HYCU Secures $53 Million Series B, Total at $140.5 Million

To grow SaaS-based service

This is a Press Release edited by StorageNewsletter.com on June 14, 2022 at 2:02 pmHYCU, Inc. announced its $53 million series B led by Acrew Capital.

All Series A investors returned, including Bain Capital Ventures (BCV). Strategic investors and innovation leaders Atlassian Ventures and Cisco Investments also participated in the round.

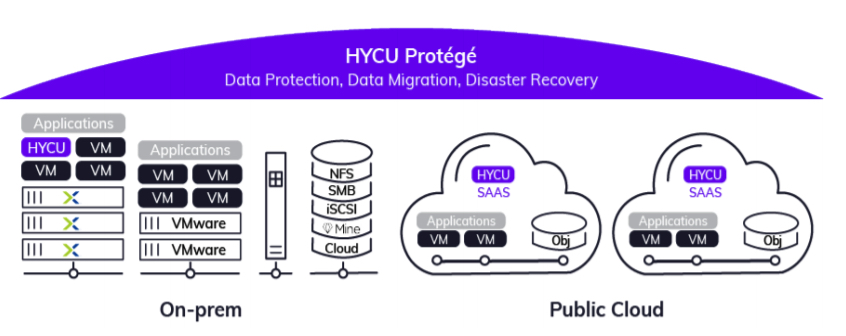

Funding will help accelerate several key go-to-market initiatives to support demand in HYCU’s multi-cloud data protection solutions across on-premises and public cloud environments, including bringing to market a new developer-led SaaS service.

With 92% of organizations rapidly adopting a SaaS-based multi-cloud model, there is a need for companies to deploy new solutions that serve as true multi-cloud data protection delivered as-a-service. With a mission of building a safer world by protecting critical data, HYCU will use the new funding to continue developing its solution to serve evolving data and recovery needs. Over the past 12 months, It has added 165 employees across go-to-market, sales, HR and engineering. The new funding will accelerate key positions in alliances, product marketing and customer success as well as advance some innovation-focused solutions and services delivery.

“With an average of more than 130 data silos in use at today’s enterprises, any solution to manage, protect and recover data should be easy to use and deploy,” said founder and CEO, Simon Taylor. “HYCU fundamentally believes there is a better way to solve data protection needs, and we are on track to deliver a profoundly simple and powerful solution before the end of the year. Adding strategic investment from Atlassian Ventures and Cisco Investments, along with the on-going support from Bain Capital and Acrew is a testament to what the team has developed and is delivering to customers worldwide.”

Theresia Gouw, co-founder of Acrew Capital, joins BCV Partners Enrique Salem and Stefan Cohen, and Simon Taylor on board of directors. An investor and strategic leader, he currently serves on several SaaS boards, including SolvHealth, PredictHQ and Ketch. Her experience in the industry will help HYCU as it continues to enhance and grow its solution portfolio to meet customer needs.

“The rise of multi-cloud brings an insurgence of ransomware threats,” said Gouw. “Amidst the current economic climate, the explosion of data assets and the high value of data, we’ve seen HYCU rise as the key way of simplifying the multi-cloud data protection experience including a powerful way to address ransomware protection and recovery. I look forward to being an active member of the HYCU board of directors and to help further position HYCU as the leading data backup and recovery solution for multi-cloud and SaaS solutions. This is only the beginning and it’s an exciting time to be paving the way to the future of data protection.”

In recent years, SaaS customers have begun to require answers to how their data is protected. As a result, organizations are identifying the need forbackup and recovery solutions. HYCU provides granular recovery capabilities, supporting individual file systems and networks that enable SaaS services to easily write an enterprise-grade data protection solution directly into its platform.

“In the hybrid world, customers expect to consume cloud delivered as-a-Service offerings. HYCU is applying this to backup and data resiliency with a cloud-native, storage agnostic solution,” said Aleem Rizvon, VP corporate development, Cisco. “Through Cisco Intersight, we are working to transform many of the traditional IT functions into cloud services. That’s why we are pleased to invest in HYCU as they bring this approach to the data resiliency space.”

“At Atlassian, we believe in breaking down organizational and data silos across technical and business teams. Collaboration is about bringing these teams together, and HYCU does this by allowing customers to work together on a secure and reliable platform,” said Matt Sonefeldt, head of Atlassian Ventures. “We’re excited to welcome HYCU to the Atlassian Ventures family and believe its approach to data protection as a service creates immense potential for our 200,000+ cloud customers.”

HYCU’s Series B follows a $87.5 million Series A led by BCV last year and brings the total investment to $140 million in a little over a year. Building on Y/Y bookings growth of 150%, this announcement follows a successful first quarter close, with projections to achieve the same growth rate in 2022. The company also tripled revenue in the past 12 months, maintained a 135% net-retention rate, maintained a 91 net promoter score (NPS), the highest in the industry for data protection companies, and saw a 4x increase in valuation in the last year.

Comments

Here are the comments of Philippe Nicolas for StorageNewsletter.com followed by other ones from DCIG.

Philippe Nicolas for StorageNewsletter.com

This new investment round is significant and clearly marks an acceleration for HYCU. Last round, series A of $87.5 million, was made in March 2021 and approximately one year later the company raised this new round, series B of $53 million, making a total of $140.3 million. This new round was made at valuation 4x the previous one confirming the business position and potential of the company.

Speaking with CEO Simon Taylor, he confirmed that the current situation of the company doesn't force or invite him to raise money but external investors knock at his door to have a piece of the growing cake. Also in the current economic climate, tons of money continues to circulate and investors wish to invest before any future potential downturn and tensions on markets.

This positive event confirms that Modern Data Protection aka MDP is a real trend covering multiCloud, SaaS apps. and service mode, Kubernetes, ransomware, etc., in addition to classic approaches mastering bare metal, virtual machines, file servers/NAS and online applications.

Each wave has disrupted previous established vendors:

- Veritas with NetBackup, Dell EMC with Networker, IBM with Spectrum Protect, Commvault with Simpana, Atempo with Tina, etc. have been shaked when Veeam landed with a very easy VM protection approach and they had to react and add some mechanisms to stay in the "race".

- Then, a few vendors - we called them the next gen players - coming with a radical new way to protect data, there are Rubrik, Cohesity, HYCU, etc., with considerations of new environments, applications such NoSQL databases and cloud of course.

- Veeam also has been touched when containers and Kubernetes wave reached the coast. The company reacted with the Kasten acquisition and others with new additions and partnerships such NetBackup with Trilio. Even players like Pure Storage realized the tsunami and acquired Portworx with a solution going beyond data protection.

- SaaS applications with Microsoft365, Salesforce and others have also unveiled some dedicated players like OwnBackup, CloudAlly now owned by OpenText, CloudHQ, Spin, Keepit or the Commvault initiative with Metallic, etc., the list being pretty long just for that protection behavior.

- Each wave shakes established positions and triggered pretty fast decisions. Druva made some acquisitions, other new players arrived like Clumio and at the same time MSPs put pressure on vendors such Asigra, Axcient, Kaseya with Spanning and Unitrends, Datto with the pending acquisition by Kaseya, N-able, Acronis, OpenText/Carbonite to name a few.

Definitely this data protection segment is hot, fueled by a few key IT changes such cloud, SaaS and Kubernetes. The battle is not over and expect to see some IPOs and above all some M&A activities in the coming months. No doubt on that.

HYCU plans to announce also some key product evolution and based on what we saw in the past, we can expect a major step forward in the data protection spectrum. Next few quarters will be for sure interesting to watch.

DCIG

These comments were written on June 9, 2022 by Jerome M. Wendt, president and founder, DCIG LLC.

HYCU Takes in Another $53 Million

to Further Accelerate Enterprise SaaS-based Backup Adoption

Enterprises want and need to move ahead with SaaS-based backup offerings to simplify their backup environment. However, enterprises loathe risk. This means they will make even an established enterprise SaaS-based backup provider prove itself before implementing its offering. Thanks to its latest $53 million investment, HYCU may more expeditiously address their concerns so enterprises may implement SaaS-based backup sooner rather than later.

Enterprises want SaaS-based backup but ...

The more that organizations focus on their core competencies, the more successful and profitable they tend to become. This mindset helps explains why more organizations want to implement SaaS offerings. Specifically, they want the benefits the software delivers. At the same, they want to shed the ongoing responsibility of managing and maintaining its underlying software and hardware.

This represents the challenge enterprise consumers of SaaS offerings face, especially when they go to select SaaS-based backup offerings. They want the simplicity and innovation they bring. However, they cannot haphazardly deploy them because they touch and protect so much of their cloud and hybrid IT infrastructure.

SaaS-based backup offerings must cross a higher bar. Enterprises need an established, technically sound, enterprise level backup and recovery SaaS-based offering. This offering must deliver robust, feature-rich backup and recovery services.

Further, enterprises often need for the provider to demonstrate its financial viability. They may want evidence of how well it provides back end technical support nationally or globally. They may simply want more of their peers to also use it before they commit to subscribing to it.

Overcoming this combination of technical, financial, and intangible hurdles represents a significant undertaking for any new SaaS provider. They become even more significant for SaaS providers entering a mature market such as backup and recovery.

Established and growing enterprise SaaS-based backup offering

HYCU already has demonstrated its enterprise technical chops in SaaS-based backup. DCIG has previously recognized this company with top 3 and top 5 awards for its enterprise backup and recovery capabilities for Azure and Google cloud backup and VMware vSphere.

Further, HYCU was in the process of addressing these other intangible enterprise concerns even before it accepted these additional funds.

Consider:

• It has taken in nearly $90million in investment over the past year with this $53 million bringing the total to over $140 million

• It has tripled its revenue over the past 12 months.

• It has grown its Y/Y bookings by 150%

• It maintains a net promoter score of 91%, the highest among data protection companies

• It maintains a 135% net-retention rate. This means it retains its current customers and experiences new growth and opportunities with them.

Despite these accomplishments, every enterprise tends to have its own set of intangible requirements and hurdles that any provider must satisfy. Meeting them takes time, money, and resources.

$53 million investment means HYCU can grow faster

That's what makes the latest $53 million funding round into HYCU so significant. It further positions the company to address the specific requirements each individual enterprise has. Now if one wants HYCU to show it a better balance sheet, HYCU can check that box. If another one wants HYCU to hire more sales reps, bring on more partners, provide better technical support, or whatever, HYCU has funds to address those concerns.

Further, these additional funds came from noteworthy investors who recognize what HYCU offers. Acrew Capital, Atlassian Ventures, Bain Capital Ventures, and Cisco Investments all came to the table unsolicited. They saw the opportunity to invest to accelerate stat-up's ability to address specific enterprise concerns. Now HYCU has more money so it can acquire or build what they need or demand.

SaaS-based backup: coming soon to your enterprise

Enterprises recognize their need to move forward with adopting a next-generation, multi-cloud SaaS-based backup offering. However, they cannot put their IT workloads and data at risk no matter how compelling the offering. They need assurance any SaaS-based backup offering they bring in keeps their workloads and data safe.

HYCU has already demonstrated its ability to perform technically and keep workloads and data safe. These additional funds will certainly help HYCU expand its technical capabilities.

However, HYCU can more importantly reach out and touch more enterprises to address and overcome their specific objections to adopting SaaS-based backup. As it does, it will help SaaS-based backup in general and the firm specifically gain traction in the market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter