History (1999): Brocade Unstoppable SAN Player

Leader in FC switches

By Jean Jacques Maleval | July 22, 2022 at 2:01 pmBrocade Communications Systems is still a young company, since it has only been operating for 4 years, but it should soon be creating considerable stir, since it is oriented towards a highly promising market, for switches that connect to computers and storage devices such as disk and tape drives.

These FC switches are, in fact, crucial elements in SAN architecture. They allow users to improve the data transfer speed between the components connected to it, and to run simultaneous applications such as duplicating or backing up without affecting other running applications.

Brocade boasts 123 employees directed by president and CEO since July 1998, Gregory Reyes, 36.

The company occupies 35,000 square feet of office space in its San Jose, CA, facility.

It bills itself the world leader for this kind of switch, based on revenue and number of ports shipped.

Moreover, its list of customers is hardly made up of unknowns: Bull, CNT, Compaq, Data General, Dell, McData, Sequent, Siemens and StorageTek.

In the six months ended April 30, sales to Sequent, McData and Data General accounted for 31%, 25% and 15% of its total revenues, respectively. A year earlier, for the same period, Sequent represented 83% of its sales.

The company also recently entered into a relationship with systems integrators such as Cranel, Polaris, RAID Power, Tokyo Electron and TranSoft Networks. In addition, it numbers Emulex, Legato, QLogic and Veritas (whose CEO, Mark Leslie is a member of Brocade’s board) among its strategic partners.

Saving the best for last, one of the firm’s sweetest deals was the announcement last month that IBM had selected its SilkWorm family of FC switches as its 8-port and 16-port FC connectivity solution for all its SAN solutions worldwide. IBM also plans to work with Brocade to integrate switches with solutions from Tivoli Systems, an IBM subsidiary.

The next gen of SAN switches to be released by Brocade will be called SilkVVorm 2000. The 2100 is an 8-port FC loop switch that, by means of a software upgrade, provides a migration from a loop-based storage environment to a fabric-based SAN. The 2400 and 2800 are respectively 8- and 16-port FC switches. These products offer hot-swappable redundant power supplies.

For the FC switch market, competitors are not legion. There is, of course, Ancor Communications, which also makes SAN switches, but there are also hub manufacturers such as Gadzoox Networks and Vixel. It is not out of the question that other competitors emerge, particularly from the networking sector.

The price of these switches is quite high, but can only fall in the months to come. This would place Brocade, which already points to an average unit price decrease of 26% for its products during FY98, in some difficulty.

Another possible concern for the company is that it has only one subcontracting source to manufacture all its products, which is not without its pitfalls. The company in question is Solectron, in Milpitas, CA.

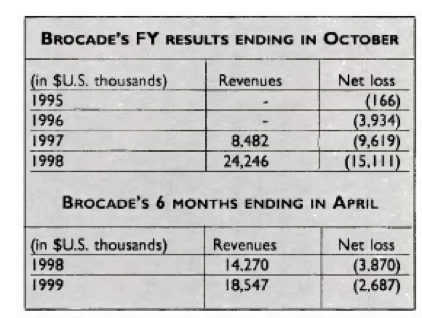

The financial community’s interest in Brocade was made evident recently when, during its IPO on May 25, the company offered $19 per share for more than 3 million shares of its common stock, which amounts to a 13% stake. The went like hotcakes, which allowed Brocade to raise $61.9 million before expenses. On the same day, the share’s value rose from 26 1/4 to 45 1/4 as 7.5 million shares changed hands on the Nasdaq. The company closed that day with a market value of $1.1 billion. Not bad for a firm with an accumulated deficit of $31.5 million that is still not about to see its first profits, not in the short term, anyway.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter