.1 million, or 54% of revenue, compared to $8.2 million and 51% of revenue in 2FQ21.

- Adjusted gross profit of $15.9 million, or 77% of revenue, compared to $12.2 million and 75% of revenue in 2FQ21.

- Net loss of $(11.6) million compared to a net loss of $(2.4) million in 2FQ21.

- Net loss per share of $(0.37) compared to a net loss per share of $(0.13) in 2FQ21

- Adjusted EBITDA of $(1.9) million, or (9)% of revenue, compared to $1.5 million and 9% of revenue in 2FQ21.

- Non-GAAP net loss of $(7.2) million compared to non-GAAP net loss of $(3.5) million in 2FQ21.

- Non-GAAP net loss per share of $(0.23) compared to a non-GAAP net loss per share of $(0.19) in 2FQ21.

- Cash and investments totaled $88.1 million as of June 30, 2022.

2FQ22 Operational Highlights:

- Annual recurring revenue (ARR) was $82.7 million, an increase of 28% Y/Y.

- B2 Cloud Storage ARR was $31.3 million, an increase of 44% Y/Y.

- Computer Backup ARR was $51.4 million, an increase of 20% Y/Y.

- Net revenue retention (NRR) rate was 113% compared to 110% in 2FQ21.

- B2 Cloud Storage NRR was 126% compared to 132% in 2FQ21

- Computer Backup NRR was 107% compared to 102% in 2FQ21.

- Gross customer retention rate was 91% in 2FQ22 and 2FQ21.

- B2 Cloud Storage gross customer retention rate was 90% compared to 89% in 2FQ21.

- Computer Backup gross customer retention rate was 91% in 2FQ22 and 2FQ21.

2FQ22 and Recent Business Highlights:

• B2 Cloud Storage data stored: Added highest amount in company history.

• B2 Cloud Storage purchase order: Added customer with largest purchase order ever.

• CMO: Hired marketing executive Kevin Gavin for the newly-created position.

• Channel Partner program: Launched a suite of tools, resources, incentives, and benefits for partners.

• New partnerships: Added new partners Carahsoft (public sector/education/health care) and Veritas (tier Backup Exec service backups to B2 Cloud Storage).

• B2 Cloud Replication: Achieved general availability in June for this new feature which supports multiple use cases, including geographic distribution to support disaster recovery objectives or serve compliance needs.

Financial Outlook

For 3FQ22

• Revenue between $21.4 million to $21.8 million.

• Adjusted EBITDA margin between (18)% to (14)%.

• Basic weighted average shares outstanding of 31.9 million to 32.9 million shares.

For FY22

• Revenue between $83 million to $86 million.

• Adjusted EBITDA margin between (17)% to (13)%.

Comments

Small public company Backblaze was about never profitable since its inception. For the quarter, it records once more a net loss of $11.6 million, the highest figure in the history of the company - but for former quarter at $12.5 million - and we don't see this trend discontinuing in the next future.

To avoid this, there could be a solution: to increase the price of firm's cloud storage services. But it's very risky as this market is highly competitive in term of prices with giant competitors, and the facts that the success of Backblaze is fundamentally based on its low prices and that the customers are very versatile as it's easy to go from a provider to another one.

Revenue for the quarter is up a record of 28% at $20.7 million, another historical record, better than the guidance - between $20.2 million to $20.6 million.

| (in $ million) | Revenue | Y/Y growth | Net income (loss) |

| FY19 | 40,748 | NA | (996) |

| 1FQ20 | 12.4 | NA | NA |

| 2FQ20 | 13,0 | 5% | (1,4) |

| 3FQ20 | 13.8 | 6% | (1.9) |

| 4FQ20 | 14.6 | 6% | (3,4) |

| FY20 | 53.8 | 32% | (6.6) |

| 1FQ21 | 15.3 | 5% | (3.7) |

| 2FQ21 | 16.2 | 5% | (2,4) |

| 3FQ21 | 17,3 | 5%-7% | (6.5 to 7.5) |

| 4FQ21 | 18.7 | 28% |

(9.6) |

| FY21 |

67.5 | 25% | (21.6) |

| 1FQ22 | 19.5 | 27% | (12.5) |

| 2FQ22 | 20.7 | 28% | (11.6) |

| 3FQ22 (estim.) | 21.4-21.8 | 24%-26% | NA |

| FY22 (estim.) |

83-86 |

23%-27% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter