NAND Flash 3Q22 Price Drop to Broaden to 8~13%

Supply chain overstocked

This is a Press Release edited by StorageNewsletter.com on July 26, 2022 at 2:02 pmAccording to TrendForce Corp., market oversupply intensified in 2Q22 due to lagging demand and continued NAND flash output and process advancement.

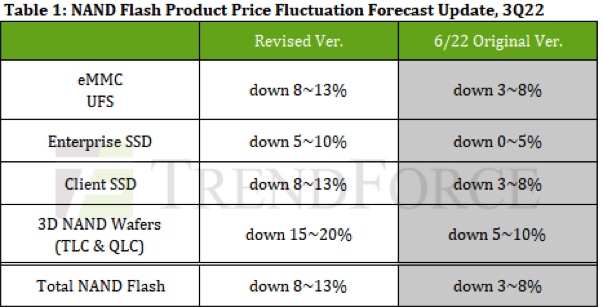

The market consensus is a disappointing 2H22 peak season for consumer electronics including notebooks, TVs, and smartphones. Material inventory levels continue to rise and has become a risk to the supply chain. Due to slow destocking among distributors and a conservative stocking approach among clients, inventory problems have bubbled over upstream onto the supply side and sellers are under increased pressure to sell. Due to the rapid deterioration of the balance between supply and demand, the drop in NAND flash pricing will expand to 8~13% in 3Q22, and this decline may continue into 4Q22.

In terms of client SSD, due to weak consumer demand, various PC brands have reduced their purchase order volume in 3Q22 in order to digest 1H22 SSD inventory.

As suppliers shift focus to 176-layer client SSD, 176-layer QLC SSDs have begun to ship, and YMTC looks to expand shipment of notebook client SSDs in 2H22, price competition has become increasingly fierce, forcing manufacturers to increase price concessions to incentivize clients to up order volume. Thus, the decline in client SSD pricing is expected to expand to 8~13% in 3Q22.

In terms of enterprise SSD, purchasing momentum in 2H22 will be inferior to 1H22, mainly due to the impact of the overall economic recession on server brands’ shipments of whole devices. Corporate order volume continues to decline, simultaneously affecting the purchasing momentum of enterprise SSDs in 3Q22. Secondly, orders from cloud service providers in China were weak in 3Q22 and demand driven by shipments of next-gen server platforms failed to meet expectations. In order to boost the growth of enterprise SSD revenue, suppliers expect to stimulate sales through more generous price negotiations. However, buyers are currently unwilling to expand procurement, so enterprise SSD price declines are estimated to broaden to 5~10% in 3Q22.

In terms of eMMC, weak demand for major applications such as chromebooks and TVs has induced buyers to carefully control inventory, so it is hard to see any signs of life in eMMC pricing. Although manufacturers’ long-term plans involve a continued reduction in the supply of 2D eMMC products to keep prices stable. End customers and module customers are focused on destocking due to the recent overall downward trend in demand. Eventually, oversupply in the eMMC market will become more serious than expected. Therefore, the price of eMMC in 3Q22 will drop by another 8-13%.

In terms of UFS, since China’s 618 e-commerce promotions have not induced recovery in smartphone demand, destocking of whole devices has become a top priority for Chinese OEMs. Sluggish demand has not only impacted Chinese smartphone brands. Even Samsung, which is mainly focused on markets excluding China, has warned that the demand outlook is clouded, leading to a sustained weakening of the UFS market in 2H22. Originally, sellers held the view that price concessions would not stimulate demand and were unwilling to negotiate pricing. With rising inventory pressure, reducing prices to capture sales is inevitable. The decline in UFS pricing is estimated to expand to 8~13% in 3Q22.

In terms of NAND flash wafers, a rebound in demand during peak season and the lifting of lockdowns in China were originally forecast to refresh the market. However, demand continues to deteriorate and inventory at module factories and end customers remains high, resulting in a sustained decline in wafer quotations. At the same time, manufacturers continue to expand the supply of wafers and process optimization continued to improve, resulting in magnified inventory pressure at the factory end. The decline in NAND flash wafer pricing is estimated to expand to 15~20% in 3Q22.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter