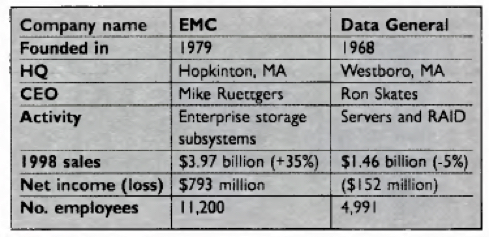

History (1999): EMC Acquired Data General for $1.1 Billion

Getting Clariion mid-range storage subsystems

By Jean Jacques Maleval | July 21, 2022 at 2:00 pmThe final agreement between the 2 firms resulted in EMC’s acquisition of all of Data General, in a stock deal valued at about $1 billion, a price that doesn’t seem excessive for a $1.46 billion company, and that amounts to less than one quarter’s sales for EMC.

If anyone is relieved by the transaction, it’s probably Ron Skates, CEO of DG since 1989, a remarkable executive who managed to keep afloat a company that, like DEC, king of the minicomputers, had missed the boat on PCs and the Wintel revolution. It’s only a theory, of course, but after encountering Skates last February, it struck us that his main priority for some time now has been to build the company back into something healthy enough to attract an eventual buyer. DG has seemed up for grabs for a while now.

Then one day, the first of June, to be more specific, Mike Ruettgers, CEO of EMC, got in touch. Everything happened rather quickly after that, with the official announcement of the acquisition on August 9.

DG will merge with Emerald Merger Corp., a wholly-owned subsidiary of EMC based in Delaware, formed solely for the purposes of this merger.

EMC thus acquires a company that is made up, in fact, of 2 distinct entities, one for Aviion servers, the other for Clariion.

DG Clariion and Aviion

It’s hard to imagine EMC venturing into servers, much less straying from its core storage business, but on the other hand, it cannot get rid of the Aviion division for 2 years, for legal reasons, since the overall acquisition was a stock-for-stock transaction. However, it could take advantage of DG’s Numa architecture with symmetric multiprocessing in order to boost its Symmetrix technology, currently relying on somewhat out-of-date microprocessors.

For EMC, of course, the jewel in the crown is Clariion. Along side its high-end Symmetrix line, EMC will now be able to offer excellent mid-range storage solutions for the NT and Unix universe.

If DG was rather weak on service and direct sales, EMC is something of a powerhouse with its impressive supersellers. DG, however, had recently decided to invest in a new sales team, with the emphasis on the OEM market. The new union can now boast a veritable armada throughout the world.

One question arises: will the 2 separate entities encounter the kind of serious problems relating to culture difference that we saw between Compaq and Digital Equipment? EMC and DG are both oldtimers, separated by only a few miles in the Massachusetts tech belt outside Boston.

We can expect a few hard cuts – EMC is not at all sentimental about such matters – among the subsidiaries.

For the nine months ended in June, revenue from Clariion increased 10%, to $322.4 million compared to the same period the previous year, and accounted for 41% of total sales.

DG, however, made a serious mistake by ignoring Ultra SCSI RAID, passing directly to FC. At the same time, this allowed it the chance to be probably the first firm to offer an FC RAID, a highly beneficial move in itself, since, for the same 9-month period, 56% of total Clariion revenues were obtained with full FC products, which have multiplied by 4 from one year to the next.

If we look more closely at DG’s FY ending in September 1998, HP was its largest single customer, representing 13% of all the manufacturer’s sales. Next up were Bull, Dell, NEC, Sequent, SGI and StorageTek, to name a few. Since then, however, HP has had less confidence in DG, to the point where, for the last known quarter, 3Q99, ended in June, sales to HP had declined 53%.

This did not prevent Clariion from achieving sales of $105.7 million, up 10% (but only 10%) from 3Q98. It remains to be seen whether Clariion’s OEMs take a dim view of rival EMC suddenly transforming itself into a customer.

Up to now, the most virulent members of the anti-EMC camp, apart from StorageTek (in other words Compaq, HP, IBM and Sun) are not huge fans of Clariion RAID. The most recent OEMs to sign on were Fujitsu in Europe and Unisys.

100,000 Clariion disk arrays, which correspond to an installed capacity of 9PB, including 2.5PB on FC units, have shipped since 1992.

This article is an abstract of news published on issue 140 on September 1999 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter