History (1999): Plasmon Set to Acquire Philips LMS for $26.4 Million

Two of few companies in world involved in both optical and tape technology

By Jean Jacques Maleval | April 27, 2022 at 2:01 pmWho could possibly buy Philips Laser Magnetic Storage, which the Dutch parent company has been trying to shed for awhile, as it has done with almost all of its peripheral activities that don’t revolve around the CD?

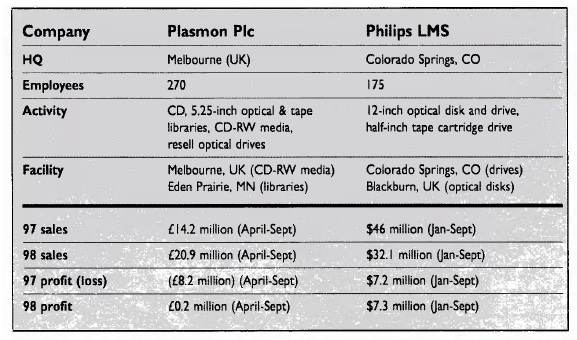

Plasmon plc is one of the few companies in the world involved in both optical and tape technology, both also specialties of Philips LMS.

In fact, the UK company has a US subsidiary, Plasmon IDE, which manufactures tape and optical libraries, whereas the parent company is a longtime manufacturer of optical disks, and now CD-RW media.

The fact that Charles Johnston, president and CEO of Philips LMS, and Jim Johnston, director of operations at Plasmon, are from the same family doesn’t hurt either.

The deal between the 2 firms was concluded for $26.4 million, $18.5 million in cash, the balance payable over 2 years, including a portion ($5.9 million) conditional on the results of LMS’ tape activity.

Plasmon gets the Colorado Springs, CO site, where 12-inch write-once optical media and half-inch tape drives are produced, as well as another site in Blackburn, UK, where 12-inch WORM media are made.

Even so, it won’t be a simple matter for Plasmon to get an immediate return on its new acquisition. The market for 12-inch optical disks has no room for growth, and while LMS is a leader, it’s virtually alone, one of the sole survivors along with the French firm ATG, which has decided not to push its own technology any further.

If only one firm is to remain, it will have to be Plasmon, which does mean hefty margins, only without any revenue growth.

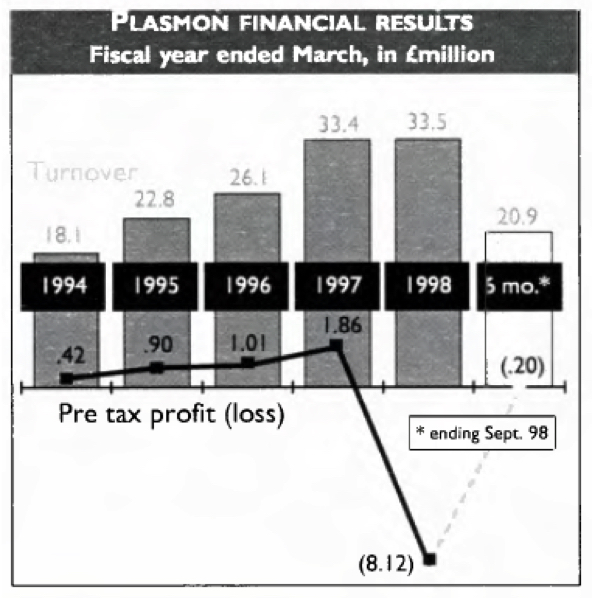

As a result of the acquisition, which should be completed this month, once the approval of Plasmon’s shareholders is secured, some of LMS’s financial data were revealed, and they are, in fact, revealing: for the first 9 months of 1998, ending September, sales were $32.1 million, down 30%, but nevertheless with a sizeable and even surprising operating profit, albeit nearly identical from one year to the next, $7.2 and then $7.3 million.

For the same period, 1998 sales can be broken down to 51.5% for 12-inch optical disks, 35.5% for optical drives and their parts and only 13% for tape drives.

LMS is alone in its proprietary technology – ultimately released with considerable delay – for NCTP magnetic tape with external sources for heads and media, and is up vs. a mob of competitors, each more ruthless than the other.

Furthermore, isn’t it significant that Plasmon IDE never ventured into libraries for 12-inch optical or NCTP media, but rather only for 5.25-inch optical disks, CDs and Magstar MP cartridges? Perhaps because the firm was skeptical, and rightly so.

Another difficulty for Plasmon will be to integrate an organization that is almost as huge as its own. Of course there are certain technological affinities for optical technology in common, more so given that LMS’ latest gen of 12-inch media use phase change technology, as with CD-RW, but for different markets.

From OSI to Philips LMS It’s an old story: Philips LMS, which started life in 1984 as Optical Storage International, a venture between Philips (51%) and Control Data (49%) focused on optical technologies, and later magnetic tape with the addition of Control Data’s Computer Peripherals Inc. (CPI) in 1986. CDC gradually sold off all its storage activities, and Philips took over total control of OSI in 1990, renaming it LMSI, then Philips LMS in 1993, before becoming a division of Philips Electronics America Corp., itself a wholly-owned subsidiary of Philips Electronics NV.

The company was a pioneer in optical disks, with its LaserDrie 12-inch units, first presented in 1994, at that time with a mere 1GB of user capacity. In theory, we should see the LD 8000, with 30GB, next June. The firm also ventured into 5.25-inch WORM units in 1987, but not for long. For a period, it also got its feet wet with CD-ROM technology. And from the very start, thanks to Control Data’s know-how, the enterprise has been and continues to be involved in mid-range IBM compatible tape drives.

At last count, Philips LMS employed 135 people in a 131,000 square-foot facility in Colorado and 45 in the UK, with offices in 2 others countries, Germany and France.

Key accounts include NCR, Compaq/Digital, FileNet, PRC and Unisys for optical products, Anacomp, Comstor, Decision Data, First Image, IBM, Memorex Telex, Siemens Nixdorf, Silicon Graphics and Western Geophysical for tape.

This article is an abstract of news published on issue 132 on January 1999 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter