History (1998): Most Difficult 6-Month Period for HDDs

Shipments for 1H98 at 66.7 million drives, modest increase of 6% from 1H97

By Jean Jacques Maleval | March 9, 2022 at 2:01 pmThe HDD industry has completed the most difficult 6-month period in recent memory, according to data just published by research firm Trendfocus.

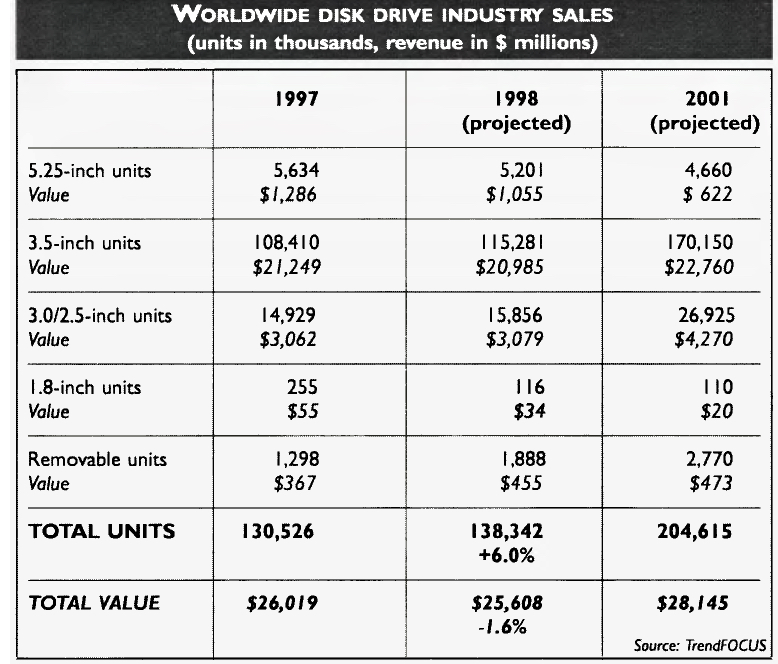

Unit shipments for the 1H98 were 66.7 million drives, a modest increase of 6% from the 1H97. More importantly, 2H98 will bring little respite due to continuously falling drive prices.

“Although improvements have been seen, there is still too much HDD inventory in light of slower PC sales,” stated John Donovan, VP. “1998 will prove to be the lowest unit growth year in decades, only 6.5%, and one of the few years in which revenues have declined.”

Still, the study remains bullish that the industry will right itself and resume an upward track well beyond the year 2000. In an industry accustomed to growth rates of 20%+, a year of single digit growth has shaken the market to its foundations.

“The drive industry cannot depend on the PC and software market’s inefficiencies to cover its problems,” added the analyst. “The euphoria of the early 1990s, when it seemed that users could never get enough storage, has been shattered. There are no ‘killer apps’ that consume vast numbers of new gigabytes, so suppliers have to reset business models until market conditions improve in 1999.“

These new projections portend a fundamental shift within the drive market. From the demand side, PC prices plummeted in the past 12 months, but sales did not increase proportionally. This led to much lower HDD pricing and bloated drive inventories, and there is little indication when PC demand will resume healthier growth.

From the supply side, the traditional Big 3 suppliers, Seagate, Quantum, and Western Digital, have tempered production plans to reduce inventories. However, the next tier of suppliers (Maxtor, IBM, Fujitsu, Samsung) have all seized the moment to gain market share by building and shipping as many drives as possible.

Average storage capacities will continue to rise in 1998 and 1999, due more to aggressive pricing than to true user requirement.

“Entering 1998, the average disk drive for desktop PCs stored 2.2GB. Despite the lack of current ‘gigabyte eaters,’ at year’s end, the average capacity should eclipse 3.6GB, a growth of 60%,” adds Donovan. “At this rate, average desktop capacities should reach 13GB in 2001.“

HDD pricing models are profoundly changing. With entry-level PC prices rapidly approaching $500, drive pricing for that segment will collapse and pull down prices for higher capacity drives.

“A year ago, a 4GB drive cost $210, now it is half that. Prices for 6GB and 8GB drives are falling faster,” added Donovan. “We got what we hoped for: cheap PCs to broaden global usage. Unfortunately, this is recreating HDD cost models and reducing profitability. Drives to support ultra-cheap PCs will be priced under $80. Our research indicates that the industry’s current challenges are temporary, and that we are poised to break out of the slump in the coming months. New OSs, application software, video editing, digital photography, home servers, and true Internet usage via greater bandwidth will boost storage requirements. Still, we have to reconcile the effects of lower PC prices and slower PC sales on drive demand, as well as a different growth rate in user requirements.“

This article is an abstract of news published on issue 128 on September 1998 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter