History (1999): Exclusive Interview With Michal Ruettgers, President and CEO, EMC

"We buy in excess of $600 million per year in HDDs."

By Jean Jacques Maleval | May 12, 2022 at 2:00 pmAbout EMC

Founded in 1979, it is a Fortune 500 company that employs 9,400 people WW. It has shipped nearly 30,000 Symmetrix storage systems since the product’s introduction in 1990.

Michael C. Ruettgers

![]() Ruettgers (pronounced rut-gers), 56, has been president and CEO of EMC since January 1992. He joined the company in 1988 as executive VP of operations and customer service and was promoted president and COO in 1991. In 1998, Business Week named him one of the world’s top 25 executives. He spent much of his earlier career with Raytheon, where he played a key role in the Patriot missile program. In 1981, he joined Boston, MA-based Keane, a software development company where he was SVP. In 1987, he became COO of Technology Financial Services where he advised such firms as IBM, AT&T and the regional Bell operating companies. He holds a B.S. from Idaho State Univesity (1964) and an MBA from Harvard Business School (1967). He is the oldest of 4 children. His father was a US Air Force pilot who moved the family in England, Germany, Japan and Turkey. He is married with Maureen, they have 2 daughters and a son. His hobbies: golf, fishing, cooking (especially coq au vin), reading military books, playing pool.

Ruettgers (pronounced rut-gers), 56, has been president and CEO of EMC since January 1992. He joined the company in 1988 as executive VP of operations and customer service and was promoted president and COO in 1991. In 1998, Business Week named him one of the world’s top 25 executives. He spent much of his earlier career with Raytheon, where he played a key role in the Patriot missile program. In 1981, he joined Boston, MA-based Keane, a software development company where he was SVP. In 1987, he became COO of Technology Financial Services where he advised such firms as IBM, AT&T and the regional Bell operating companies. He holds a B.S. from Idaho State Univesity (1964) and an MBA from Harvard Business School (1967). He is the oldest of 4 children. His father was a US Air Force pilot who moved the family in England, Germany, Japan and Turkey. He is married with Maureen, they have 2 daughters and a son. His hobbies: golf, fishing, cooking (especially coq au vin), reading military books, playing pool.

Computer fata Storage Newsletter: EMC. E for Egan, M for Marino. But who is the mysterious Mister C.? Ruettgers: Who is the mysterious Mr. C.?

Ruettgers: That’s a good question. The answer is that originally there were 3 partners, Egan, Marino, and ???. I think his name was Curry, or Curley, but he left within a week after the company was originally formed. He’s kind of like the Beatle’s drummer before Ringo Starr, nobody remembers who he was.

Is anyone from Egan’s family working in your company now?

No, the 3 sons are all outside the company.

Who had the great idea to go from memory boards to storage, and when?

We started some of that just as I arrived, and then the idea to focus on mainframe products in 1990 was the culmination of some technology, and a decision by me and a guy called Bob Ano.

I’ve heard a lot about someone called Moshe Yanai, who seems to be a key element of your team…

Yes, he’s the engineering manager, he runs most of the engineers.

Has he been with EMC for a long time?

About the same amount of time as me, 11 years.

I’ve often heard from your competitors that EMC is just selling cache. What do you say to that?

In the original days, our systems had huge amounts of cache in them, but that’s because we had some very smart microcode that would anticipate the computer’s next request so we could take stuff off the disk drive and put it in the cache, which made our system so much faster than anybody else’s. Originally we were much more reliable, much faster than the competition due to the cache, then because of the design, using small disk drives, we were also much smaller. We could put in a cabinet the size of this table what IBM would require the rest of this room to hold. So you can imagine, as expensive as space is in Paris, Tokyo or London, that represents considerable savings.

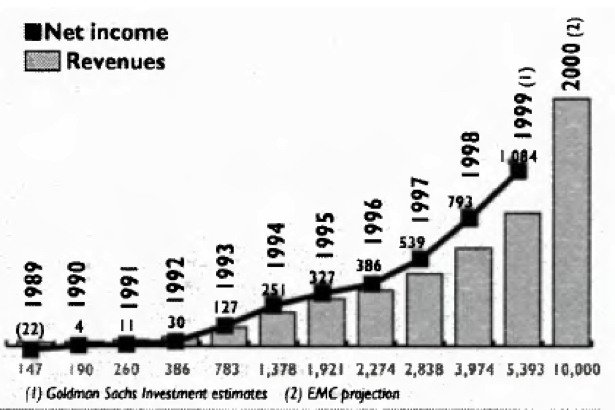

Your target is to be a $10 billion company in 2001, from $4 billion last year. In summary, what new ideas do you have to reach that level?

One is to do higher capacity Symmetrix systems, 9TB, the new microcode that helps with the Internet and also with ESN (enterprise storage networks), the FC switches and directors that were in a big cabinet, and finally the announcement of professional services to help with the ESN. All four of those announcements are important.

Do you think you can reach this level despite the rapidly falling prices in the storage industry?

Yes. Historically, we’ve seen price declines, so this won’t be a new environment for us.

How do you manage Hewlett-Packard, which is both your best customer, with nearly 20% of your revenues, and also one of your competitors?

I’m surprised to hear you call them a competitor, because we don’t see them as a competitor. They’re a partner to us. But in the Unix environment, HP is selling storage subsystems… In the target market, to the best of my knowledge, they sell our stuff almost all the time. A small number of big customers.

What is your average sale per user?

I’d characterize it as our having a large number of good customers. To give you a sense, each quarter, we look at the top 10 customers, and from quarter to quarter it’s never the same. Different companies are always buying at different times. The typical large customer probably buys in excess of $10 million per year.

How many accounts do you have per year?

Actively, we’re marketing to about 2,000 companies.

During your press conference in London, UK, you stated that you were the only company in storage system multi-host environments. Did you forget about IBM on purpose?

No, IBM has no system that will do what we do. But they are multi-host… But they’re all different systems. We have the only system where you can connect it to a mainframe, at the same time connect it to Unix, and at the same connect it to NT. IBM has no system that can do that They have one system to work with mainframes, another to work with Unix, another one with NT. But they don’t have a single system, which makes them no different from all these other people that just sell systems with attachments.

Dataquest said that you were the leader in external RAID revenue in 1998, but IDC put you in third place after Compaq and IBM for storage systems revenue. Who is right?

Dataquest is right, and IDC is right The difference is that IDC includes all the storage that is shipped inside a PC, all the internal storage as well. Dataquest makes the distinction for external systems, sold separately.

Are you going to compete in the low-cost SAN market, like Dell or Compaq?

No. For our target customers, they’re consolidating more and more data into the data center. They need the larger systems. We believe that 80% of the business comes from 20% of the world’s customers, that’s what we’re focused on.

Your company talks about open systems, open storage, and so on, but you are a proprietary company – the key to Symmetrix is the controller, with proprietary microcodes.

But what’s important is not the components. For example, at the disk drive level, IBM doesn’t build Seagate’s disk drives, they have their own controllers that are slightly different What’s important, is to make those systems capable of operating in other systems. What we do is provide, particularly for management software, we provide APIs that let other management systems control our systems, and that’s really what customers are interested in.

It’s nice to have a storage subsystem with multiple OSs, but when will it be possible to access the same records in a unique data base, using different OSs?

We’ll see that in the next several years. We’re already beginning to move information back and forth within the storage system now, so it won’t be that long. How do you see the solution to this problem? With more software.

And who’s going to do it?

A company like EMC, or Oracle… You’ll see combinations of companies.

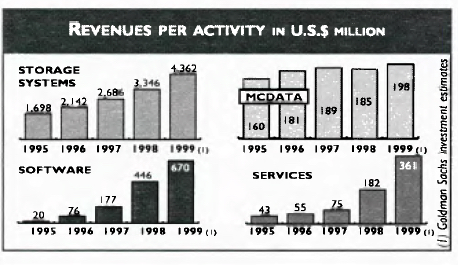

EMC decided to invest $1 billion in software in 1994. And recently, another $1 billion for the next three years. But if we look at your software revenues, 1997 saw $177 million, and $446 million in 1998, there’s a huge gap between investment and revenues.

Well, if you look at the value in our systems, there’s a tremendous amount of software that goes into the system itself that we don’t sell separately as software. All the value in our system is not just the hardware, it’s the microcode and the software.

If I’ve understood correctly, the new Connectrix from MacData, your new 64-port switch only supports NT and Unix, not OS/390… that’s a big drawback, no?

Only in the sense that IBM doesn’t yet support what they call Ficon, so they don’t have it available yet, but as soon as it’s available, then we’ll support it. It’s a case where we’re waiting for IBM, not the other way ’round.

Where do you buy your disk drives?

They come primarily from Seagate and IBM.

How many do you buy per year?

Hundreds of thousands. I think the total is in excess of $600 million in disk drives.

Do you already integrate FC drives?

We’ve done it in the laboratory, but we still don’t think they’re reliable enough today, they don’t add very much to the performance of the system yet.

EMC was the first company in the mainframe environment to have a sales strategy like photocopier vendors, Xerox or Canon for instance. You’re well paid, but you’d better reach your goals. Do you agree?

Absolutely. We just had some sales people in Japan that weren’t performing that were asked to leave.

Why did you buy the French service company, MCI?

We bought it because we were looking to expand the professional services business that we offer in France.

Legato Systems seems to be a complement to EMC. Do you agree?

I think that Legato does some complementary stuff, as does Veritas. Both of them complement us. We compete with them in some areas, but we’re also working together in other areas. Both of those companies are part of Fiber Alliance.

No acquisition in view in the near future?

We’ll certainly be acquiring some additional software companies, I don’t know if it will be one of those 2 firms.

A few years ago, you bought another French company, called Copernique. Was it just for the building?

No, it wasn’t just for the building. We’re actually using some of their technology and some of the new software.

For which products?

For the Celerra software product. Data base management is the application for all the big companies.

Data base management is the application for all the big companies. Are you working on a specifically-designed optimized server for that?

Not so much on the server side, but clearly we’re working very closely with people like Oracle to make sure that the two systems, our software and their software, work together very well.

One of the future opportunities you talk about is the new tape replacement market. Could you give some specifics?

There’s a real desire for companies to minimize the amount of information they put on tape today, because tape is slow, and it’s becoming very expensive to manage, all the handling of it. There’s a strong desire to put some tape data onto disk drives. What you would like to do is not to have the computer reformat it for the disk, you’d like to have the computer and programs say’ Write this to tape,’ and then intercept those instructions and write them to disk. A lot of customers have shown an interest in that.

Will you have 2 kinds of disk drives, as with HSM, a slow one and a fast one?

Yes, something like that.

Will you enter into virtual tape systems or systems incorporating both disk and tape libraries?

We have some joint activities with a company in that business right now, a company called Sutmyn, they’re a spin-off from Memorex, they’re doing virtual tape stuff and we’re providing disk storage at the back end for that.

But you won’t have your own product?

We have some software that’s right around that, and as part of this tape replacement market we’ll do something in this area that will look like that.

You’re on the board of EG&G. What is that company?

It’s an American conglomerate, it used to be primarily in the defense business, they used to run a number of the big energy programs for the government in the US, nuclear waste disposal, that sort of thing, now they’re out of that. Today if you go through metal detectors at airports, they own Hymen, which makes them.

I calculated that in 1998 you earned around $2 million, including salary, bonus, compensation, etc.

Probably a little less than that, but that’s in the ballpark.

What will be your next big personal expense?

When my wife comes back from her next shopping trip. The good news is that of the $2 million you mentioned, almost half of that went to Clinton…

Is it true that you wash the dishes at home?

My wife thinks it is… Somebody caught me cleaning up yesterday, the conference room had gotten messy, and I was putting things away, and someone came in and said: ‘Oh! You do the dishes.’

EMC Stock

EMC stock began trading publicly in 1986. A stockholder who bought 1,000 shares of the company’s stock for $16,500 at the initial offering in April 1986 and held onto the stock would today be sitting on 18,000 shares today at $1.89 million (based on the closing price of $105 on February 24, 1999). During 90s, EMC’s stock has been, after Dell Computer, the second-best performer among all public companies traded on US exchanges, rising 38,654% since January 1, 1990, which translates to an average total compound annual return of 69%.

This article is an abstract of news published on issue 134 on March 1999 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter