History (1999): HDD Industry Starts Upwards Sales Trend in 1999

Revenue down 5.2% in 1998, despite an 11.1% increase in unit shipments

By Jean Jacques Maleval | July 7, 2022 at 2:06 pmSeveral disk drive manufacturers placed a higher priority on market share than on profits during the 1998-99 period, according to the 1999 report on rigid disk drives ($2,960) from Disk/Trend.

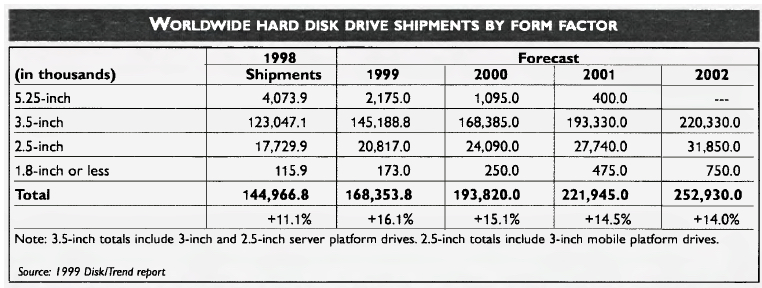

As a result, WW HDD sales were down 5.2% in 1998, despite an 11.1%t increase in unit shipments. [The research firm must have revised these figures downward since last year at the same time, when it forecasted 7.9% growth in value and 16.9% in volume for 1998. Ed]

In 1999, the industry is just as price competitive, but overall revenue is forecasted to increase 7.7%, boosted by a 16.1% increase in unit shipments.

The industry shipped 144.9 million HDDs in 1998, and the projection for 1999 is 168.3 million, with the forecast for 2002 set at 252.9 million drives. By 2002, the industry is expected to have total sales of $50.3 billion, as shipments of HDDs follow the upward path of various types of computer and consumer markets, and as average disk capacities continue to escalate.

75% are desktop drives

Currently, desktop drives dominate shipments, with 74.9% of the 1999 estimated WW total, followed by server drives at 12.7%, and mobile drives with 12.3%.

Several major computer manufacturers produce “captive” disk drives – the drives they sell with their own computer systems. Both captive drive manufacturers and independent drive producers also compete in the noncaptive market, selling disk drives through distribution and OEM drives to other system manufacturers.

Data shows that the noncaptive sales channel is a key to the industry’s future growth, expanding from 76.5% of 1998 revenue to 83.7% in 2002.

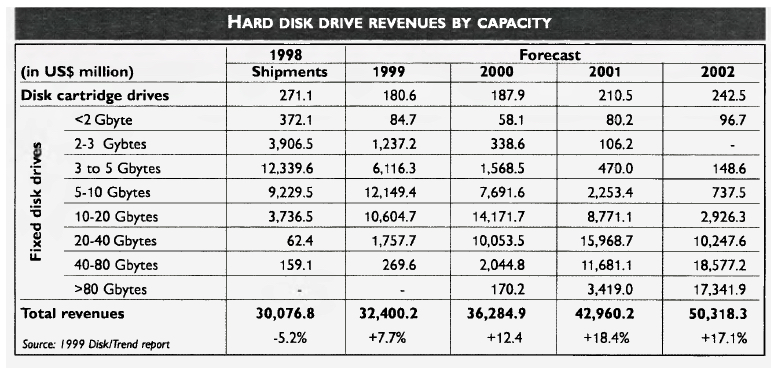

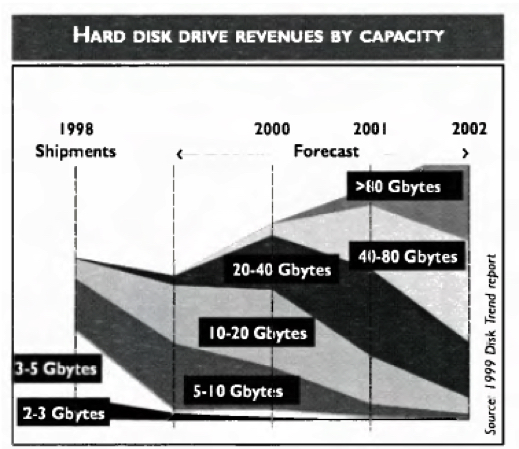

There’s no stopping the upward movemert in average disk drive capacities. Drives in the 3 to 5GB range held the lead in 1998 shipments, but the market’s appetite for more capacity goes up every year. In 1999, leadership has already moved up to the 5-10GB group, with 40-80GB forecasted to be 2002’s leading product group.

IBM, leader in revenue

The overall leader in sales revenue was again IBM, with 27.1% of the WW total, including a combination of captive and noncaptive sales. Second and third places, involving only noncaptive drives, went to Seagate Technology, with 19.8%, and Quantum, with 12.4%. Both companies lost market share in 1998, in the face of severe competition. Only those disk drive producers which are well suited to an environment of very short product life cycles and intense competition manage to survive.

59 companies manufactured rigid disk drives at the beginning of the 1990’s, but in 1999 only 18 active or announced manufacturers remain, a net reduction of 2 from the previous year.

The report counted 389 different disk drive models.

0.3 cent, the projected price per MB in 2002

The race to deliver ever higher capacities and very competitive prices has been tough on disk drive manufacturers’ profits, but it’s been a good deal for the industry’s customers. In 1988, the average price per megabyte for all HDDs was $11.54. In 1998, the average price had fallen to 4.3 cents, and the estimate for 1999 is 2.3 cents. By 2002, the overall average price per megabyte for all disk drives is projected to be 0.3 cents.

This article is an abstract of news published on issue 138 on July 1999 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter